Dear US Senators,

Here is a refutation of every lobbyist lie that more solar/wind subsidies are good for electricity.

FACT: SUBSIDIES HAVE PROVABLY REDUCED CAPACITY + RELIABILITY—AND INCREASED PRICES.

More subsidies can only make things worse.

Vote against extending them!

⚡️

Here is a refutation of every lobbyist lie that more solar/wind subsidies are good for electricity.

FACT: SUBSIDIES HAVE PROVABLY REDUCED CAPACITY + RELIABILITY—AND INCREASED PRICES.

More subsidies can only make things worse.

Vote against extending them!

⚡️

Senators are deluged by lobbyists who say solar/wind subsidies have been great for America—and that the Senate needs to pass @joniernst's amendment to extend them.

But the Administration's top experts know the truth: these subsidies are a disaster the Senate needs to terminate.

But the Administration's top experts know the truth: these subsidies are a disaster the Senate needs to terminate.

@SecretaryWright @SecretaryBurgum Chris Wright, Secretary of Energy, this year called IRA solar and wind subsidies “lunacy,” “a big mistake,” and “political posturing that results in higher costs and less reliable electricity.”

James Danly, Deputy Secretary of Energy and former FERC Chairman, warned in 2023 of a "looming reliability crisis in our electricity markets” due largely to “the price-distorting and warping effects of subsidies.”

Doug Burgum, Chair of the National Energy Dominance Council, said in 2025 that IRA grants "massive tax subsidies" for "sources of energy that are by definition intermittent" and "The idea that we can power our country on intermittent power... is a fantasy."

Solar/wind subsidies are advocated by lobbyists for companies that profit from cost-adding solar/wind—including many utilities.

Vs. those obligated to lower costs, such as Florida Municipal Power, which says we need legislation that "ends federal energy ITC and PTC tax credits."

Vs. those obligated to lower costs, such as Florida Municipal Power, which says we need legislation that "ends federal energy ITC and PTC tax credits."

https://twitter.com/32913997/status/1930055781073989646

Why are real electricity experts so opposed to subsidies for solar and wind?

1) Because like all subsidies, they raise real prices

2) Because these particular subsidies also do grievous harm to the reliability of our grid

1) Because like all subsidies, they raise real prices

2) Because these particular subsidies also do grievous harm to the reliability of our grid

How do solar and wind subsidies raise the real price of electricity?

They add new costs in the form of

1. Massive transmission line costs that are only necessary for solar and wind

2. Massive backup costs—because solar and wind are unreliable

3. More taxes

4. More inflation

They add new costs in the form of

1. Massive transmission line costs that are only necessary for solar and wind

2. Massive backup costs—because solar and wind are unreliable

3. More taxes

4. More inflation

How do solar and wind subsidies harm the reliability of our grid?

Subsidized and unreliable solar and wind destroy the economics of reliable power plants by taking away the electricity market revenue that reliable power plants need to be profitable.

Here's how it "works."

👇

Subsidized and unreliable solar and wind destroy the economics of reliable power plants by taking away the electricity market revenue that reliable power plants need to be profitable.

Here's how it "works."

👇

The IRA's ITC and PTC subsidies pay companies a fortune to build unreliable solar and wind installations that would otherwise be unprofitable—so companies build unreliable solar and wind on as many grids as they can.

Since subsidized solar/wind can make money even by paying the grid to take their electricity, whenever the sun shines and the wind blows subsidized solar and wind always “outcompete” reliable sources.

The more subsidized solar/wind on the grid, the less time reliable power plants operate and thus the less revenue they get.

This harms the economics of current reliable plants and discourages the building of new reliable plants.

See why we have a capacity/reliability crisis?

This harms the economics of current reliable plants and discourages the building of new reliable plants.

See why we have a capacity/reliability crisis?

MYTH: If we don't subsidize solar/wind/batteries, they will be "destroyed" and unable to meet demand.

TRUTH: If we don't subsidize them, the most-cost-effective versions will be used as much as actually needed (batteries most of all).

And WITHOUT defunding reliable generation.

TRUTH: If we don't subsidize them, the most-cost-effective versions will be used as much as actually needed (batteries most of all).

And WITHOUT defunding reliable generation.

https://twitter.com/95869752/status/1939393173706457296

MYTH: America’s AI buildout depends on subsidizing solar/wind.

TRUTH: America's AI buildout depends on NOT subsidizing solar/wind.

AI depends on highly reliable, dispatchable generation. Only by de-subsidizing solar/wind can we re-incentive reliable generation ASAP.

Including:

* Rapid upgrades of existing gas plants (huge increases in capacity are possible without needing new turbines)

* New gas and oil generation

* Batteries

Once we get rid of the subsidies the market will go FULL SPEED AHEAD IN BUILDING OUT RELIABLE CAPACITY.

TRUTH: America's AI buildout depends on NOT subsidizing solar/wind.

AI depends on highly reliable, dispatchable generation. Only by de-subsidizing solar/wind can we re-incentive reliable generation ASAP.

Including:

* Rapid upgrades of existing gas plants (huge increases in capacity are possible without needing new turbines)

* New gas and oil generation

* Batteries

Once we get rid of the subsidies the market will go FULL SPEED AHEAD IN BUILDING OUT RELIABLE CAPACITY.

Tell me more claims you hear about solar/wind subsidies being good for electricity and I'll refute them here!

Here's a Cha-myth, refuted.

Notice how so many of these pro-subsidy commentators have a lot of money to lose if they don't get to loot taxpayer money...

Notice how so many of these pro-subsidy commentators have a lot of money to lose if they don't get to loot taxpayer money...

https://x.com/AlexEpstein/status/1925696451444678917

MYTH: Oil & gas gets just as much or more subsidies than solar and wind.

TRUTH: The vast majority of oil & gas projects in the US are unsubsidized! (Subsidies are for CO2 capture and hydrogen projects—which I oppose.) All US solar/wind/EV projects are massively subsidized.

TRUTH: The vast majority of oil & gas projects in the US are unsubsidized! (Subsidies are for CO2 capture and hydrogen projects—which I oppose.) All US solar/wind/EV projects are massively subsidized.

If you really want a deep dive on the myth of fossil fuel subsidies...

https://x.com/AlexEpstein/status/1658514837192990720

MYTH: Batteries were helpful on a given grid (e.g., TX) on a given day, therefore we need battery, solar, and wind subsidies.

TRUTH: Without subsidies, batteries would be used, but less—since they wouldn’t need to compensate for solar/wind unreliability.

TRUTH: Without subsidies, batteries would be used, but less—since they wouldn’t need to compensate for solar/wind unreliability.

https://x.com/AlexEpstein/status/1939407695624487303

MYTH: Solar/wind subsidies have been great for TX.

TRUTH: These subsidies *have* allowed TX to loot endless billions from the rest of America. But they've caused deep capacity problems that led to the 2021 blackouts and have proven very costly to fix.

TRUTH: These subsidies *have* allowed TX to loot endless billions from the rest of America. But they've caused deep capacity problems that led to the 2021 blackouts and have proven very costly to fix.

https://x.com/mitchrolling/status/1939763022979043389

MYTH: Lots of good jobs will be lost if we terminate the IRA subsidies during Trump’s term.

TRUTH: Lobbyists are deliberately lying about this. If we terminate eligibility by 2027, all complete and near-complete still get their subsidies and therefore the relevant jobs are kept.

Furthermore, the IRA really didn’t create any new jobs, it just shifted investment and jobs to less productive, subsidized projects.

If subsidized, unsustainable jobs go away they will soon be replaced with better jobs—like the jobs we need to actually build out reliable capacity and AI data centers.

(Note that the most plausible job loss claim is from the 2025 termination of the 25D residential solar tax credit for homeowners, which will short-term affect a lot of industry workers. And yet while I have argued that 25D should terminate at the end of 2027 like the ITC, the solar/wind lobbying core doesn't seem to care about residential purchasers. Their efforts are focused on extending subsidies for utilities and leasing companies.)

TRUTH: Lobbyists are deliberately lying about this. If we terminate eligibility by 2027, all complete and near-complete still get their subsidies and therefore the relevant jobs are kept.

Furthermore, the IRA really didn’t create any new jobs, it just shifted investment and jobs to less productive, subsidized projects.

If subsidized, unsustainable jobs go away they will soon be replaced with better jobs—like the jobs we need to actually build out reliable capacity and AI data centers.

(Note that the most plausible job loss claim is from the 2025 termination of the 25D residential solar tax credit for homeowners, which will short-term affect a lot of industry workers. And yet while I have argued that 25D should terminate at the end of 2027 like the ITC, the solar/wind lobbying core doesn't seem to care about residential purchasers. Their efforts are focused on extending subsidies for utilities and leasing companies.)

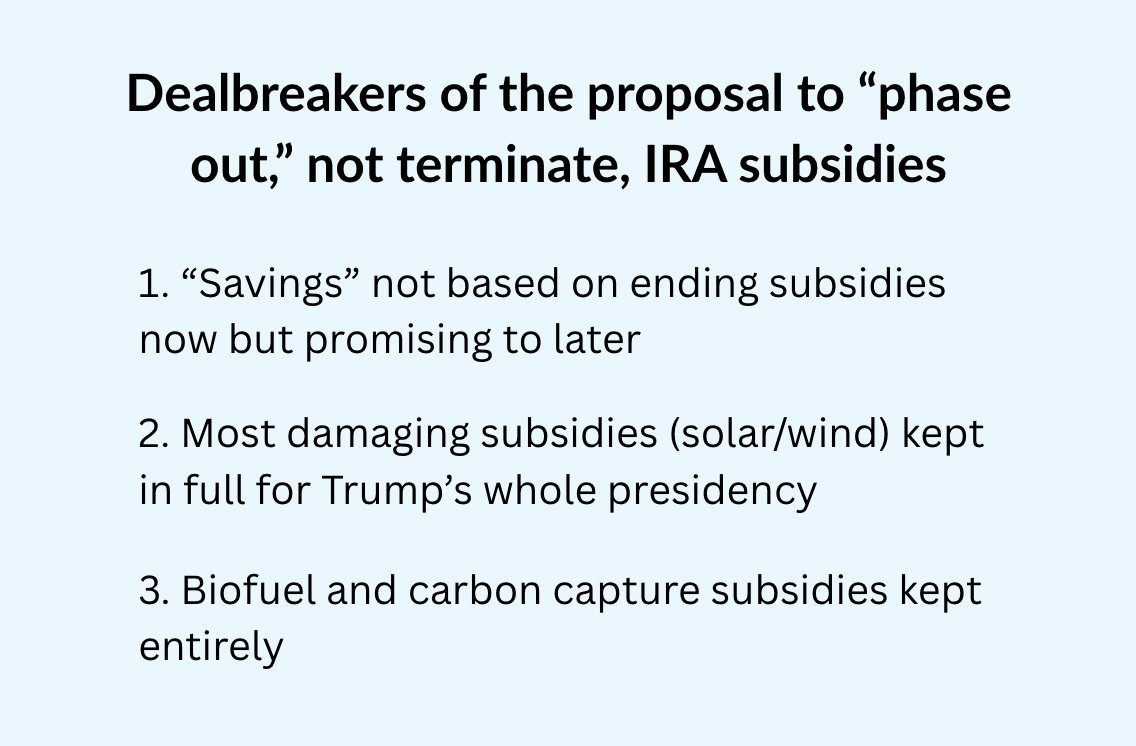

MYTH: Extending solar/wind subsidies, as the Senate is now (ominously) considering once again, has very little budget cost.

TRUTH: It obviously has a huge cost, but rigged government budget scoring always underestimates it. E.g., underestimating IRA $ 5X.

TRUTH: It obviously has a huge cost, but rigged government budget scoring always underestimates it. E.g., underestimating IRA $ 5X.

https://x.com/AlexEpstein/status/1939806706546221141

• • •

Missing some Tweet in this thread? You can try to

force a refresh