2/ What if I told you there’s 1 macro force that’s appeared before every major move Bitcoin has made over the last decade?

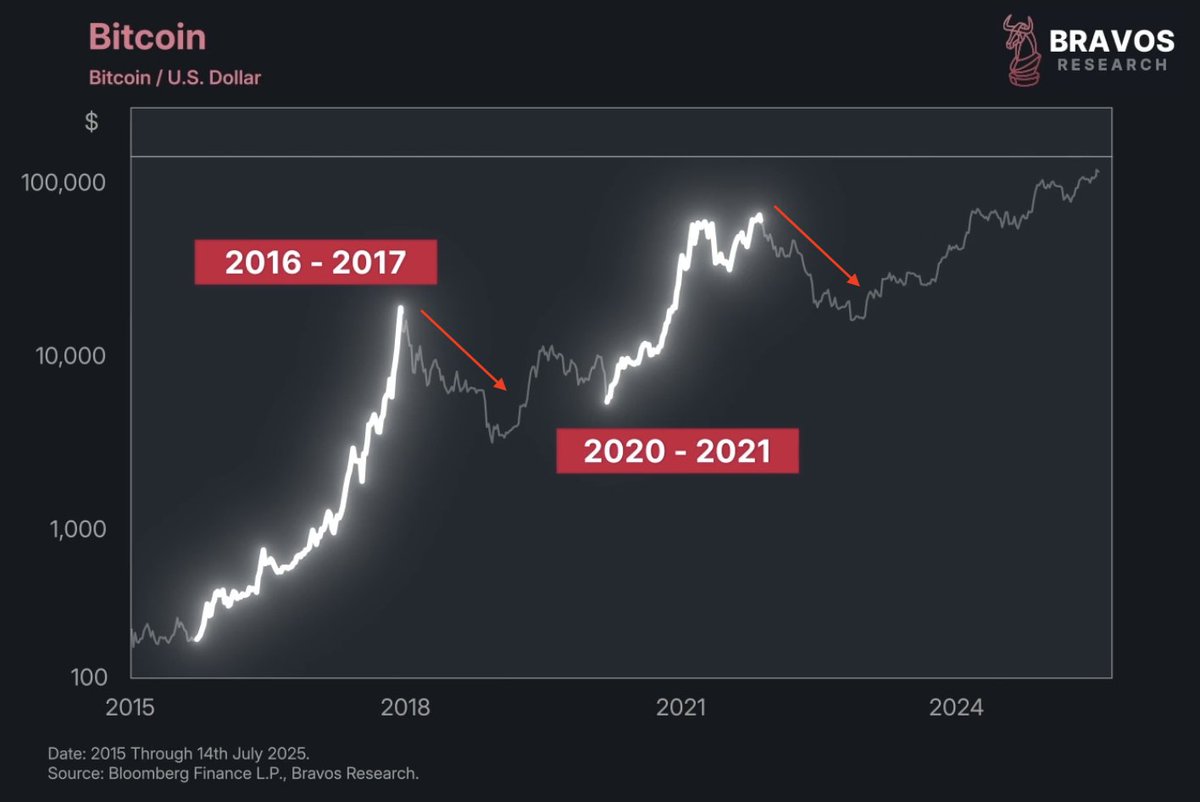

It showed up before Bitcoin’s 5,000% rally in 2016–2017

Before the 1,000% surge in 2020–2021

And right before the 70% crashes in 2018 and 2022

It showed up before Bitcoin’s 5,000% rally in 2016–2017

Before the 1,000% surge in 2020–2021

And right before the 70% crashes in 2018 and 2022

3/ It’s a force every investor knows exists, but very few actually know how to use

It’s called global liquidity

And believe it or not, it’s flashing another major signal right now that could tell us where Bitcoin is headed by August of this year

It’s called global liquidity

And believe it or not, it’s flashing another major signal right now that could tell us where Bitcoin is headed by August of this year

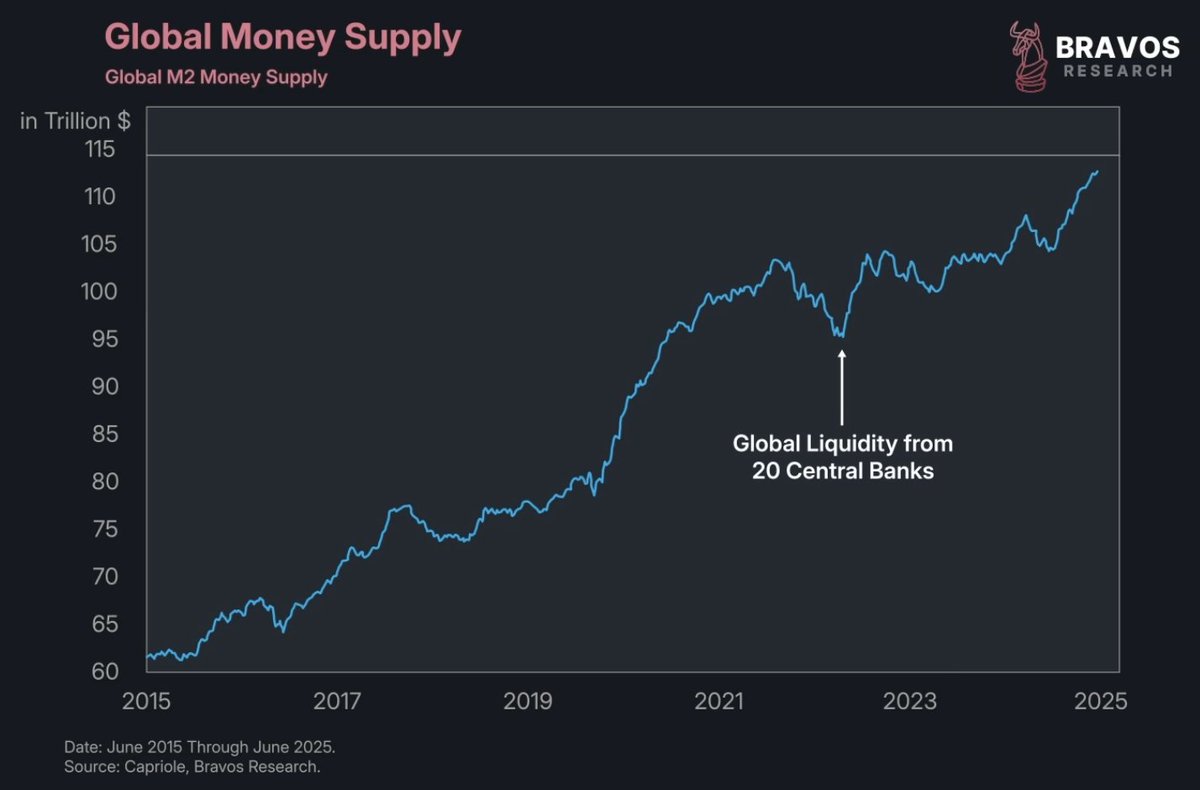

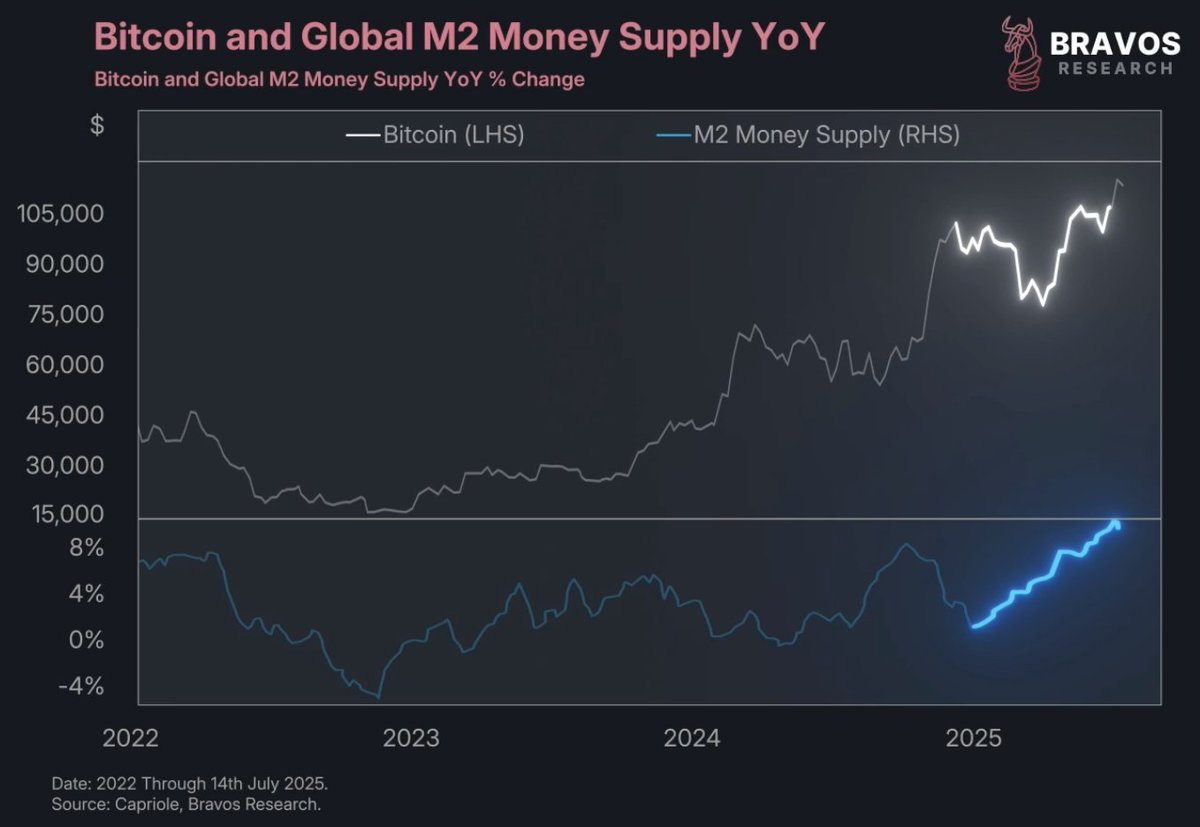

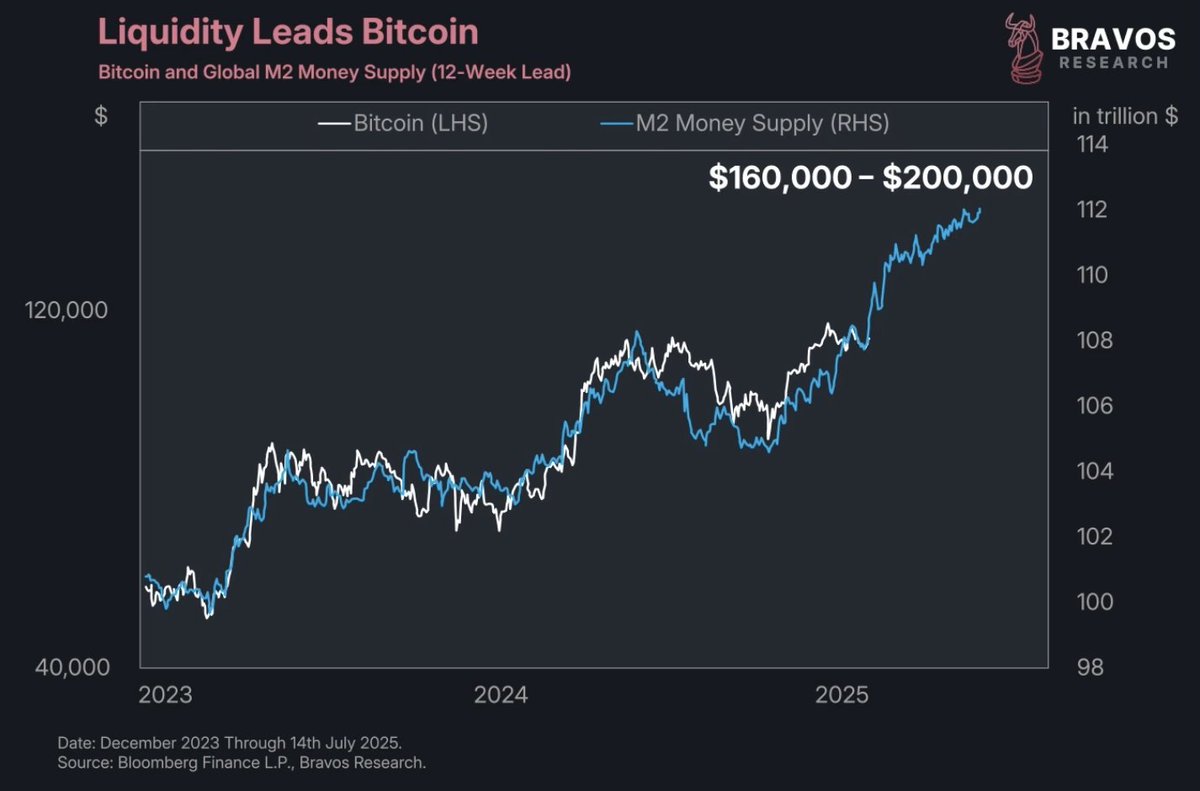

4/ We can track global liquidity using this chart of global M2 money supply

Which reflects the liquidity provided by the world’s 20 largest central banks

Right now, that money supply is breaking out to the highest level ever recorded

Which reflects the liquidity provided by the world’s 20 largest central banks

Right now, that money supply is breaking out to the highest level ever recorded

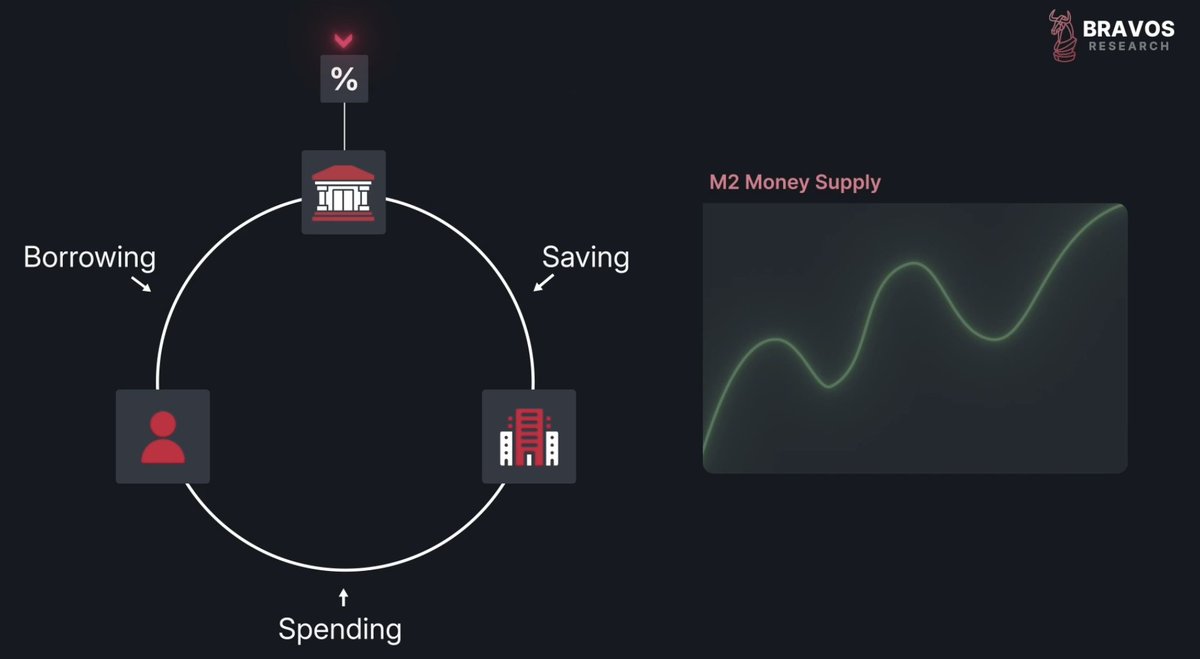

5/ Global liquidity is largely driven by central bank interest rates

When central banks cut rates, borrowing gets cheaper

That leads to more lending and spending

Which pumps more money into the system

Causing M2 money supply to rise

When central banks cut rates, borrowing gets cheaper

That leads to more lending and spending

Which pumps more money into the system

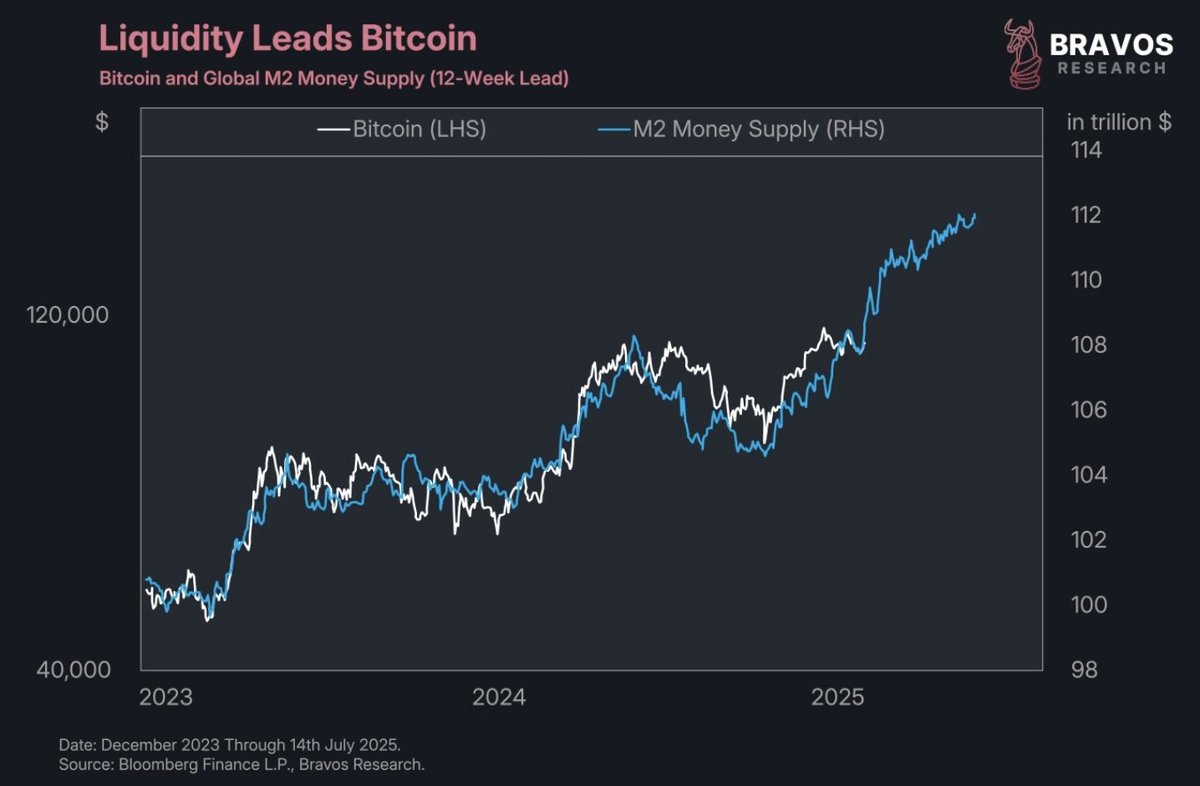

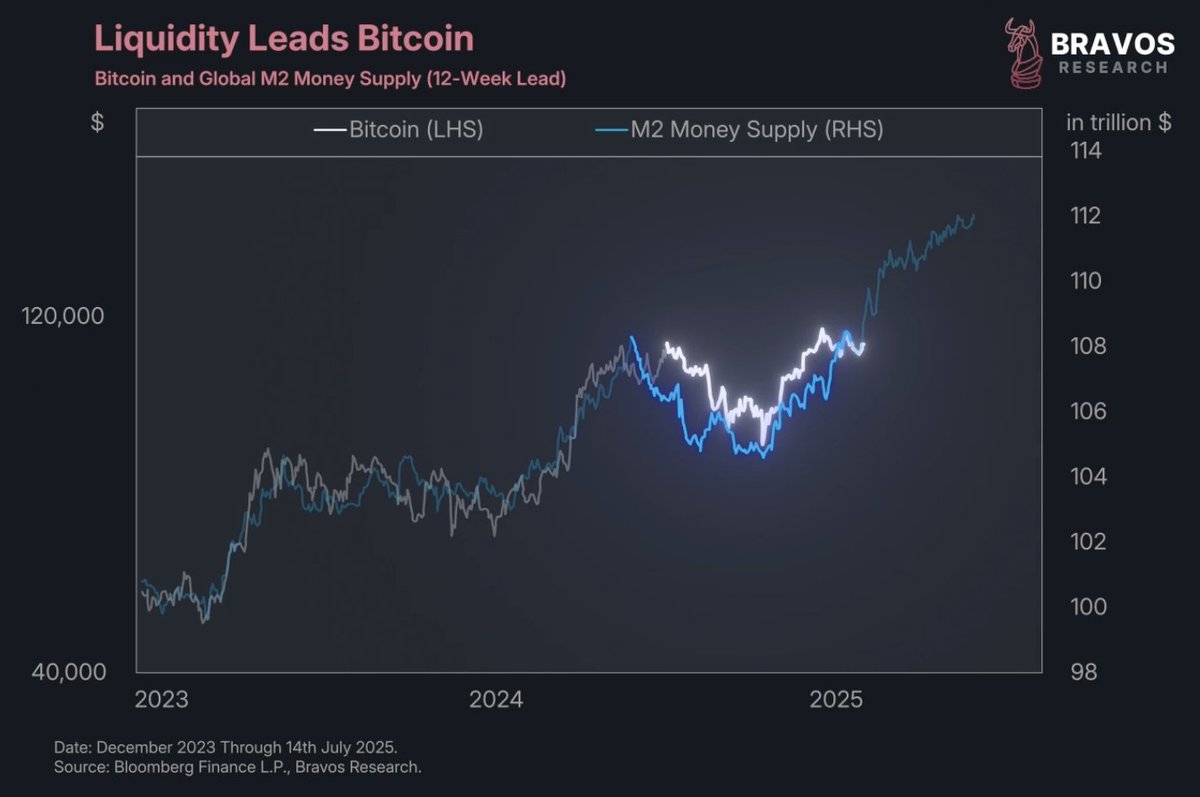

Causing M2 money supply to rise

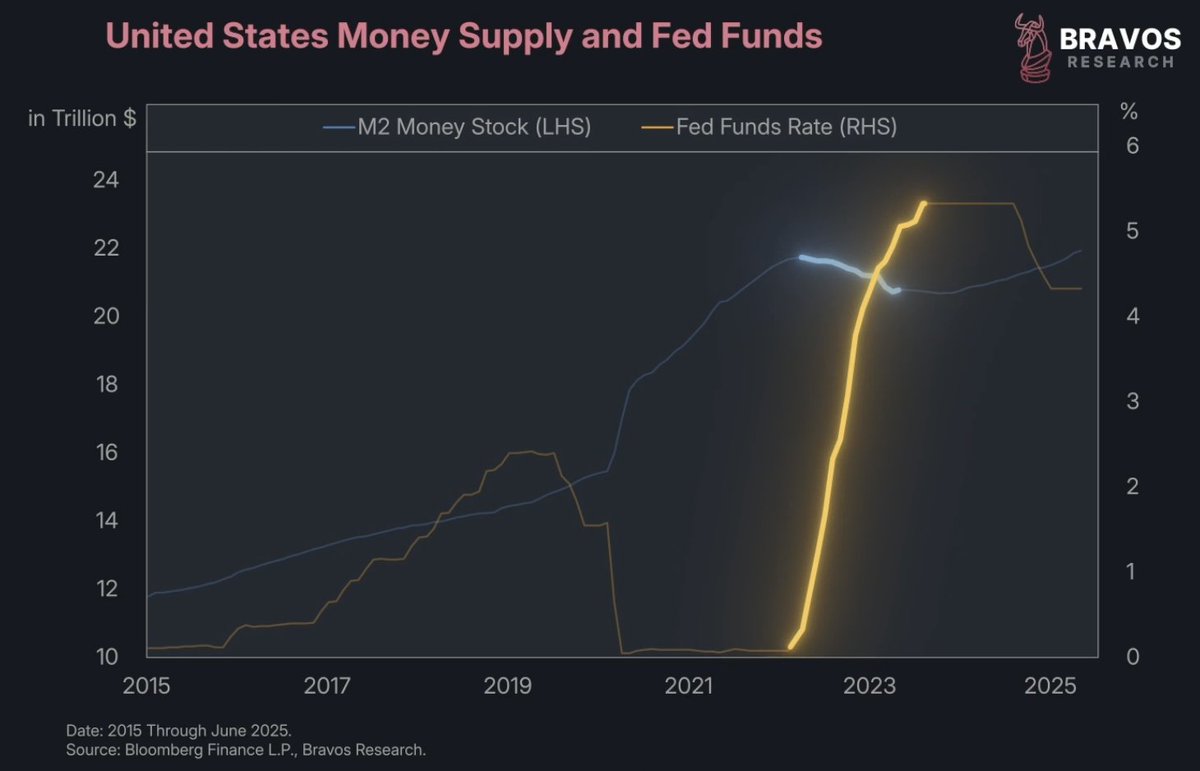

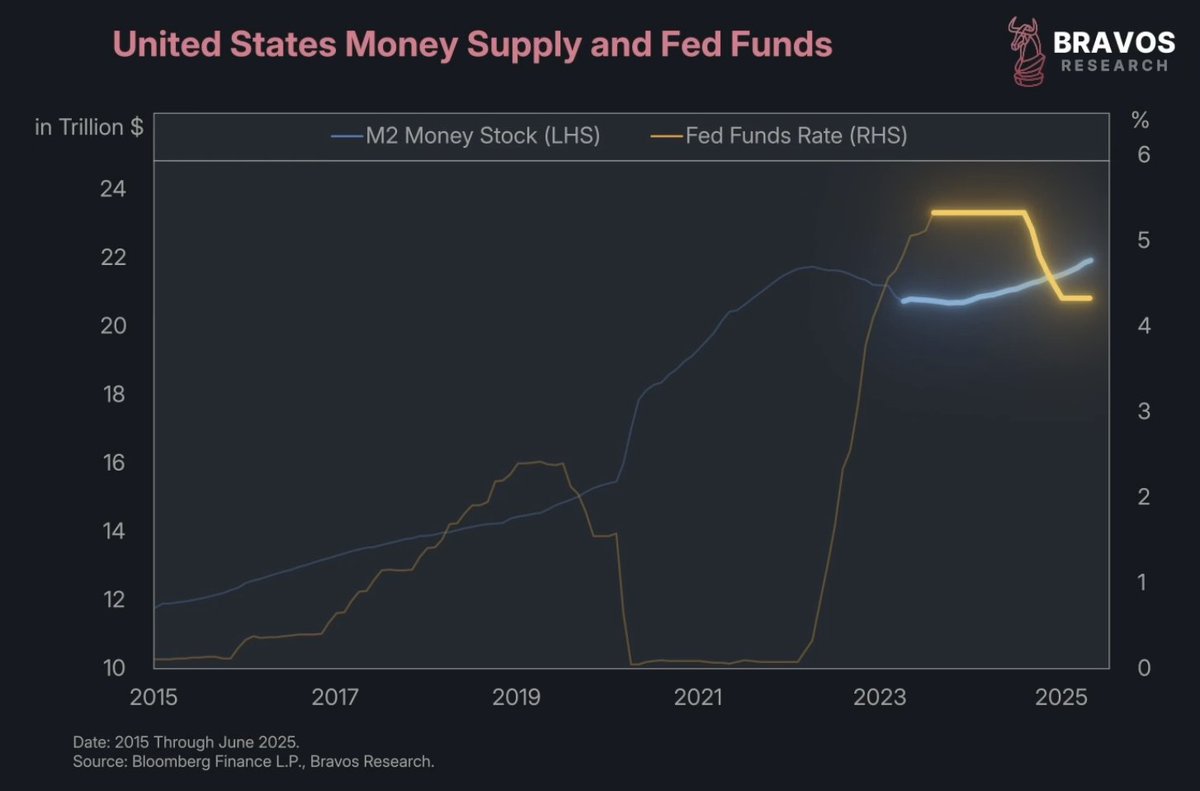

6/ For example, after peaking in 2022, the US money supply started falling

And when we put the Fed Funds Rate on top, we see this decline in money supply coincided with the Fed aggressively raising rates and tightening conditions

And when we put the Fed Funds Rate on top, we see this decline in money supply coincided with the Fed aggressively raising rates and tightening conditions

7/ But from Aug 2023 onwards, the Fed paused its hikes and then shifted towards rate cuts

As a result, US money supply began climbing and just hit new highs

This principle applies not just for the US but for central banks around the world

As a result, US money supply began climbing and just hit new highs

This principle applies not just for the US but for central banks around the world

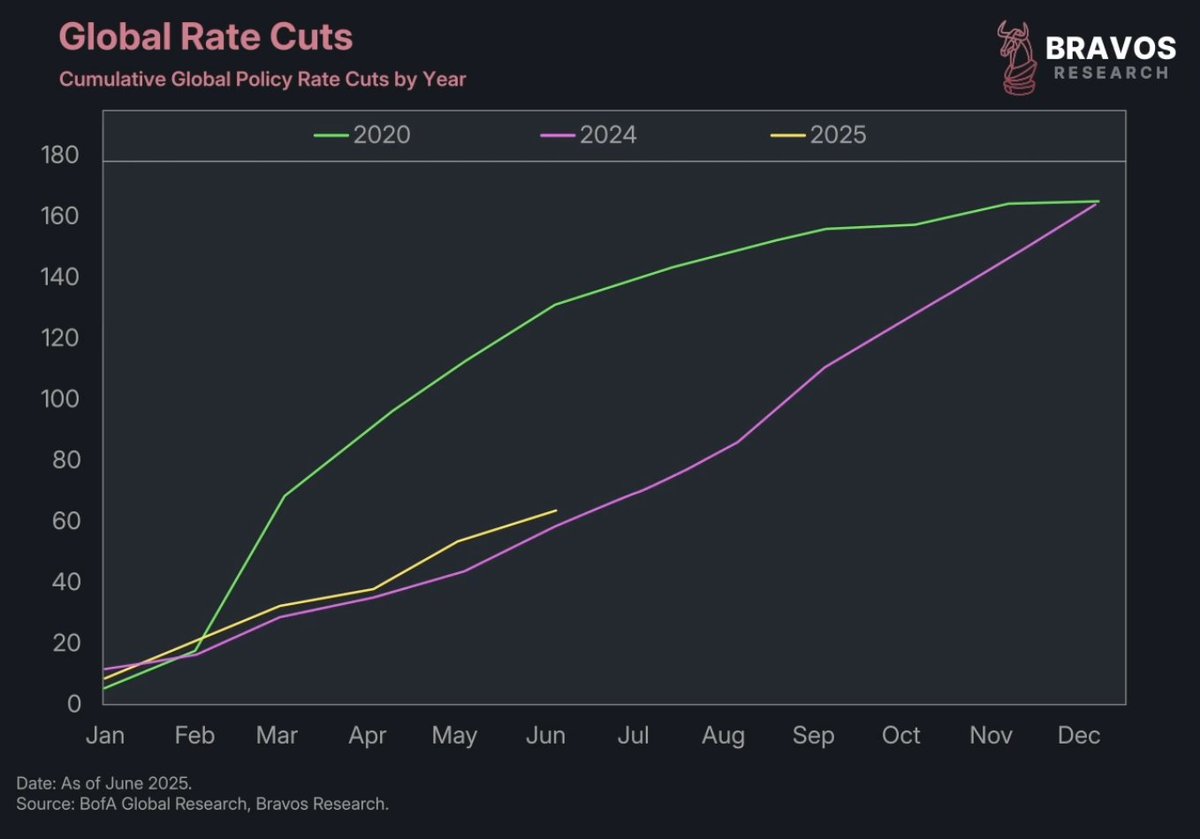

8/ Today, global central banks have cut rates 64 times in the past 6 months

This is an even faster pace than 2024

The last time we saw cuts this aggressive was back in 2020 during the pandemic

So how does this affect Bitcoin?

This is an even faster pace than 2024

The last time we saw cuts this aggressive was back in 2020 during the pandemic

So how does this affect Bitcoin?

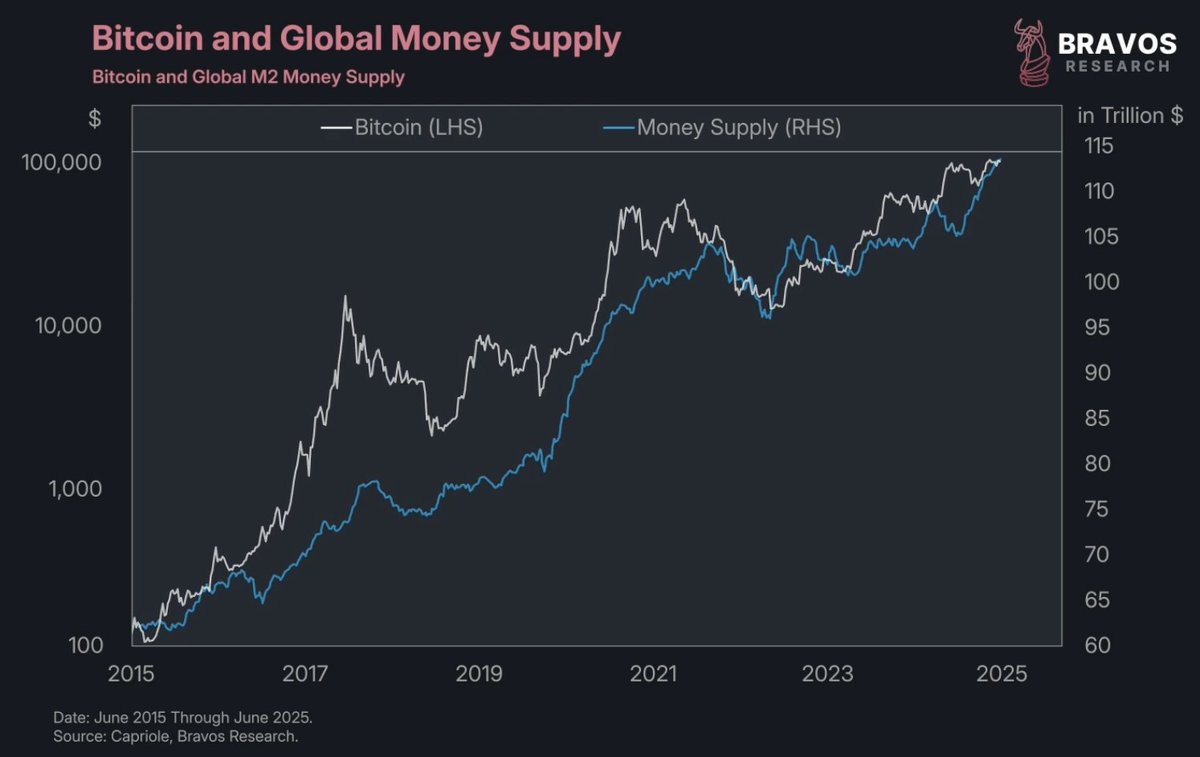

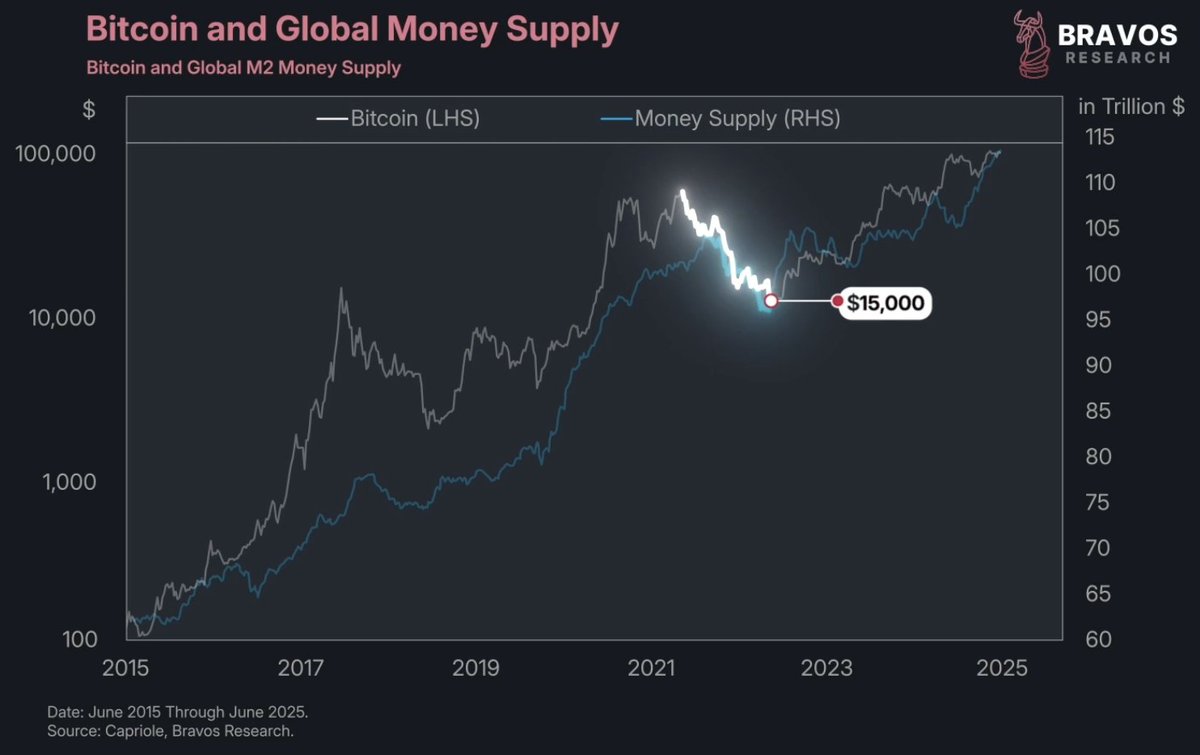

9/ When we put Bitcoin’s price with global money supply, a clear relationship emerges

It’s not a perfect one-to-one, but Bitcoin generally moves in the same direction as global liquidity

It’s not a perfect one-to-one, but Bitcoin generally moves in the same direction as global liquidity

10/ Take 2020, for example

After the pandemic hit, central banks cut rates and money supply exploded

In response, Bitcoin surged from under $5,000 to nearly $70,000 in just 1 year

After the pandemic hit, central banks cut rates and money supply exploded

In response, Bitcoin surged from under $5,000 to nearly $70,000 in just 1 year

11/ In contrast, 2022 saw liquidity shrink as rate hikes kicked in

And Bitcoin fell from $70,000 to $15,000

So, when liquidity expands, Bitcoin and other risk assets rally

When it contracts, they tend to struggle

And Bitcoin fell from $70,000 to $15,000

So, when liquidity expands, Bitcoin and other risk assets rally

When it contracts, they tend to struggle

12/ These are the type of Crypto insights we regularly use in our strategy at Bravos Research

Access all our Premium Videos, strategy breakdowns, and real-time alerts at:

bit.ly/BravosResearch

Access all our Premium Videos, strategy breakdowns, and real-time alerts at:

bit.ly/BravosResearch

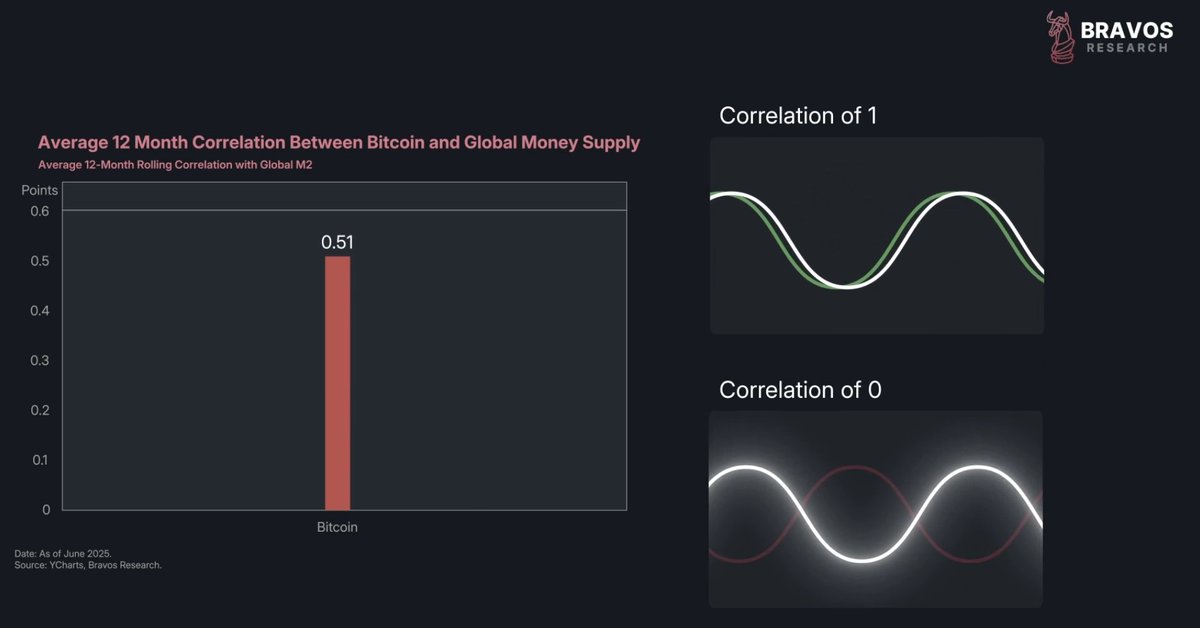

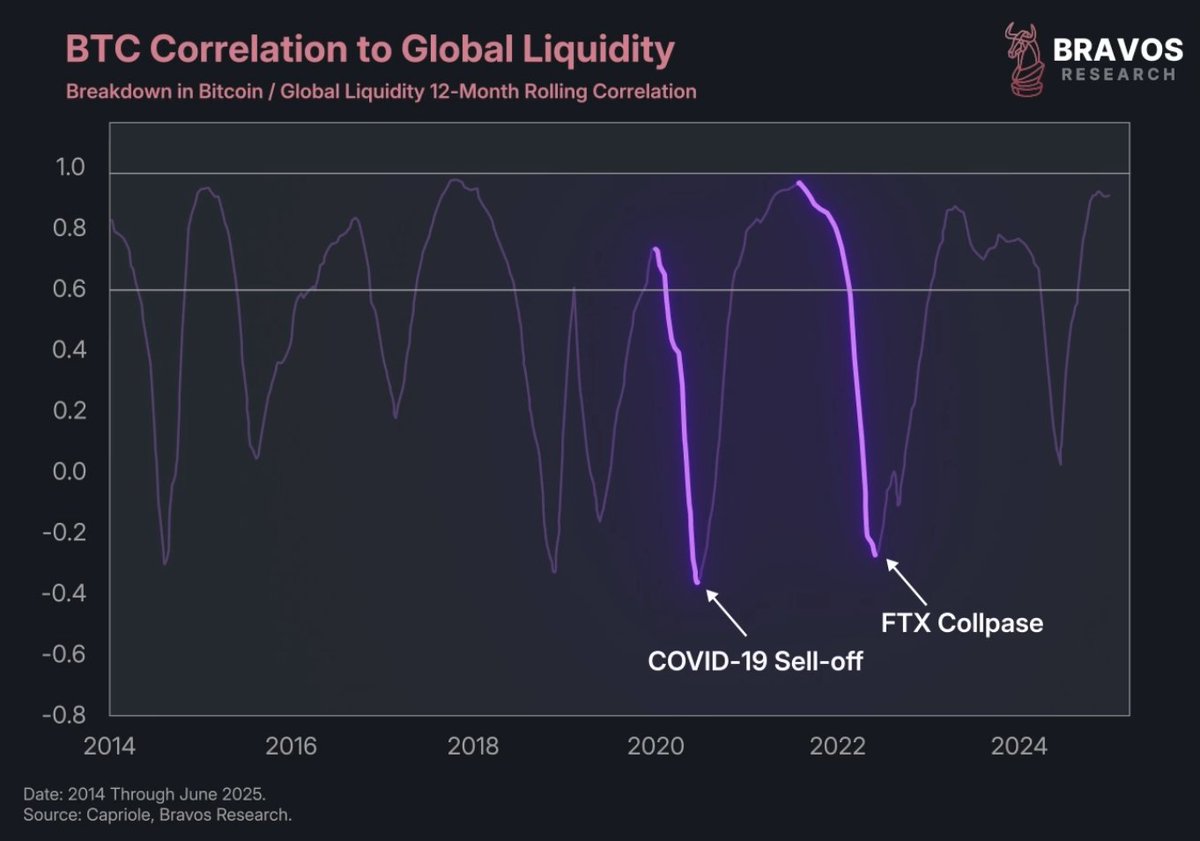

13/ Now, Bitcoin currently has a 0.51 correlation coefficient with global money supply

A correlation coefficient measures how closely the movement of two variables track each other

Hypothetically, a correlation of 1 would mean the two variables are doing exactly the same thing

A 0 correlation would mean no relationship at all

A correlation coefficient measures how closely the movement of two variables track each other

Hypothetically, a correlation of 1 would mean the two variables are doing exactly the same thing

A 0 correlation would mean no relationship at all

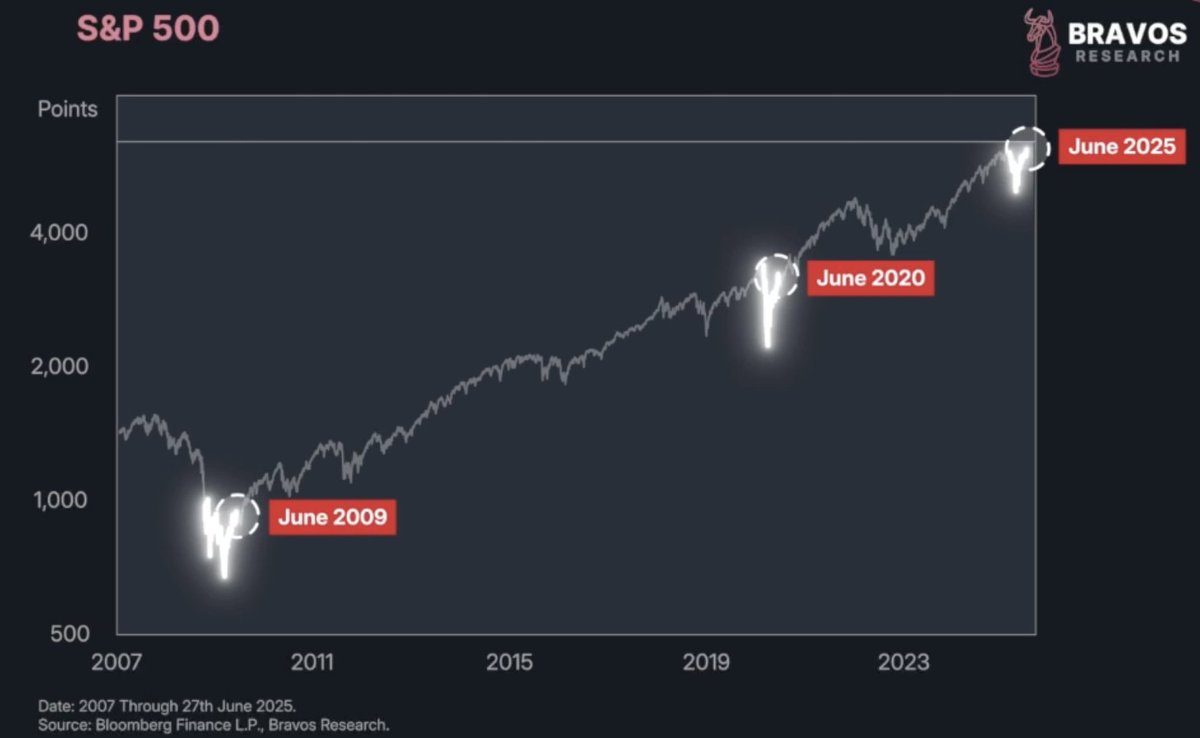

14/ That 0.51 figure is higher than the correlation of global liquidity with gold, the S&P 500, emerging markets, or treasury bonds

It’s not perfect, but it’s a key factor influencing Bitcoin’s price

And there’s a fundamental reason for that

It’s not perfect, but it’s a key factor influencing Bitcoin’s price

And there’s a fundamental reason for that

15/ Bitcoin isn’t tied to earnings, cash flows, or dividends

It performs best when investors are chasing risk and returns

Something they do more of when liquidity is plentiful

It performs best when investors are chasing risk and returns

Something they do more of when liquidity is plentiful

16/ And since Bitcoin is borderless and globally accessible, it reacts not just to US liquidity

But to capital flows from around the world

That makes it more sensitive to global liquidity than most traditional assets

But to capital flows from around the world

That makes it more sensitive to global liquidity than most traditional assets

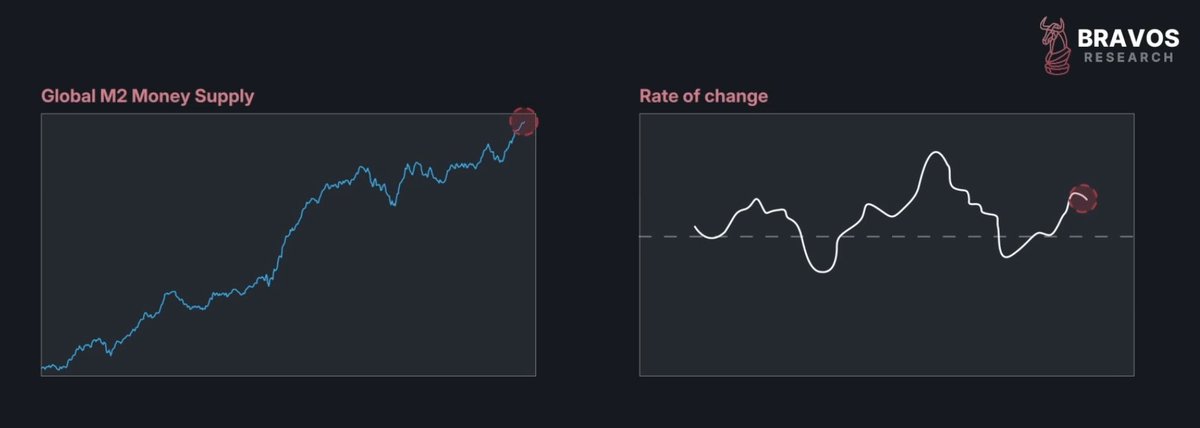

17/ So how much of an impact could this have today?

Well, so far we’ve only talked about the absolute level of global M2 money supply

But what markets really respond to is the rate of change - how fast liquidity is rising or falling

Well, so far we’ve only talked about the absolute level of global M2 money supply

But what markets really respond to is the rate of change - how fast liquidity is rising or falling

18/ That’s because investors don't just react to current conditions, they adjust their positioning based on how quickly those conditions are likely to change

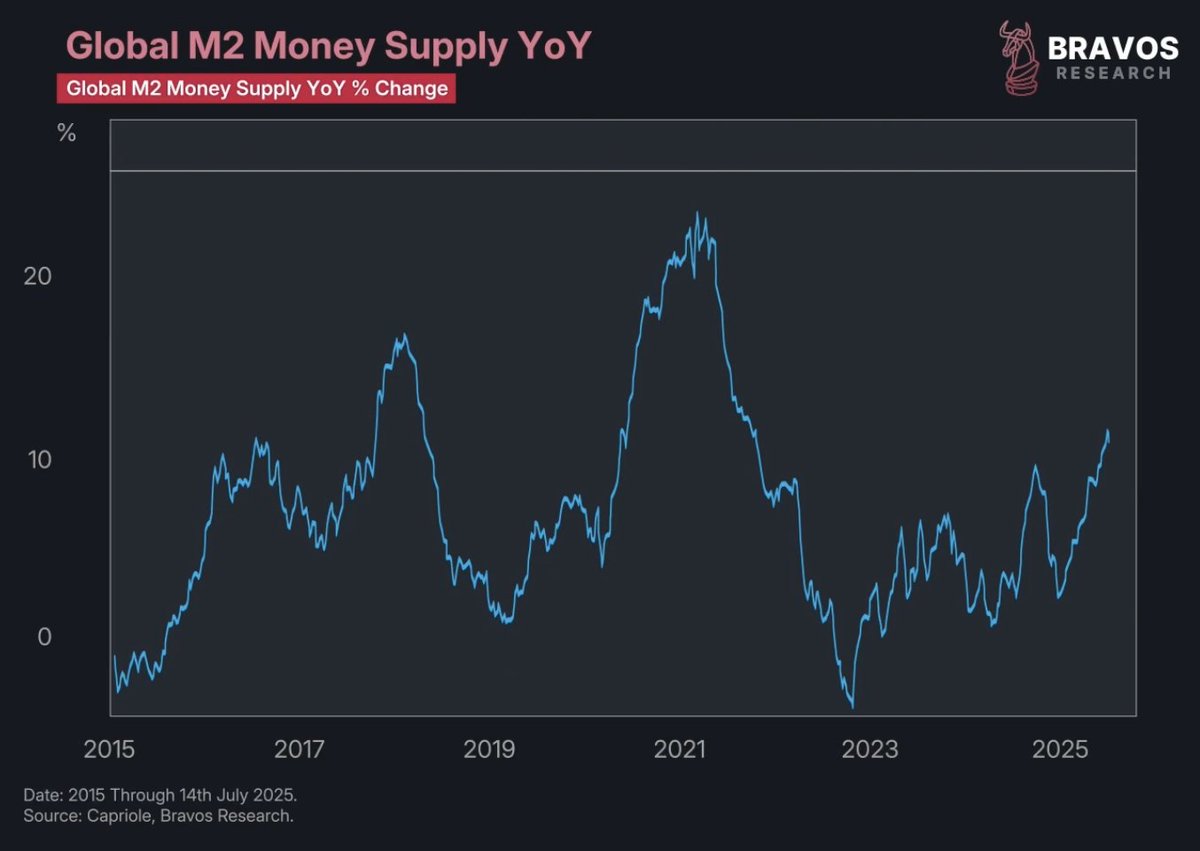

This chart shows the year-over-year change in global liquidity

This chart shows the year-over-year change in global liquidity

19/ When this chart is rising, it means liquidity is expanding

And those periods tend to align with some of the strongest Bitcoin rallies historically

And those periods tend to align with some of the strongest Bitcoin rallies historically

20/ Research shows Bitcoin has an 8.95 sensitivity to changes in global liquidity

That means a 10% rise in global M2 has historically led to a 90% gain in Bitcoin

That extreme sensitivity explains why Bitcoin booms when liquidity rises

And experiences very tough bear markets when global capital tightens

That means a 10% rise in global M2 has historically led to a 90% gain in Bitcoin

That extreme sensitivity explains why Bitcoin booms when liquidity rises

And experiences very tough bear markets when global capital tightens

21/ We’ve used this to our advantage multiple times at Bravos Research

Securing 14%, 30%, and even 39% on different Bitcoin trades in the past year

Get real-time crypto Trade Alerts at:

bit.ly/BravosResearch

Securing 14%, 30%, and even 39% on different Bitcoin trades in the past year

Get real-time crypto Trade Alerts at:

bit.ly/BravosResearch

22/ Zooming in, global liquidity has been steadily expanding in recent weeks

At first, Bitcoin didn’t react and stagnated near its all-time highs

That gave us a window to take another position at Bravos Research

Since then, Bitcoin has started to break out

And we believe this is just the beginning

At first, Bitcoin didn’t react and stagnated near its all-time highs

That gave us a window to take another position at Bravos Research

Since then, Bitcoin has started to break out

And we believe this is just the beginning

23/ Now, there have been moments when the Bitcoin–liquidity link broke down

Like during Covid-19 or the FTX collapse

In those cases, the correlation briefly turned negative and Bitcoin moved opposite to liquidity

Like during Covid-19 or the FTX collapse

In those cases, the correlation briefly turned negative and Bitcoin moved opposite to liquidity

24/ That’s the main risk to this trade: that some new event breaks the correlation again, sending Bitcoin lower despite rising liquidity

But, if the relationship holds then what kind of move should we expect?

But, if the relationship holds then what kind of move should we expect?

25/ When we plot Bitcoin’s price against global liquidity and shift the liquidity line forward by 3 months, a pattern emerges

Bitcoin doesn’t just follow liquidity, it follows with a lag

Bitcoin doesn’t just follow liquidity, it follows with a lag

26/ We first pointed this out in April when Bitcoin was around $80,000

And many were calling for a bear market

But global liquidity told us Bitcoin would bottom and rally

And that’s exactly what happened

And many were calling for a bear market

But global liquidity told us Bitcoin would bottom and rally

And that’s exactly what happened

27/ If the relationship continues to hold, global liquidity is signaling that Bitcoin could rally to $170,000 by September 2025

Keep in mind though, the correlation between Bitcoin and liquidity is 0.51, not 1

So this isn’t an exact forecast

Keep in mind though, the correlation between Bitcoin and liquidity is 0.51, not 1

So this isn’t an exact forecast

28/ That’s why we use a range-based target: $160,000 to $200,000 by year-end

Depending on how strong the broader crypto market gets

Depending on how strong the broader crypto market gets

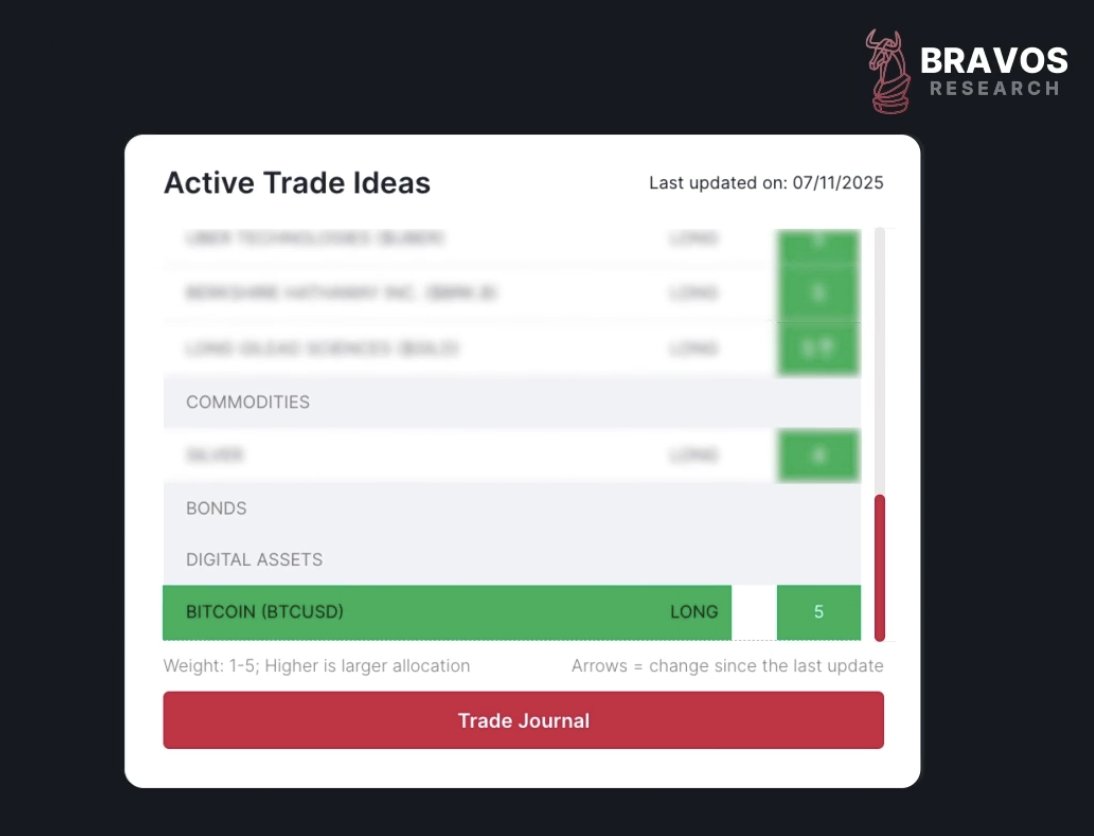

29/ This outlook is why we currently hold an active Bitcoin position on our site

We haven’t yet deployed capital into other crypto assets

But we’re watching closely and will consider new trades once we get further confirmation of a breakout across the crypto market

We haven’t yet deployed capital into other crypto assets

But we’re watching closely and will consider new trades once we get further confirmation of a breakout across the crypto market

30/ In 2024, our crypto trades delivered standout returns:

30% on Bitcoin, 63% on Solana, and 83% on Ethereum

And most of our losing trades were capped at under 5%

Get real-time Trade Alerts at:

bit.ly/BravosResearch

30% on Bitcoin, 63% on Solana, and 83% on Ethereum

And most of our losing trades were capped at under 5%

Get real-time Trade Alerts at:

bit.ly/BravosResearch

31/ Thanks for reading!

If you enjoyed this thread, please ❤️ and 🔁 the first tweet below

And follow @bravosresearch for more market insights, finance and investment strategies

If you enjoyed this thread, please ❤️ and 🔁 the first tweet below

And follow @bravosresearch for more market insights, finance and investment strategies

https://x.com/bravosresearch/status/1945509117386522945

• • •

Missing some Tweet in this thread? You can try to

force a refresh