MACD (Moving Average Convergence Divergence) is most commonly used in Technical Trading.

But, it can be used as part of a factor model.

Let's see how.

But, it can be used as part of a factor model.

Let's see how.

1. What is MACD?

MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security's price.

The MACD is calculated by subtracting the long-term exponential moving average (EMA) from the short-term EMA.

MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security's price.

The MACD is calculated by subtracting the long-term exponential moving average (EMA) from the short-term EMA.

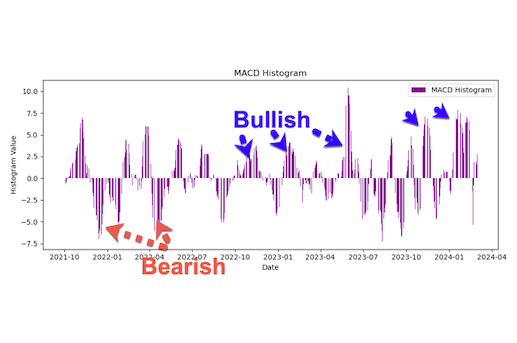

2. Components of MACD:

MACD Line: This is calculated by subtracting the 26-period EMA from the 12-period EMA.

Signal Line: This is a 9-period EMA of the MACD Line itself.

MACD Histogram: This is the difference between the MACD line and the Signal line.

MACD Line: This is calculated by subtracting the 26-period EMA from the 12-period EMA.

Signal Line: This is a 9-period EMA of the MACD Line itself.

MACD Histogram: This is the difference between the MACD line and the Signal line.

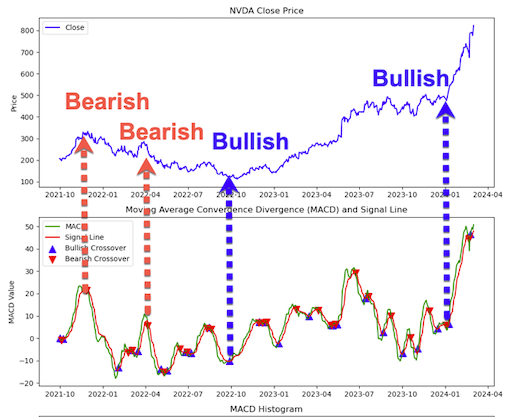

3. How MACD is used:

The primary method is to look for crossovers between the MACD line and the signal line.

When the MACD line crosses above the signal line, it is a bullish signal.

Conversely, when the MACD line crosses below the signal line, it is a bearish signal.

The primary method is to look for crossovers between the MACD line and the signal line.

When the MACD line crosses above the signal line, it is a bullish signal.

Conversely, when the MACD line crosses below the signal line, it is a bearish signal.

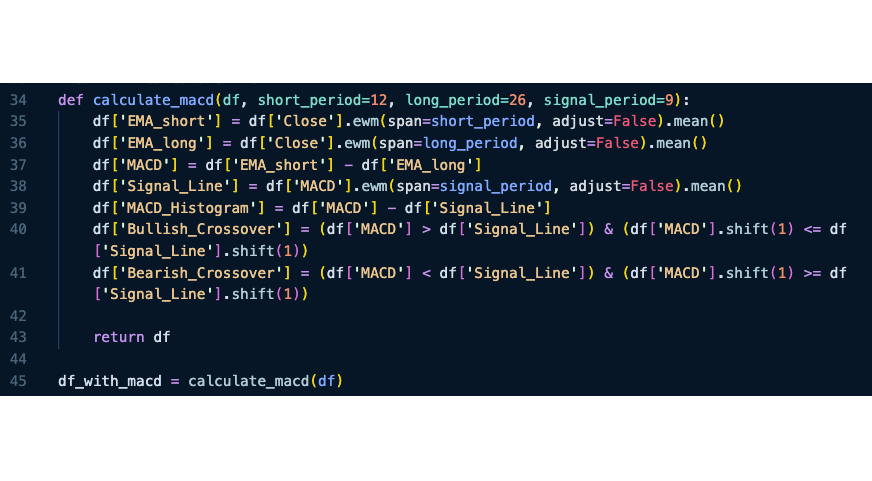

4. Factor model with MACD

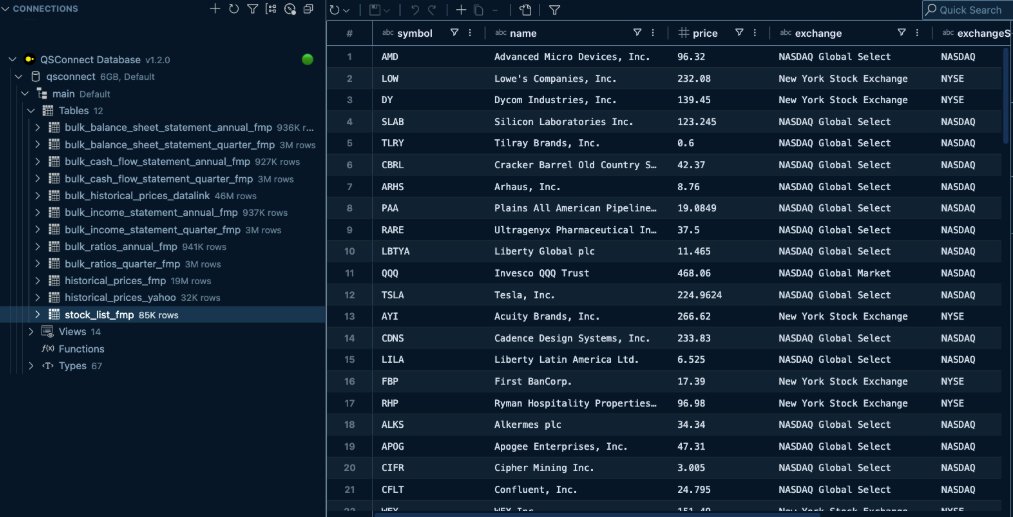

We can add MACD as features.

These features power our Machine Learning models.

And allow us to predict: 1D, 5D, 10D, and 21D returns forecasts.

We can add MACD as features.

These features power our Machine Learning models.

And allow us to predict: 1D, 5D, 10D, and 21D returns forecasts.

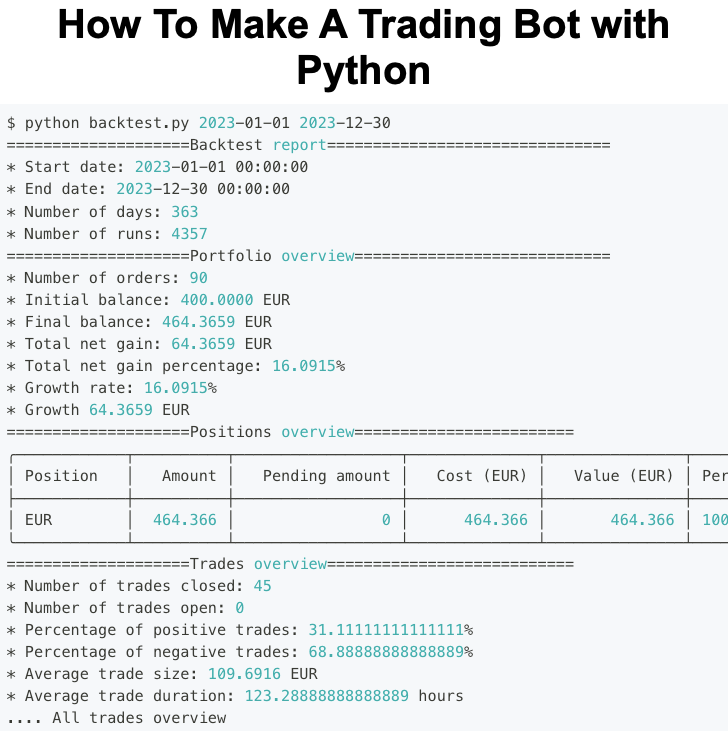

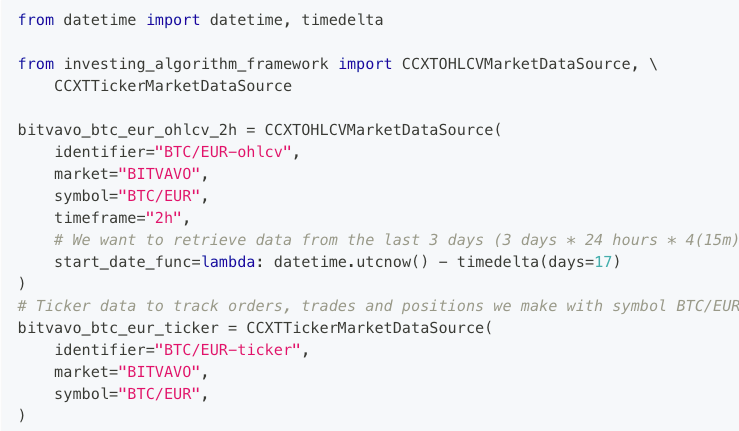

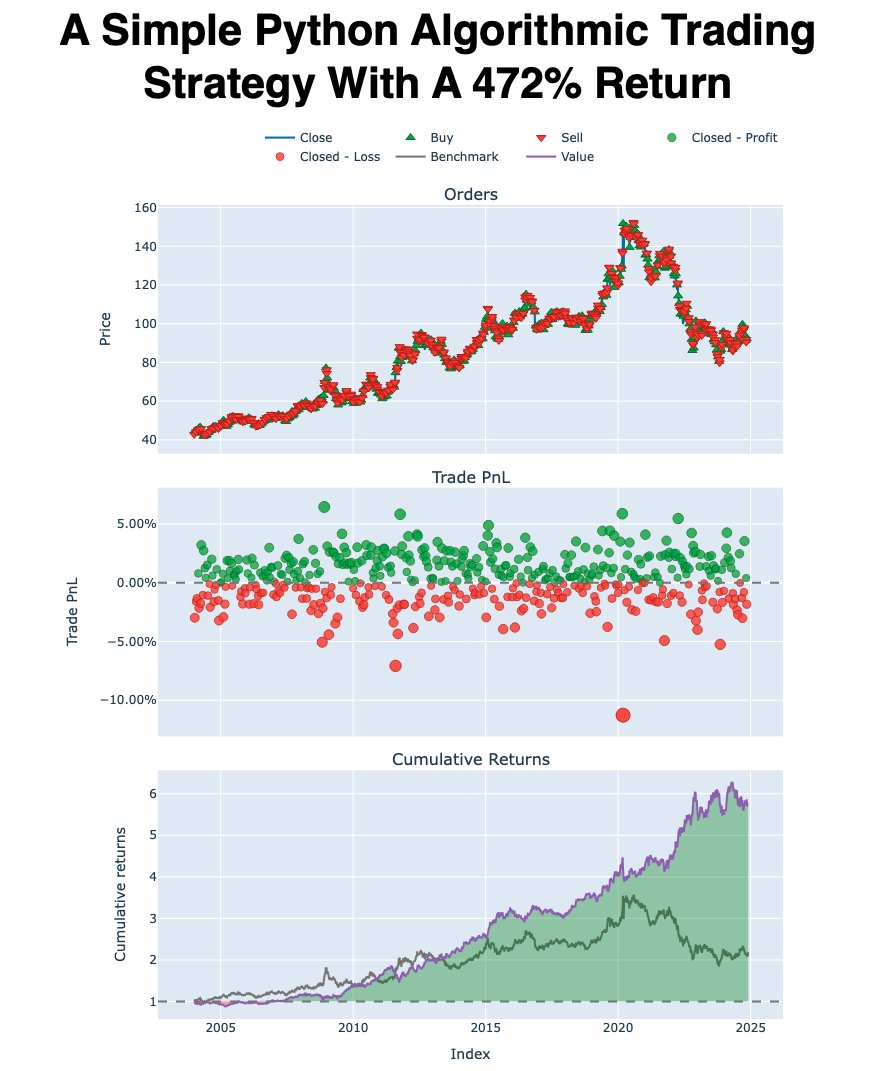

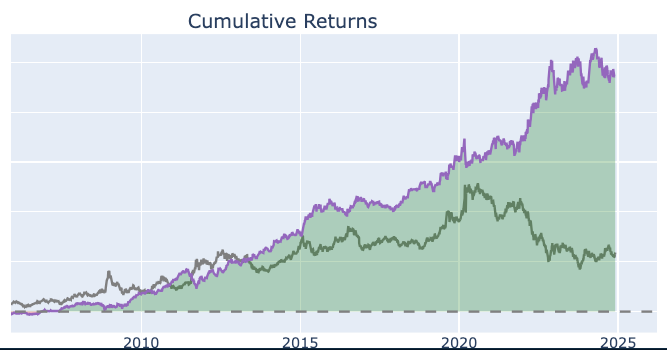

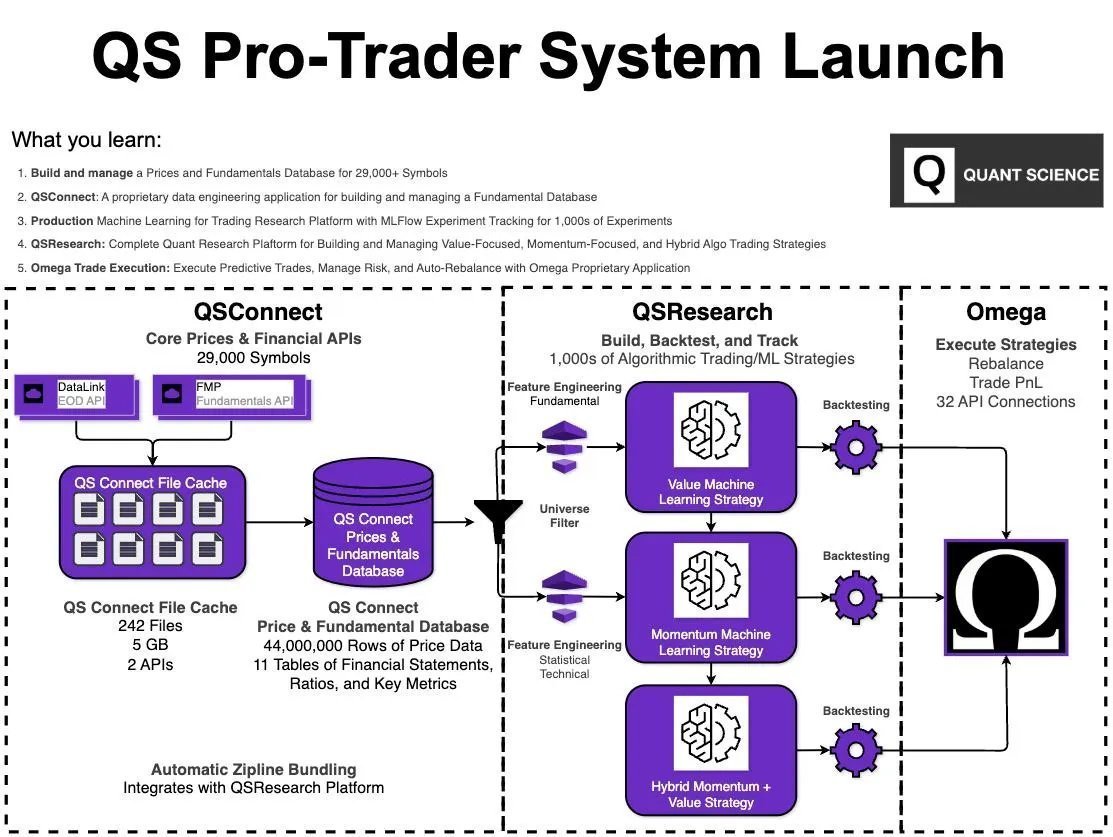

🚨 NEW WORKSHOP: How I built an automated algorithmic trading system with Python.

Hedge funds have better tools & faster execution.

That ends on July 9th.

👉 Register here to learn how to compete in an unfair game with Python (500 seats): learn.quantscience.io/become-a-pro-q…

Hedge funds have better tools & faster execution.

That ends on July 9th.

👉 Register here to learn how to compete in an unfair game with Python (500 seats): learn.quantscience.io/become-a-pro-q…

That's a wrap! Over the next 24 days, I'm sharing my top 24 algorithmic trading concepts to help you get started.

If you enjoyed this thread:

1. Follow me @quantscience_ for more of these

2. RT the tweet below to share this thread with your audience

If you enjoyed this thread:

1. Follow me @quantscience_ for more of these

2. RT the tweet below to share this thread with your audience

https://twitter.com/1683526993059430411/status/1939296157198327981

P.S. - Want to learn Algorithmic Trading Strategies that actually work?

I'm hosting a live workshop. Join here: learn.quantscience.io/qs-register

I'm hosting a live workshop. Join here: learn.quantscience.io/qs-register

• • •

Missing some Tweet in this thread? You can try to

force a refresh