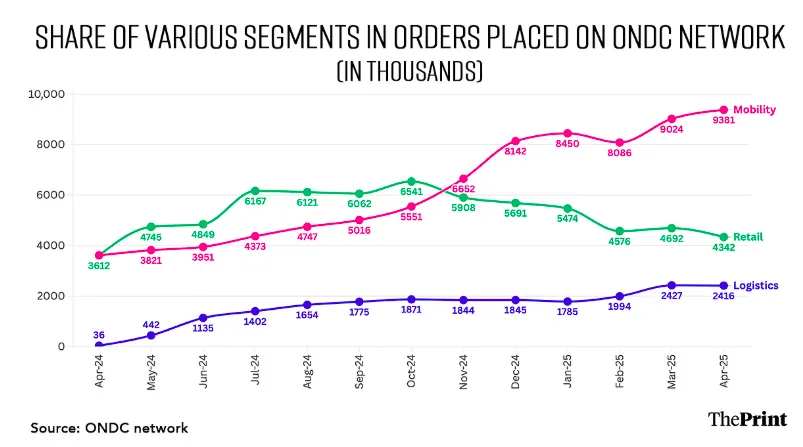

It's been a stormy time for ONDC, India's public infrastructure for e-commerce. Monthly retail orders fell 31% to 46 lakh between Oct 2024-Feb 2025. The CEO, CBO, and non-executive chairperson have all resigned this year. Yet ONDC just announced a new ₹150 crore subsidy plan.🧵👇

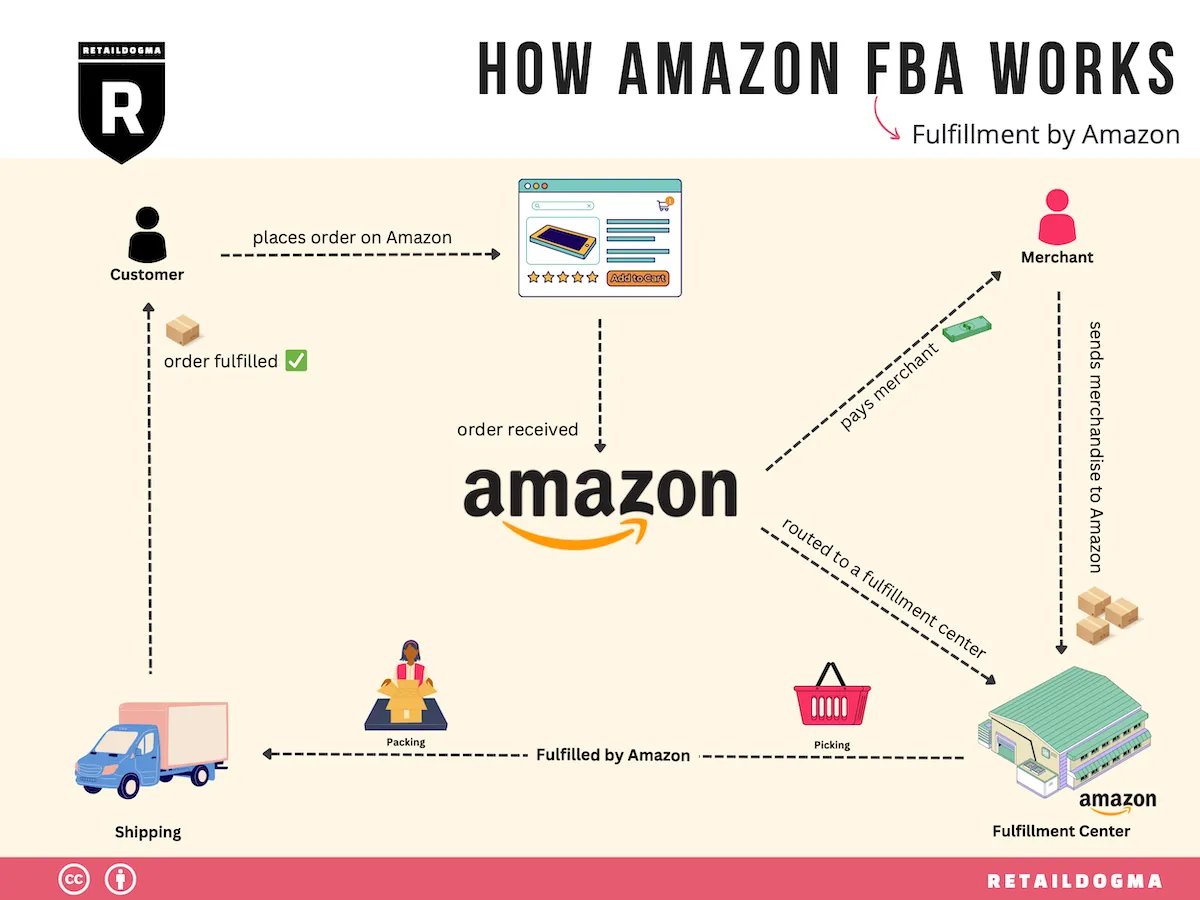

ONDC wants to fundamentally change how e-commerce works. Think about your last Amazon order - you searched, bought through their payment gateway, got it from their warehouse via their delivery driver. Amazon owns this entire process and extracts value at every step.

Sellers pay Amazon for listing their goods. The more they pay, the more they show up in your search - even if they aren't the most relevant to you. Buying an Amazon listing is like paying rent for prime property. This has made small Indian sellers very unhappy.

Amazon controls how you discover products. It has mountains of data on you and knows what you buy. But more importantly, it has your attention. For digital markets, attention is arguably the most precious commodity. Amazon sells this attention to merchants.

If you've ever felt like you're spending a lot of time scrolling through things you don't need, that might be because someone bought your time. Amazon also dominates warehouses to last-mile delivery. Every step gives it an added layer of power and control.

This isn't just Amazon. From Uber to Swiggy, the internet is full of businesses that connect buyers and sellers but gain tremendous power by connecting the two. They're technically just "middlemen," but they're also the most powerful entities in their respective ecosystems.

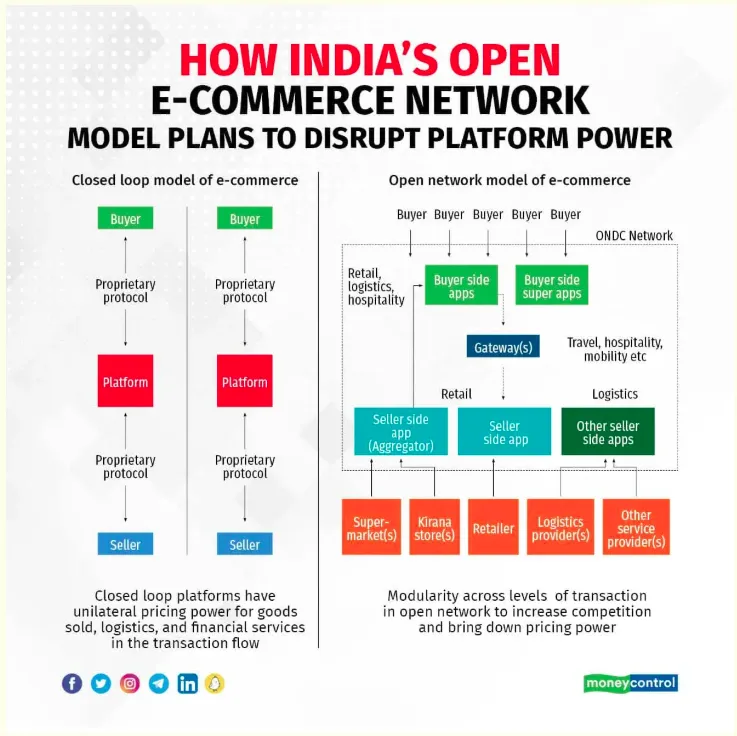

ONDC wants to be the antidote to this power. Its goal is to unbundle the networks behind online markets into smaller building blocks - so anyone can choose how they want to participate. You don't have to be the next Amazon, doing everything from end to end.

Maybe you just list sellers. Maybe you only build a user-friendly app for buyers. Maybe you don't write any code at all, and just handle deliveries in the real world. ONDC hopes to be the connective tissue between completely different entities that specialise in just doing one task well.

ONDC isn't a consumer app. It has no user interface of its own. At its heart is an open protocol called Beckn that smoothens communication between 5 kinds of roles: buyer apps, seller apps, gateways, technology service providers, and logistics providers.

If you're using ONDC, you interact with these entities, not ONDC itself. In essence, ONDC allows you to separate the various cogs of e-commerce - search, discovery, fulfilment - from each other. This creates more competition at every step of a transaction.

Where Zomato charges 18-25% commission, players competing on ONDC could give something closer to 10%. It might also ensure that the results you get are more relevant. At least in theory, this has inherent benefits over an Amazon-style "closed loop" model.

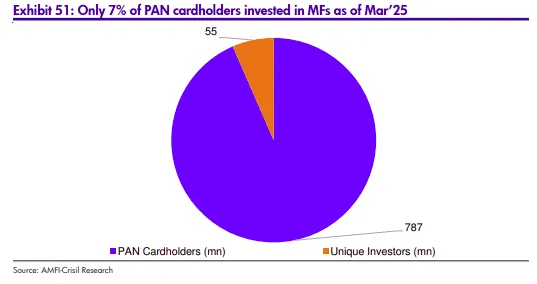

In ONDC's second year - 2023 - it seemed like it would take e-commerce by storm. It went from 50 transactions a day in January to 1,00,000 daily transactions by August. Its seller base rose from 800 to 1,40,000 sellers in the same time span.

Mobility emerged as the largest use-case, led by Namma Yatri's success. In 3 years, it crossed 100 million rides, unlocking earnings of ₹1,600 crore for 6 lakh drivers. Now all major ride-hailing players - including Uber - have been forced to adopt the zero-commission model.

Food delivery went from 4,000 monthly orders in March 2023 to 5 lakh monthly orders a year later. However, this growth came with an asterisk - it was fueled by subsidies. When subsidies were cut from ₹3 crore to ₹30 lakh monthly, retail growth slowed down fast.

ONDC's core challenge: unbundling adds coordination costs between each function. The more steps/stakeholders in the supply chain, the higher these costs become. This creates liability problems - if something goes wrong, who do you complain to? Who gives you a refund?

In a LocalCircles survey, 35% of respondents were unhappy with ONDC's support. In contrast, if Zomato screws up, you just call Zomato. ONDC tries to solve for every use case at once, but these use cases are different. In trying to solve everything, it optimises for nothing.

Amazon, Flipkart, Zomato, Swiggy don't control the entire stack only for power, but also to synchronise functions and optimise at scale. Their centralisation permits tight operational choreography. ONDC breaks this integration. Openness can come at the cost of operational reliability.

ONDC does understand these problems. The answer lies in incentivising better features and use cases than traditional platforms. There's also the chance ONDC doesn't disrupt today's platforms but succeeds by doubling down on new categories where it has already seen bright spots.

We cover this and one more interesting story in today's edition of The Daily Brief. Watch on YouTube, read on Substack, or listen on Spotify, Apple Podcasts, or wherever you get your podcasts.

All links here:thedailybrief.zerodha.com/p/how-zee-lost…

All links here:thedailybrief.zerodha.com/p/how-zee-lost…

• • •

Missing some Tweet in this thread? You can try to

force a refresh