How to get URL link on X (Twitter) App

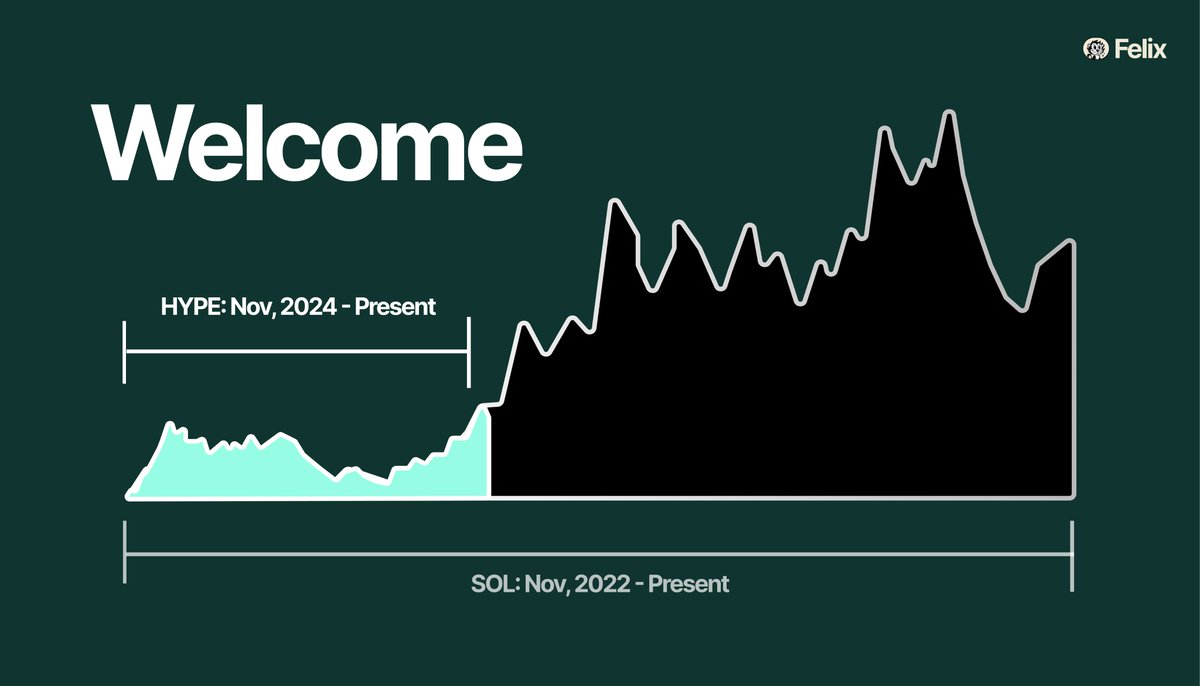

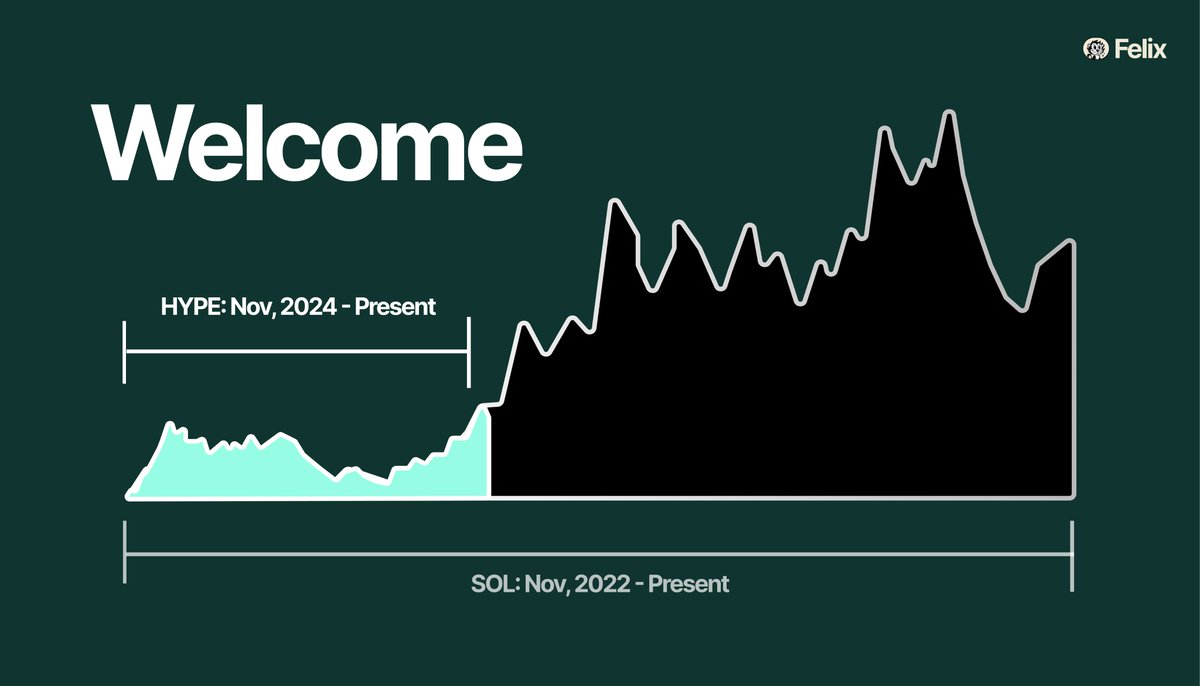

2/ You have HYPE, Why?

2/ You have HYPE, Why?

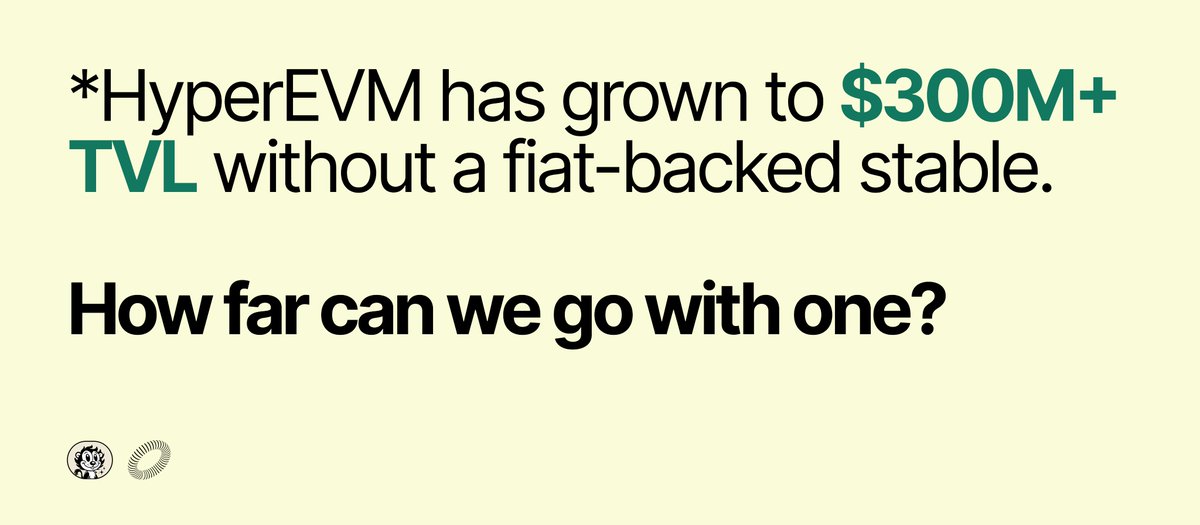

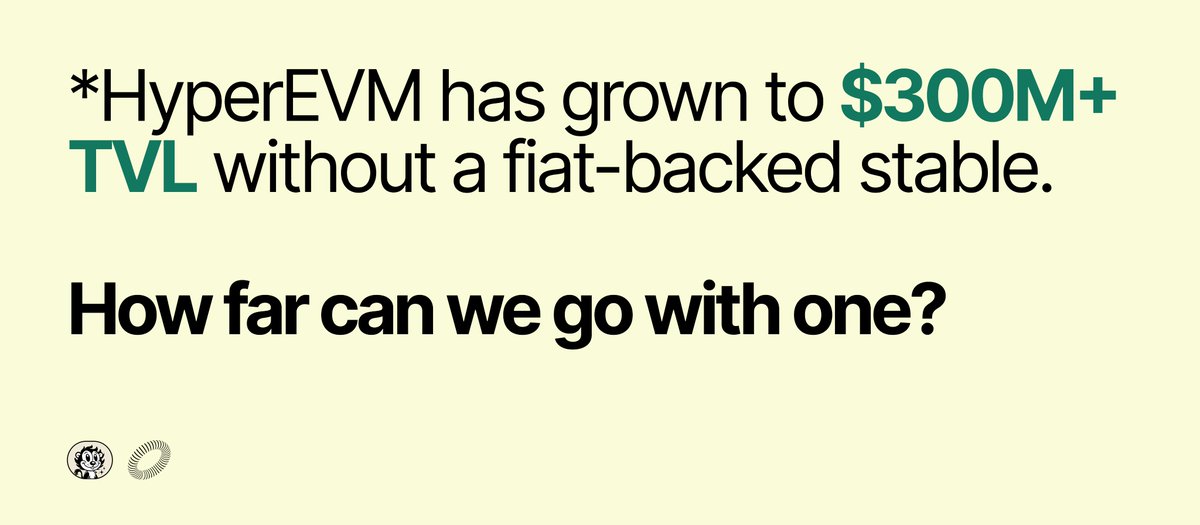

2/ The need for a fiat stable

2/ The need for a fiat stable

2/ Risk-on Use Cases

2/ Risk-on Use Cases

2/ Lazarus, DPRK, and the Dark Forest

2/ Lazarus, DPRK, and the Dark Forest

2/ Introducing feUSD

2/ Introducing feUSD