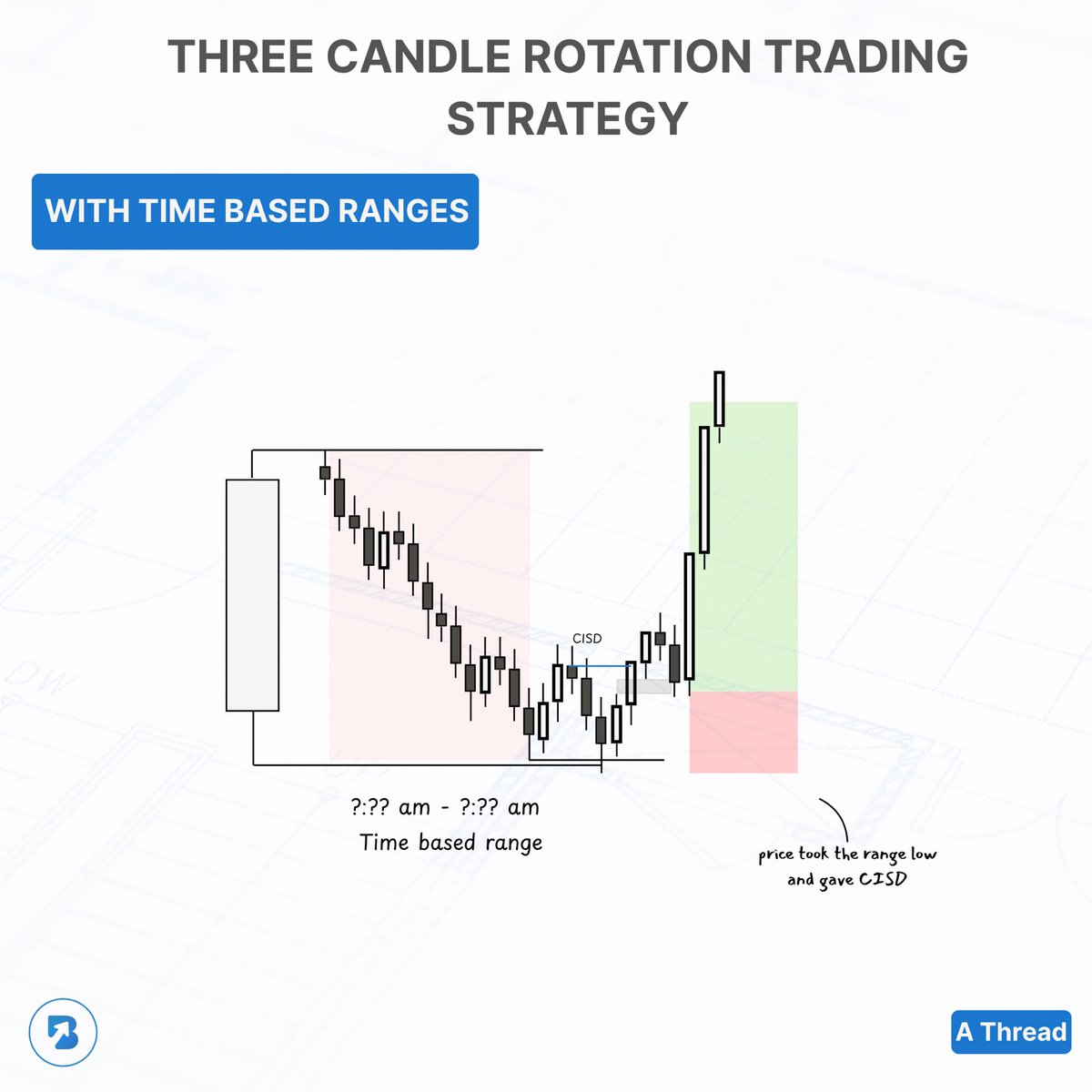

Understanding how to enter within the market.

Once you know the draw on liquidity - where price wants to go entering is simple.

A THREAD 🧵

Once you know the draw on liquidity - where price wants to go entering is simple.

A THREAD 🧵

Introduction

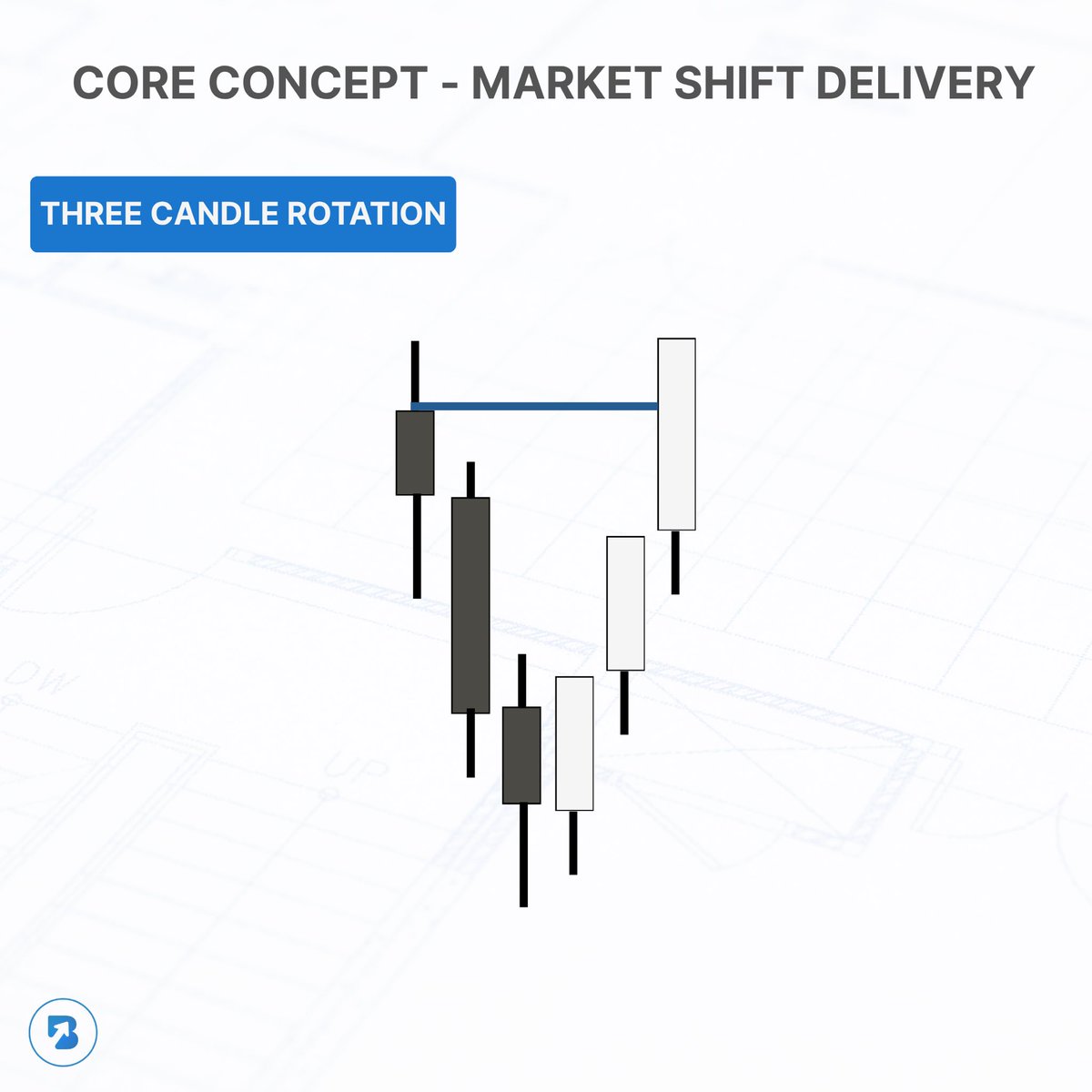

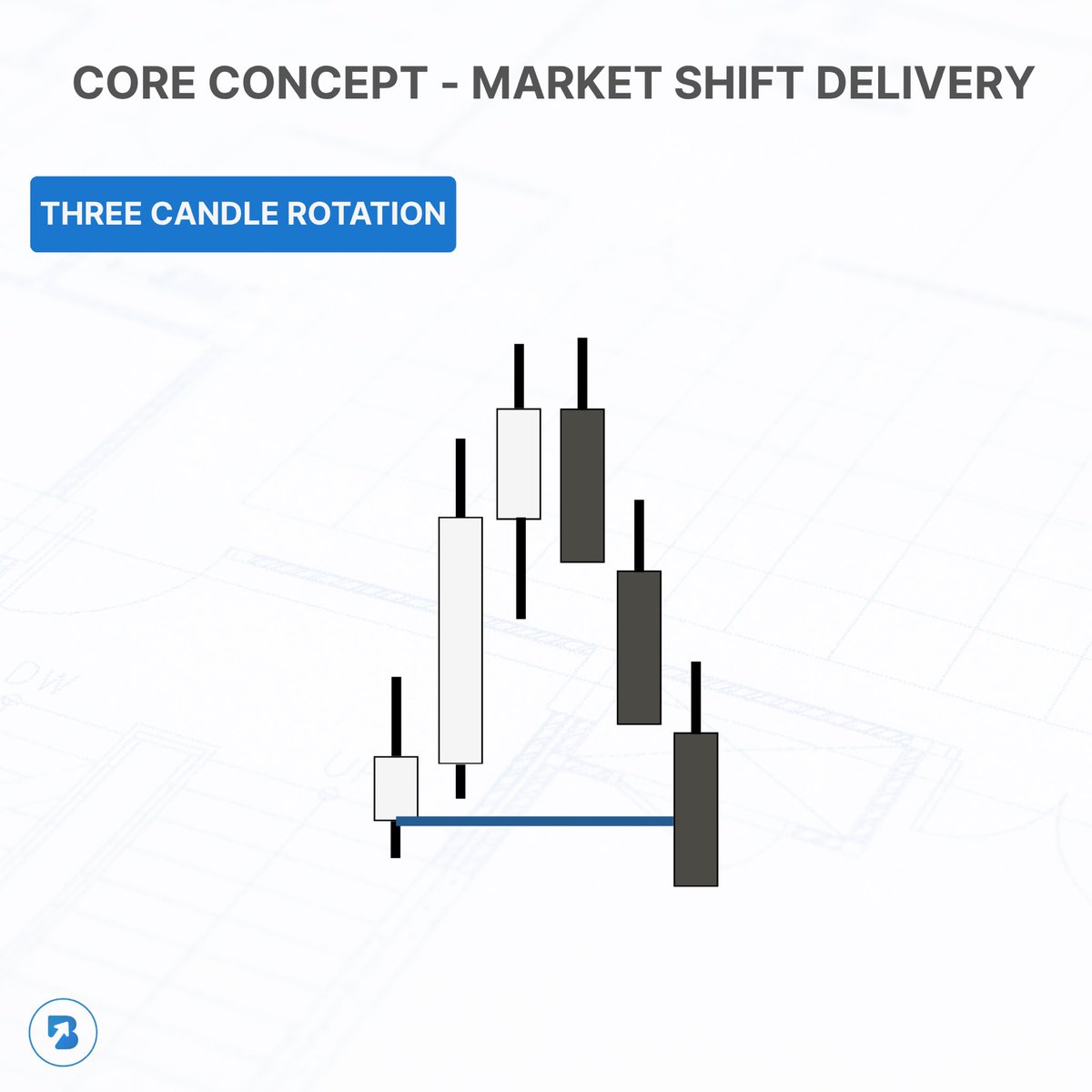

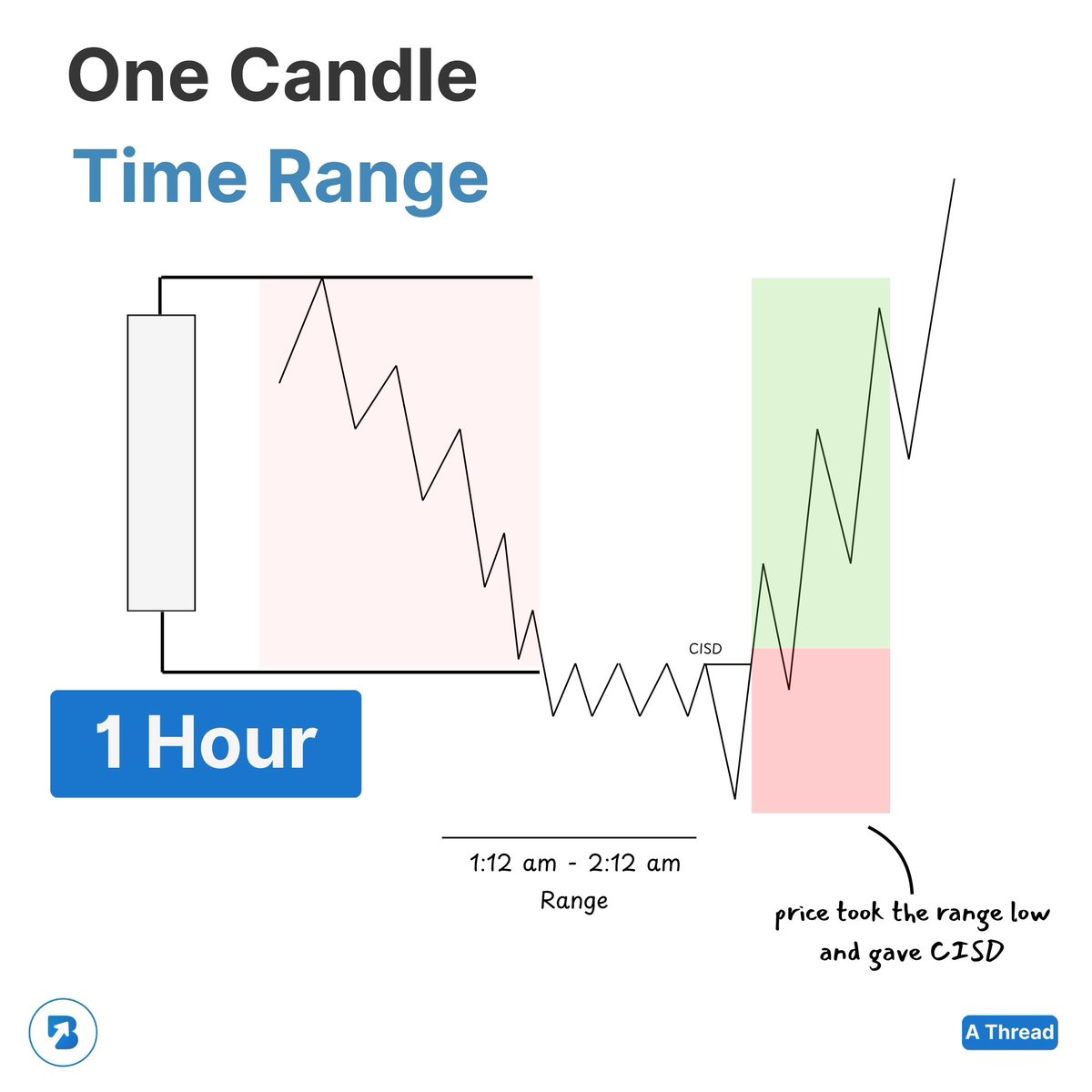

Understanding the importance of DOL - using CISD for entry

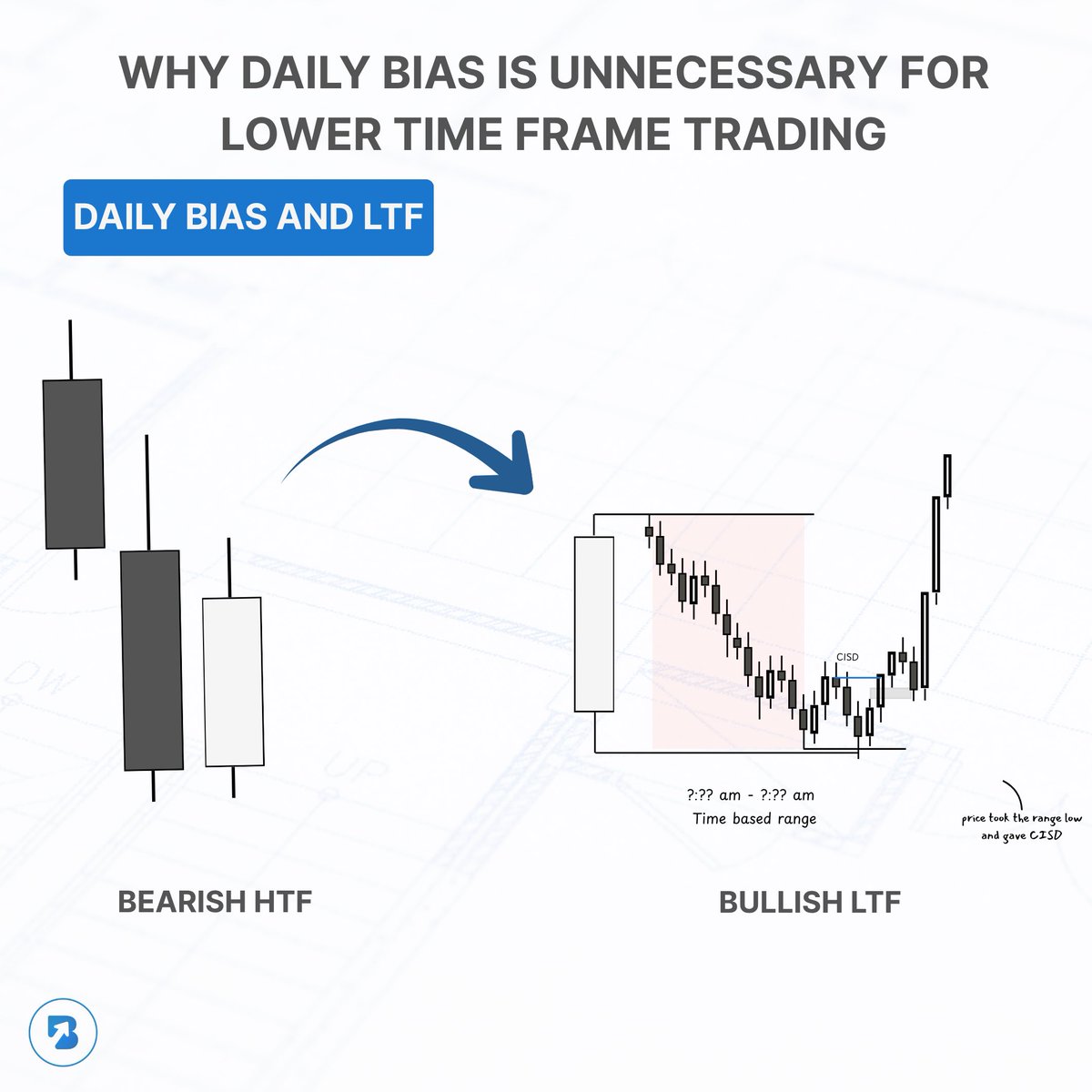

Using HTF PDAs to enter

Watch FULL video:

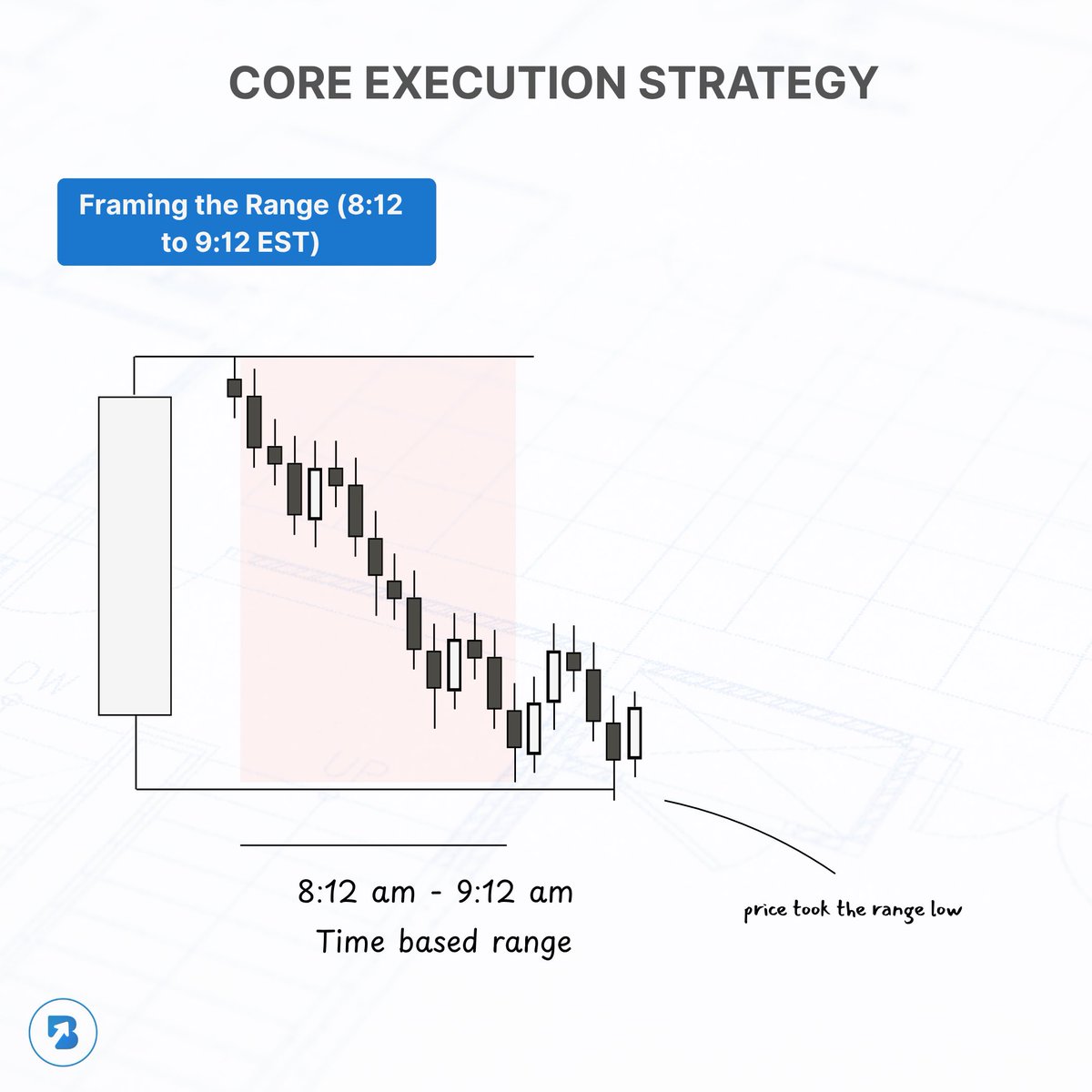

Personal entry technique

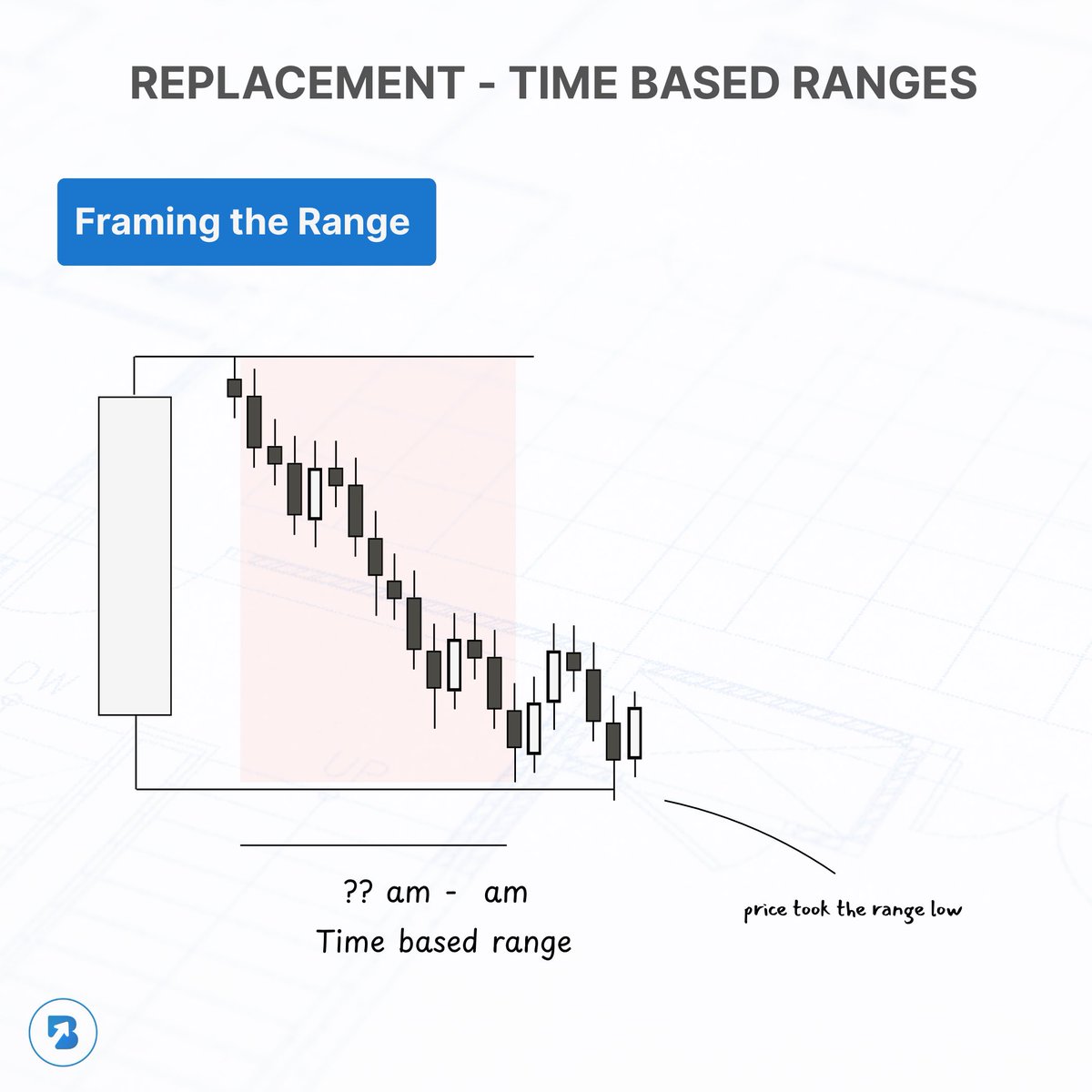

Using the full range

CISD Entry chart example

Understanding rejection blocks

2nd entry chart example

Final entry chart example

Learn more for free: t.me/DayTradingRauf

• • •

Missing some Tweet in this thread? You can try to

force a refresh