100 years ago, Charles Ponzi discovered the psychological trick that makes smart people do stupid things with money.

Today, scammers still use his exact playbook to steal billions.

Here's the dangerous psychology behind every "get rich quick" scheme: 🧵

Today, scammers still use his exact playbook to steal billions.

Here's the dangerous psychology behind every "get rich quick" scheme: 🧵

Charles Ponzi wasn't born a criminal.

He was born into a fallen Italian noble family - once wealthy merchants, now his father was just a postman.

This early taste of "lost status" planted a dangerous seed in young Ponzi's mind...

He was born into a fallen Italian noble family - once wealthy merchants, now his father was just a postman.

This early taste of "lost status" planted a dangerous seed in young Ponzi's mind...

At 21, Ponzi inherited money and enrolled in college.

Instead of studying, he burned through his inheritance on fancy clothes, expensive restaurants, and gambling.

He was living a lie - pretending to be rich when he was broke.

This pattern would define his entire life.

Instead of studying, he burned through his inheritance on fancy clothes, expensive restaurants, and gambling.

He was living a lie - pretending to be rich when he was broke.

This pattern would define his entire life.

When the money ran out, Ponzi fled to America in 1903.

Reality hit hard. He worked as a dishwasher, factory hand, insurance salesman - any job he could find.

But every time he saved money, he'd blow it all trying to recapture his "wealthy" lifestyle.

Reality hit hard. He worked as a dishwasher, factory hand, insurance salesman - any job he could find.

But every time he saved money, he'd blow it all trying to recapture his "wealthy" lifestyle.

In Montreal, Ponzi got his first taste of financial fraud.

His boss at Banco Zarossi was running a classic scheme - using new investor money to pay old investors.

When it collapsed, Ponzi learned two crucial lessons about human psychology...

His boss at Banco Zarossi was running a classic scheme - using new investor money to pay old investors.

When it collapsed, Ponzi learned two crucial lessons about human psychology...

Lesson 1: People will believe anything if you promise them easy money.

Lesson 2: The key isn't having a real business - it's having a believable story.

Ponzi spent the next decade perfecting both skills while bouncing between jobs and prison sentences.

Lesson 2: The key isn't having a real business - it's having a believable story.

Ponzi spent the next decade perfecting both skills while bouncing between jobs and prison sentences.

In 1919, everything changed when Ponzi received a letter from Spain containing something called an International Reply Coupon (IRC).

These coupons could theoretically be bought cheap in one country and redeemed for higher value in another.

The arbitrage opportunity was real... but tiny.

These coupons could theoretically be bought cheap in one country and redeemed for higher value in another.

The arbitrage opportunity was real... but tiny.

Here's where Ponzi's genius (and evil) kicked in:

He realized he didn't need the IRC business to actually work.

He just needed people to BELIEVE it worked.

And the story was perfect - complex enough to sound smart, simple enough to understand.

He realized he didn't need the IRC business to actually work.

He just needed people to BELIEVE it worked.

And the story was perfect - complex enough to sound smart, simple enough to understand.

Ponzi's psychological playbook was devastatingly effective:

• Promise impossible returns (50% in 45 days)

• Refuse to explain details ("trade secrets")

• Pay early investors immediately

• Let word-of-mouth do the marketing

• Target financially desperate people

• Promise impossible returns (50% in 45 days)

• Refuse to explain details ("trade secrets")

• Pay early investors immediately

• Let word-of-mouth do the marketing

• Target financially desperate people

The early payments were crucial psychological manipulation.

When the first 18 investors got their promised returns, they became Ponzi's best salespeople.

"I invested $100 and got $150 back in 6 weeks!"

Social proof is the most powerful marketing tool ever created.

When the first 18 investors got their promised returns, they became Ponzi's best salespeople.

"I invested $100 and got $150 back in 6 weeks!"

Social proof is the most powerful marketing tool ever created.

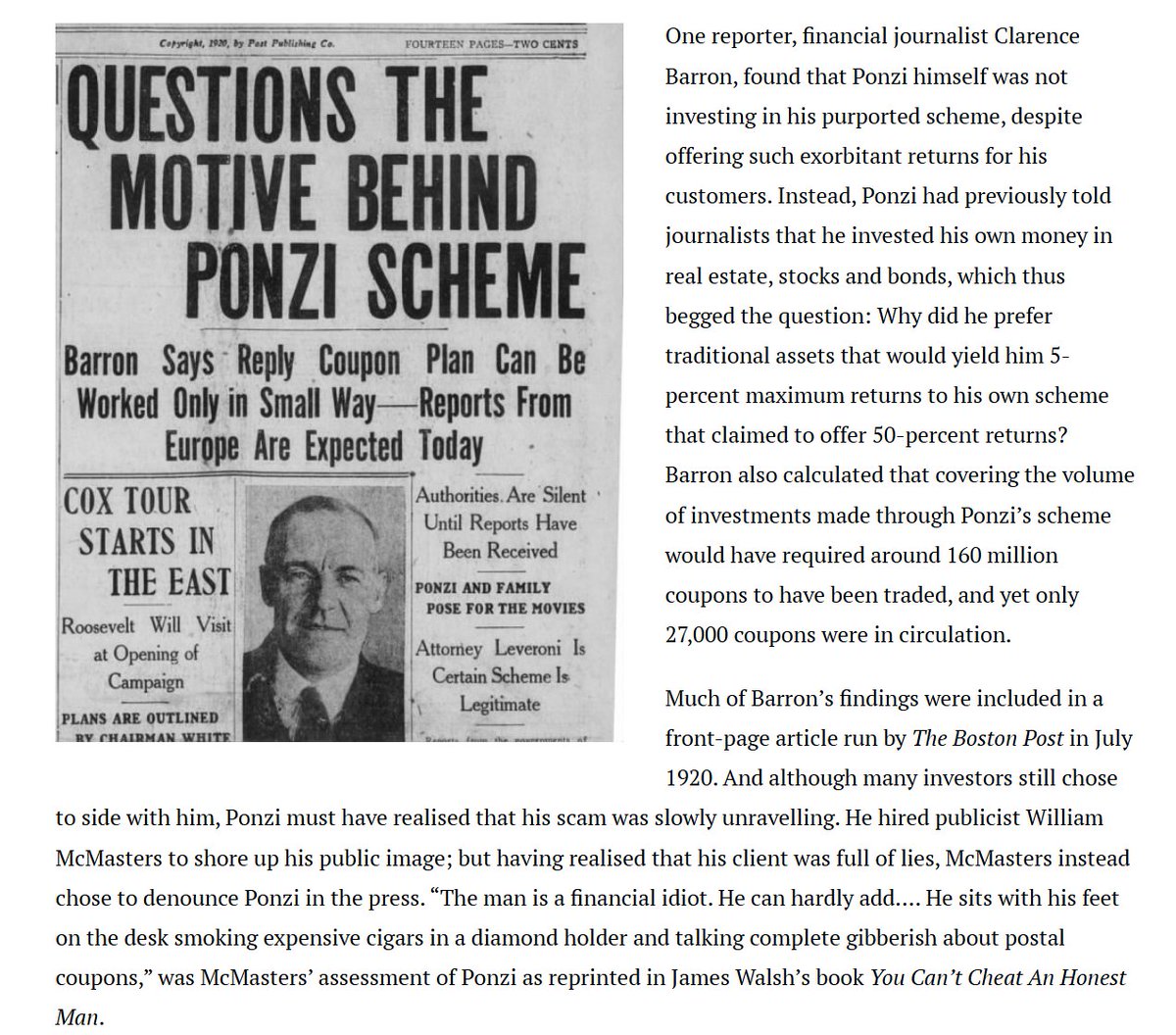

But here's the terrifying part:

Experts immediately knew it was impossible.

Clarence Barron calculated Ponzi needed 160 million IRCs.

Only 27,000 existed worldwide.

Yet people kept investing anyway. Why?

Experts immediately knew it was impossible.

Clarence Barron calculated Ponzi needed 160 million IRCs.

Only 27,000 existed worldwide.

Yet people kept investing anyway. Why?

Because Ponzi understood a dark truth about human psychology:

When people desperately want something to be true, they'll ignore obvious evidence that it's false.

Greed literally shuts down critical thinking.

The bigger the promise, the more willing people are to believe.

When people desperately want something to be true, they'll ignore obvious evidence that it's false.

Greed literally shuts down critical thinking.

The bigger the promise, the more willing people are to believe.

At his peak, Ponzi was collecting $250,000 per day.

The Boston Post called him a "financial genius."

He bought mansions, expensive cars, diamond jewelry.

40,000 people had given him their life savings.

But the math never worked...

The Boston Post called him a "financial genius."

He bought mansions, expensive cars, diamond jewelry.

40,000 people had given him their life savings.

But the math never worked...

The scheme collapsed when his own publicist, William McMasters, exposed him.

McMasters later said: "Ponzi is a financial idiot. He can hardly add! He sits smoking expensive cigars talking complete gibberish about postal coupons."

McMasters later said: "Ponzi is a financial idiot. He can hardly add! He sits smoking expensive cigars talking complete gibberish about postal coupons."

The aftermath was devastating:

• Tens of thousands lost their life savings

• Multiple banks went bankrupt

• Ponzi got only 5 years in prison

• He immediately tried another scam after release

The victims? Most never recovered financially.

• Tens of thousands lost their life savings

• Multiple banks went bankrupt

• Ponzi got only 5 years in prison

• He immediately tried another scam after release

The victims? Most never recovered financially.

Here's what makes this story terrifying:

The exact same psychological tricks work today.

Cryptocurrency scams, MLM schemes, investment fraud - they all use Ponzi's playbook:

1. Impossible promises

2. Social proof from early "winners"

3. Urgency and secrecy

The exact same psychological tricks work today.

Cryptocurrency scams, MLM schemes, investment fraud - they all use Ponzi's playbook:

1. Impossible promises

2. Social proof from early "winners"

3. Urgency and secrecy

I hope you've found this thread helpful.

Follow me @GeniusBusiness_ for more threads on underrated 100% original business, finance, and marketing stories.

Could you help me reach 100k before July?

Like/Repost the quote below to spread the word:

Follow me @GeniusBusiness_ for more threads on underrated 100% original business, finance, and marketing stories.

Could you help me reach 100k before July?

Like/Repost the quote below to spread the word:

https://twitter.com/1654777769807560707/status/1944018162003153179

• • •

Missing some Tweet in this thread? You can try to

force a refresh