Claims Thursday:

1/ I'm on vacation through the 4th across the pond - I won't be able to resist labor market tweeting, but will be lighter than usual.

Benchmark for continuing claims on Thursday is 1.925M, but I'd bet it'll be north of 1.955M. Bad news!

1/ I'm on vacation through the 4th across the pond - I won't be able to resist labor market tweeting, but will be lighter than usual.

Benchmark for continuing claims on Thursday is 1.925M, but I'd bet it'll be north of 1.955M. Bad news!

2/ On initial claims, the benchmark is 244K. We've been hewing pretty closely to what I've expected on this front - i.e. not seeing clear deterioration on the layoff front in the same way as on the unemployment front.

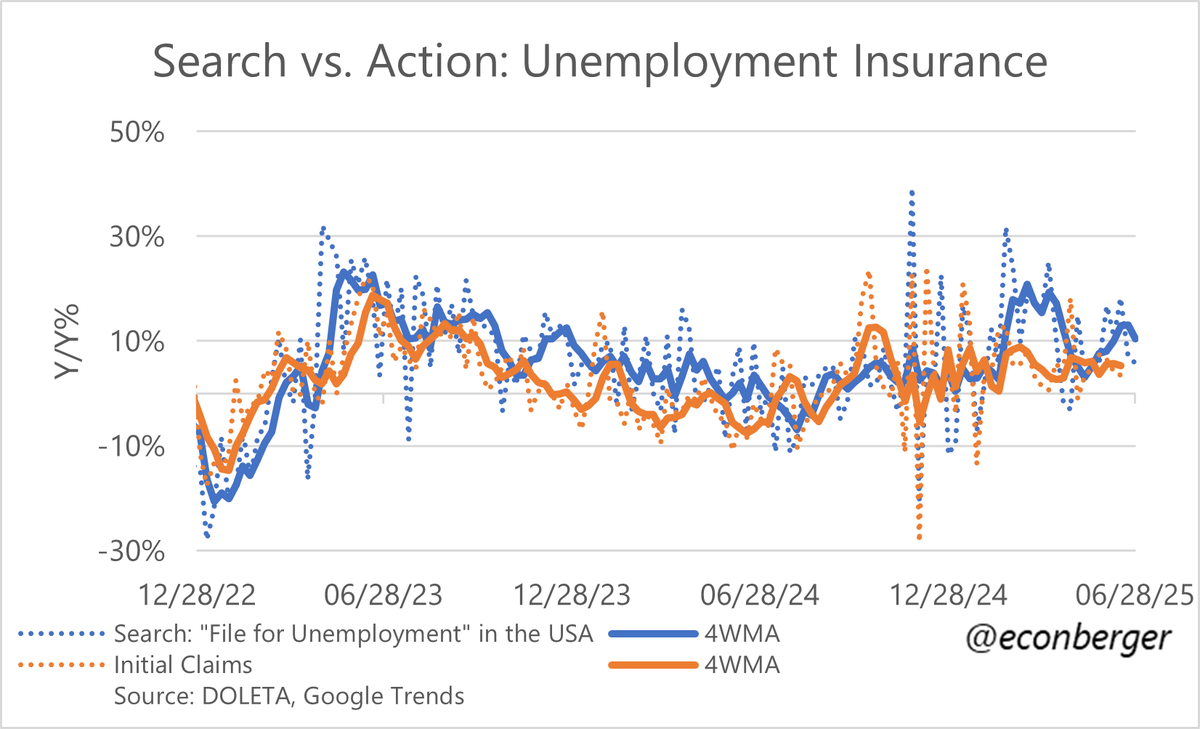

3/ Google Trends data suggest an acceleration in initial claims, and while this has historically functioned as a pretty good nowcast, it generates false positives fairly often for small swings.

• • •

Missing some Tweet in this thread? You can try to

force a refresh