1/4 You're wrong old friend. The @federalreserve is not only providing stimulus at present, but has been for a while. How do I know?

https://twitter.com/ces921/status/1943689333208199323

2/4 Does anyone wonder why Crypto is at an all-time-high & stocks keep going up daily despite deteriorating economic data (job losses picking up + poor $AMZN Prime Day sales + revolving credit dropping -3.2% YoY in May [most since Aug. '20] + real wage growth falling + etc.)?

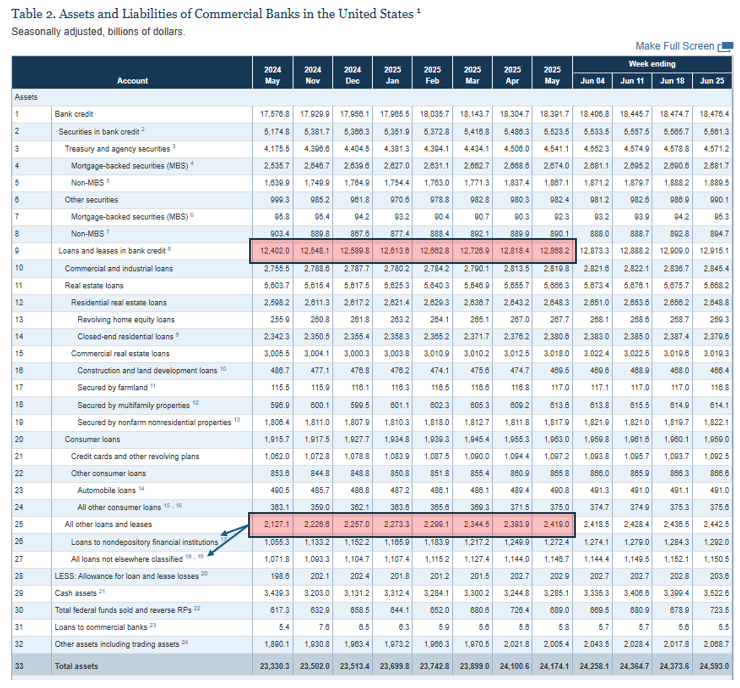

3/4 U.S. M2 has hit an all-time high, and is currently above COVID levels. What's funding all this? Well, an expansion of 💵 printing, of course, by the @federalreserve. And, where's all this money flowing too? Essentially hedge funds and non-bank financial entities - i.e., QE.

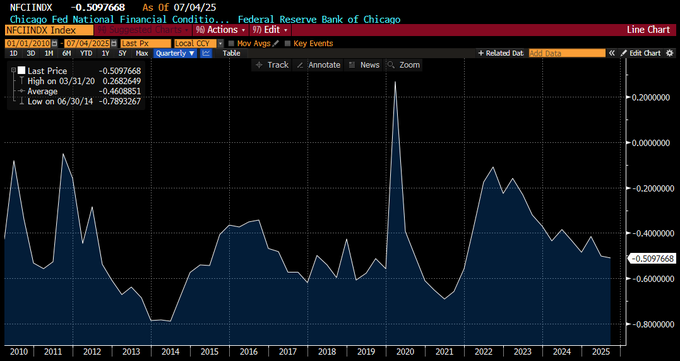

4/4 And, it's all resonating in LOOSENING financial conditions, which means inflation will take back off imminently. Get ready for MUCH higher prices! #thefoundingfathersarerollingintheirgraves

• • •

Missing some Tweet in this thread? You can try to

force a refresh