Don't be fooled by the 2.10% inflation number. There's more to it than meets the eye. Because there is something called core inflation, which is at 4.60%.

What is core inflation? How does it differ from inflation? We break this down in a quick Varsity explainer. (1/n)

What is core inflation? How does it differ from inflation? We break this down in a quick Varsity explainer. (1/n)

Consumer Price Index (CPI) inflation measures the price change for a basket of goods and services of regular use, such as food, fuel, housing, clothing, education, health, and transport.

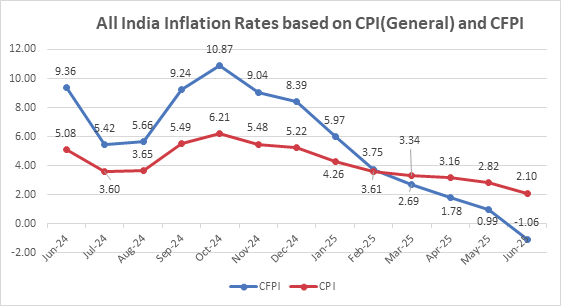

CPI inflation gets reported in the news headlines, so it is also called headline inflation. And this is at 2.10% now. (2/n)

CPI inflation gets reported in the news headlines, so it is also called headline inflation. And this is at 2.10% now. (2/n)

Core Inflation is CPI inflation without food and energy prices.

Food and energy prices are removed from the calculation because they are dependent on external events like weather and geopolitics and the prices can be extremely volatile. Down one month and up the next. (3/n)

Food and energy prices are removed from the calculation because they are dependent on external events like weather and geopolitics and the prices can be extremely volatile. Down one month and up the next. (3/n)

By excluding food and energy categories, core inflation serves as an indicator of the more persistent inflation trends. Or the underlying stickiness of inflation. At 4.6%, core inflation is stickier than CPI.

So, why is CPI so low? (4/n)

So, why is CPI so low? (4/n)

1⃣CPI is calculated on a year-on-year basis. So, 2.10% is CPI’s growth from June 2024 to June 2025. And if inflation back then was high and prices have moderated since then, it can lead to a lower inflation number. That is what has happened here. (5/n)

2⃣Food prices have been cooling down. In fact, the Consumer Food Price Index (CFPI) fell 1.06% from June 2024 to June 2025. Prices of vegetables and pulses have fallen by 19% and 11.76% respectively. Since F&B makes up nearly 50% of the CPI, that has pushed inflation lower, too. (6/n)

So, what does this mean for us?

The RBI makes decisions on interest rates based on inflation. If inflation is low, it keeps interest rates low as well. The belief is that if it’s cheap to borrow money, people and companies will borrow and spend. And this will push growth. (7/n)

The RBI makes decisions on interest rates based on inflation. If inflation is low, it keeps interest rates low as well. The belief is that if it’s cheap to borrow money, people and companies will borrow and spend. And this will push growth. (7/n)

It works in reverse, too; if the RBI wants to control inflation, it keeps rates high.

Today, overall inflation is within the RBI’s comfort range, but the core inflation stickiness could make the RBI think twice before making policy rate decisions when they meet in August. (8/n)

Today, overall inflation is within the RBI’s comfort range, but the core inflation stickiness could make the RBI think twice before making policy rate decisions when they meet in August. (8/n)

Remember, the central bank has already cut interest rates (repo) by 1% in 2025, from 6.5% to 5.5%, to promote borrowing and growth. And it may not be in a hurry for more rate cuts. (9/9)

• • •

Missing some Tweet in this thread? You can try to

force a refresh