Former journalist, now financial analyst. Based in Taipei. Tweet mainly about semiconductors and Taiwan. Not investment advice. Views are my own.

How to get URL link on X (Twitter) App

2/8 “This year, particularly in the last six months, demand of computing has gone up substantially,” Nvidia CEO Jensen Huang told CNBC on Wednesday.

2/8 “This year, particularly in the last six months, demand of computing has gone up substantially,” Nvidia CEO Jensen Huang told CNBC on Wednesday.

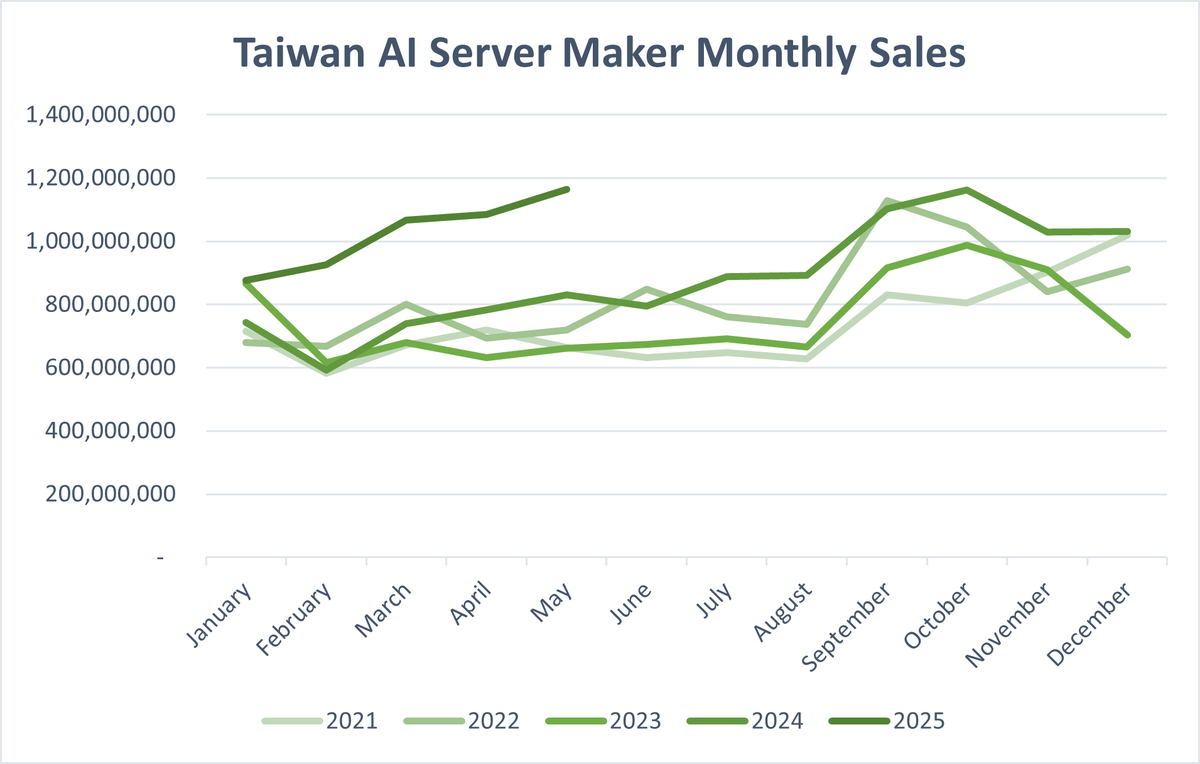

2/6 Check out the lift-off in 2025 versus prior years. $NVDA $TSM #AIservers #semiconductors

2/6 Check out the lift-off in 2025 versus prior years. $NVDA $TSM #AIservers #semiconductors

https://x.com/DylanOnChips/status/1902136100262732232

2/11

2/11