📢New paper in the Economic Journal @EJ_RES:

👉Differences in patience can account for substantial regional variation in educational achievement within countries

Data on Facebook interests allow us to derive regional measures of patience

A🧵 1/9 academic.oup.com/ej/advance-art…

👉Differences in patience can account for substantial regional variation in educational achievement within countries

Data on Facebook interests allow us to derive regional measures of patience

A🧵 1/9 academic.oup.com/ej/advance-art…

“Patience and Subnational Differences in Human Capital:

Regional Analysis with Facebook Interests”

w/ @EricHanushek, @KinneLavinia & P. Sancassani

Decisions to invest in human capital depend on time preferences

➡️New perspectives on longstanding within-country disparities

2/9

Regional Analysis with Facebook Interests”

w/ @EricHanushek, @KinneLavinia & P. Sancassani

Decisions to invest in human capital depend on time preferences

➡️New perspectives on longstanding within-country disparities

2/9

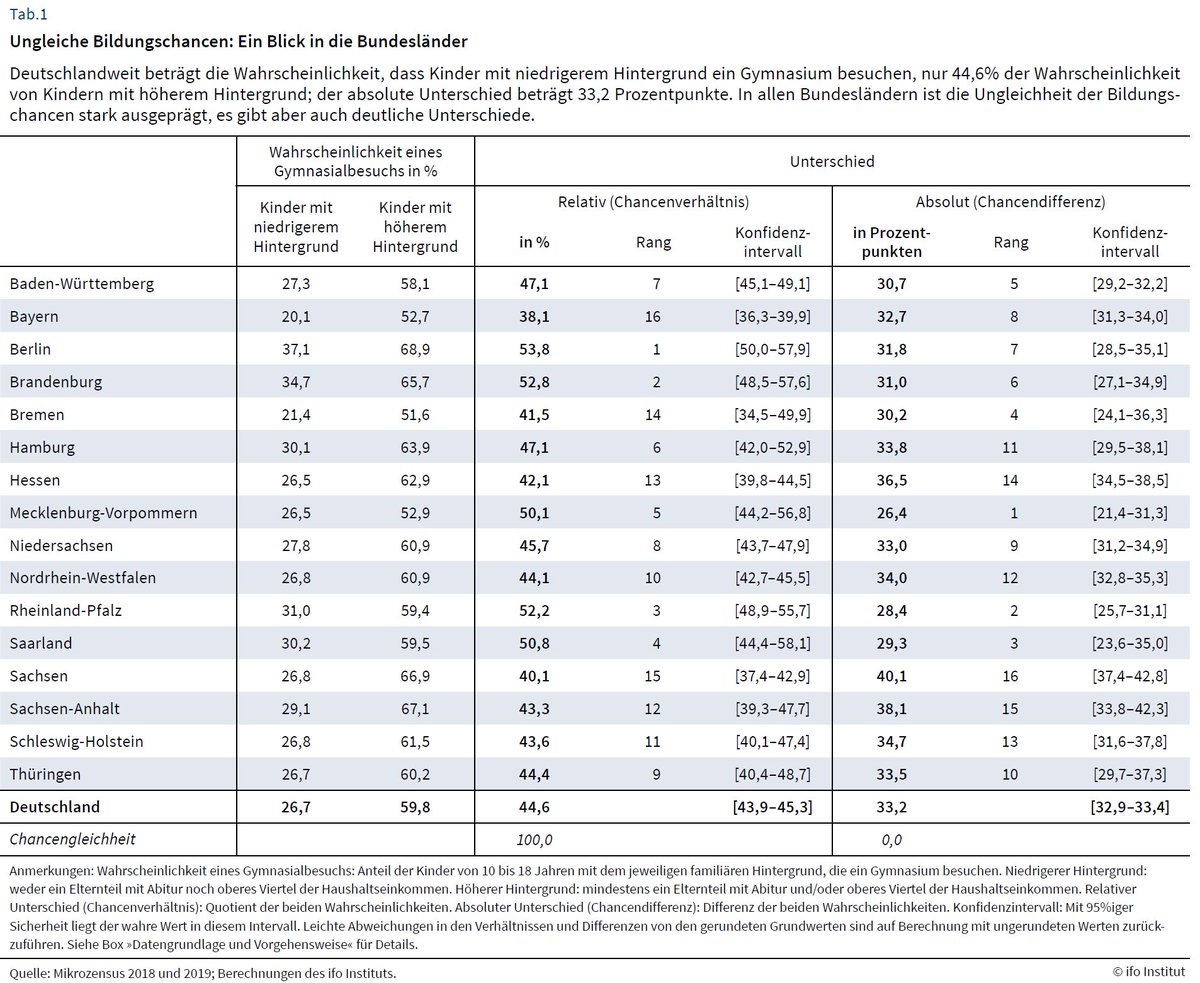

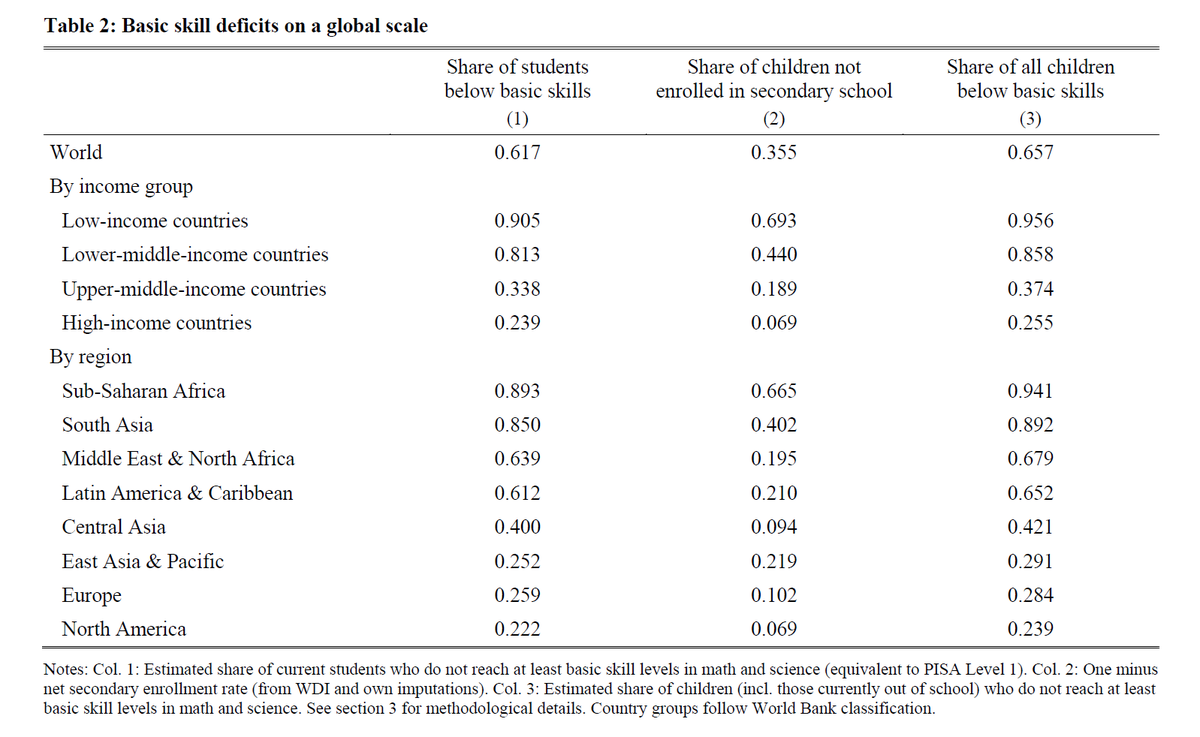

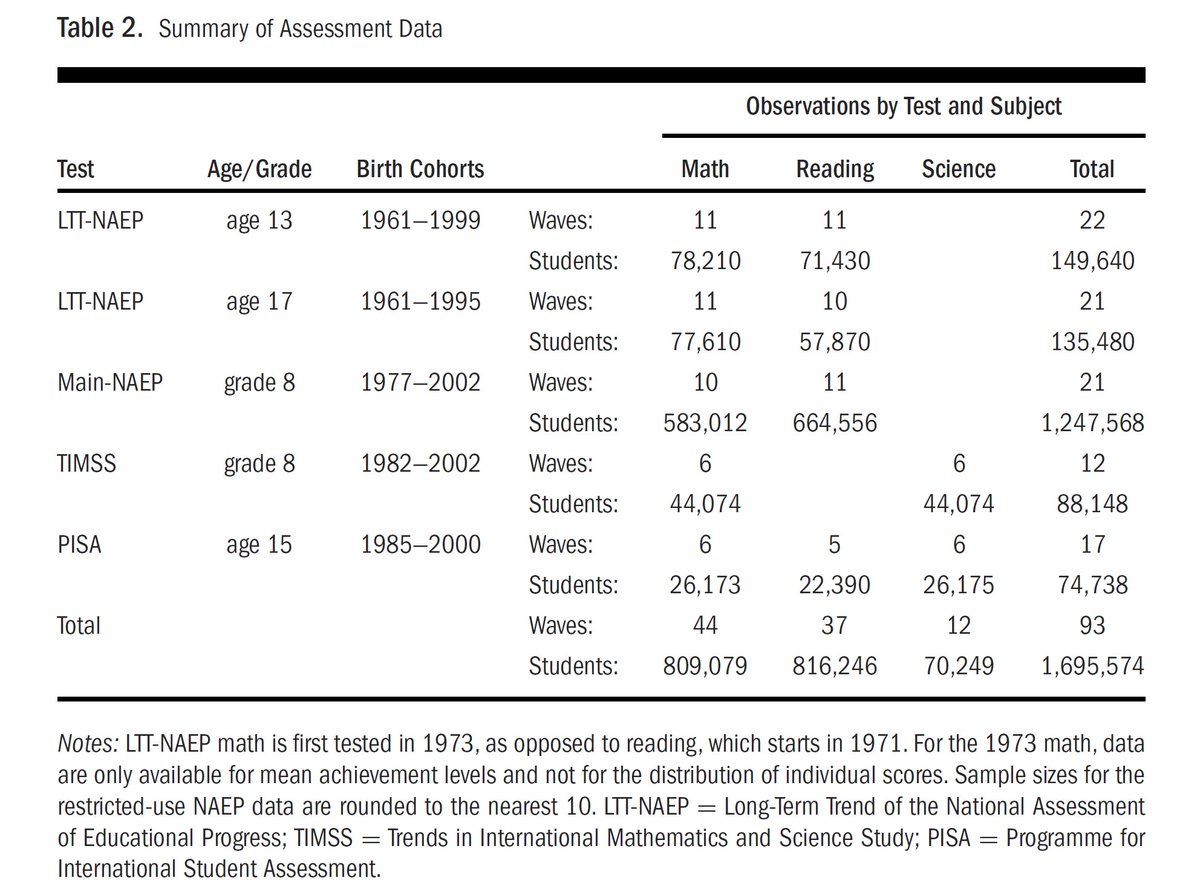

Regional differences in student achievement are large & longstanding:

Difference in math achievement between top- & bottom-performing 🇺🇸 states ≈ ⅔ of cross-country differences

Equivalent to > 2 years of learning

Similar for 🇮🇹 regions

3/9

Difference in math achievement between top- & bottom-performing 🇺🇸 states ≈ ⅔ of cross-country differences

Equivalent to > 2 years of learning

Similar for 🇮🇹 regions

3/9

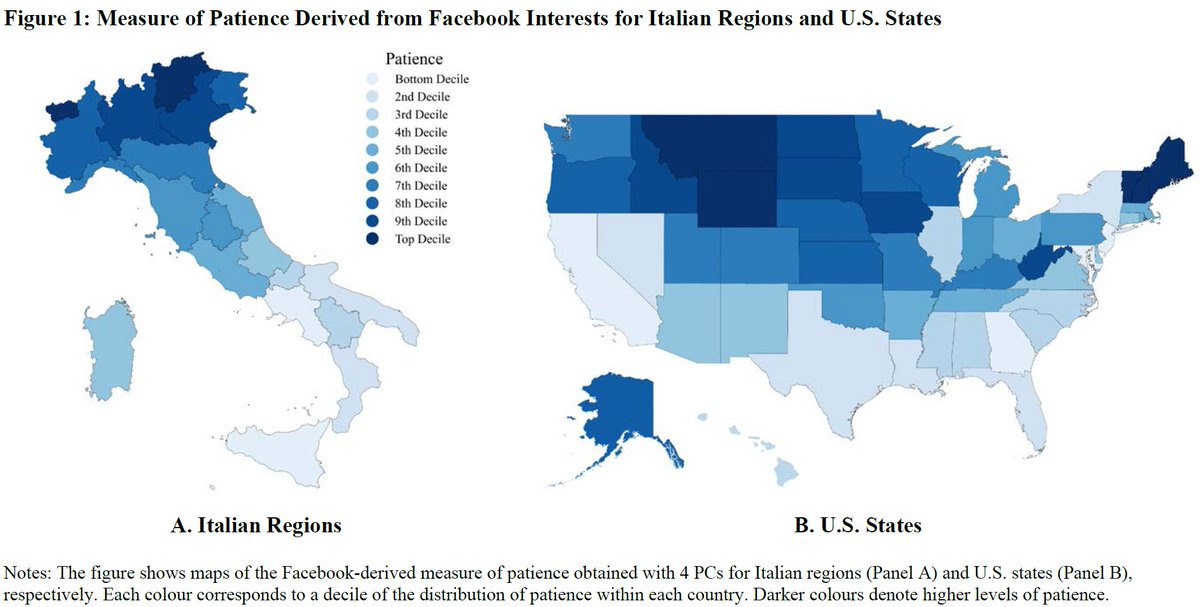

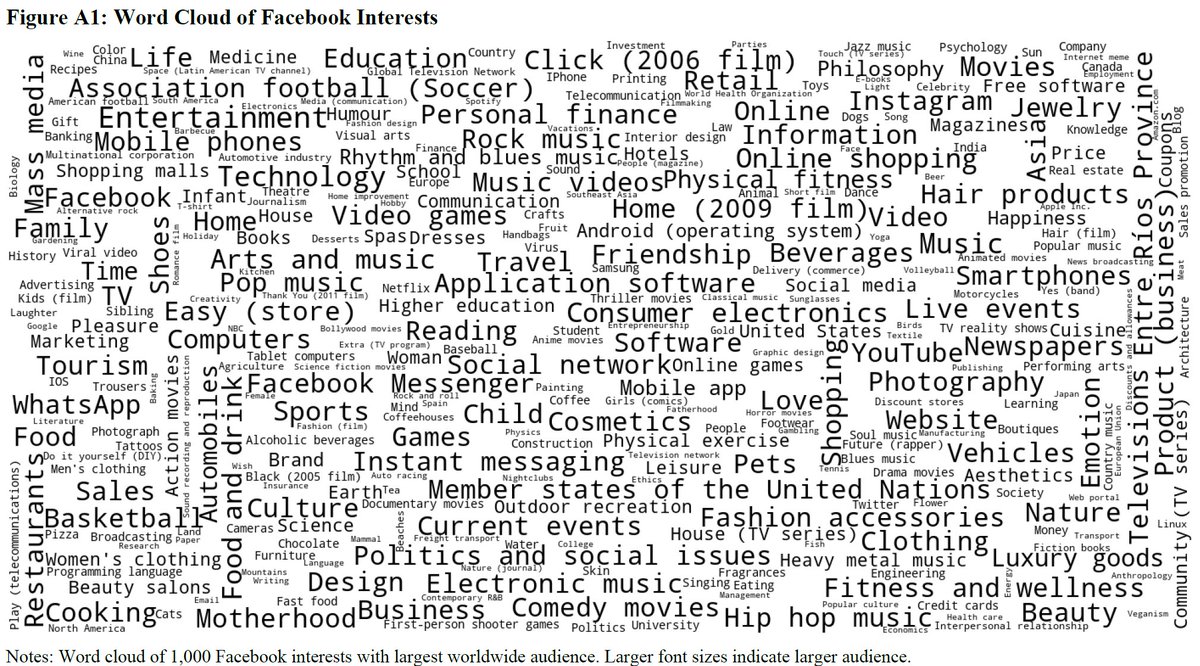

We combine the massive data available from social media –Facebook interests– with machine-learning algorithms to construct novel regional measures of patience within 🇮🇹 Italy & 🇺🇸 U.S.

Geographic patterns of patience coincide with longstanding North-South disparities

4/9

Geographic patterns of patience coincide with longstanding North-South disparities

4/9

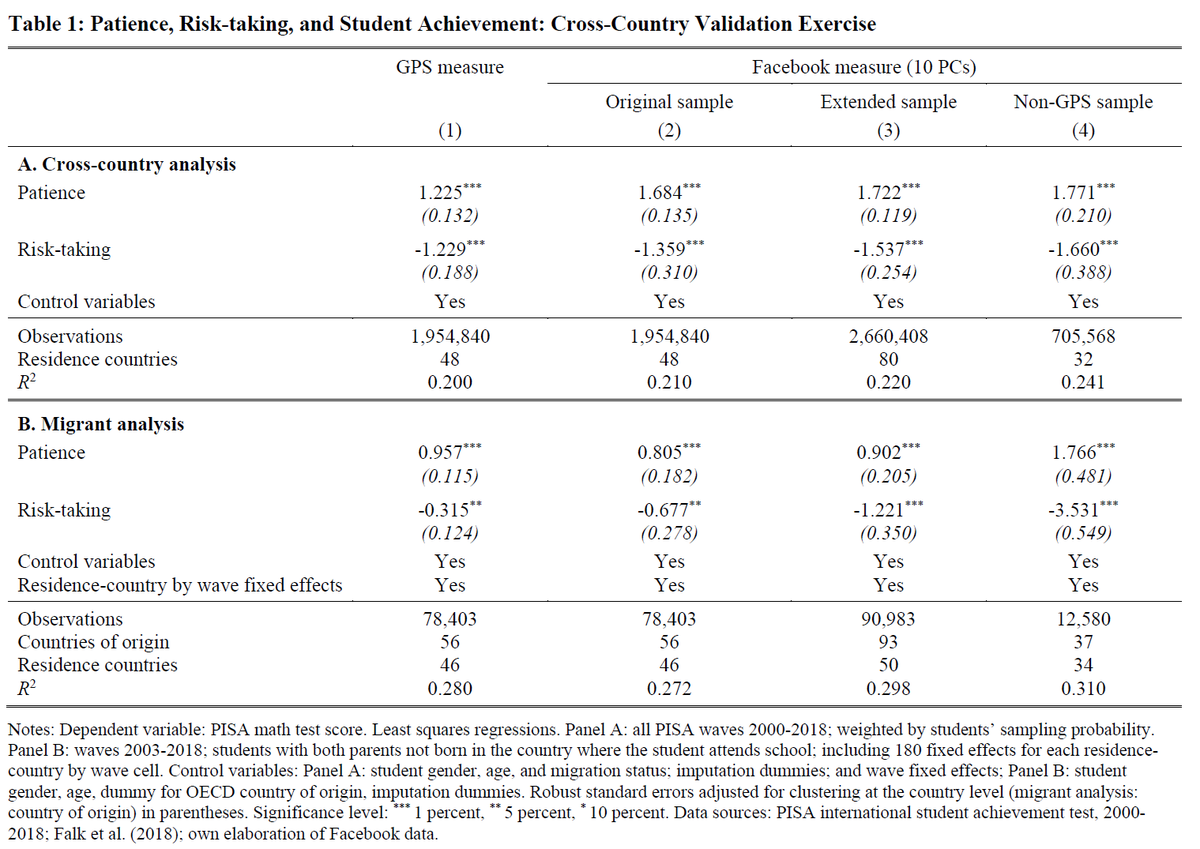

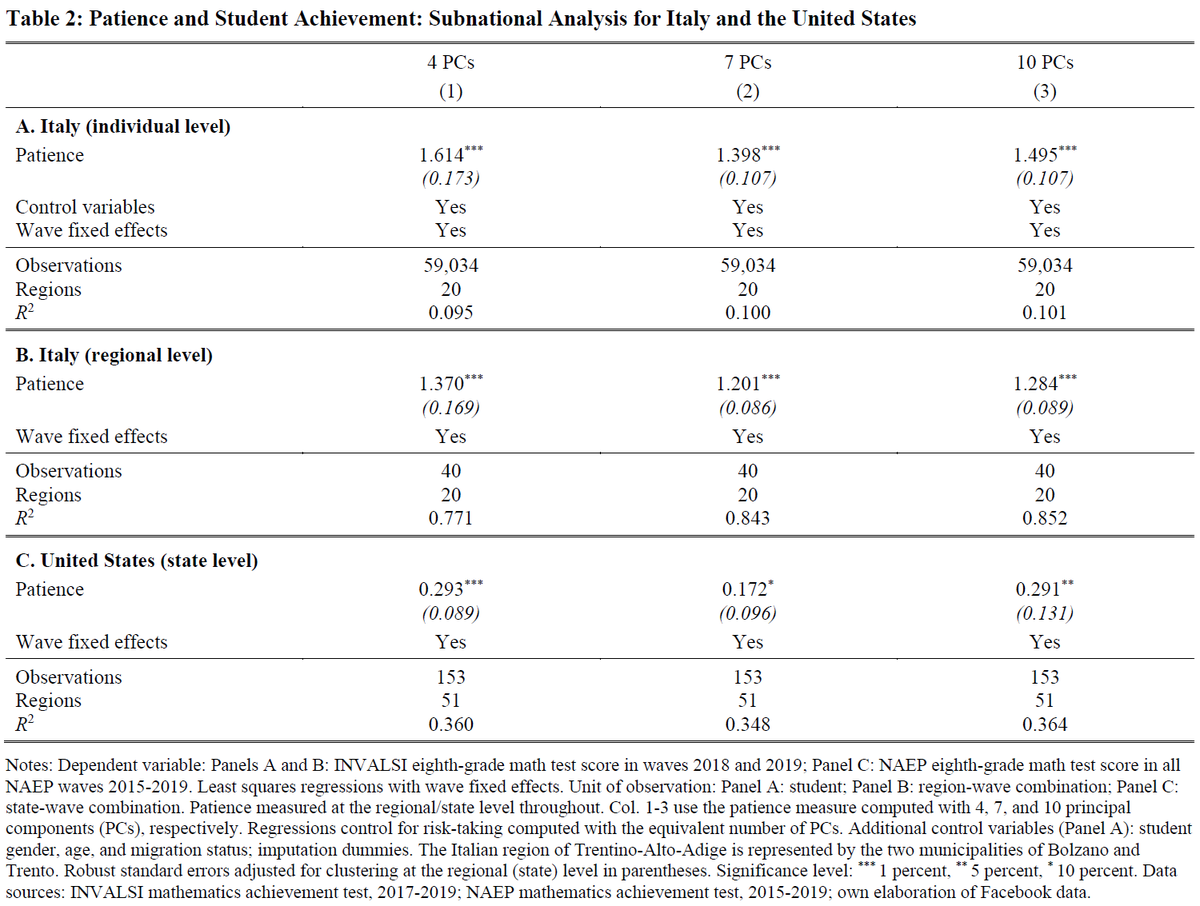

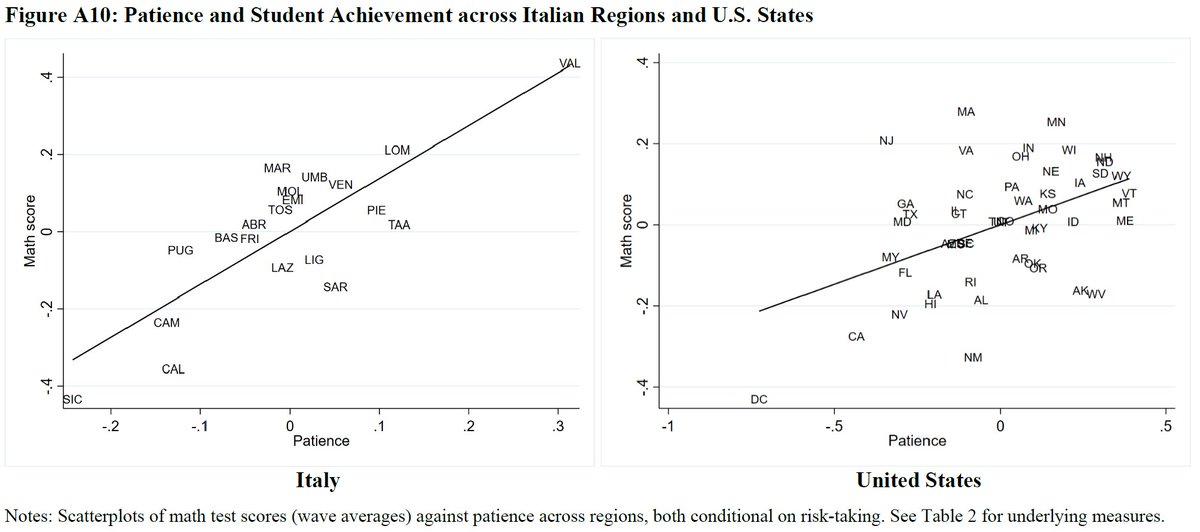

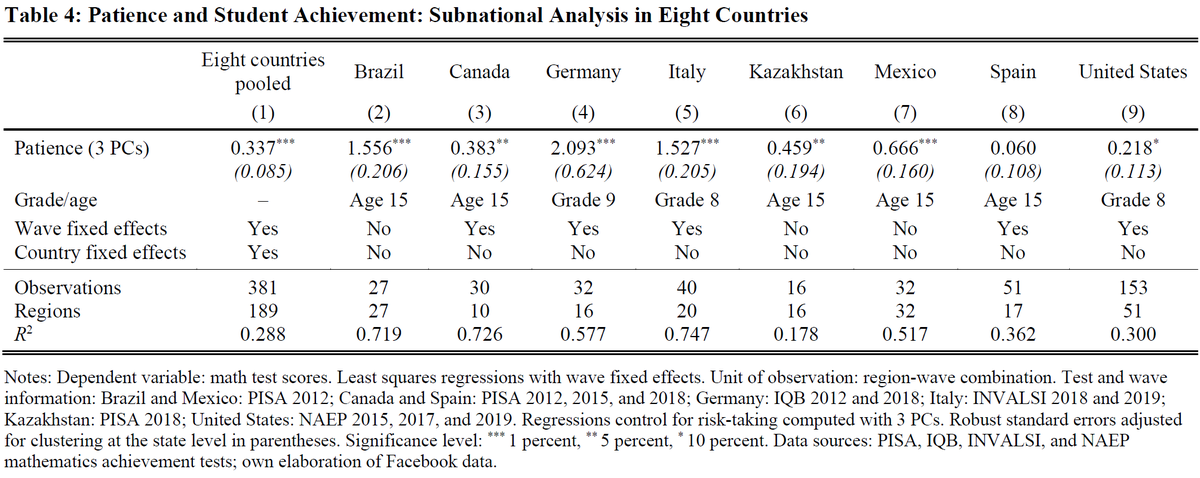

▶️Main result:

Patience is strongly positively associated with student achievement across regions in both countries

Accounts for ¾ of achievement variation across 🇮🇹 regions and ⅓ across 🇺🇸 states

Lower 🇺🇸 estimate possibly related to internal mobility

6/9

Patience is strongly positively associated with student achievement across regions in both countries

Accounts for ¾ of achievement variation across 🇮🇹 regions and ⅓ across 🇺🇸 states

Lower 🇺🇸 estimate possibly related to internal mobility

6/9

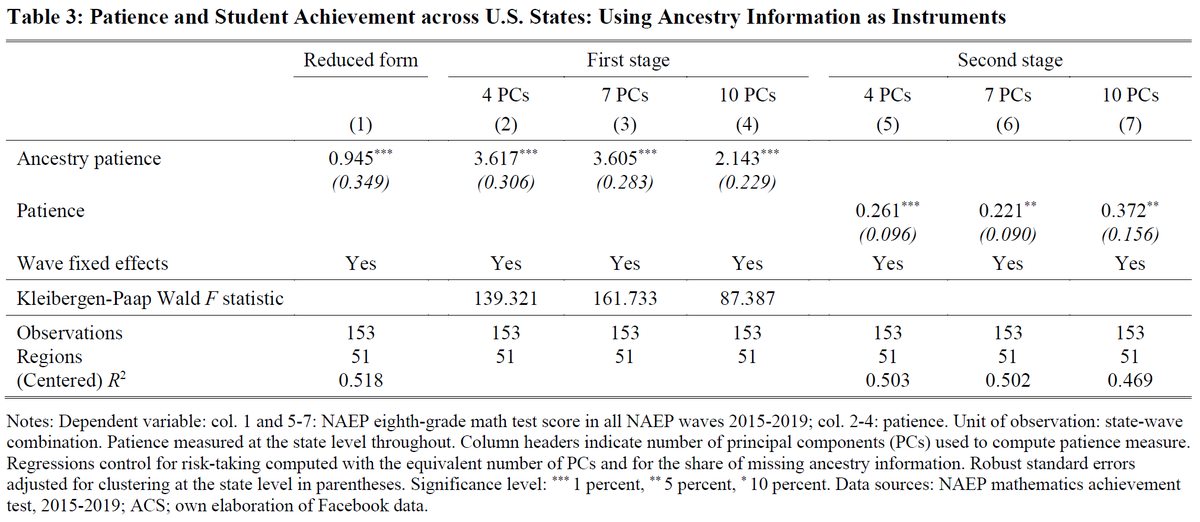

Finding is confirmed in identification strategy that employs variation in ancestry countries of current population of 🇺🇸 states

7/9

7/9

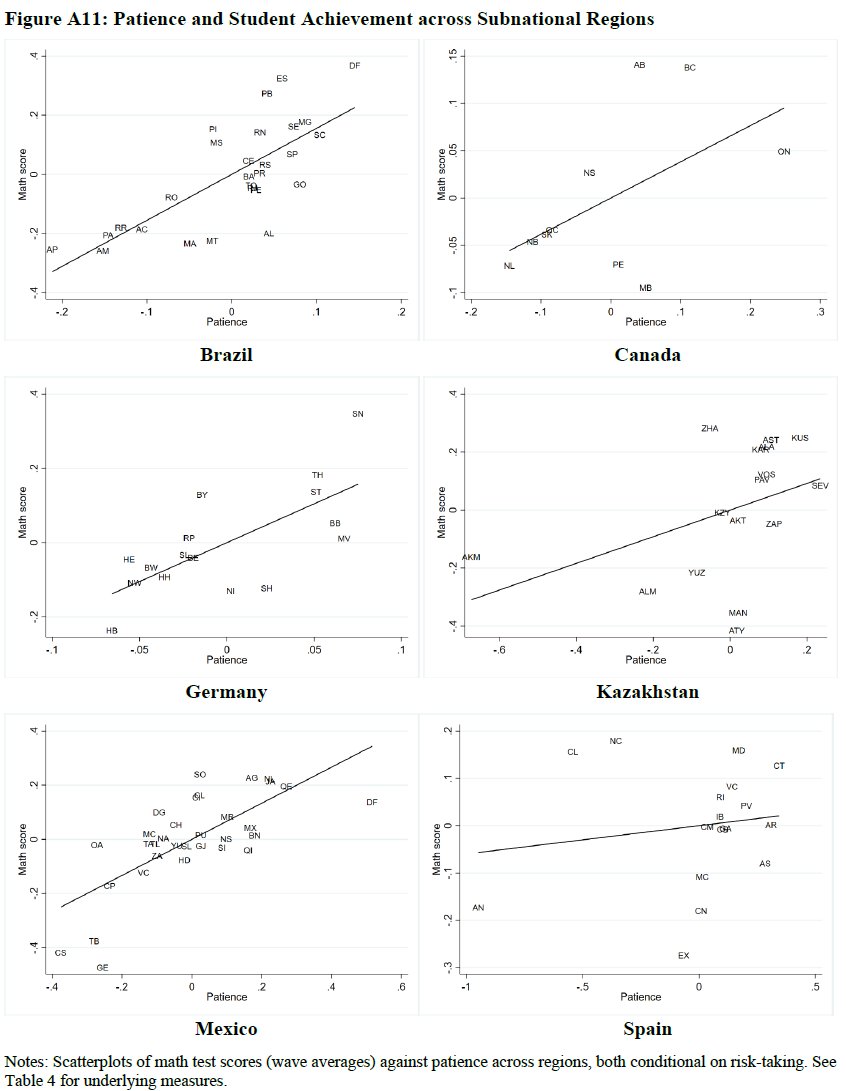

Results are consistent for 6 additional countries with more limited regional achievement data

🇧🇷🇨🇦🇩🇪🇰🇿🇲🇽🇪🇸

8/9

🇧🇷🇨🇦🇩🇪🇰🇿🇲🇽🇪🇸

8/9

Short VoxEU piece on the paper:

cepr.org/voxeu/columns/…

Link to the paper at the Economic Journal:

academic.oup.com/ej/advance-art…

9/9

cepr.org/voxeu/columns/…

Link to the paper at the Economic Journal:

academic.oup.com/ej/advance-art…

9/9

📢FYI: New paper in EJ on patience & regional achievement: @albertobisin @ProfTDee @BenjaminEnke @GalorOded @zingales @JRuhose @MariaBigoni1 @Borty_ste @acrumin @raganpetrie @klausvanieper @iyadrahwan @Econ_Sandy @jmontalbancas @AndreaIchino @SarahCohodes @uZoelitz @karthik_econ

📢FYI: New paper in EJ on patience & regional achievement: @karthik_econ @JeffDenning @edwinleuven @ALPWillen @MariSRege @pqblair @ChristinaFelfe @astrid_mjs @Gabri_EllaConti @hooster1 @ProfTDee @BenjaminArold @simon_jaeger @MatthewAKraft @giu_sorrenti @ariel_kalil @profsimonb

📢FYI: New paper in EJ on patience & regional achievement: @instrumenthull @D_Langenmayr @Lars_Feld @KhoaVuUmn @MathiasHuebener @jhaushofer @angrist_noam @CaciliaLipowski @FelixWeinhardt @mdoepke @CEDR_US @Lnavarrosola @econjeffsmith @margherita_fort @FabianKosse @DrNathanNunn

📢FYI: New paper in EJ on patience & regional achievement: @FuestClemens @ECONMunich @RationalityCRC @ifo_Education

• • •

Missing some Tweet in this thread? You can try to

force a refresh