In investing, your track record is everything.

In 2 minutes, I'll uncover the secrets hedge funds use to track their portfolio performance: 🧵

In 2 minutes, I'll uncover the secrets hedge funds use to track their portfolio performance: 🧵

There are 3 main areas that smart investors care about:

1. Profits (Returns)

2. Risks

3. Drawdowns

Let's break them down using the snapshot:

1. Profits (Returns)

2. Risks

3. Drawdowns

Let's break them down using the snapshot:

1. Profitability Insights

Annual Return: 22.44%—strong growth!

CAGR: 23.78%—compounded gains over time.

MAR: 0% (minimum acceptable)—room to beat risk-free rates.

Significance level (5%) sets the risk benchmark.

Annual Return: 22.44%—strong growth!

CAGR: 23.78%—compounded gains over time.

MAR: 0% (minimum acceptable)—room to beat risk-free rates.

Significance level (5%) sets the risk benchmark.

2. Risk Measures

Std Dev: 12.41%—volatility is moderate.

VaR (18.97%) & CVaR (29.76%)—expect losses up to 18.97% (95%) or 29.76% (worst cases).

Worst Realization: 50.74%—a rare but brutal drop to watch

Std Dev: 12.41%—volatility is moderate.

VaR (18.97%) & CVaR (29.76%)—expect losses up to 18.97% (95%) or 29.76% (worst cases).

Worst Realization: 50.74%—a rare but brutal drop to watch

3. Drawdowns and Risks

Max Drawdown: 14.61%—peak loss to recover from.

Ulcer Index: 2.80%—measures drawdown stress.

Drawdown at Risk (5.21%)—likely loss duration.

Use these to stress-test your strategy

Max Drawdown: 14.61%—peak loss to recover from.

Ulcer Index: 2.80%—measures drawdown stress.

Drawdown at Risk (5.21%)—likely loss duration.

Use these to stress-test your strategy

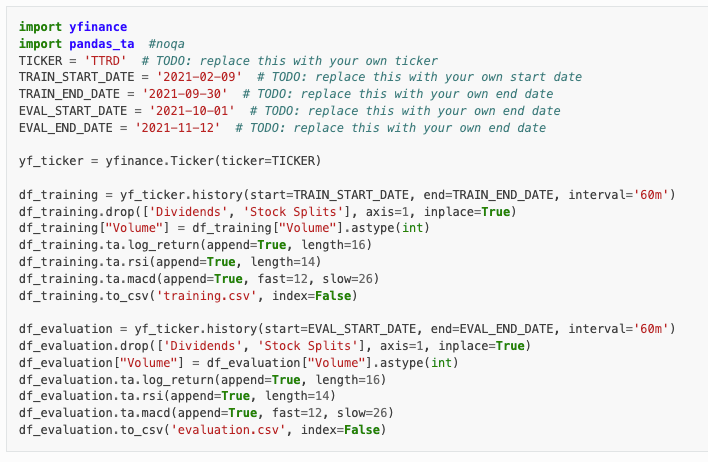

Want to learn how we do this inside our hedge fund in Python?

In our new live workshop, we'll share everything (and you can ask any question)

In our new live workshop, we'll share everything (and you can ask any question)

🚨 WORKSHOP: How I built an automated algorithmic trading system with Python.

Hedge funds have an unfair advantage: better tools & faster execution.

That ends on July 24th.

👉 Register here to learn how with Python (500 seats): learn.quantscience.io/become-a-pro-q…

Hedge funds have an unfair advantage: better tools & faster execution.

That ends on July 24th.

👉 Register here to learn how with Python (500 seats): learn.quantscience.io/become-a-pro-q…

That's a wrap! Over the next 24 days, I'm sharing my top 24 algorithmic trading concepts to help you get started.

If you enjoyed this thread:

1. Follow me @quantscience_ for more of these

2. RT the tweet below to share this thread with your audience

If you enjoyed this thread:

1. Follow me @quantscience_ for more of these

2. RT the tweet below to share this thread with your audience

https://twitter.com/1683526993059430411/status/1943702935352885737

P.S. - Want to learn Algorithmic Trading Strategies that actually work?

I'm hosting a live workshop. Join here: learn.quantscience.io/qs-register

I'm hosting a live workshop. Join here: learn.quantscience.io/qs-register

• • •

Missing some Tweet in this thread? You can try to

force a refresh