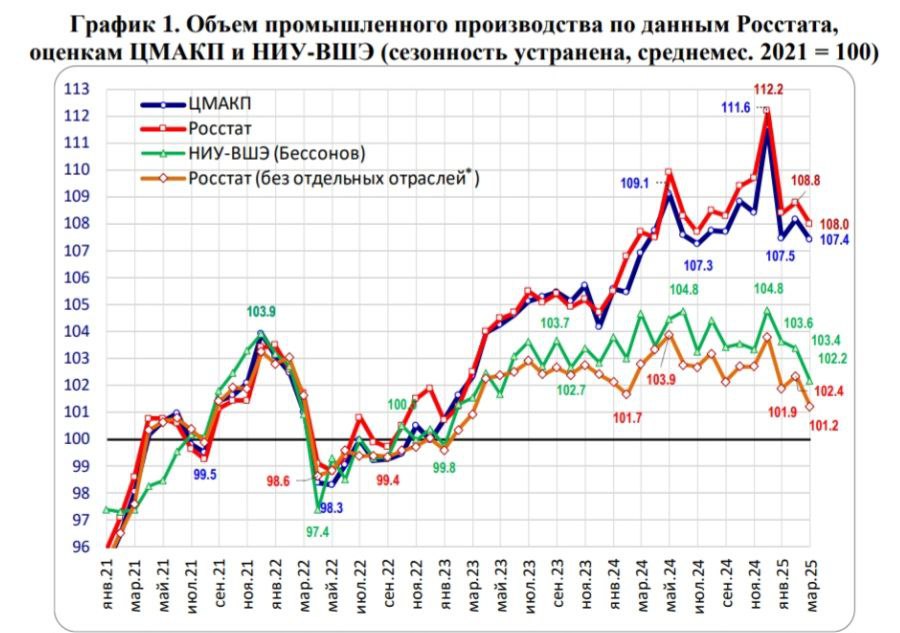

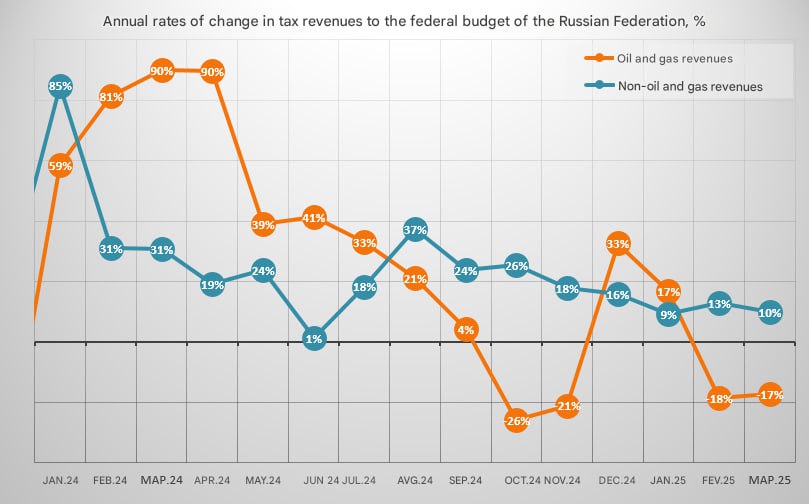

More bad news from Russia.

Amid the collapse of budget revenues, the Ministry of Finance is forced to increase the national debt at a frantic pace to close the hole in the budget. Since the beginning of the year, federal government bonds have been placed for 2.155 trillion rub

1/

Amid the collapse of budget revenues, the Ministry of Finance is forced to increase the national debt at a frantic pace to close the hole in the budget. Since the beginning of the year, federal government bonds have been placed for 2.155 trillion rub

1/

The rate of growth of the national debt has especially accelerated over the past two months against the backdrop of the collapse of oil prices. The economy is collapsing, revenues are falling, the national debt is growing. Rus is flying into the abyss. Inflation will soon soar

2/

2/

Such a frantic growth of the national debt against the backdrop of falling raw material revenues is hello to hyperinflation!

3/

3/

• • •

Missing some Tweet in this thread? You can try to

force a refresh