For years, Sanjiv Bhasin had a stock call for every investor. Whether you were a 25-year-old watching Zee Business or a retiree on ET Now, you saw him pitching picks with bold targets and confident reasoning. To many retail investors, he was a rare trusted voice in complex markets.🧵👇

And that, according to SEBI's recent 149-page interim order, is what let him get away with fraud. To SEBI, this is a case of monetised trust, weaponised mass media, and an architecture built around extracting profits from public beliefs through sophisticated market manipulation.

The fraud was built on one simple idea: Bhasin was front-running the very people who trusted him. From January 2022 to June 2024, he would make media appearances following a consistent pattern - recommend stocks on TV, trigger buying frenzies, then dump through connected entities.

Bhasin built his public persona riding IIFL's coat-tails. Personally, he was never registered as a research analyst or investment adviser - he didn't have basic legitimacy to make recommendations. But his association with IIFL gave a veneer of legitimacy to his calls.

He continued using titles like "Director, IIFL" in public appearances long after stepping down as Director in 2022. Though technically just a consultant, media projected him as IIFL's face. His tips were posted on IIFL's official Telegram channel followed by thousands of retail investors.

This association gave Bhasin public cover. Why would someone high up in a large, respected entity play shady games? Many viewers ignored the possibility of conflict. And that gave him room to work his scheme with a sophisticated, family-controlled network.

Behind him was a tightly-run network of shell companies, brokerage infrastructure, and insider communication channels. Bhasin's cousin Lalit Bhasin, brother-in-law Ashish Kapur, and loyal dealers were all part of the operation. Bhasin sat at the top, feeding ideas to the public.

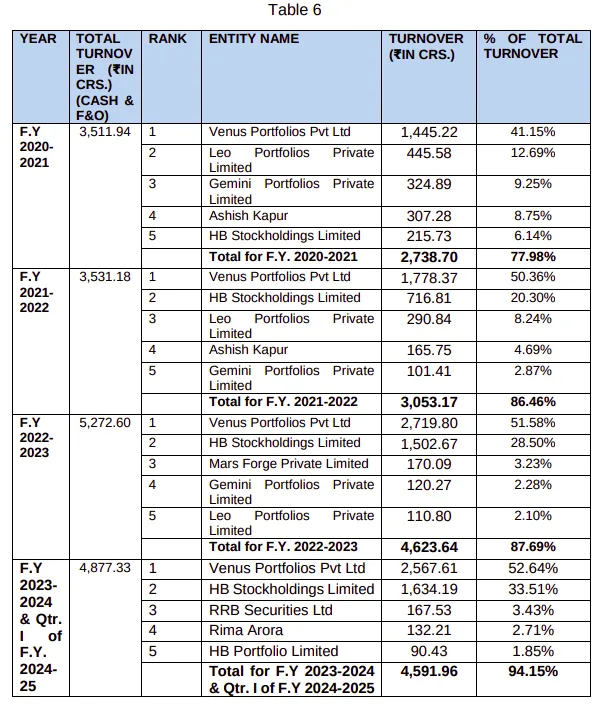

Virtually all trades were executed through RRB Master Securities, whose Managing Director Ashish Kapur was Bhasin's brother-in-law. 75% of its revenues came from just five accounts, largely controlled by Bhasin's cousin and others close to the family.

The elaborate dance worked like this: Minutes before Bhasin went on air at predictable times, the network would place orders for target stocks. RRB dealers were complicit - when Bhasin messaged to buy a stock, dealers first bought for group accounts, then for themselves.

Within minutes or seconds of these front-running trades, Bhasin would deliver his recommendation on live TV - usually a strong "buy" with target price and credible narrative about sector tailwinds or quarterly performance. Public buying would push prices up, then the group would dump shares.

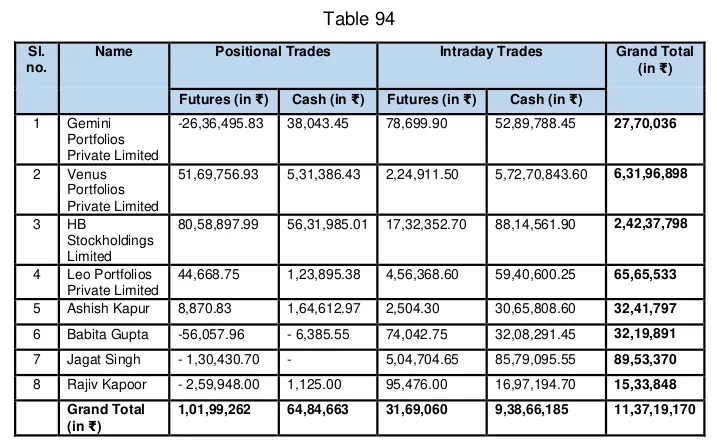

This wasn't random coincidence. SEBI examined nearly 40,000 trades and found this pattern repeated across at least thirty stock calls. Despite Bhasin positioning tips as "long-term ideas," the network's portfolios would often exit stocks within an hour of his TV appearance.

The scale was massive. Venus Portfolios alone accounted for over ₹2,700 crore in trading volumes in FY23 through RRB Master Securities. From just NSE trades SEBI could match, it identified over ₹11 crore in ill-gotten gains - and there might be more yet uncovered.

How did SEBI catch them? Three complaints in late 2023 triggered investigation when investors noticed strange patterns - stocks recommended by Bhasin would spike, but rumors suggested certain large accounts had bought earlier. This looked suspicious but wasn't easy to prove initially.

SEBI began checking RRB Master trade data, found it suspicious, then escalated to full investigation. On June 13-14, 2024, they ran search and seizure operations across homes, offices, and brokerage back-ends, collecting data from phones, laptops, terminals, and bank accounts.

The evidence was overwhelming. Bhasin had thousands of calls with RRB dealers during market hours. From one number registered in his wife's name but used by him, he exchanged over 5,000 calls with just two dealers in 18 months, spiking before media appearances.

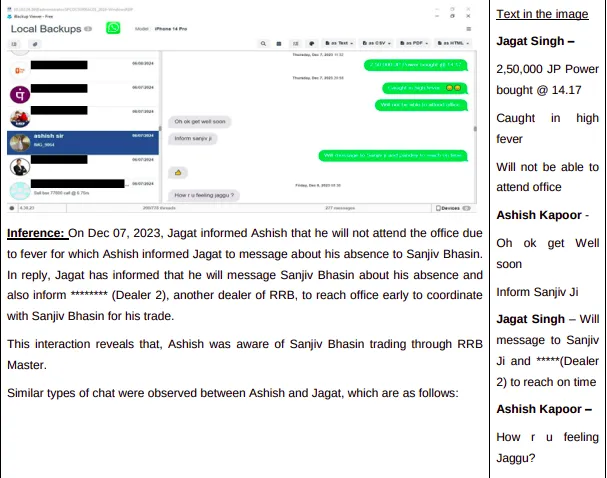

WhatsApp messages showed dealers updating Bhasin on trade status, entry levels, and execution progress. Some even asked if he was going on TV that day. Others informed him of margin availability before finalising trades. Dealers would report to Bhasin directly if they were on leave.

Trading terminals had specific coded logins that SEBI tracked. Trades came in bursts right before and after recommendations. Often, the same stock was traded in all four entities simultaneously, underlining coordinated strategy hidden under elaborate corporate structures.

SEBI traced layers of intermediaries and shell entities to discover that Lalit Bhasin and his family controlled more than 75% of shareholding in Venus and Gemini, directly or indirectly. The network's trading activity left clear footprints of systematic manipulation.

SEBI's interim order terms Bhasin the "mastermind of the manipulative/fraudulent scheme" with "joint and several" liability for his entire network. They've ordered disgorgement of ₹11.37 crore, barred market access, and prohibited media appearances until further notice.

This isn't final - SEBI issued show-cause notices with 21 days to respond before permanent orders. But this episode leaves uncomfortable questions: How many others are doing the same? How many TV tips are actually trades in disguise? Be very careful about what anyone tells you in markets.

We cover this and one more interesting story in today's edition of The Daily Brief. Watch on YouTube, read on Substack, or listen on Spotify, Apple Podcasts, or wherever you get your podcasts.

All links here: thedailybrief.zerodha.com/p/your-favouri…

All links here: thedailybrief.zerodha.com/p/your-favouri…

• • •

Missing some Tweet in this thread? You can try to

force a refresh