Career Index market maker.

Now focused on structural analysis, systematic delta flow & algorithmic dealer hedging to predict market behavior.

13 subscribers

How to get URL link on X (Twitter) App

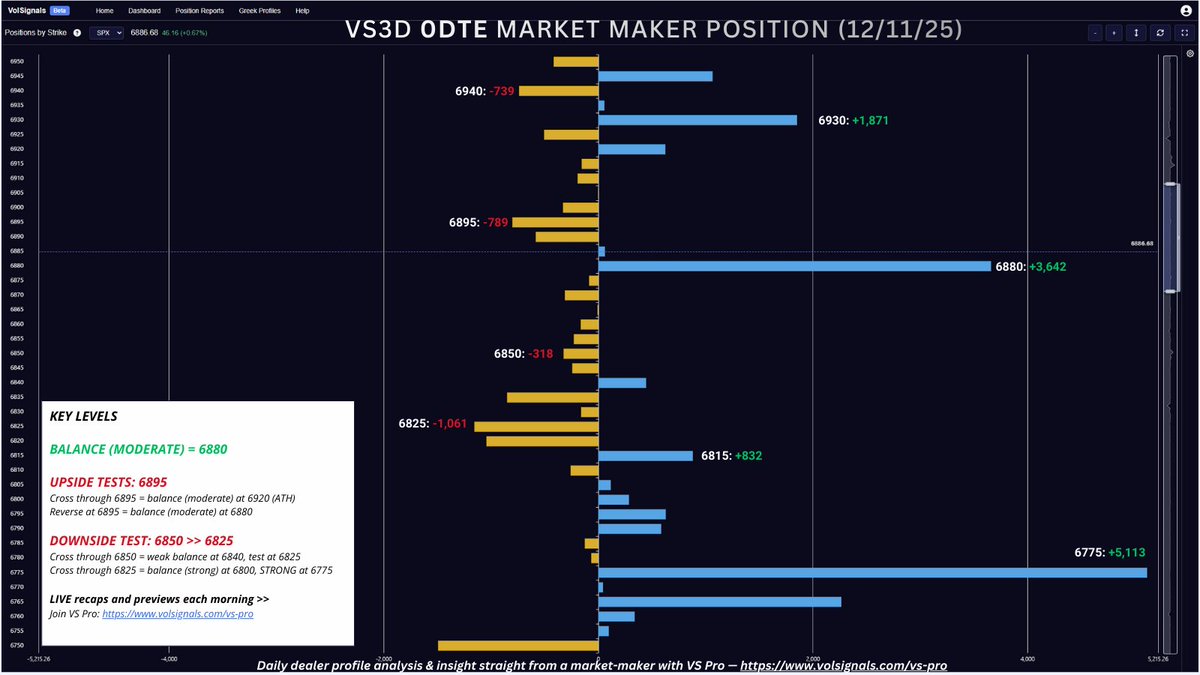

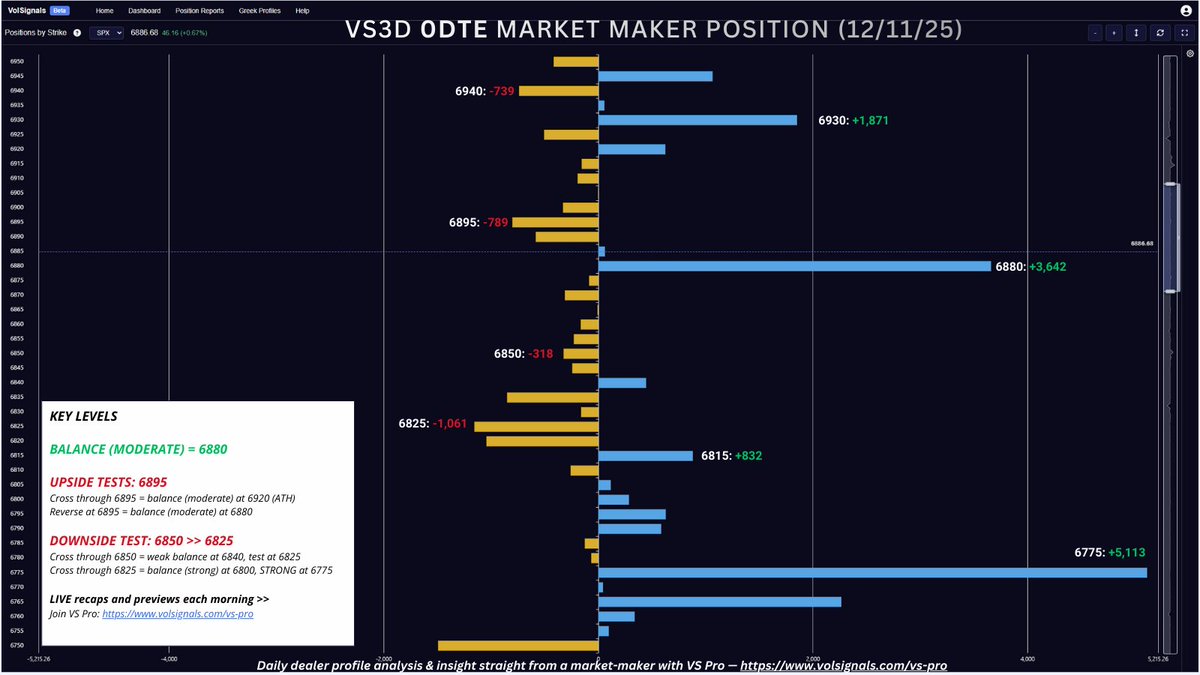

https://twitter.com/GodOfVega1/status/2018045808743186844If our delta is 100 and the SPX goes up $1, we make 100

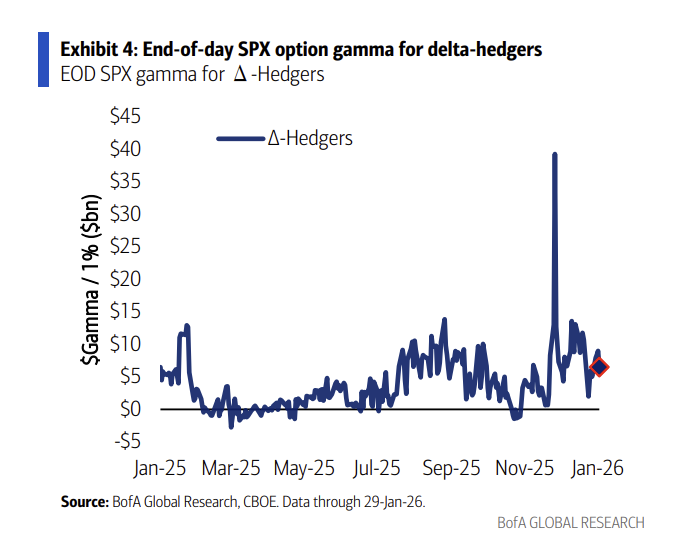

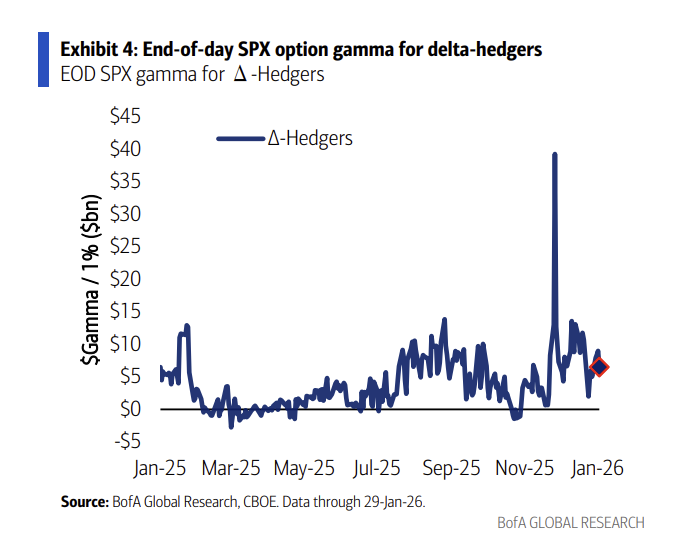

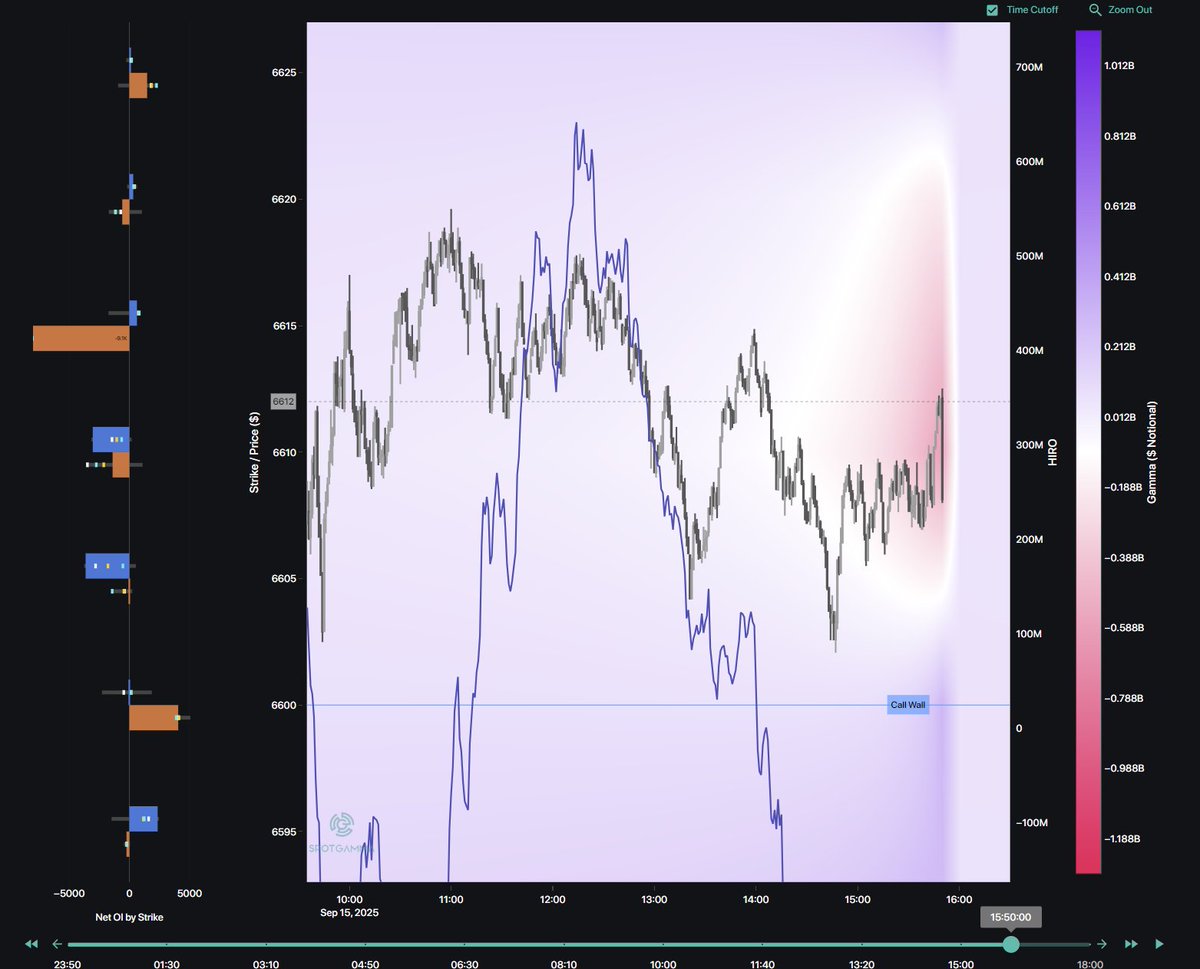

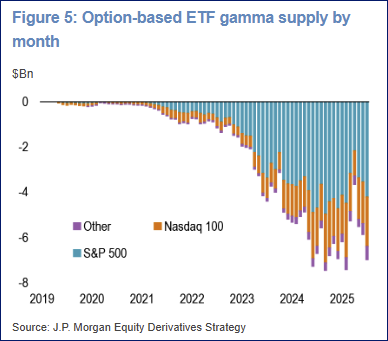

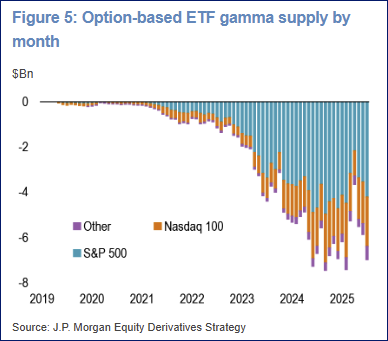

First, that figure is Notional Gamma

First, that figure is Notional Gamma

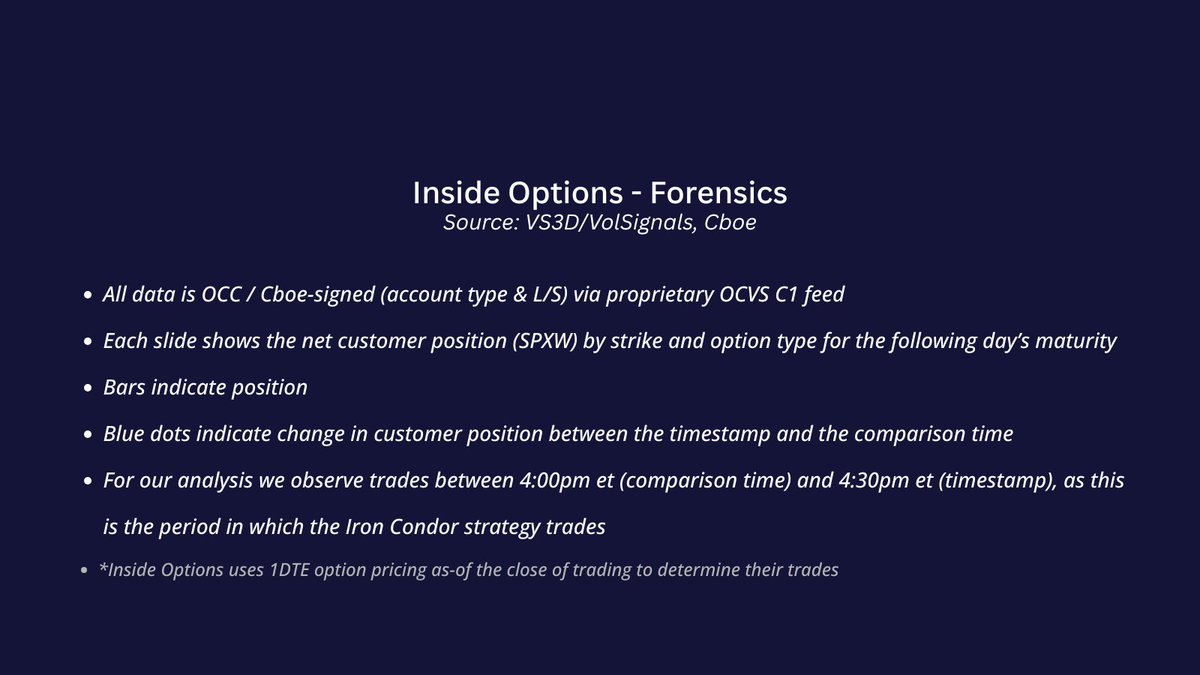

First, let's define some things up front:

First, let's define some things up front:

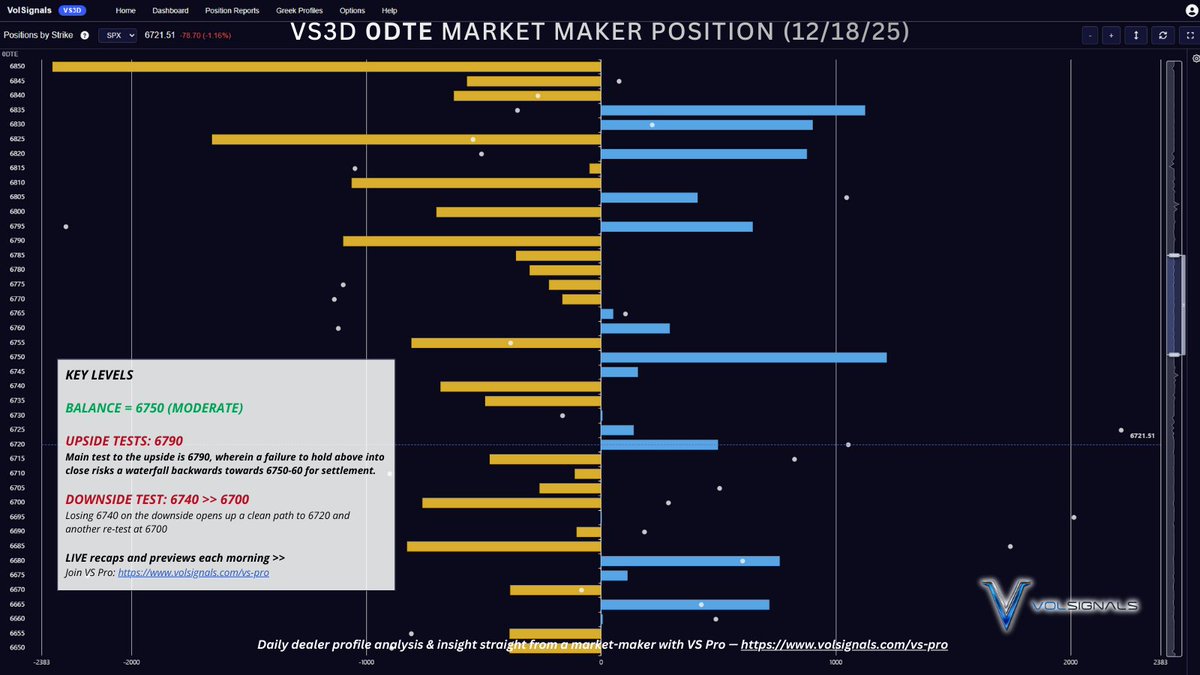

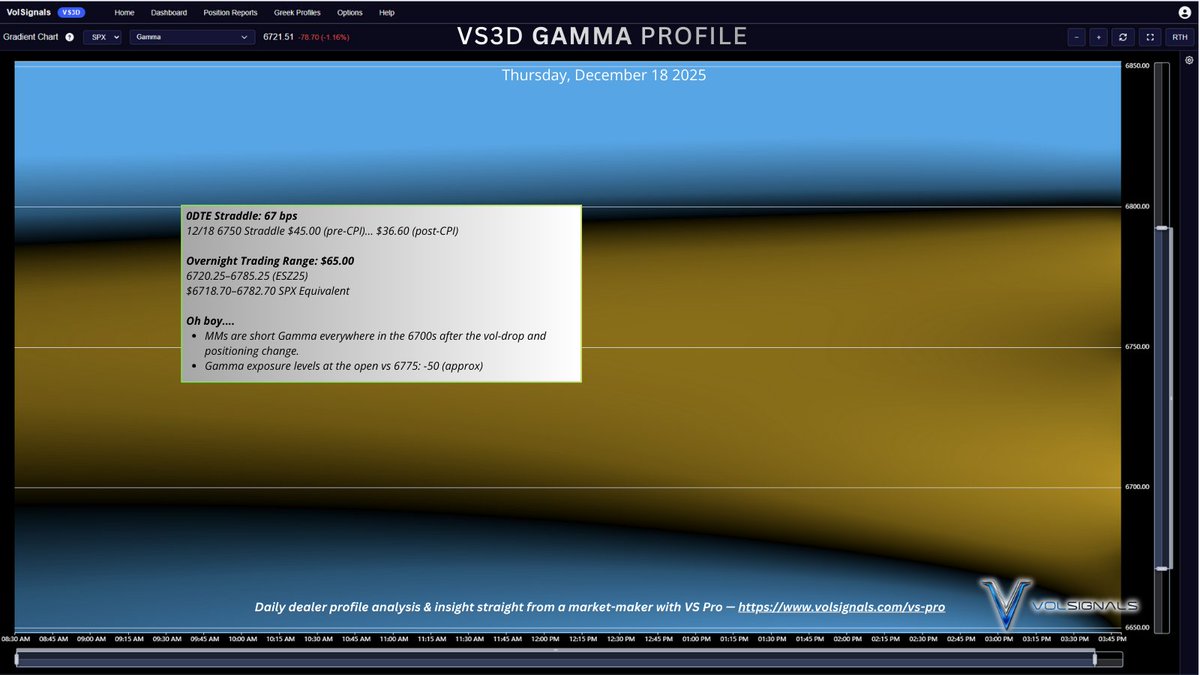

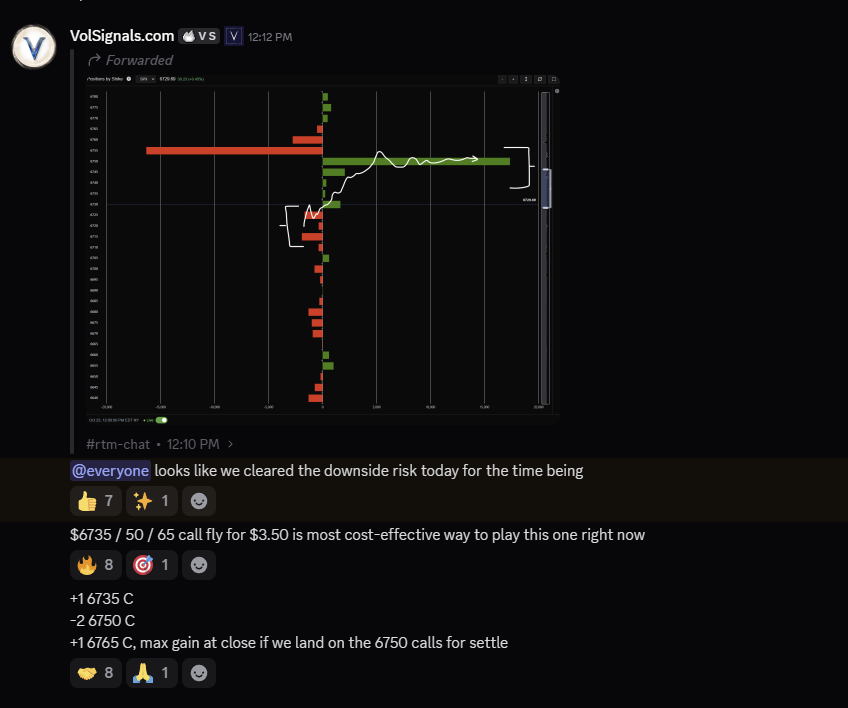

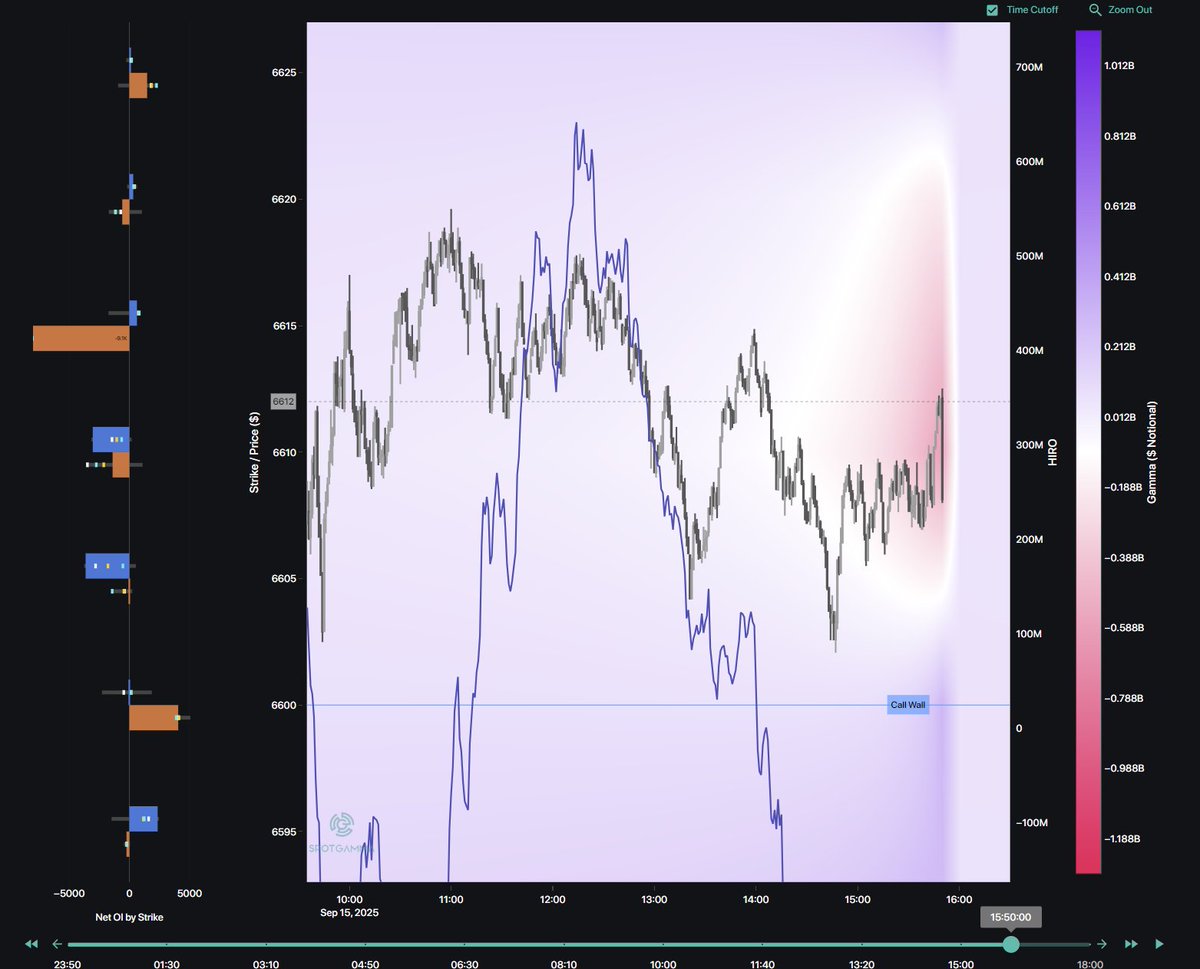

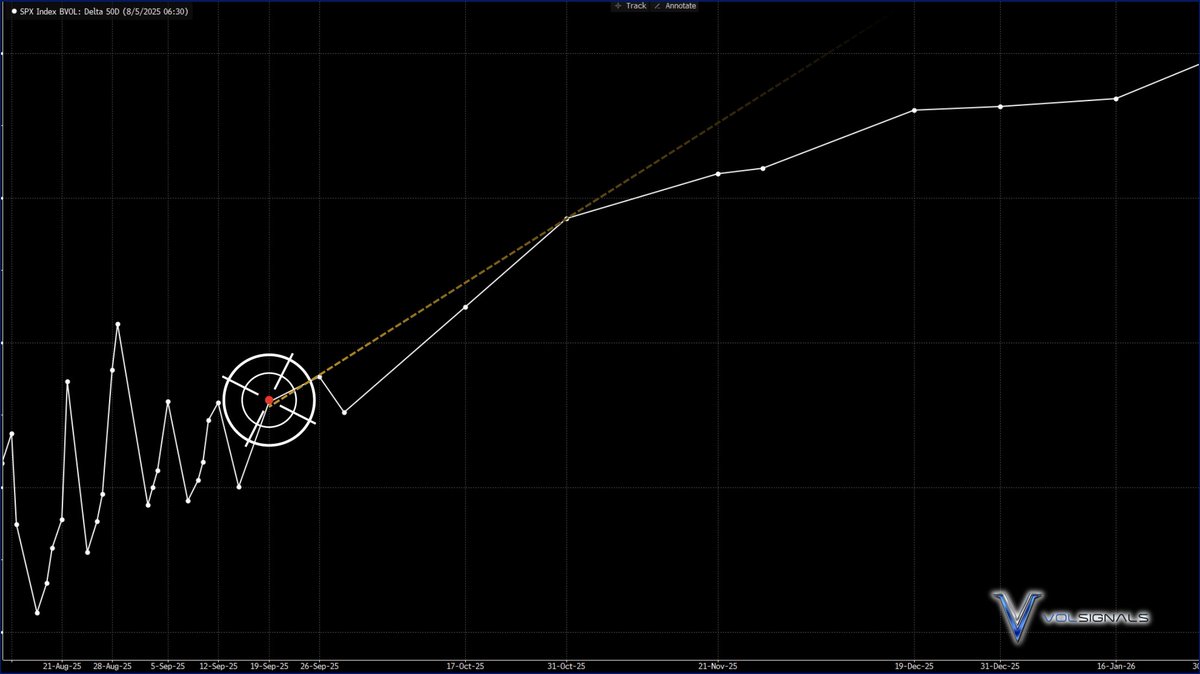

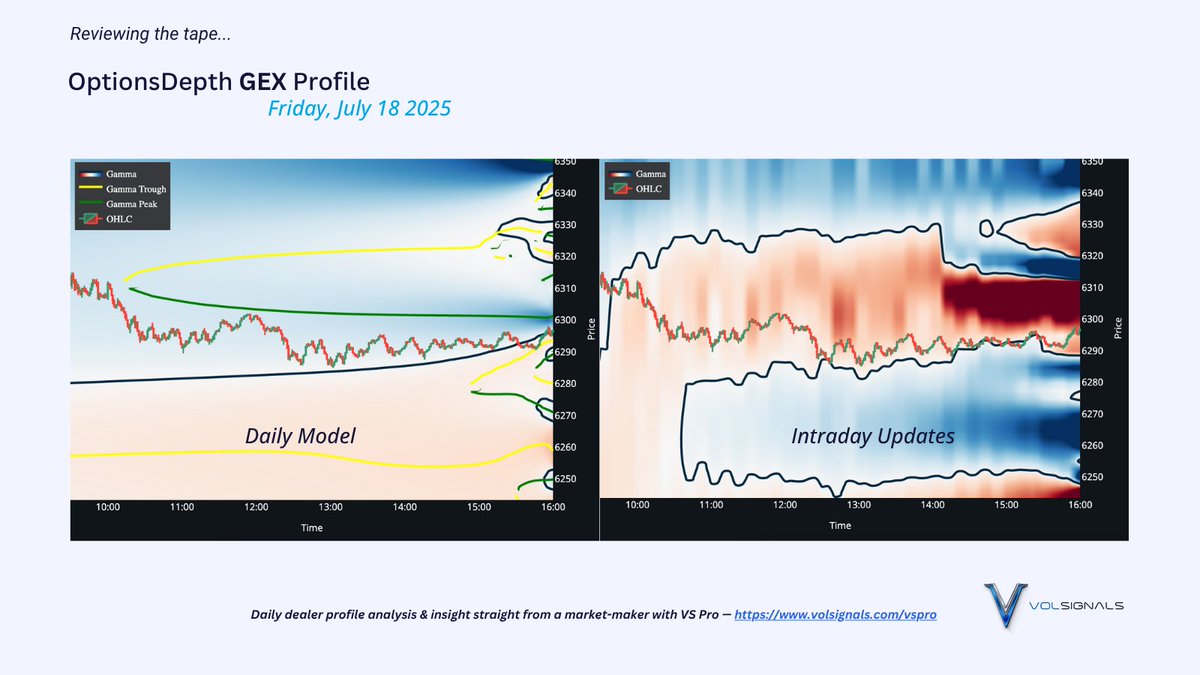

VS3D GAMMA PROFILE

VS3D GAMMA PROFILE

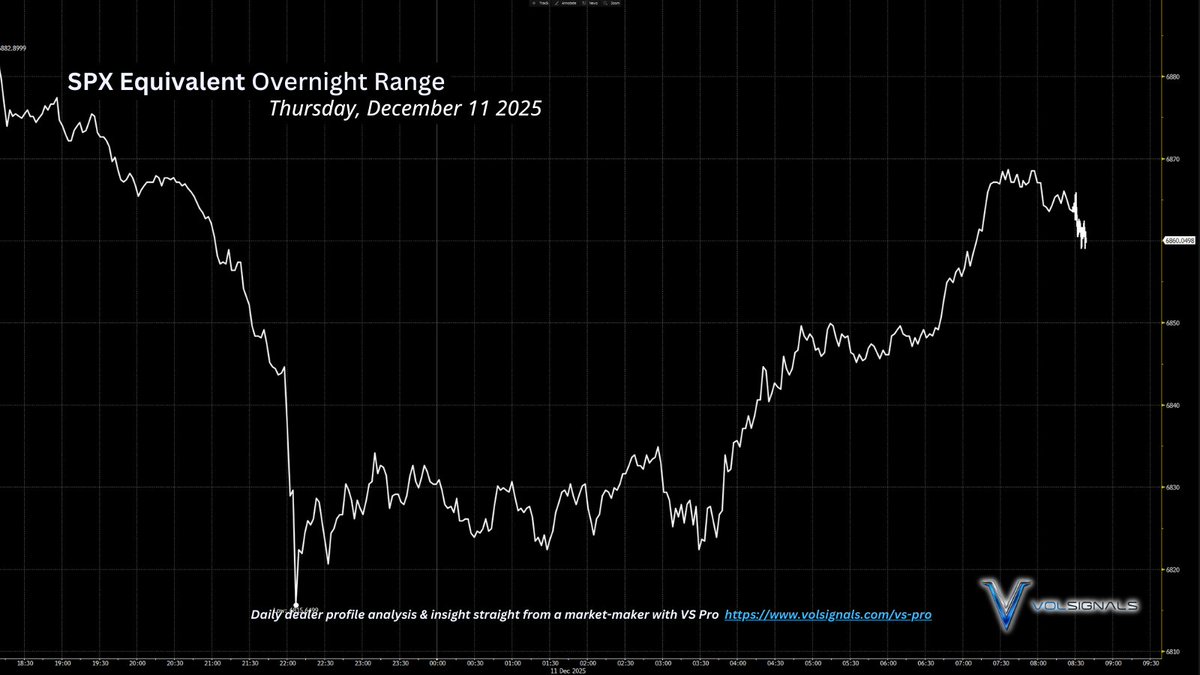

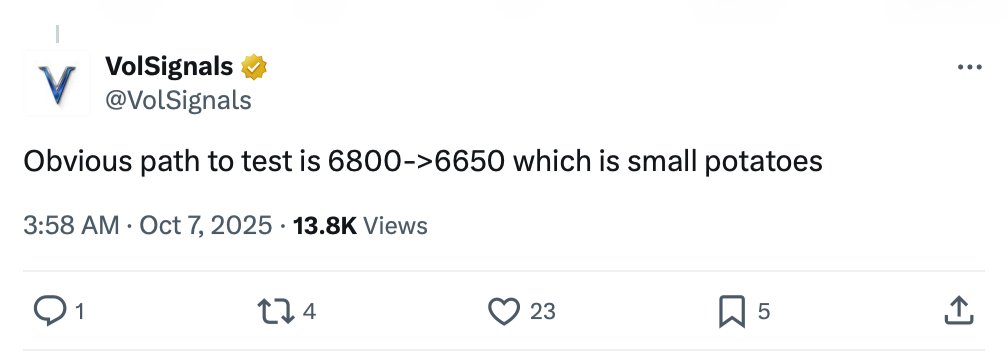

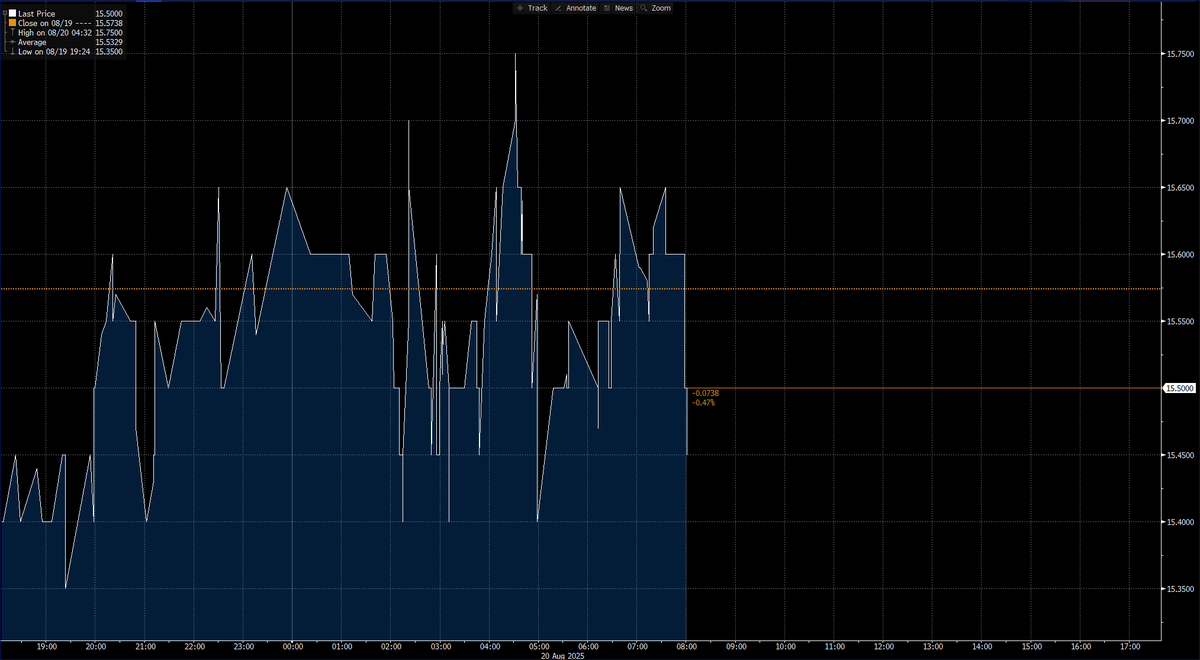

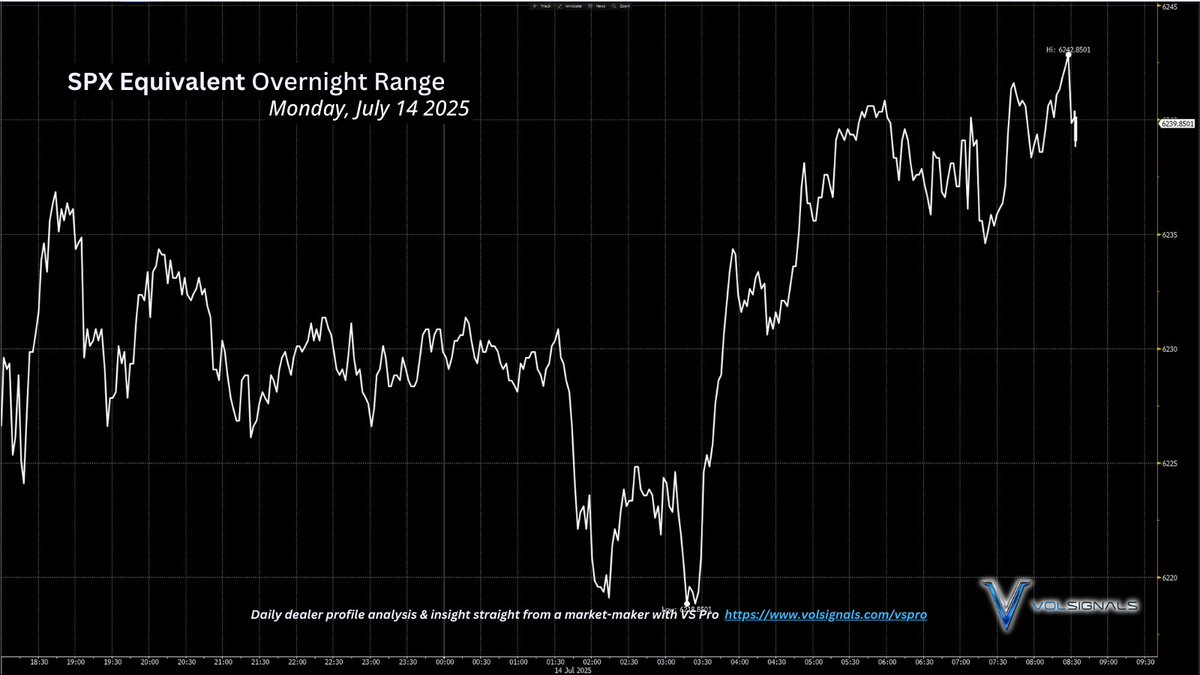

THE OVERNIGHT PRICE ACTION

THE OVERNIGHT PRICE ACTION

What's GAMMA when it comes to option hedging?

What's GAMMA when it comes to option hedging?

https://twitter.com/Tom___Banks/status/1981329315770819029

I had to go way back on this one to find a winner.

I had to go way back on this one to find a winner.

We are hedging Delta.

We are hedging Delta.

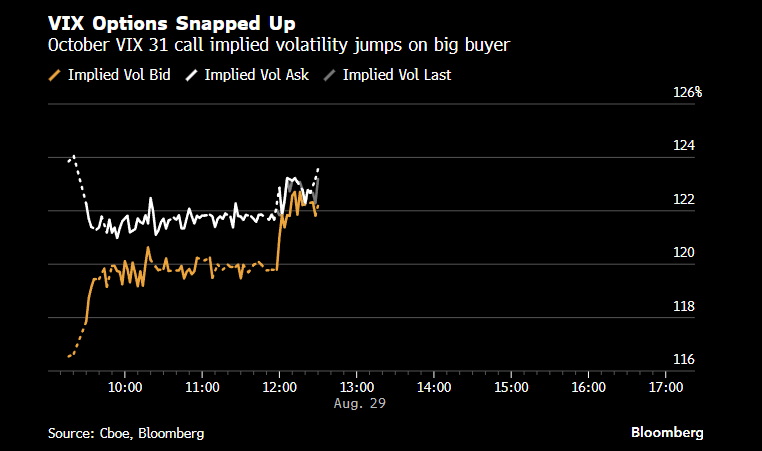

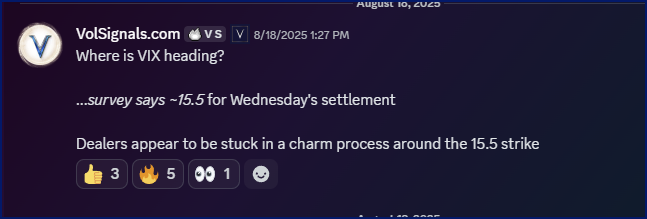

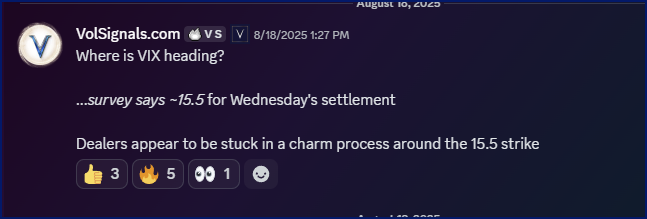

VIX options pin, too.

VIX options pin, too.

How does this keep a lid on volatility?

How does this keep a lid on volatility?

https://twitter.com/phlegminglib/status/1948922138846507288They were mostly held long by one customer

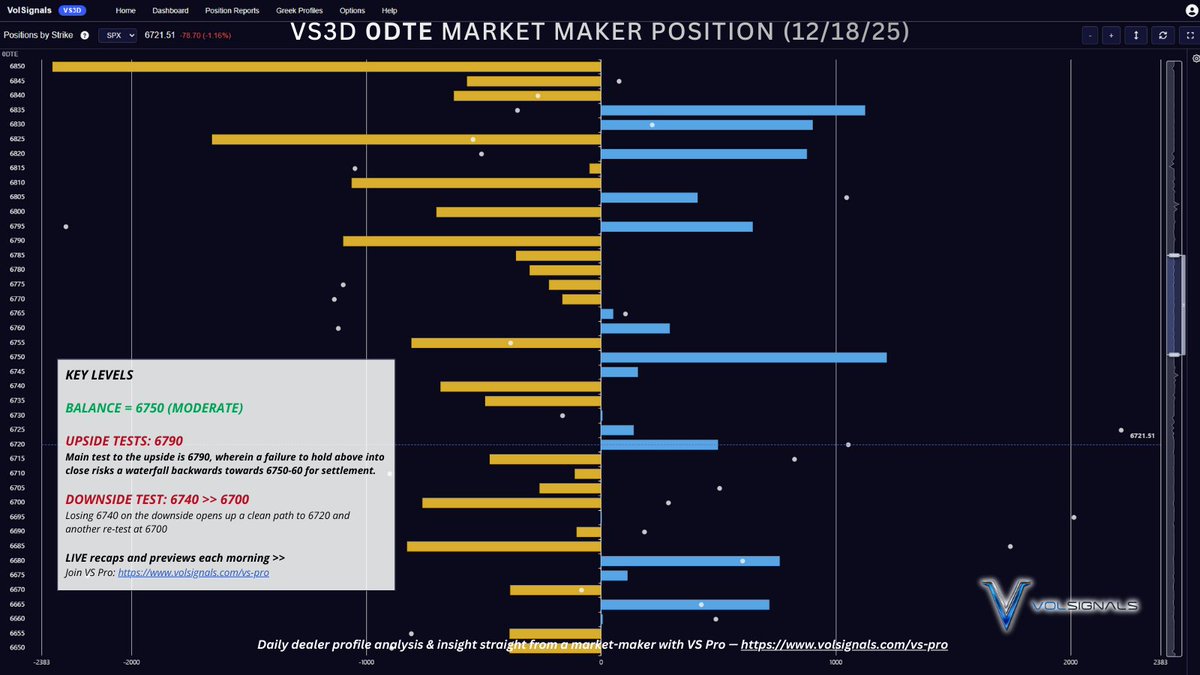

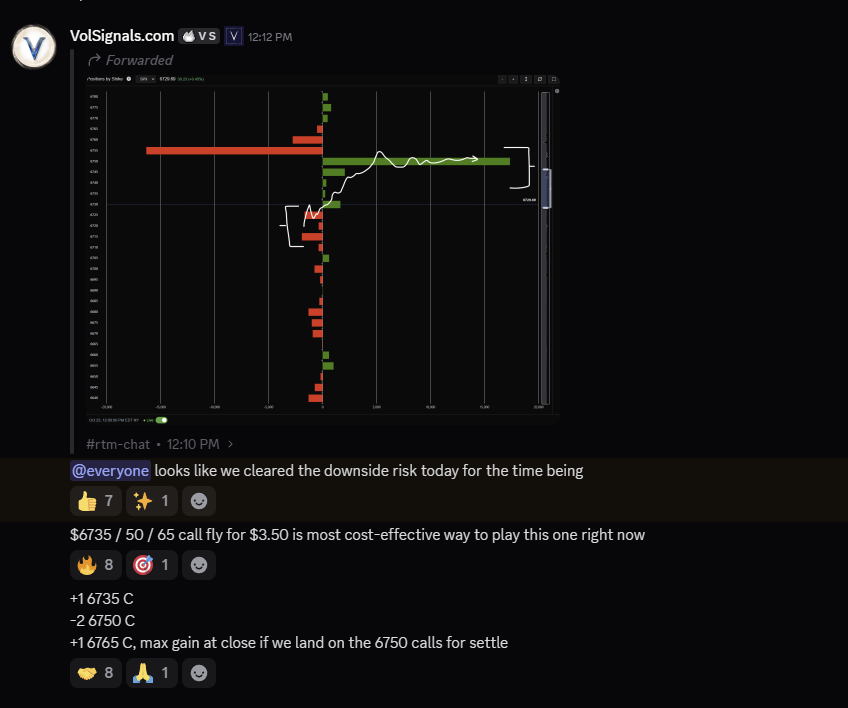

It sure looks like the market may be overpricing a repeat of Friday's price action...

It sure looks like the market may be overpricing a repeat of Friday's price action...

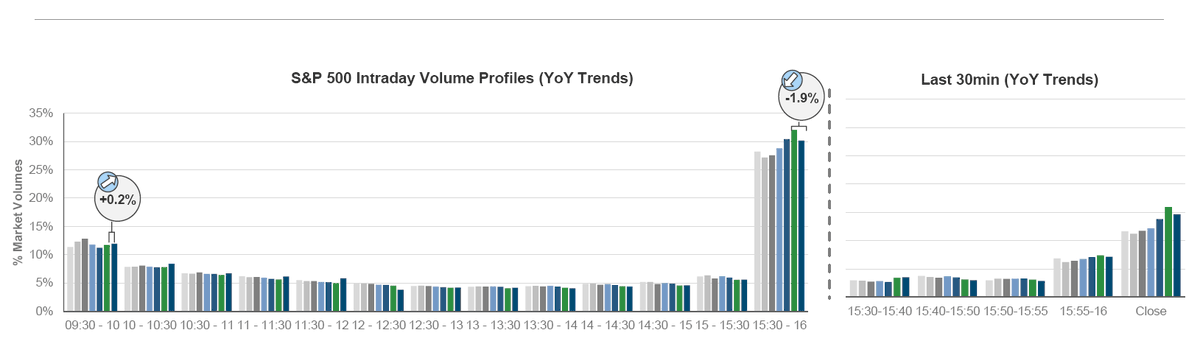

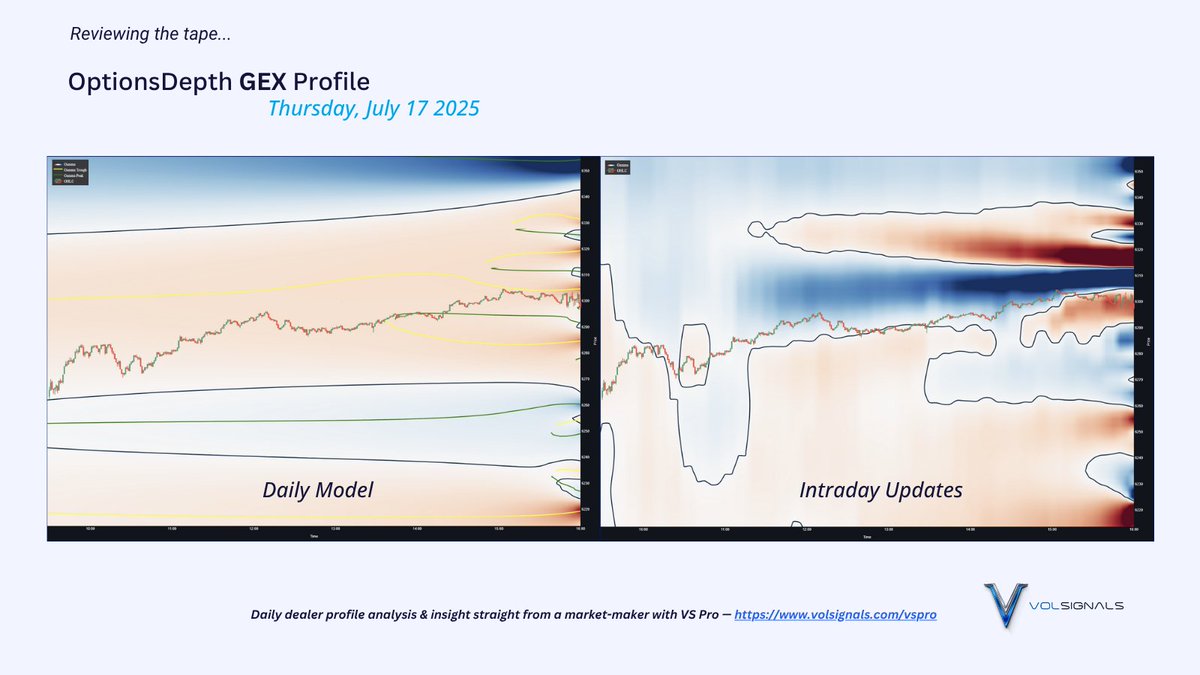

First, why was yesterday so boring compared to Wednesday?

First, why was yesterday so boring compared to Wednesday?

Customers are confused today...

Customers are confused today...