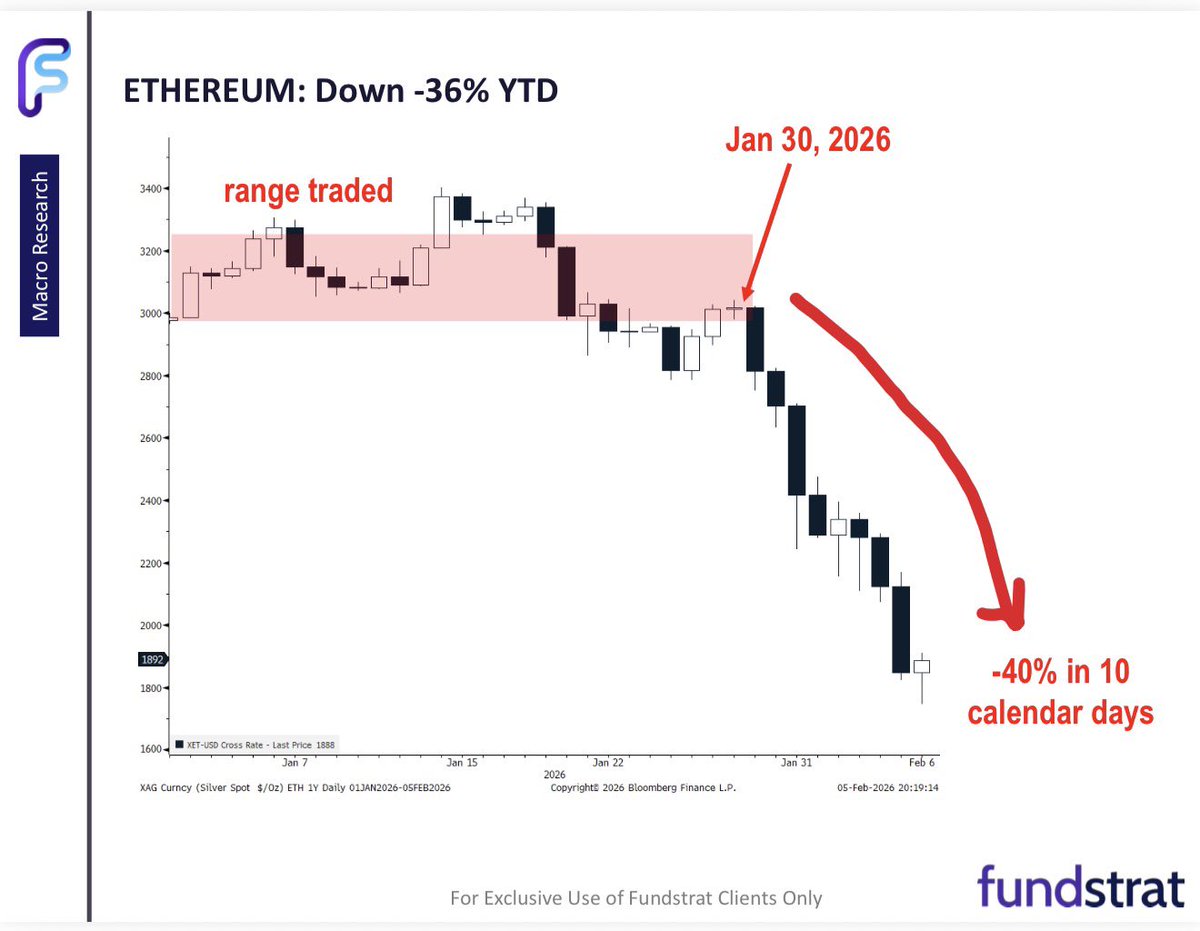

A 🧵 on stablecoins and Ethereum

1/

Stablecoins is the singular most successful crypto product and the only one to move into the "real world" with $250 billion in total assets

we are in the earliest days....

(keep reading plz)

@fs_insight @SeanMFarrell

1/

Stablecoins is the singular most successful crypto product and the only one to move into the "real world" with $250 billion in total assets

we are in the earliest days....

(keep reading plz)

@fs_insight @SeanMFarrell

https://twitter.com/SharpLinkGaming/status/1937505642618474811

2/

Stablecoins are a good business model and attracted the interest of banks $JPM $V and even merchants $AMZN $WMT

- issuers of stablecoins generate significant profits as the collateral (USD) can earn yield and this is not paid to holders of the stablecoin (yet)

@fs_insight @SeanMFarrell @WSJ @business

Stablecoins are a good business model and attracted the interest of banks $JPM $V and even merchants $AMZN $WMT

- issuers of stablecoins generate significant profits as the collateral (USD) can earn yield and this is not paid to holders of the stablecoin (yet)

@fs_insight @SeanMFarrell @WSJ @business

3/

Merchants like stablecoins but there is lower transaction costs and the merchants do not take the continuous loss from "chargebacks" which can run as high as 5%-6% of transaction dollar volume

- and BONUS: a large untapped market of users who do not use credit cards

@fs_insight @SeanMFarrell

Merchants like stablecoins but there is lower transaction costs and the merchants do not take the continuous loss from "chargebacks" which can run as high as 5%-6% of transaction dollar volume

- and BONUS: a large untapped market of users who do not use credit cards

@fs_insight @SeanMFarrell

4/

In fact, 80% of USD stablecoin volume is outside the US

- Singapore, Hong Kong and Japan nearly 40% of stablecoin volume

- in some nations USDT trades above $1.00 because of high demand

- even real estate transactions are paid with stablecoins

@fs_insight @SeanMFarrell

In fact, 80% of USD stablecoin volume is outside the US

- Singapore, Hong Kong and Japan nearly 40% of stablecoin volume

- in some nations USDT trades above $1.00 because of high demand

- even real estate transactions are paid with stablecoins

@fs_insight @SeanMFarrell

5/

US gov't realizes stablecoins = two structural benefits:

first, USD dominance surges in stablecoin/crypto:

- USD = 27% global GDP

- USD = 57% of global central bank reserves

- USD = 88% of liquid financial market

- USD = 100% of stablecoin denomination

The more assets move to the blockchain, the greater the demand for stablecoins:

= greater USD dominance

@fs_insight @SeanMFarrell

US gov't realizes stablecoins = two structural benefits:

first, USD dominance surges in stablecoin/crypto:

- USD = 27% global GDP

- USD = 57% of global central bank reserves

- USD = 88% of liquid financial market

- USD = 100% of stablecoin denomination

The more assets move to the blockchain, the greater the demand for stablecoins:

= greater USD dominance

@fs_insight @SeanMFarrell

6/

The second benefit to USD: Stablecoins collectively now the 12th largest holder of US Treasuries

- Tether $USDT owns more UST than Germany

@fs_insight @SeanMFarrell

The second benefit to USD: Stablecoins collectively now the 12th largest holder of US Treasuries

- Tether $USDT owns more UST than Germany

@fs_insight @SeanMFarrell

7/

Looking ahead, stablecoins is the "front end" of the convergence of financial services and crypto:

- the next generation may prefer to bank to be crypto-friendly company $HOOD $CRCL $COIN $JPM $GS

- hence, as banks likely to add crypto to their balance sheet Bitcoin $BTC and Ethereum $ETH (staking)

@fs_insight @SeanMFarrell @WSJ

Looking ahead, stablecoins is the "front end" of the convergence of financial services and crypto:

- the next generation may prefer to bank to be crypto-friendly company $HOOD $CRCL $COIN $JPM $GS

- hence, as banks likely to add crypto to their balance sheet Bitcoin $BTC and Ethereum $ETH (staking)

@fs_insight @SeanMFarrell @WSJ

8/

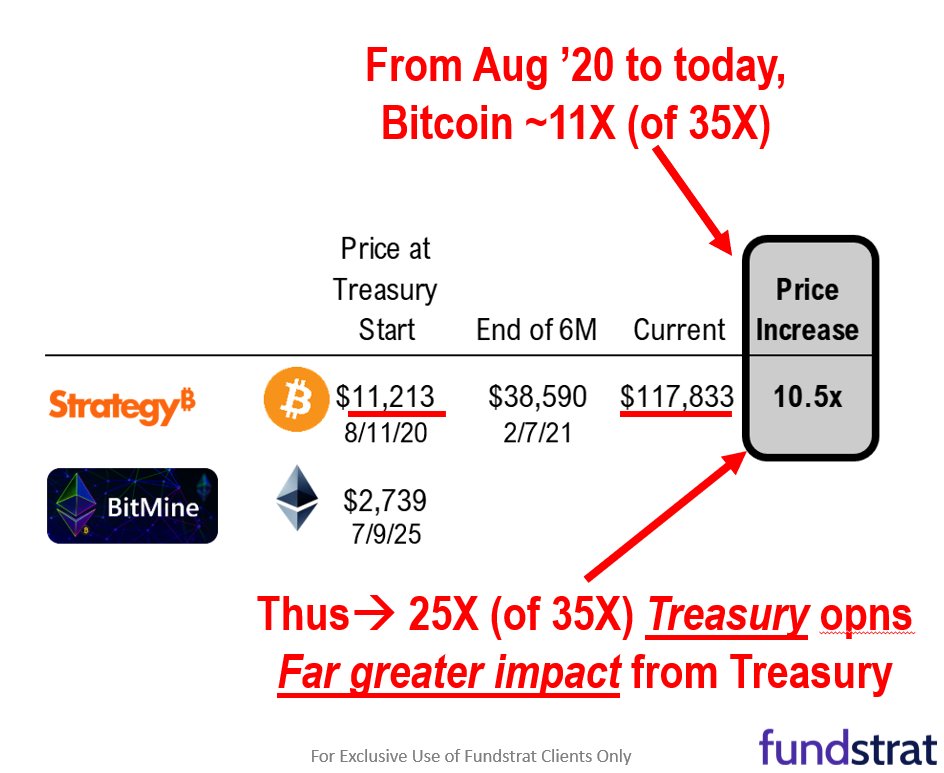

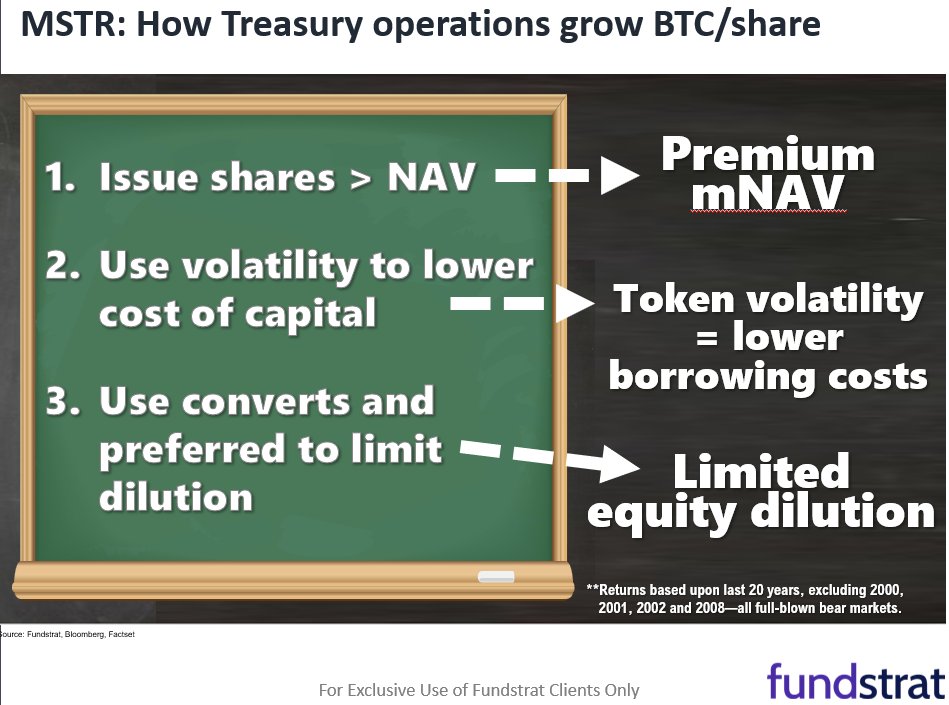

TREASURY STOCKS = BACKBONE FUTURE FINANCE:

In future, Banks, credit card issuers ($PYPL) and biz likely hold "crypto" on balance sheet as working capital:

- thus, "pure play" Treasury companies like $MSTR $SMLR $SBET $MTPLF $DFDV $UPEXI

- arguably represent the "high margin" component of future bank and financial institutions architecture

These $ETH $SOL Treasury stocks earn yield from staking which is a positive feature

@fs_insight @SeanMFarrell

TREASURY STOCKS = BACKBONE FUTURE FINANCE:

In future, Banks, credit card issuers ($PYPL) and biz likely hold "crypto" on balance sheet as working capital:

- thus, "pure play" Treasury companies like $MSTR $SMLR $SBET $MTPLF $DFDV $UPEXI

- arguably represent the "high margin" component of future bank and financial institutions architecture

These $ETH $SOL Treasury stocks earn yield from staking which is a positive feature

@fs_insight @SeanMFarrell

9/

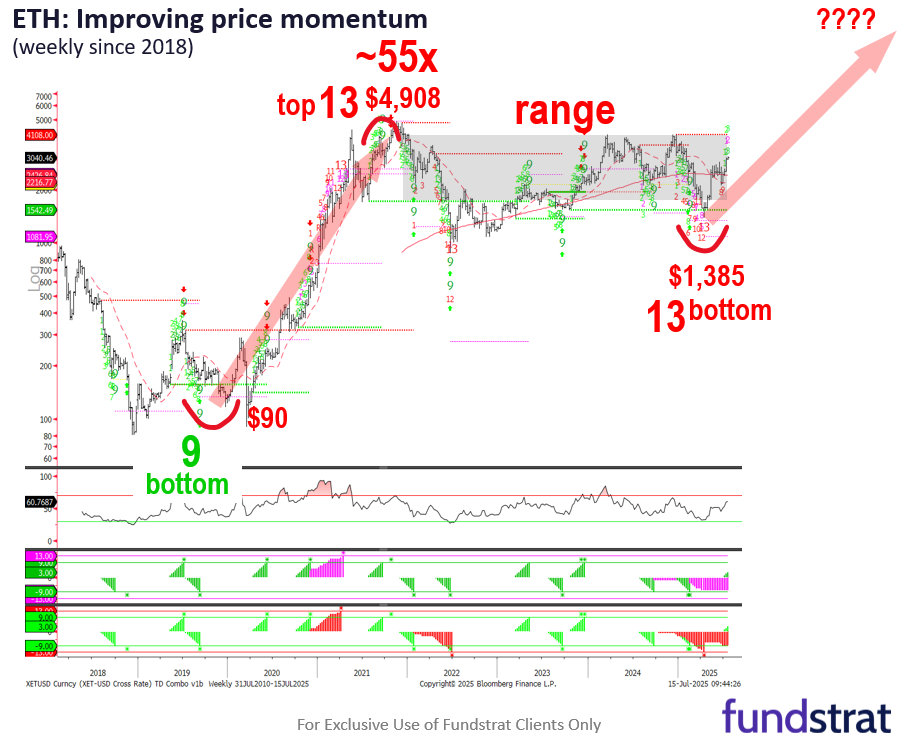

This is positive for the layer 1 blockchains issuing stablecoins

Why Ethereum? $ETH

- the majority of stablecoins minted on Ethereum

- most of the "real world assets" (RWA) in crypto are on Ethereum such as stablecoins, tokenized equities, tokenized real estate

@coingecko @SeanMFarrell

This is positive for the layer 1 blockchains issuing stablecoins

Why Ethereum? $ETH

- the majority of stablecoins minted on Ethereum

- most of the "real world assets" (RWA) in crypto are on Ethereum such as stablecoins, tokenized equities, tokenized real estate

@coingecko @SeanMFarrell

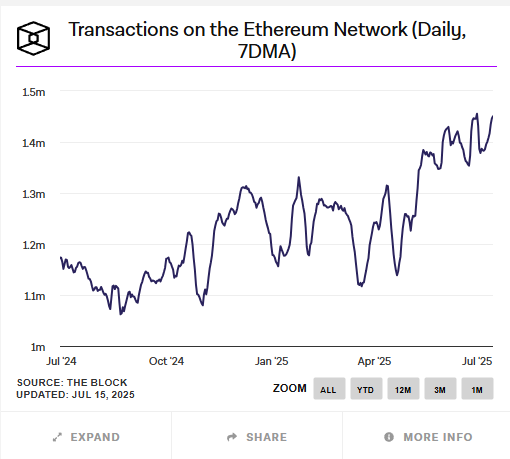

10/

Stablecoin fees are 30% of Ethereum $ETH network fees today:

- @SecScottBessent recently said >$2 trillion USD market for stablecoins is reasonable

- this is 10X exponential growth in network fees for $ETH Ethereum

- other nations may mint stablecoins = upside

@fs_insight @SeanMFarrell

Stablecoin fees are 30% of Ethereum $ETH network fees today:

- @SecScottBessent recently said >$2 trillion USD market for stablecoins is reasonable

- this is 10X exponential growth in network fees for $ETH Ethereum

- other nations may mint stablecoins = upside

@fs_insight @SeanMFarrell

11/

That is it for now

Thank you to the @fundstrat @fs_insight crypto team for the data:

Sean Farrell @SeanMFarrell

Thomas Couture

Tireless Ken @tirelessken

Get our crypto research at @fs_insightFSinsight.com/tlee-services

That is it for now

Thank you to the @fundstrat @fs_insight crypto team for the data:

Sean Farrell @SeanMFarrell

Thomas Couture

Tireless Ken @tirelessken

Get our crypto research at @fs_insightFSinsight.com/tlee-services

• • •

Missing some Tweet in this thread? You can try to

force a refresh