Mega Backdoor Roth strategy allows married couples to invest $80,000+ a year into a Roth IRA.

It’s one of the most powerful tax strategies to avoid taxes on investments, but 99% of people have never even heard of it.

Here's how to take advantage of it:

It’s one of the most powerful tax strategies to avoid taxes on investments, but 99% of people have never even heard of it.

Here's how to take advantage of it:

First, make sure to bookmark the first post for reference and share it with a friend.

Your 401(k) plan generally has 2 options:

1. Before-tax (traditional)

2. Roth 401(k)

Your 401(k) plan generally has 2 options:

1. Before-tax (traditional)

2. Roth 401(k)

The overall 401k limit in 2025 is $70,000 (combines employee + employer)

The employee limit (the first 2 options, before-tax and Roth) is $23,500.

The rest, minus the employer match, can be put into this after-tax account.

The employee limit (the first 2 options, before-tax and Roth) is $23,500.

The rest, minus the employer match, can be put into this after-tax account.

So, say you are a high earner and maxing out your 401(k) of $23.5k limit. Your employer gives you $10k match.

This means that you can put $70k - $10k - $23.5k = $36.5k into the after-tax account per person.

This after-tax account can typically be rolled over in a Roth IRA.

This means that you can put $70k - $10k - $23.5k = $36.5k into the after-tax account per person.

This after-tax account can typically be rolled over in a Roth IRA.

This strategy is only available if your employer allows the "after-tax contributions"

Let's say they allow it. How do you do it? It's simple:

1. Contribute to a 401k after-tax account

2. Roll the funds over to Roth 401k or Roth IRA (depends what your plan supports)

Let's say they allow it. How do you do it? It's simple:

1. Contribute to a 401k after-tax account

2. Roll the funds over to Roth 401k or Roth IRA (depends what your plan supports)

The rules will vary from plan to plan into which account you can rollover.

If you have both, here are the benefits of each:

Roth 401k - minimize earnings by automatic conversion, easy to set up

Roth IRA - more investment variety and more flexible on withdrawals

If you have both, here are the benefits of each:

Roth 401k - minimize earnings by automatic conversion, easy to set up

Roth IRA - more investment variety and more flexible on withdrawals

When you do step 1, the amount is typically automatically invested.

When you do step 2 (rollover) you might have some earnings.

To reduce this taxable amount, do steps 1 and 2 as soon as possible. Some companies also offer immediate conversion.

When you do step 2 (rollover) you might have some earnings.

To reduce this taxable amount, do steps 1 and 2 as soon as possible. Some companies also offer immediate conversion.

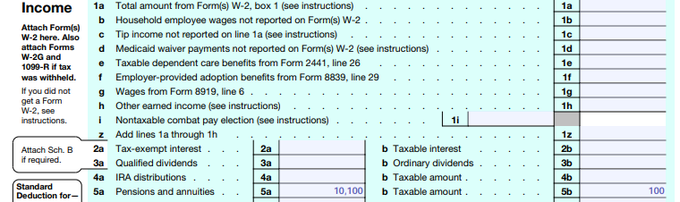

By the end of the year, you will receive a 1099-R form.

Say you contribute $10,000, get $100 of earnings, and roll it all into Roth IRA.

Your Tax Form 1040, Line 5a, will be $10,100, and Line 5b will be $100 of 1040:

Say you contribute $10,000, get $100 of earnings, and roll it all into Roth IRA.

Your Tax Form 1040, Line 5a, will be $10,100, and Line 5b will be $100 of 1040:

"What if I'm a business owner?"

There are Solo 401(k) providers that have the "after tax" option enabled.

So it's possible even if you are a single owner, assuming you have sufficient income.

There are Solo 401(k) providers that have the "after tax" option enabled.

So it's possible even if you are a single owner, assuming you have sufficient income.

The after-tax contribution limits are per plan, so your spouse can also do the MBR if allowed by the 401(k) plan.

This also means that if you quit and start a new job, you can contribute even more $$$ to after-tax, or if you're a doctor working for multiple employers.

This also means that if you quit and start a new job, you can contribute even more $$$ to after-tax, or if you're a doctor working for multiple employers.

The main benefit of this strategy is getting as much money as possible into Roth accounts before investing in a brokerage account.

The tax-free growth and withdrawals can save you a lot of money on taxes.

Don't sleep on this option if allowed.

The tax-free growth and withdrawals can save you a lot of money on taxes.

Don't sleep on this option if allowed.

If you learned something new, please:

1. follow me @money_cruncher

2. share this post with a friend📨

3. repost it so others learn about it 🔁

1. follow me @money_cruncher

2. share this post with a friend📨

3. repost it so others learn about it 🔁

• • •

Missing some Tweet in this thread? You can try to

force a refresh