futures trader | @dtrblueprint | time based ranges logic

2 subscribers

How to get URL link on X (Twitter) App

The primary struggle for retail traders is identified as a lack of deep knowledge of how the market actually operates

The primary struggle for retail traders is identified as a lack of deep knowledge of how the market actually operates

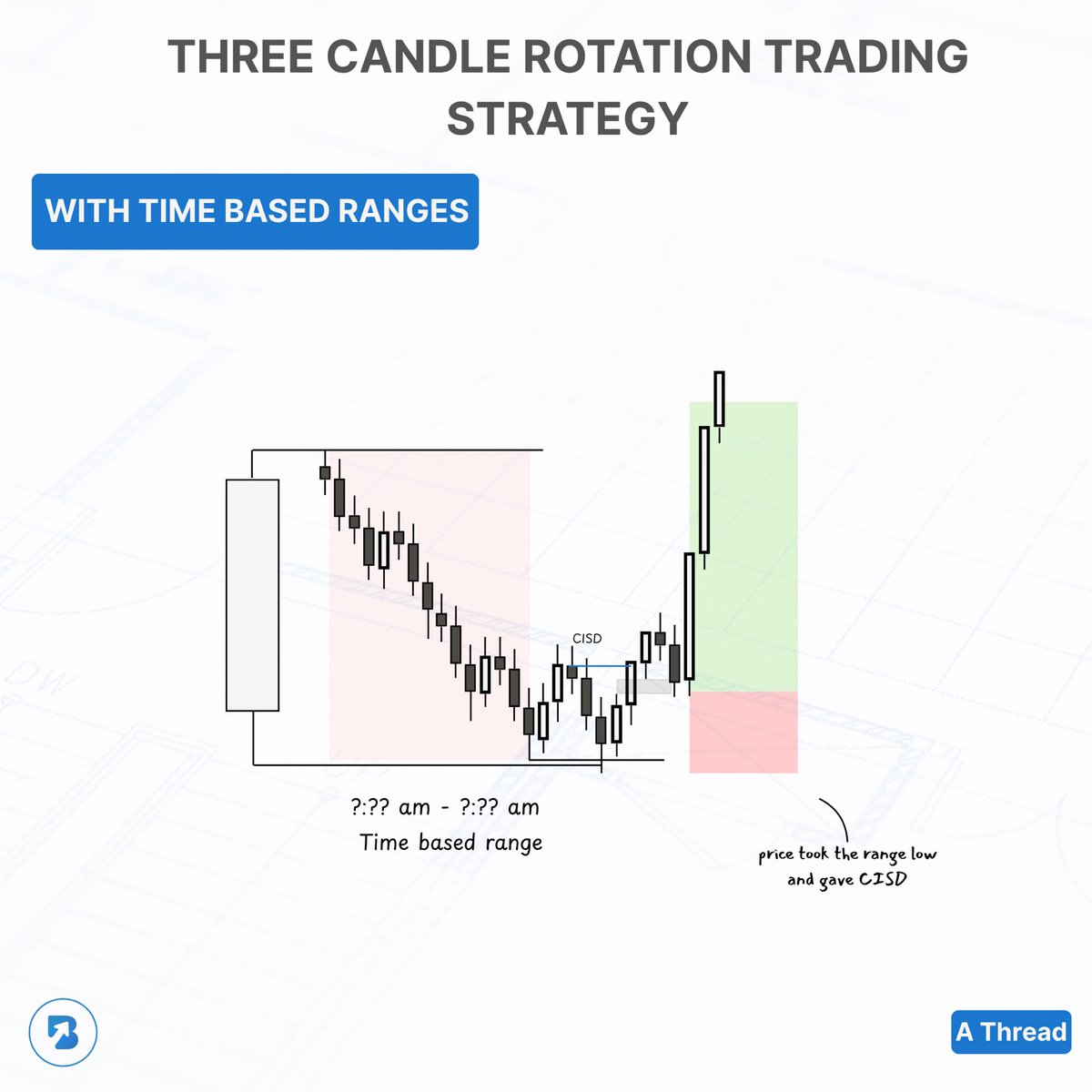

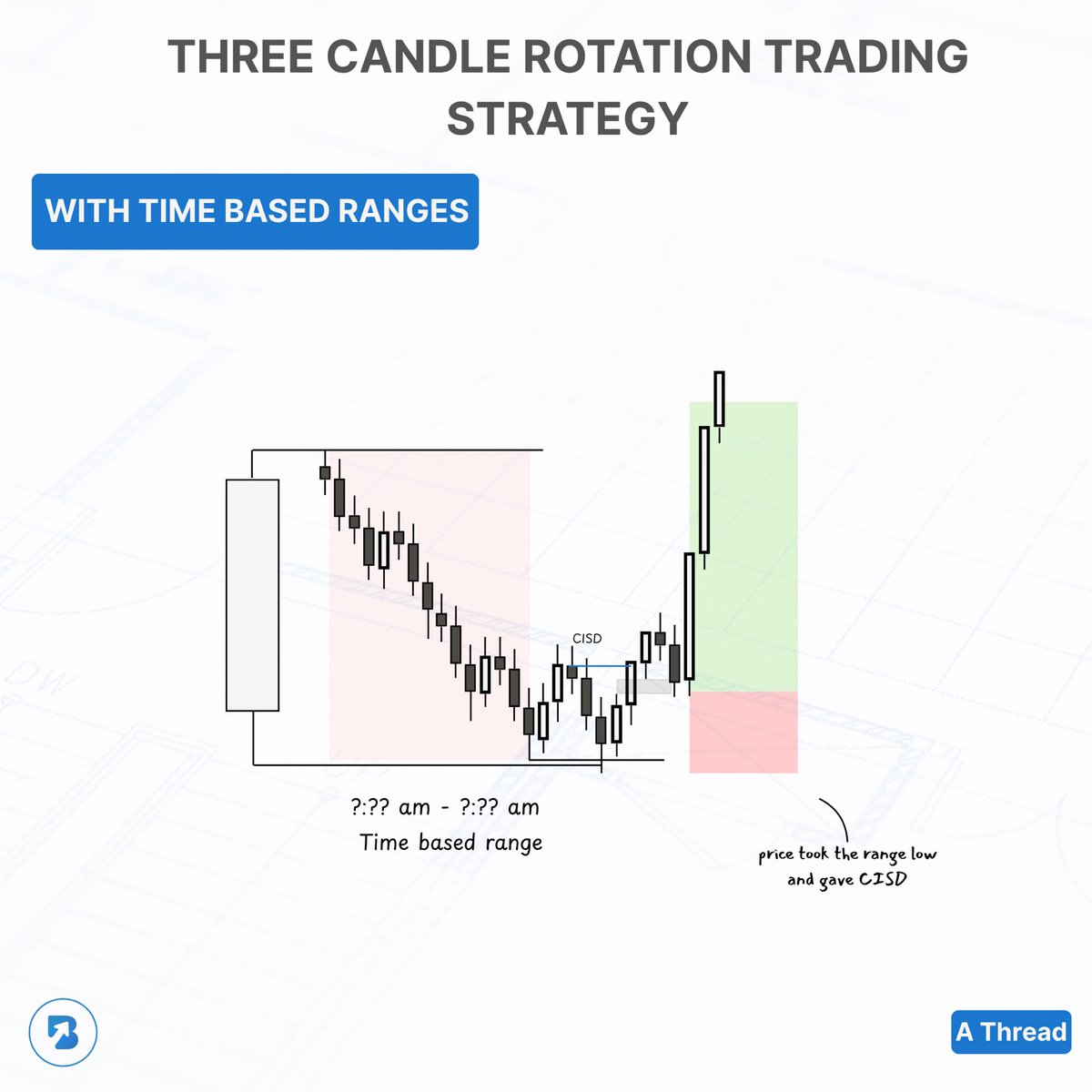

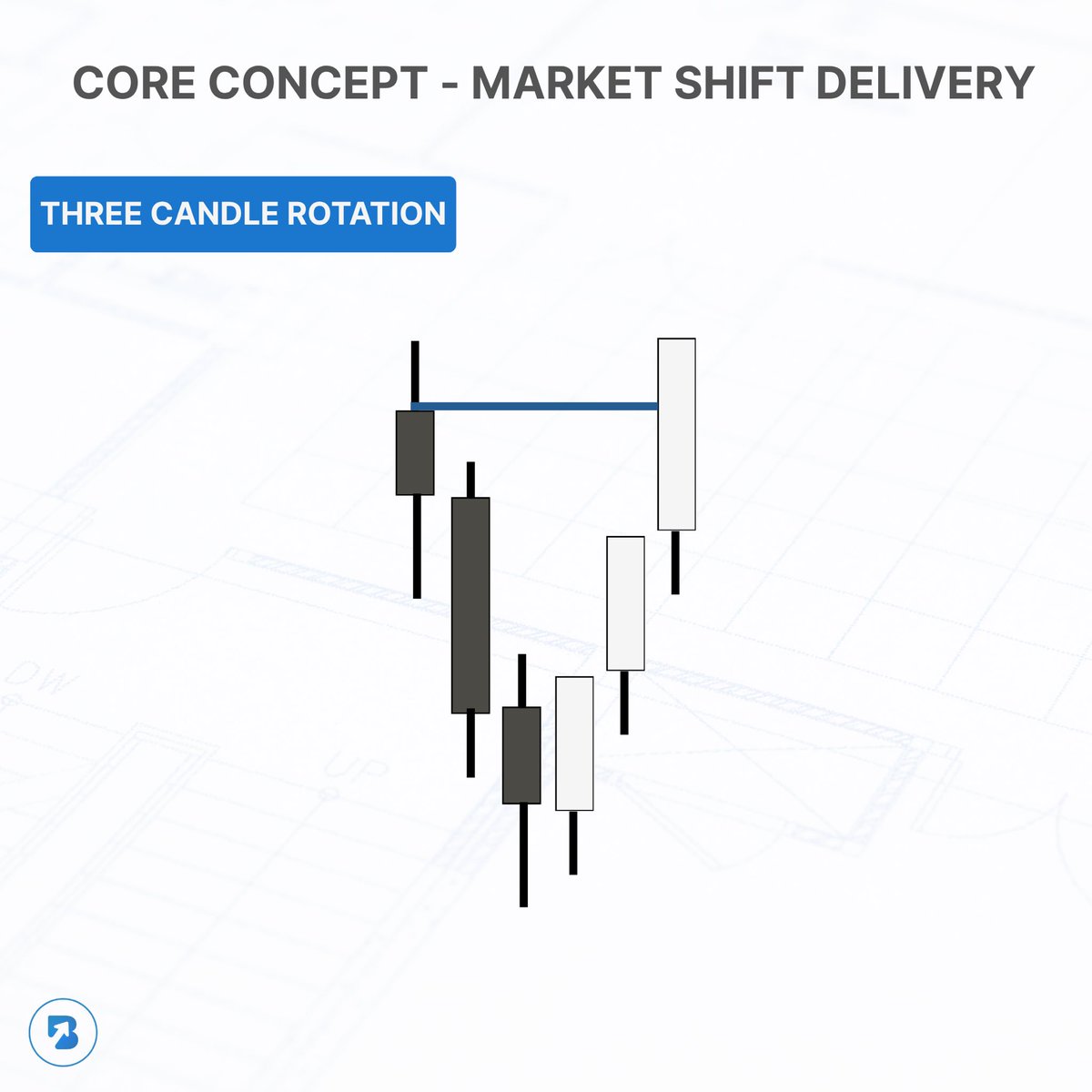

Core Concept:

Core Concept:

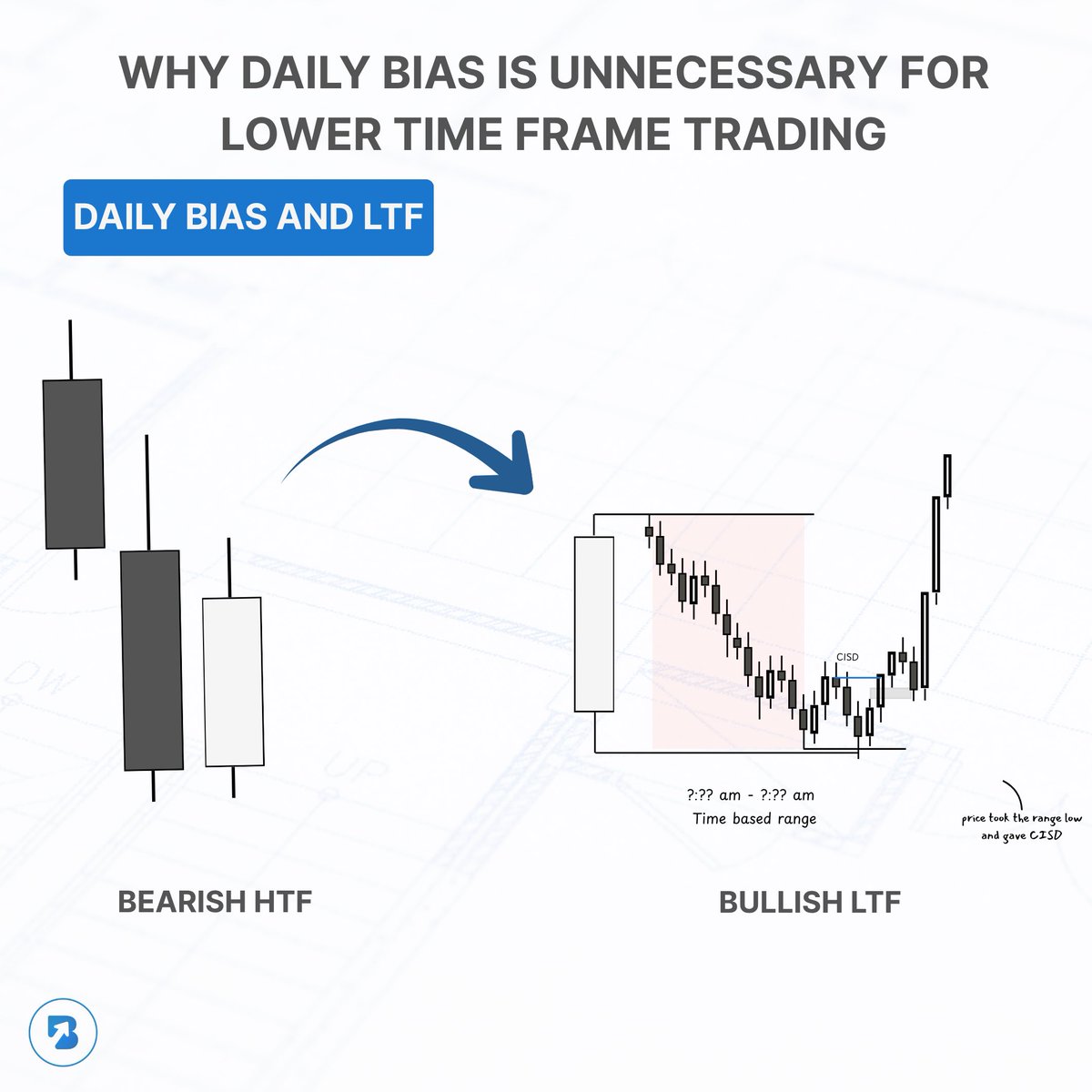

Why Daily Bias is Unnecessary for Lower Time Frame Trading

Why Daily Bias is Unnecessary for Lower Time Frame Trading