1/ Welcome to Hyperliquid

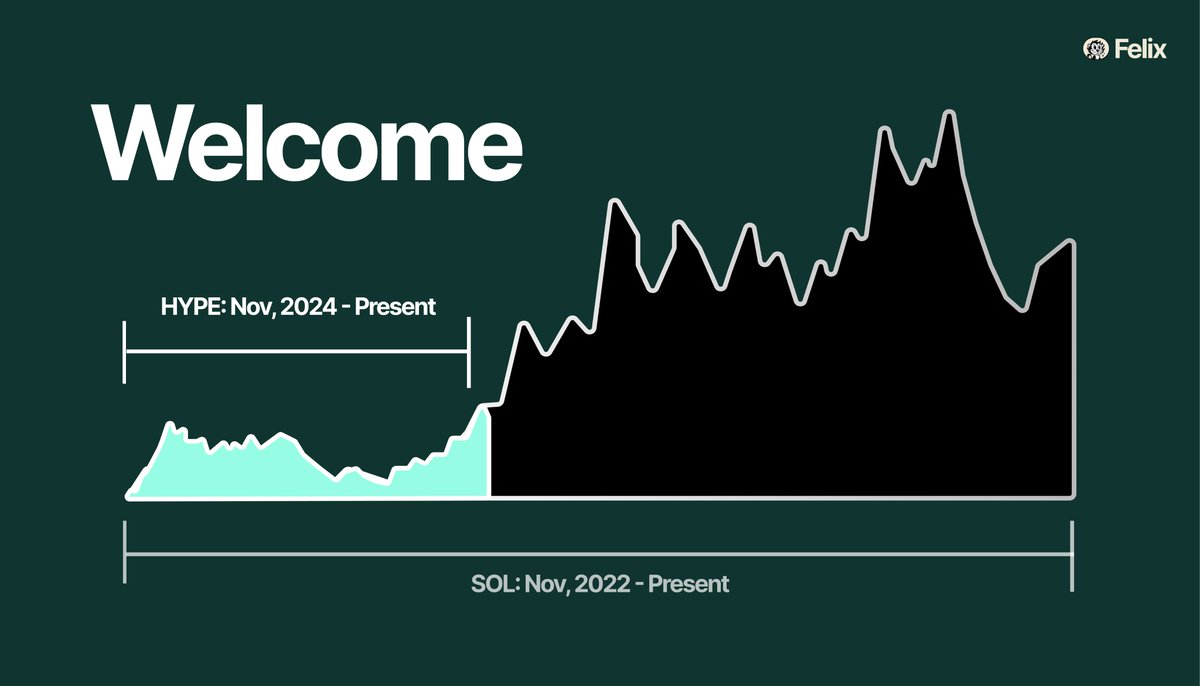

In the past 10 days, with HYPE nearly reaching $40, Hyperliquid has gained nearly 70,000 or +10% new users.

To all new users making their first journey into Hyperliquid with this recent ATH, what are we building here, and what does the opportunity set look like for you? A brief breakdown:

In the past 10 days, with HYPE nearly reaching $40, Hyperliquid has gained nearly 70,000 or +10% new users.

To all new users making their first journey into Hyperliquid with this recent ATH, what are we building here, and what does the opportunity set look like for you? A brief breakdown:

2/ You have HYPE, Why?

You may have come to Hyperliquid firstly to buy HYPE, one of the few fundamentals-driven assets in DeFi. The Hyperliquid Assistance Fund has been buying back $1M–$3M of HYPE daily. Meanwhile, HYPE staking powers Hyperliquid’s proof-of-stake consensus (HyperBFT) and unlocks trading fee discounts for large stakers, adding utility and demand.

These dynamics have driven over $784M in HYPE buybacks, $13.3B staked, and more than $400M liquid-staked so far.

You may have come to Hyperliquid firstly to buy HYPE, one of the few fundamentals-driven assets in DeFi. The Hyperliquid Assistance Fund has been buying back $1M–$3M of HYPE daily. Meanwhile, HYPE staking powers Hyperliquid’s proof-of-stake consensus (HyperBFT) and unlocks trading fee discounts for large stakers, adding utility and demand.

These dynamics have driven over $784M in HYPE buybacks, $13.3B staked, and more than $400M liquid-staked so far.

3/ What is to come for Hyperliquid?

On May 2, 2025, Hyperliquid announced HIP-3, a proposal to enable builder-deployed perpetuals markets. This follows a series of major expansions: the launch of PURR in early 2024 brought user-listed spot assets via ticker auctions, and by early 2025, Hyperliquid began supporting majors like BTC, ETH, and SOL through @hyperunit.

HIP-3 will also introduce the ability to have new collateral types for perps, one potential collateral asset bring USDhl, a fiat-backed stablecoin built for Hyperliquid. USDhl uses treasury yield to buy back HYPE, distributing it to users who LP, lend, or otherwise engage with USDhl across the ecosystem. Just a couple glimpses into what is to come.

On May 2, 2025, Hyperliquid announced HIP-3, a proposal to enable builder-deployed perpetuals markets. This follows a series of major expansions: the launch of PURR in early 2024 brought user-listed spot assets via ticker auctions, and by early 2025, Hyperliquid began supporting majors like BTC, ETH, and SOL through @hyperunit.

HIP-3 will also introduce the ability to have new collateral types for perps, one potential collateral asset bring USDhl, a fiat-backed stablecoin built for Hyperliquid. USDhl uses treasury yield to buy back HYPE, distributing it to users who LP, lend, or otherwise engage with USDhl across the ecosystem. Just a couple glimpses into what is to come.

4/ To All 70,000 new .HLs, Welcome

For those looking for a more bespoke experience on Hyperliquid or still unsure of where to go next, feel free to send a DM–our team at Felix has been building on Hyperliquid for almost a year now, and we are happy to help you get set up directly based on your desires regarding yield, liquidity, etc.

Read the full piece here on HyperEVM:

paragraph.com/@felixprotocol…

For those looking for a more bespoke experience on Hyperliquid or still unsure of where to go next, feel free to send a DM–our team at Felix has been building on Hyperliquid for almost a year now, and we are happy to help you get set up directly based on your desires regarding yield, liquidity, etc.

Read the full piece here on HyperEVM:

paragraph.com/@felixprotocol…

• • •

Missing some Tweet in this thread? You can try to

force a refresh