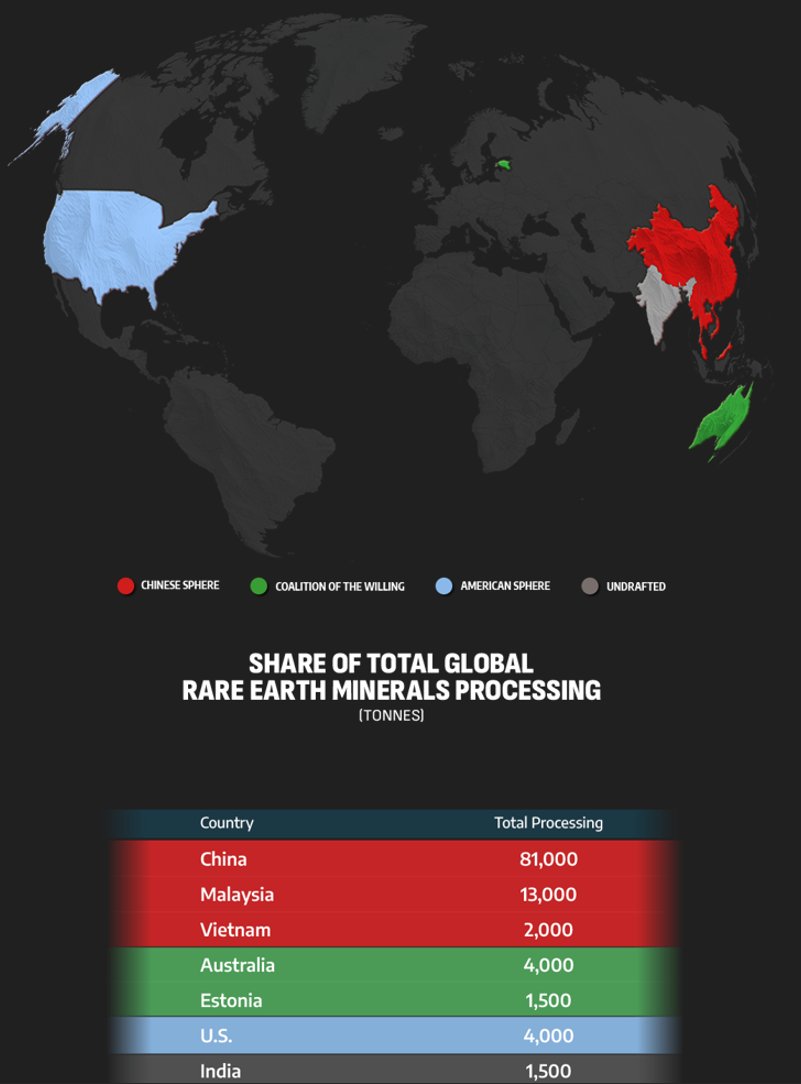

The image below shows control. Specifically, it maps global magnet-grade rare earth oxide output: the refined feedstock (Nd, Pr, Dy, Tb) that enables Stage 3 transformation into industrial leverage, NdFeB magnets used in EVs, drones, missiles, turbines, and hard drives.🧵

China accounts for 81,000 tonnes of this oxide processing annually. Malaysia’s Lynas facility adds 13,000 tonnes, and Vietnam contributes another 2,000. Together, the Chinese sphere controls over 90% of global rare earth processing capacity. The rest of the world exists at the margins. Australia (4,000 t), Estonia (1,500 t), the U.S. (4,000 t), and India (1,500 t) collectively struggle to reach even 10,000 tonnes.

But this is only Stage 2. China refines the oxides and carries the process through to full magnet conversion, controlling both the feedstock and the finished product. Approximately 300,000 tonnes of NdFeB magnets are produced annually within China’s ecosystem. What appear as industrial outputs operate as geopolitical circuits, embedded with control, not just utility. Oxides become leverage, and that leverage becomes supply chain dominance.

Beijing’s command is vertically integrated: feedstock from Africa and Southeast Asia, refining capacity in Jiangxi and Baotou, and a magnet conversion layer that operates at global scale. Meanwhile, Western governments are just beginning to rediscover the upstream. The U.S. has recently re-engaged in the Democratic Republic of Congo to secure access to cobalt and copper, critical elements already embedded in China’s Belt and Road blueprint two decades ago.

The fracture is visible in cases like antimony. Once obscure, it is now classified as critical by the U.S. Department of Defense due to its role in infrared optics and smart munitions. North America’s richest deposit, Beaver Brook in Newfoundland, sits dormant under Chinese ownership. This move is calculated, designed as a strategic switch. Turn it on to flood the market. Turn it off to starve competitors. Either way, control is maintained without firing a shot.

Funding attempts in the West reflect recognition but not parity. The U.S. has deployed around $440 billion via the Inflation Reduction Act and DoD programs. Canada has allocated approximately C$4 billion. The EU has pledged $45 billion. Saudi Arabia, recognizing oil’s twilight, is entering the mineral race with a war chest that outpaces Europe. But China has already spent its $80+ billion. Its circuits are running, its metals are moving, and its magnets are in the field.

The geopolitical map of critical minerals organizes itself around a central axis of control, China at the core, others circling at varying depths of dependency. A red core of command, surrounded by green aspirants, blue dependents, and black undecided peripheries. Everyone else moves in orbit, or breaks under drift. This was never about who owns the ore. It's about who commands the circuit that turns material into force. In 2025, that circuit still runs through Chinese hands. And the rest of the world, for now, flows downstream.

• • •

Missing some Tweet in this thread? You can try to

force a refresh