—JP MORGAN'S QUARTERLY PUT SPREAD COLLAR—

all you ever wanted to know about:

✓ the trade

✓ its market impact

✓ its expiration effects

(a thread)

all you ever wanted to know about:

✓ the trade

✓ its market impact

✓ its expiration effects

(a thread)

first, the fund itself.

the giant SPX put spread collar

that's bought at the end of every quarter comes from JHEQX- JP Morgan's Hedged Equity Fund-I

It's the largest of 3 funds which are all contractually obligated to do the exact same thing, just at the end of different 3-month cycles.

the giant SPX put spread collar

that's bought at the end of every quarter comes from JHEQX- JP Morgan's Hedged Equity Fund-I

It's the largest of 3 funds which are all contractually obligated to do the exact same thing, just at the end of different 3-month cycles.

the largest of the (3) funds, JHEQX trades on the quarterly cycle.

Position sizes are typically between 32-40k

Position sizes are typically between 32-40k

JHQDX is the second largest fund of the trio, and trades on a rolling three month cycle starting with the end of January.

Right now, JHQDX holds a position 25% the size of the quarterly collar-

Jul-31 4440 / 5270 Put Spread vs 5880 Call

they own the Put Spread 8,940x

Right now, JHQDX holds a position 25% the size of the quarterly collar-

Jul-31 4440 / 5270 Put Spread vs 5880 Call

they own the Put Spread 8,940x

And finally, we have JHQTX starting its 3 month window at the end of February.

This is the smallest of the lot and currently holds 5,400 of the August 29th 4710 / 5595 - 6210 Put Spread Collar

This is the smallest of the lot and currently holds 5,400 of the August 29th 4710 / 5595 - 6210 Put Spread Collar

the fund is designed to provide a

"consistent hedged experience"

"consistent hedged experience"

this is accomplished with a put spread collar which resets at the very end of each three month period.

if you don't know, a "put spread collar" involves buying a put spread, and selling a call against it to reduce the cost of the hedge.

the tradeoff is that the fund doesn't participate in any market gains beyond the strike of their call option, within the reset period

if you don't know, a "put spread collar" involves buying a put spread, and selling a call against it to reduce the cost of the hedge.

the tradeoff is that the fund doesn't participate in any market gains beyond the strike of their call option, within the reset period

...the fund is currently "trading this off" as we speak.

With the SPX indicated to open at 6200, the index has moved nearly 300 points through the fund's short Call strike at 5905 expiring today.

With the SPX indicated to open at 6200, the index has moved nearly 300 points through the fund's short Call strike at 5905 expiring today.

—but this is neither good, nor bad.

Contrary to popular belief, the fund doesn't care about the call expiring in the money. They have a rule- a mandate- and they follow it.

They never adjust the spread beyond the EOD strike roll on execution day-

and they certainly never attempt to defend or close their calls once ITM

Contrary to popular belief, the fund doesn't care about the call expiring in the money. They have a rule- a mandate- and they follow it.

They never adjust the spread beyond the EOD strike roll on execution day-

and they certainly never attempt to defend or close their calls once ITM

Once the call is in the money, the fund simply stops participating in quarterly gains beyond that level.

The call is sold 1-for-1 against the fund's underlying equity book. So every dollar the call loses, the fund makes back with the stocks themselves.

The call is sold 1-for-1 against the fund's underlying equity book. So every dollar the call loses, the fund makes back with the stocks themselves.

How do they choose the strikes?

A quick glance at their prospectus makes most of the process clear.

The fund is designed to buy the down 20%/down 5% put spread, and finance it by selling a call to make the whole structure "zero-cost"

A quick glance at their prospectus makes most of the process clear.

The fund is designed to buy the down 20%/down 5% put spread, and finance it by selling a call to make the whole structure "zero-cost"

IF the index remained at 6200 and the vol surface remained mostly unchanged...

then at 2:00 PM ET the fund would buy the SepQ 4940 / 5880 - 6485 Put Spread Collar.

then at 2:00 PM ET the fund would buy the SepQ 4940 / 5880 - 6485 Put Spread Collar.

It would likely be packaged with the JunQ 5400 Calls (or similar)

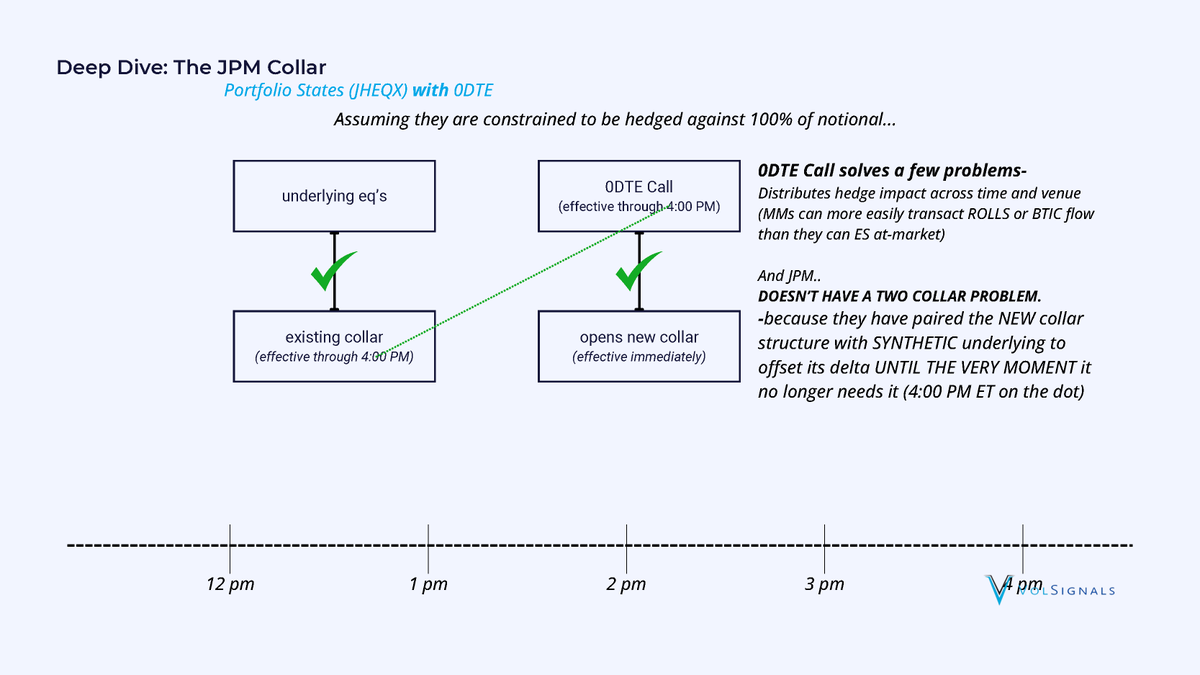

The 0DTE call is provided to hedge the FUND's side of the trade, but also reduces the market impact of the trade in general by shifting the delta hedging into the close

Remember, the fund is designed to be hedged 1:1

When it trades at 2PM, they have a problem.

Two hedges, one portfolio...

so they delta hedge the new collar until the second the old collar expires

When it trades at 2PM, they have a problem.

Two hedges, one portfolio...

so they delta hedge the new collar until the second the old collar expires

Market makers sell the 0DTE call and sell BTIC at the time of trade- instead of ES, shifting the hedge to the close where it's more easily absorbed in high volume with time to match.

and the fund is clean in terms of intraday exposure until the close

and the fund is clean in terms of intraday exposure until the close

At 4PM, everything in June Quarterly expires.

The old collar—AND the deep ITM 0DTE calls bought by the fund to hedge the new collar all disappear.

Leaving the fund with only the NEW collar.

The old collar—AND the deep ITM 0DTE calls bought by the fund to hedge the new collar all disappear.

Leaving the fund with only the NEW collar.

Is there a market impact?

Yes, and it's both *not* exactly what you think it is

—and bigger than most understand.

It goes well beyond the "gamma pinning" near expiration

Yes, and it's both *not* exactly what you think it is

—and bigger than most understand.

It goes well beyond the "gamma pinning" near expiration

Retweet the original post in the thread, and I'll fill in the gaps with details on the trade's impact at time of hedge, throughout the cycle, and at expiration

https://x.com/VolSignals/status/1939651220018270596

the fund re-strikes at the close if the market moves, in order to remain in line with their stated objectives in terms of strike determination

today's rebalance:

today's rebalance:

https://x.com/VolSignals/status/1939778164747903403

this 6-way trade leaves the fund with one single put spread collar:

https://x.com/VolSignals/status/1939778387150541211

What about market impact?

Let's start with time of trade

since the fund packages the collar with the 0dte call in appropriate size, there's technically no delta for MMs to sell when the trade happens.

how can that be?

Let's start with time of trade

since the fund packages the collar with the 0dte call in appropriate size, there's technically no delta for MMs to sell when the trade happens.

how can that be?

all of the delta of the new collar is paired with the 0dte calls which the fund provides

but at 4 PM ET the MM will no longer have those short calls against the long delta from selling the put spread in the collar trade

so what do they do?

but at 4 PM ET the MM will no longer have those short calls against the long delta from selling the put spread in the collar trade

so what do they do?

they sell BTIC contracts

"Basis trade at index close"

Instead of pitching thousands of futures into a void at 4 PM, they trade a contract which promises to deliver short futures ON THE CLOSE at a price determined by the cash settlement + the basis from the futures trade:

"Basis trade at index close"

Instead of pitching thousands of futures into a void at 4 PM, they trade a contract which promises to deliver short futures ON THE CLOSE at a price determined by the cash settlement + the basis from the futures trade:

This makes the delta hedging process much smoother, shifting the burden of the hedge to the close, where there's significantly more liquidity than at time of trade

What about Vega?

Since the order has dealers selling the 24 delta put and buying both the 5 delta put and the 30 delta call

the net of this is that the trade SELLS Vega to the MM

They know this.

They prepare for this.

(It's not so easy to time the impact/absorption anymore)

Since the order has dealers selling the 24 delta put and buying both the 5 delta put and the 30 delta call

the net of this is that the trade SELLS Vega to the MM

They know this.

They prepare for this.

(It's not so easy to time the impact/absorption anymore)

this trade also buys tight skew (25/25) from the dealer and sells them put wing (5d put)

this may also impact the vol surface when it trades

but the dynamic influence is actually much more interesting

this may also impact the vol surface when it trades

but the dynamic influence is actually much more interesting

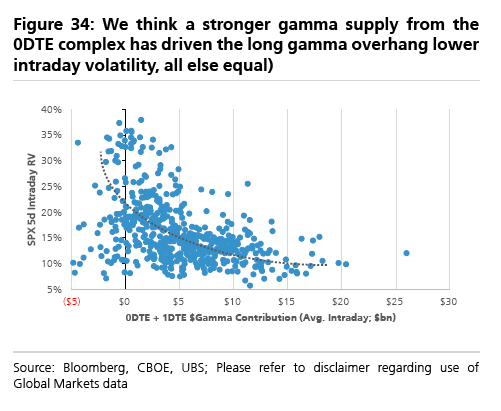

Skew = Vanna in this context

The dealers get re-supplied with long Vanna

SPX goes up?

they own more Vega

SPX goes down?

they get shorter Vega

but wait, there's more

The dealers get re-supplied with long Vanna

SPX goes up?

they own more Vega

SPX goes down?

they get shorter Vega

but wait, there's more

Vanna not only works from Delta -> Vega

it also works from IVOL -> Delta

Implied vol goes up?

dealers get longer option delta & sell futures

Implied vol goes down?

dealers get shorter option delta & buy futures

this creates what I call "recycling the hedge"

it also works from IVOL -> Delta

Implied vol goes up?

dealers get longer option delta & sell futures

Implied vol goes down?

dealers get shorter option delta & buy futures

this creates what I call "recycling the hedge"

Whether you realize it or not,

you've seen this process in action

Let's look back at August 5th 2024, for example

you've seen this process in action

Let's look back at August 5th 2024, for example

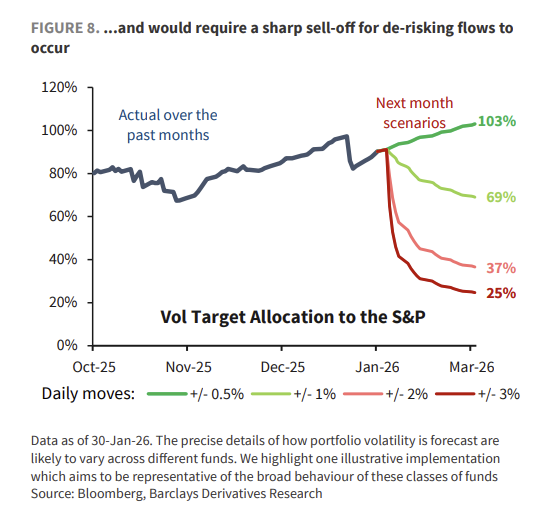

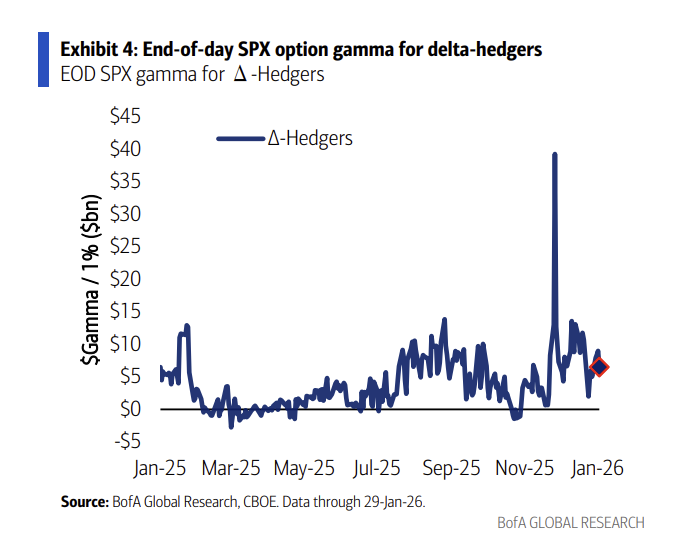

the problem started making its way through the VIX product first

that forced an outsized move in implied volatility when the market was least tolerant of it (Sunday night/premarket during background liquidity strain)

The vol spike changes the deltas of the listed options

that forced an outsized move in implied volatility when the market was least tolerant of it (Sunday night/premarket during background liquidity strain)

The vol spike changes the deltas of the listed options

and the market makers *have to* hedge this-

it's not fake delta. it's real delta.

and it's not small...

even a small net delta change on the structure:

Call from 19->20

Put from 11->12

forces 800 futures to be sold contemporaneously

when the book is 5 deep across 4 levels.

it's not fake delta. it's real delta.

and it's not small...

even a small net delta change on the structure:

Call from 19->20

Put from 11->12

forces 800 futures to be sold contemporaneously

when the book is 5 deep across 4 levels.

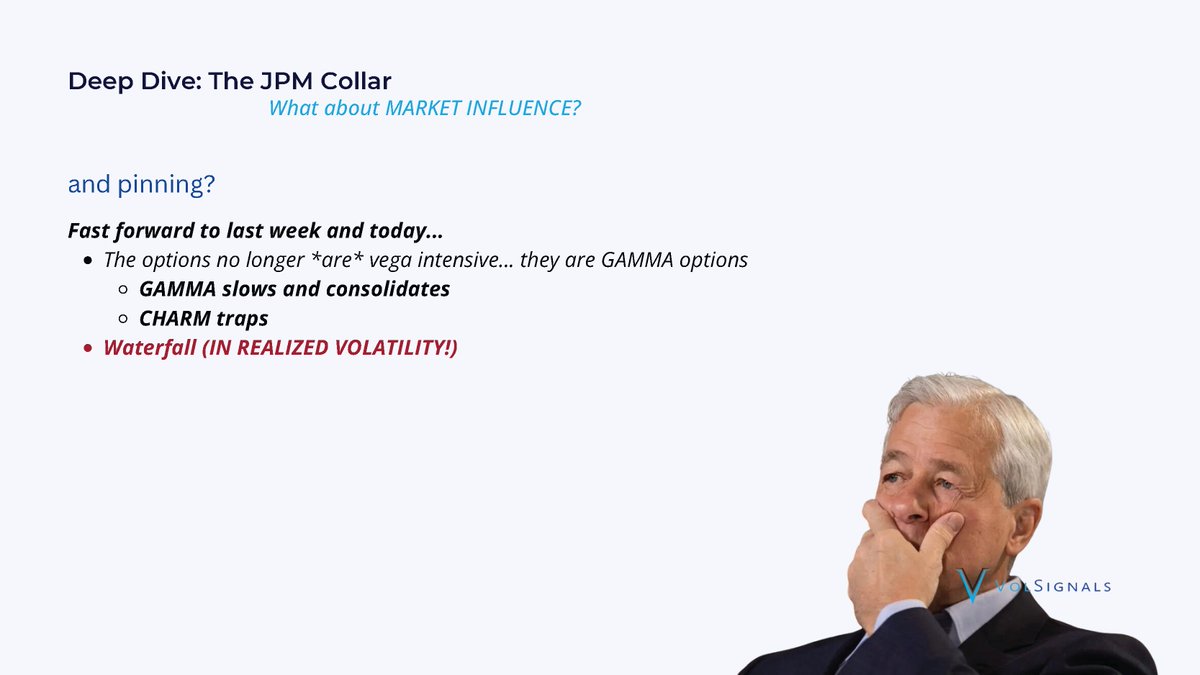

At this point, the options had over 6 weeks until expiration

what happens when they meet their maker?

what happens when they meet their maker?

Depending on how local we are (in September of 2024 we were very local), the hedging effects can be extreme

The interaction between gamma and charm creates PINNING

It is a nontrivial process- if you don't understand it, you should

The interaction between gamma and charm creates PINNING

It is a nontrivial process- if you don't understand it, you should

I'll leave you with some homework...

can you explain what happened on Thursday, September 26th on the open and why?

can you explain what happened on Thursday, September 26th on the open and why?

Debunking common misconceptions: x.com/i/spaces/1eaJb…

• • •

Missing some Tweet in this thread? You can try to

force a refresh