It's better to be a stablecoin genius than a stable genius.

🚨 BEST STABLECOIN YIELDS ISSUE #9 🚨

I am once again reminding you to bookmark this thread

🧵👇

🚨 BEST STABLECOIN YIELDS ISSUE #9 🚨

I am once again reminding you to bookmark this thread

🧵👇

1) @MidasRWA breaks $115M TVL

@MEVCapital curates the mMEV vault, which is currently rocking a 12.6% APY plus points.

► @ResolvLabs

► @SonicLabs

► @GetYieldFi

► @elixir

► @NapierFinance

So, you could deposit into the vault and let MEV go get the yield for you.

But you have some other options as well:

1) Buy YTs: right now you can buy YTs at an IY of 10%, meaning you're getting more yield than you're paying for AND you're getting all those points for free on top.

Risk: If the actual yield goes under the IY (10.66%) that you purchased at, you can experience a loss.

2) LP on Pendle for up to 24% APY plus points

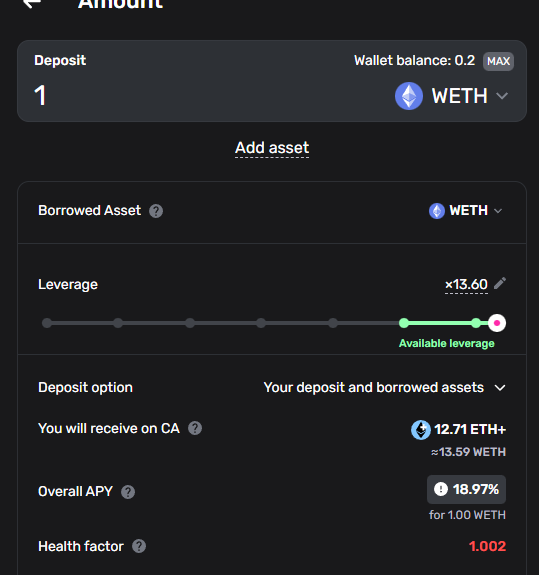

3) Leverage on Morpho

(20% net APR plus 10x the points)

@MEVCapital curates the mMEV vault, which is currently rocking a 12.6% APY plus points.

► @ResolvLabs

► @SonicLabs

► @GetYieldFi

► @elixir

► @NapierFinance

So, you could deposit into the vault and let MEV go get the yield for you.

But you have some other options as well:

1) Buy YTs: right now you can buy YTs at an IY of 10%, meaning you're getting more yield than you're paying for AND you're getting all those points for free on top.

Risk: If the actual yield goes under the IY (10.66%) that you purchased at, you can experience a loss.

2) LP on Pendle for up to 24% APY plus points

3) Leverage on Morpho

(20% net APR plus 10x the points)

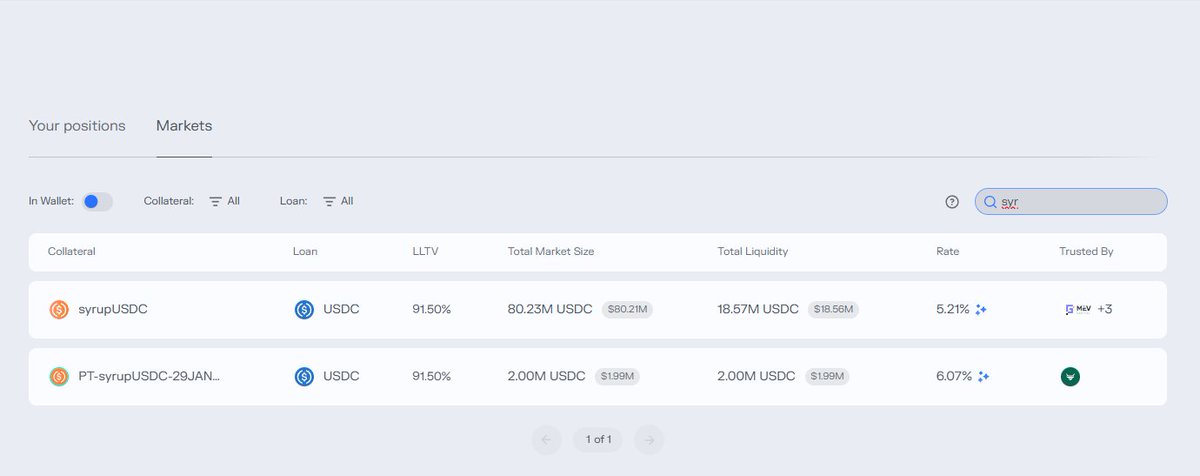

2) @0xCoinshift 🤝 @Contango_xyz

I just wrote a Coinshift PT leveraging thread:

TL;DR 41% APR

Read More:

But I failed to mention that if you don't want to spend all day leveraging, you can one-click in on Contango.

Contango shows an even higher yield PLUS Contango points, over $1M principal to deposit.

I just wrote a Coinshift PT leveraging thread:

TL;DR 41% APR

Read More:

But I failed to mention that if you don't want to spend all day leveraging, you can one-click in on Contango.

Contango shows an even higher yield PLUS Contango points, over $1M principal to deposit.

https://x.com/phtevenstrong/status/1927733633730650267

3) @protocol_fx is under-rated

fxSAVE is the wrapped-and-composible stability pool for f(x).

It's currently yielding 13% APY.

► Average 1-month borrow cost on Morpho is 7.77%

► Current instantaneous borrow cost is 9.5%

At 5x leverage (85% LTV):

@ 7.8% Borrow: 33% APR

@ 9.5% Borrow: 27% APR

fxSAVE is the wrapped-and-composible stability pool for f(x).

It's currently yielding 13% APY.

► Average 1-month borrow cost on Morpho is 7.77%

► Current instantaneous borrow cost is 9.5%

At 5x leverage (85% LTV):

@ 7.8% Borrow: 33% APR

@ 9.5% Borrow: 27% APR

4) @ResolvLabs is the Basis King 👑

While sUSDe has a solid 6.8% weekly APR,

👏wstUSR has a 10% weekly APR👏

That's a 50% higher yield.

And if you're bold, you can leverage wstUSR, RLP, and PT versions of each on @eulerfinance for over 40% APR and millions in available liquidity.

While sUSDe has a solid 6.8% weekly APR,

👏wstUSR has a 10% weekly APR👏

That's a 50% higher yield.

And if you're bold, you can leverage wstUSR, RLP, and PT versions of each on @eulerfinance for over 40% APR and millions in available liquidity.

5) @reservoir_xyz may be the hidden king of passive income.

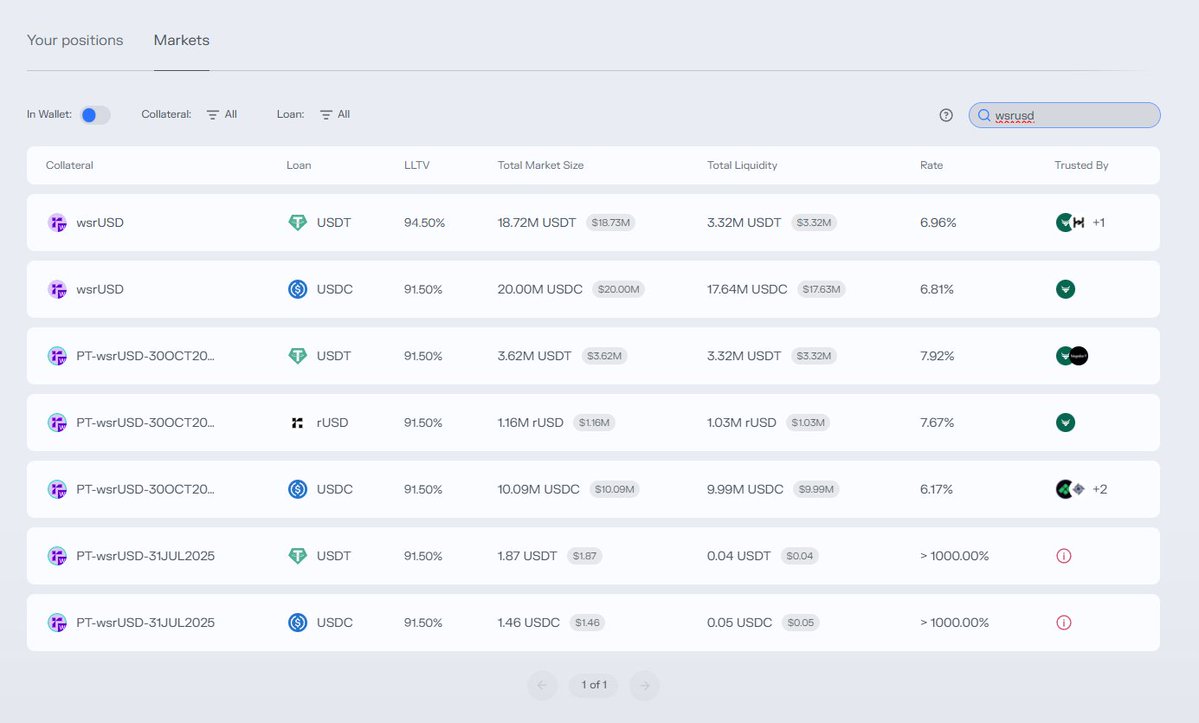

For over half a year, srUSD has been printing a 15-25% APR either on @MorphoLabs, @Dolomite_io, or @eulerfinance.

Even @ipor_io, now that I think about it.

ON TOP OF THAT, the yield on srUSD has been wildly stable, ranging between 5.5% and 8.5% APY for months.

ON TOP OF THAT, you get points, with S1 about to close and S2 about to begin.

They've done this by making rUSD attractive to hold via POL incentives on Berachain and their points campaign. This has led to dramatically leveraged yields for the srUSD connoisseur.

For example, right now:

➢ Euler: 32% Organic + 4.25x Points

➢ Morpho: 25% Organic + 5x Points

➢ Ipor: 20% Organic + 10x Points

This is STILL one of my largest positions. Can't wait for the airdrop, but I've been appreciating the real yield along the way.

For over half a year, srUSD has been printing a 15-25% APR either on @MorphoLabs, @Dolomite_io, or @eulerfinance.

Even @ipor_io, now that I think about it.

ON TOP OF THAT, the yield on srUSD has been wildly stable, ranging between 5.5% and 8.5% APY for months.

ON TOP OF THAT, you get points, with S1 about to close and S2 about to begin.

They've done this by making rUSD attractive to hold via POL incentives on Berachain and their points campaign. This has led to dramatically leveraged yields for the srUSD connoisseur.

For example, right now:

➢ Euler: 32% Organic + 4.25x Points

➢ Morpho: 25% Organic + 5x Points

➢ Ipor: 20% Organic + 10x Points

This is STILL one of my largest positions. Can't wait for the airdrop, but I've been appreciating the real yield along the way.

6) @LiquityProtocol is another sleeper.

Liquity gets 4% FDV of friendly forks as incentives / airdrops to the LPs and stability pools for BOLD.

There's something like 20 friendly forks so far.

That means on top of the very solid 5-15% stability pool APR, you also have 20 or so incoming airdrops.

I did some math...

My Assumptions:

➢ 1.5% of the 4% goes to the stability pool(s)

➢ Stability pools average 50M TVL until airdrops

➢ Friendly Forks average 10M FDV Tokens

➢ Airdrops happen in next two quarters

BUT, it gets better. @yearnfi and @k3_capital are launching yBOLD and sBOLD which will qualify you for the airdrop while also making the BOLD stability pool composable.

That means you can leverage the yield and the airdrops. AND anytime there are liquidations, yBOLD and sBOLD will autocompound the liquidated ETH back into more BOLD, boosting the APRs dramatically.

Liquity gets 4% FDV of friendly forks as incentives / airdrops to the LPs and stability pools for BOLD.

There's something like 20 friendly forks so far.

That means on top of the very solid 5-15% stability pool APR, you also have 20 or so incoming airdrops.

I did some math...

My Assumptions:

➢ 1.5% of the 4% goes to the stability pool(s)

➢ Stability pools average 50M TVL until airdrops

➢ Friendly Forks average 10M FDV Tokens

➢ Airdrops happen in next two quarters

BUT, it gets better. @yearnfi and @k3_capital are launching yBOLD and sBOLD which will qualify you for the airdrop while also making the BOLD stability pool composable.

That means you can leverage the yield and the airdrops. AND anytime there are liquidations, yBOLD and sBOLD will autocompound the liquidated ETH back into more BOLD, boosting the APRs dramatically.

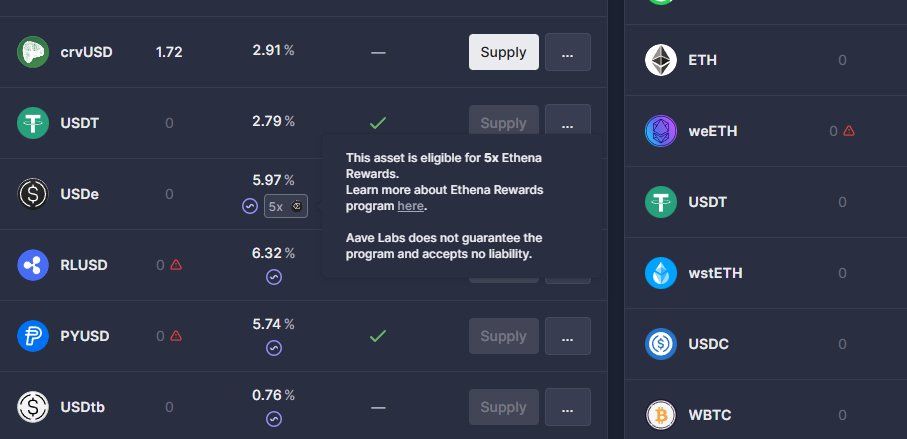

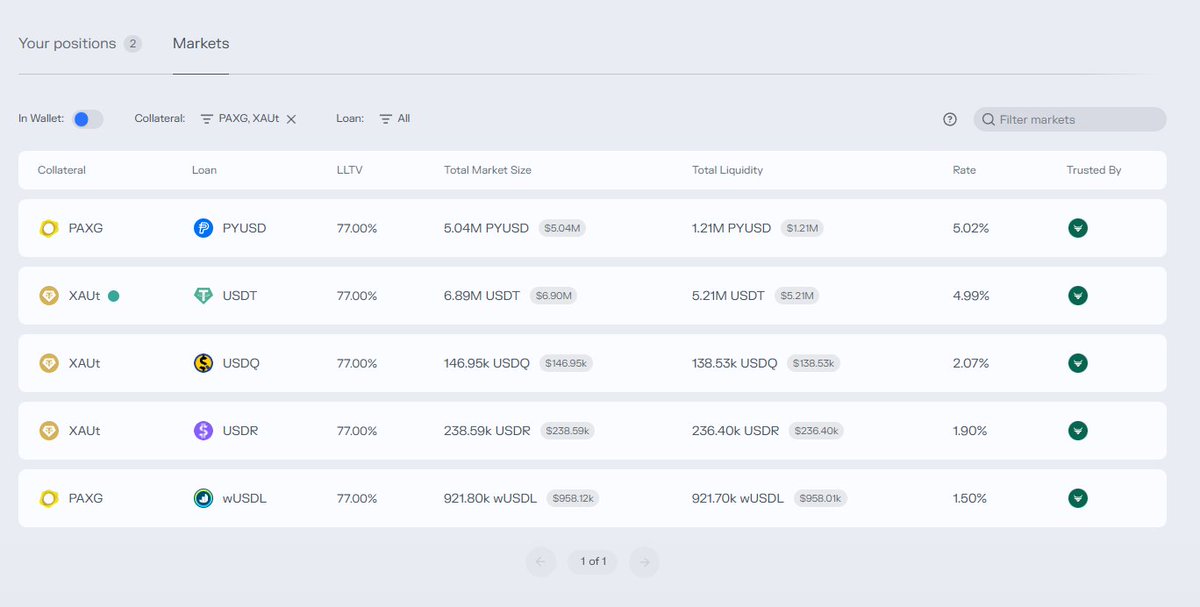

7) Honestly, @eulerfinance is a yield powerhouse.

Their partnerships have led to consistent high double-digit yields for months on end.

Right now, @Ripple (yes, that Ripple) is running a big campaign with $RLUSD, with something like $85K in incentives for the first week.

This means roughly a bajillion percent APY while people catch wise to the opportunity.

(sorry for diluting your bags, Anton)

Their partnerships have led to consistent high double-digit yields for months on end.

Right now, @Ripple (yes, that Ripple) is running a big campaign with $RLUSD, with something like $85K in incentives for the first week.

This means roughly a bajillion percent APY while people catch wise to the opportunity.

(sorry for diluting your bags, Anton)

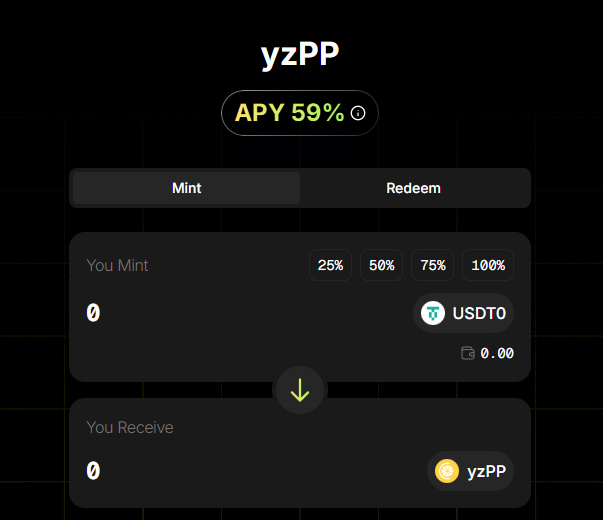

8) @beraborrow 🤝 @reservoir_xyz

Reservoir and Beraborrow have been two of the primary reasons to bridge stables over to @berachain.

SO, to see them team up in a meaningful way is pretty sweet.

In short, you can LP rUSD<>USDT0 for 14% APR in iBGT through @InfraredFinance and then mint $NECT against that at a 7% interest rate.

You can loop this 20x, which is INSANE and not recommended (but possible).

The quick math on that is 147% APR.

BUT THERE ARE CAVEATS.

There's a 0.5% minting fee. So if you were to 20x leverage, you'd pay a 9.5% fee on your principal that you'd have to hope to recover through high yields.

Reservoir and Beraborrow have been two of the primary reasons to bridge stables over to @berachain.

SO, to see them team up in a meaningful way is pretty sweet.

In short, you can LP rUSD<>USDT0 for 14% APR in iBGT through @InfraredFinance and then mint $NECT against that at a 7% interest rate.

You can loop this 20x, which is INSANE and not recommended (but possible).

The quick math on that is 147% APR.

BUT THERE ARE CAVEATS.

There's a 0.5% minting fee. So if you were to 20x leverage, you'd pay a 9.5% fee on your principal that you'd have to hope to recover through high yields.

9) @FalconStable!

Falcon's PT-sUSDf has one of the highest fixed rate returns, but ALSO has a fixed rate (11.12%) FOR 119 DAYS.

This allows you to lock in a highly competitive yield for a whole quarter rather than rely on shorter dated opportunities.

AND, you can leverage on lending platforms, but the borrow costs are currently not-so-great. But when they come down, I'll be sure to include those opportunities in a thread.

Also, if you're a Pendle LP maximalist, like many of my whale friends are (they like their yield with points) you can get up to 19% APY on Pendle as well.

Falcon's PT-sUSDf has one of the highest fixed rate returns, but ALSO has a fixed rate (11.12%) FOR 119 DAYS.

This allows you to lock in a highly competitive yield for a whole quarter rather than rely on shorter dated opportunities.

AND, you can leverage on lending platforms, but the borrow costs are currently not-so-great. But when they come down, I'll be sure to include those opportunities in a thread.

Also, if you're a Pendle LP maximalist, like many of my whale friends are (they like their yield with points) you can get up to 19% APY on Pendle as well.

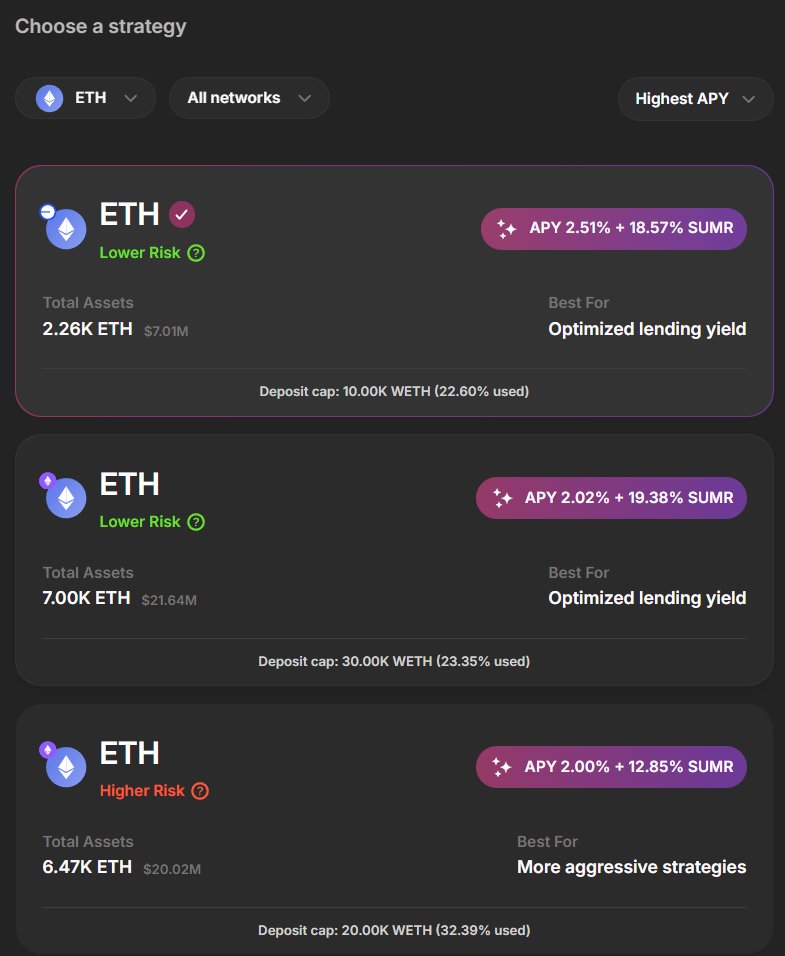

10) The @ether_fi campaign is still printing

TL;DR: ~21% APR on collateral for EtherFi Cash and you can spend against it with no fee.

► 14% APY on liquidUSD (can be used as collateral)

► .15ETHFI / $1K Collateral / Day = +7% APR

Total Collateral APR: 21%

AND

► 3% Cashback (Scroll Tokens)

► 2% Cashback (ETHFI Tokens)

You can also get that 7% on eBTC, liquidETH, weETH, etc. So you can be a BTC maxi while spending against the value with your card.

Physical cards are also coming very very soon.

Also, you can use this as a checking / debit card or keep your collateral and spend against it like a credit card, where you just have to pay down your debt at some future date.

Shameless reflink shill, get $50 back on the first $1K spent:

ether.fi/refer/defidojo

TL;DR: ~21% APR on collateral for EtherFi Cash and you can spend against it with no fee.

► 14% APY on liquidUSD (can be used as collateral)

► .15ETHFI / $1K Collateral / Day = +7% APR

Total Collateral APR: 21%

AND

► 3% Cashback (Scroll Tokens)

► 2% Cashback (ETHFI Tokens)

You can also get that 7% on eBTC, liquidETH, weETH, etc. So you can be a BTC maxi while spending against the value with your card.

Physical cards are also coming very very soon.

Also, you can use this as a checking / debit card or keep your collateral and spend against it like a credit card, where you just have to pay down your debt at some future date.

Shameless reflink shill, get $50 back on the first $1K spent:

ether.fi/refer/defidojo

THAT'S IT, thanks for reading!

I hope you enjoy the stablecoin yields, feel free to comment with any questions

Disclaimer: Please assume any protocol mentioned may have a current, past, or future ambassadorship with me and my team.

I hope you enjoy the stablecoin yields, feel free to comment with any questions

Disclaimer: Please assume any protocol mentioned may have a current, past, or future ambassadorship with me and my team.

• • •

Missing some Tweet in this thread? You can try to

force a refresh