If you aim to be a trader with probabilistic thinking, at the very least, remember this 🧵

I have gathered only important short words.

Engrave these into your mind repeatedly.

🧵1/5

I have gathered only important short words.

Engrave these into your mind repeatedly.

🧵1/5

2/5

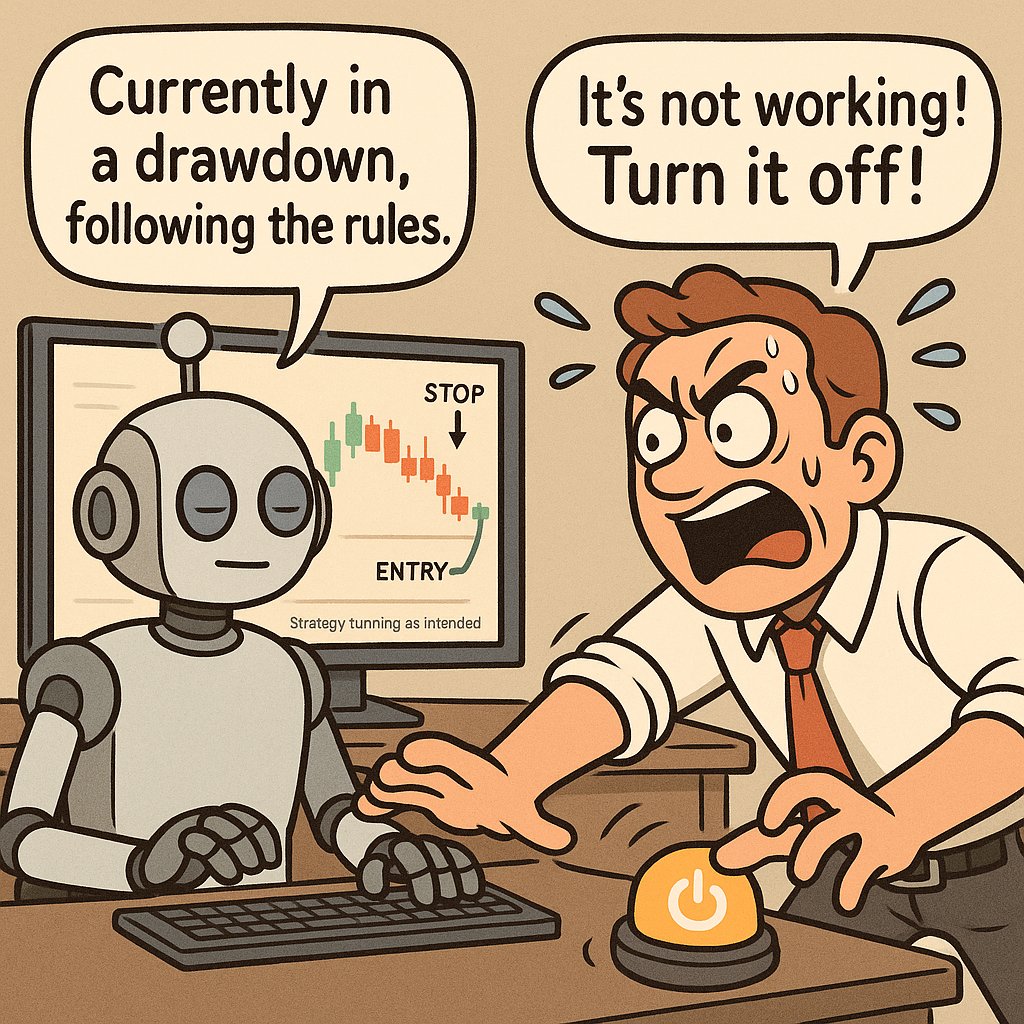

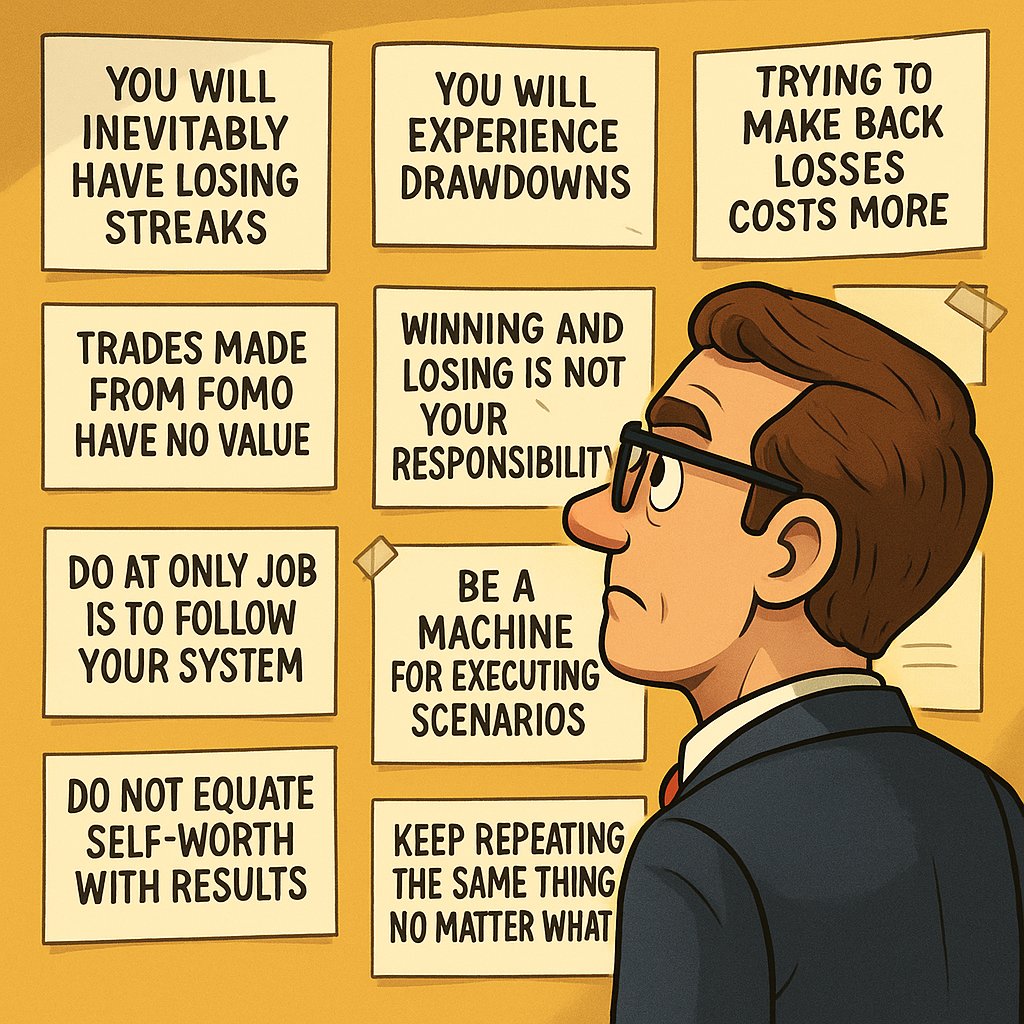

・No matter what strategy you use, you will inevitably have a losing streak.

・You will inevitably experience a drawdown.

・Trying to win back your losses will cost you more.

・A trade you place out of fear of missing out is worthless.

・As long as you follow your rules, winning or losing is not your responsibility.

・Your job is "only" to create a system with an edge (a systematized strategy) and then follow the rules.

・No matter what strategy you use, you will inevitably have a losing streak.

・You will inevitably experience a drawdown.

・Trying to win back your losses will cost you more.

・A trade you place out of fear of missing out is worthless.

・As long as you follow your rules, winning or losing is not your responsibility.

・Your job is "only" to create a system with an edge (a systematized strategy) and then follow the rules.

3/5

・When you are emotional, explore what thought processes or beliefs are causing that emotion.

・Do not make fun of other people's strategies. That is merely declaring that you are immature as a trader and as a person.

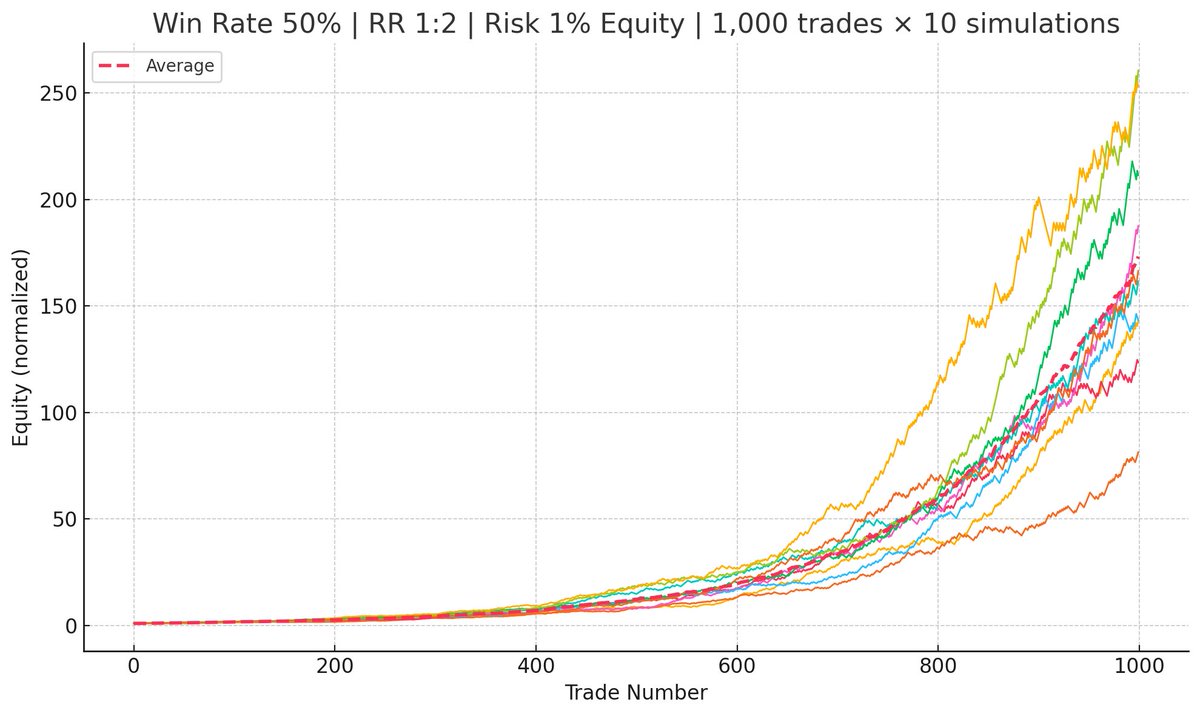

・A system is premised on repetition. Incorporate a money management strategy with a 0% risk of ruin into your system.

・Do not link wins and losses to your self-worth. What is evaluated is your discipline and consistency over a long period.

・You are not unable to win because you don't have capital. You just don't have the skill.

・The immediately preceding stop-loss or losing streak is completely irrelevant.

・When you are emotional, explore what thought processes or beliefs are causing that emotion.

・Do not make fun of other people's strategies. That is merely declaring that you are immature as a trader and as a person.

・A system is premised on repetition. Incorporate a money management strategy with a 0% risk of ruin into your system.

・Do not link wins and losses to your self-worth. What is evaluated is your discipline and consistency over a long period.

・You are not unable to win because you don't have capital. You just don't have the skill.

・The immediately preceding stop-loss or losing streak is completely irrelevant.

4/5

・Become a scenario execution machine that just creates scenarios and executes them.

・Do not tinker based on short-term results (the current result is completely irrelevant to the effectiveness of your strategy).

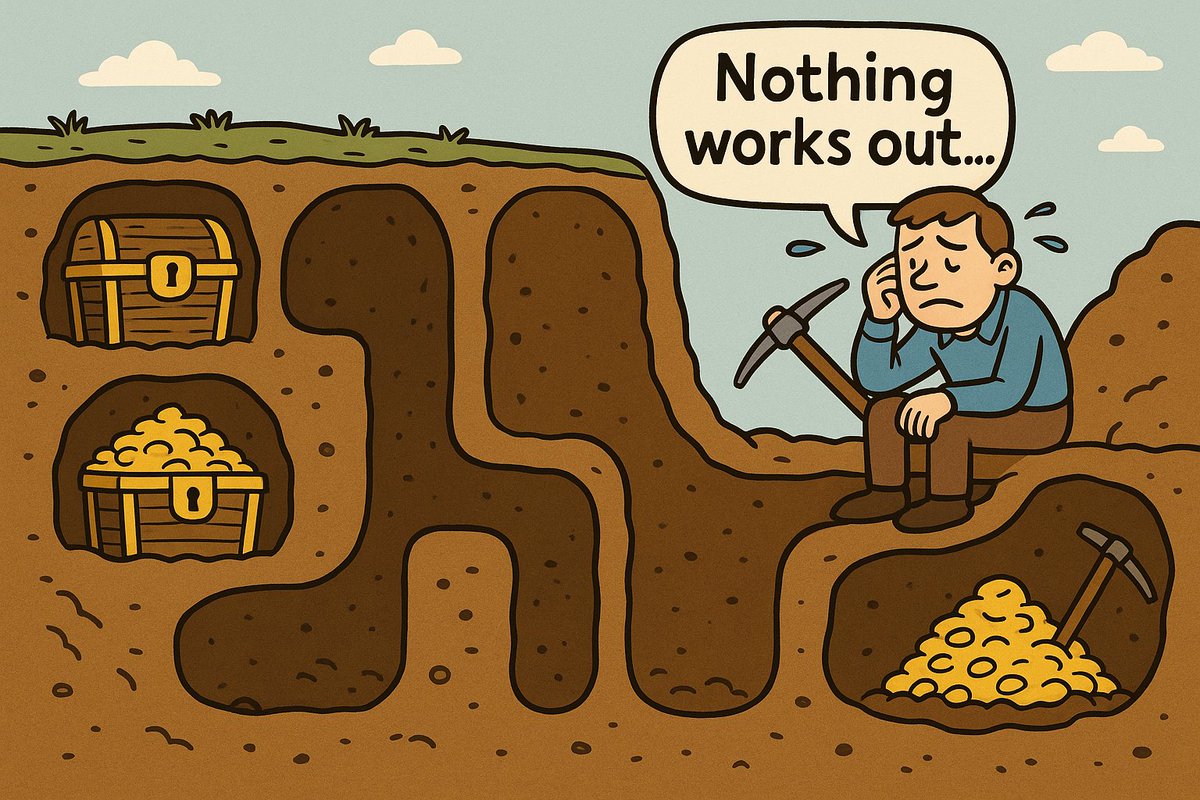

・No matter what happens, keep doing the same thing over and over again.

・Master not being influenced by single outcomes.

・Take measures, such as creating routines and a list of things not to do, to avoid being influenced by results.

・The secret to success in trading is how tenaciously you can keep repeating the same rule-based trades.

・Become a scenario execution machine that just creates scenarios and executes them.

・Do not tinker based on short-term results (the current result is completely irrelevant to the effectiveness of your strategy).

・No matter what happens, keep doing the same thing over and over again.

・Master not being influenced by single outcomes.

・Take measures, such as creating routines and a list of things not to do, to avoid being influenced by results.

・The secret to success in trading is how tenaciously you can keep repeating the same rule-based trades.

5/5

There is still more, but first, let's drill this in.

What is important for making a profit with probabilistic thinking is an edge and sample size.

It all depends on how well you can accept short-term randomness and maintain long-term consistency.

Good luck.

Thanks for reading!

If you enjoyed this thread, check out my books on trading.

E-book

payhip.com/YumiSakura

Paperback

【THE PATH TO SUCCESS IN TRADING】

a.co/d/fXmRhIa

【Trading Psychology】

a.co/d/d0QJMxK

Hope these insights help your trading journey😊

There is still more, but first, let's drill this in.

What is important for making a profit with probabilistic thinking is an edge and sample size.

It all depends on how well you can accept short-term randomness and maintain long-term consistency.

Good luck.

Thanks for reading!

If you enjoyed this thread, check out my books on trading.

E-book

payhip.com/YumiSakura

Paperback

【THE PATH TO SUCCESS IN TRADING】

a.co/d/fXmRhIa

【Trading Psychology】

a.co/d/d0QJMxK

Hope these insights help your trading journey😊

• • •

Missing some Tweet in this thread? You can try to

force a refresh