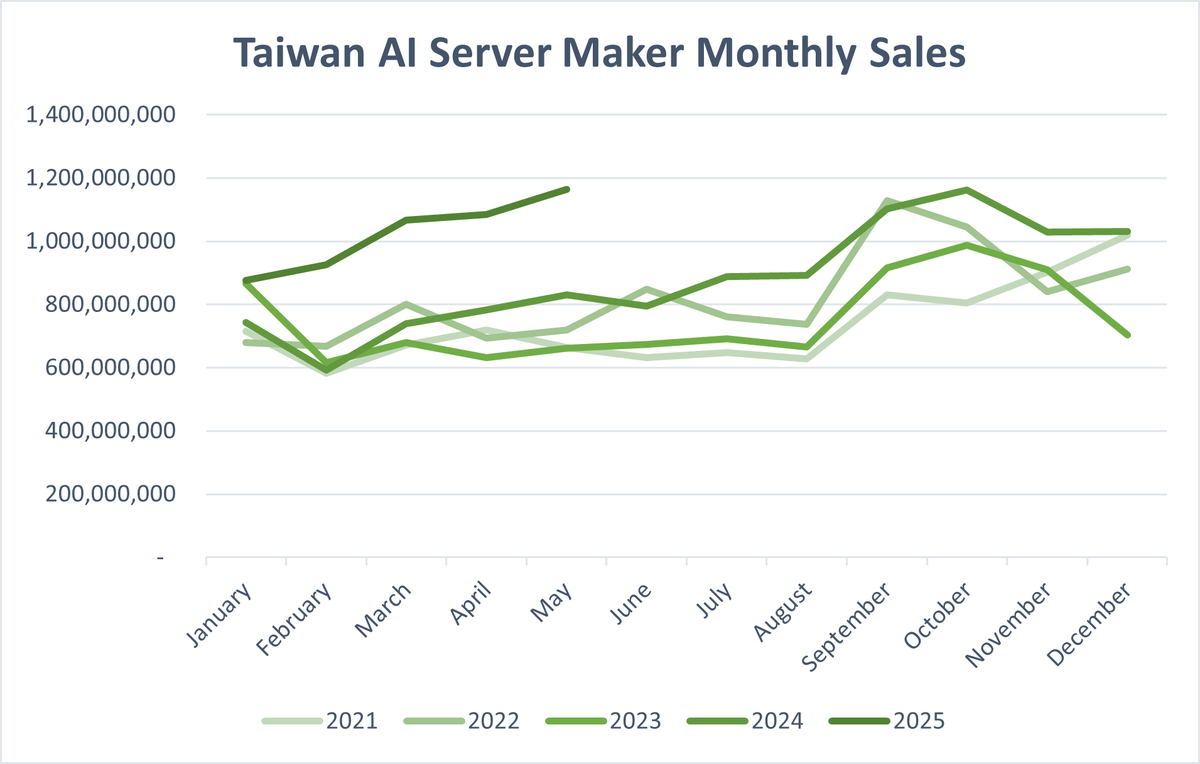

1/6 Driven by surging demand for Nvidia Blackwell-based systems, Taiwan's top six AI server makers' monthly revenue is climbing at an average 39.4% year-on-year clip in 2025, up sharply from 10% last year. $NVDA $TSM #semiconductors

3/6 The “Big 6” reported record combined monthly revenue of NT$1.163 trillion (US$38.8 billion) in May 2025, a 40.1% year-on-year increase that topped last October's NT$1.162 trillion.

They are: Foxconn, Quanta, Wistron, Inventec, Wiwynn and Gigabyte. #Foxconn #Quanta #Wistron #Inventec #Wiwynn #Gigabyte

They are: Foxconn, Quanta, Wistron, Inventec, Wiwynn and Gigabyte. #Foxconn #Quanta #Wistron #Inventec #Wiwynn #Gigabyte

4/6 Strong growth is expected to continue as revenue typically peaks in September-November. However, US tariffs may pull some 2025 demand forward, impacting later sales.

5/6 Nvidia's product cycle is driving seasonality this year, with Blackwell shipments now ramping up. Blackwell Ultra is up next. $NVDA $TSM #semiconductors #AIservers #Blackwell #Foxconn #Quanta #Wistron #Inventec #Wiwynn #Gigabyte

6/6 Links:

Foxconn (Hon Hai Precision Industry): foxconn.com/en-us/investor…

Quanta Computer Inc: quantatw.com/Quanta/chinese…

Wistron Corp: wistron.com/en/Investors/F…

Inventec Corp: inventec.com/en/finance

Wiwynn Corp: wiwynn.com/investors?srsl…

Gigabyte Technology Co. Ltd:

gigabyte.com/Investor/81

Foxconn (Hon Hai Precision Industry): foxconn.com/en-us/investor…

Quanta Computer Inc: quantatw.com/Quanta/chinese…

Wistron Corp: wistron.com/en/Investors/F…

Inventec Corp: inventec.com/en/finance

Wiwynn Corp: wiwynn.com/investors?srsl…

Gigabyte Technology Co. Ltd:

gigabyte.com/Investor/81

• • •

Missing some Tweet in this thread? You can try to

force a refresh