9 trading strategies everyone should know (with Python code):

Bollinger Bands Pattern Recognition

The mid band is the moving average on the price series.

The upper and lower bands are two moving standard deviations away from the mid band.

The mid band is the moving average on the price series.

The upper and lower bands are two moving standard deviations away from the mid band.

MACD oscillator

MACD refers to Moving Average Convergence/Divergence.

MACD is a momentum trading strategy.

It assumes momentum has more impact on short-term moving average than long-term moving average.

MACD refers to Moving Average Convergence/Divergence.

MACD is a momentum trading strategy.

It assumes momentum has more impact on short-term moving average than long-term moving average.

Pairs Trading

Pairs trading is a basic form of statistical arbitrage.

It assumes that two cointegrated stocks do not drift too far away from each other.

When they do, it generates the trading signal.

Pairs trading is a basic form of statistical arbitrage.

It assumes that two cointegrated stocks do not drift too far away from each other.

When they do, it generates the trading signal.

Heikin-Ashi Candlestick

Heikin-Ashi refers to 'Average Bar' in Japanese.

It's an alternative style of candlestick chart.

The rules of Heiki-Ashi are designed to filter out the noise for momentum trading.

Heikin-Ashi refers to 'Average Bar' in Japanese.

It's an alternative style of candlestick chart.

The rules of Heiki-Ashi are designed to filter out the noise for momentum trading.

London Breakout

It’s an information arbitrage strategy across different markets in different time zones.

As FX markets are decentralized, you can take a peek at the activity in a closed foreign FX market before the opening of the domestic FX market.

It’s an information arbitrage strategy across different markets in different time zones.

As FX markets are decentralized, you can take a peek at the activity in a closed foreign FX market before the opening of the domestic FX market.

Awesome Oscillator

Awesome oscillator is an upgraded version of the MACD oscillator.

Instead of taking a moving average on the close price, it uses the mean of high and low.

It uses short-term and long-term moving averages to construct the oscillator.

Awesome oscillator is an upgraded version of the MACD oscillator.

Instead of taking a moving average on the close price, it uses the mean of high and low.

It uses short-term and long-term moving averages to construct the oscillator.

Dual Thrust

Dual thrust is an opening range breakout strategy.

We establish upper and lower thresholds based on previous day's open, close, high and low.

When the market opens and the price exceeds the thresholds, take positions before the thresholds.

Dual thrust is an opening range breakout strategy.

We establish upper and lower thresholds based on previous day's open, close, high and low.

When the market opens and the price exceeds the thresholds, take positions before the thresholds.

Parabolic SAR

Parabolic SAR identifies the stop and reversal of a trend.

It's used to identify resistance to the price momentum.

Orders are executed when the SAR and price curves cross over.

Parabolic SAR identifies the stop and reversal of a trend.

It's used to identify resistance to the price momentum.

Orders are executed when the SAR and price curves cross over.

Relative Strength Index Pattern Recognition

RSI reflects the current strength/weakness of the stock price momentum.

When RSI above 70 is overbought and RSI below 30 is oversold.

RSI reflects the current strength/weakness of the stock price momentum.

When RSI above 70 is overbought and RSI below 30 is oversold.

And if that isn't enough, there's 8 more strategies here:

And if THAT isn't enough, there's one more thing for you:github.com/je-suis-tm/qua…

And if THAT isn't enough, there's one more thing for you:github.com/je-suis-tm/qua…

That's a wrap!

If you enjoyed this thread:

1. Follow me @pyquantnews for more of these

2. RT the tweet below to share this thread with your audience

If you enjoyed this thread:

1. Follow me @pyquantnews for more of these

2. RT the tweet below to share this thread with your audience

https://twitter.com/3187132960/status/1934308531689136336

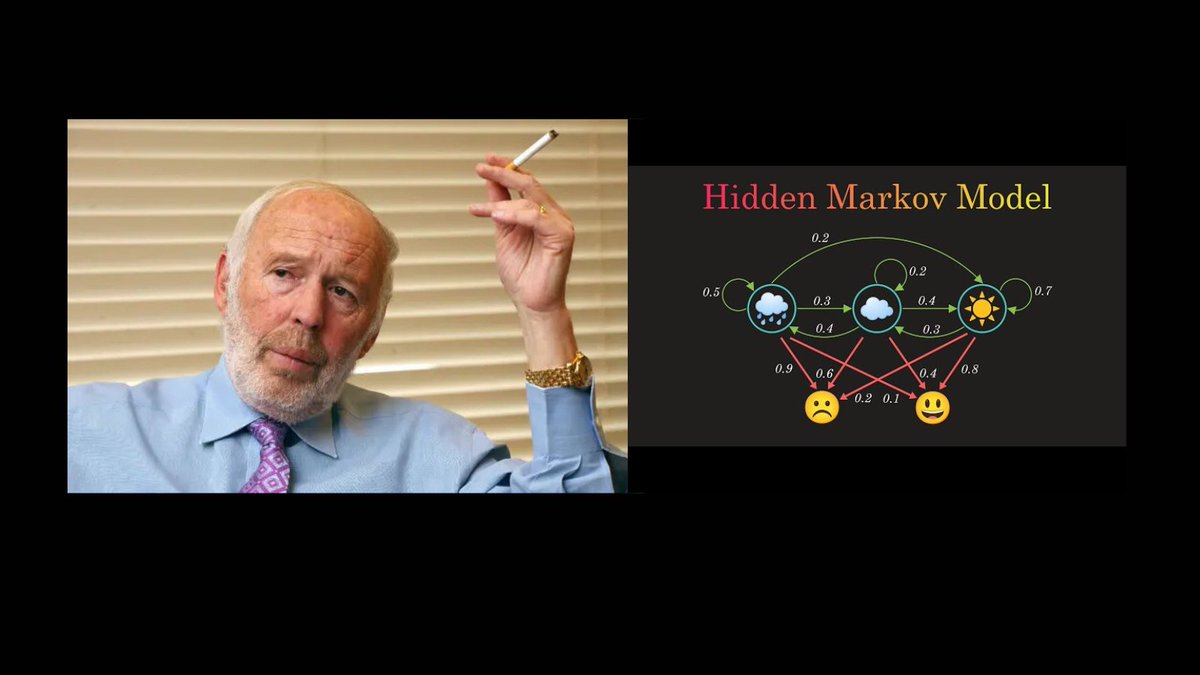

Looking to start using Python for systematic trading?

Here's a free Crash Course with everything you need to get started.

Join the 1,000s of people who finally started with Python after reading it:

pyquantnews.com/free-course

Here's a free Crash Course with everything you need to get started.

Join the 1,000s of people who finally started with Python after reading it:

pyquantnews.com/free-course

• • •

Missing some Tweet in this thread? You can try to

force a refresh