TSMC 2Q25; Beats the high-end of rev guidance, despite FX impact, GM close to high-end of the guidance and OPM > high-end guidance.

2Q25 vs 2Q24

Revenue: $30.070B (+44%)

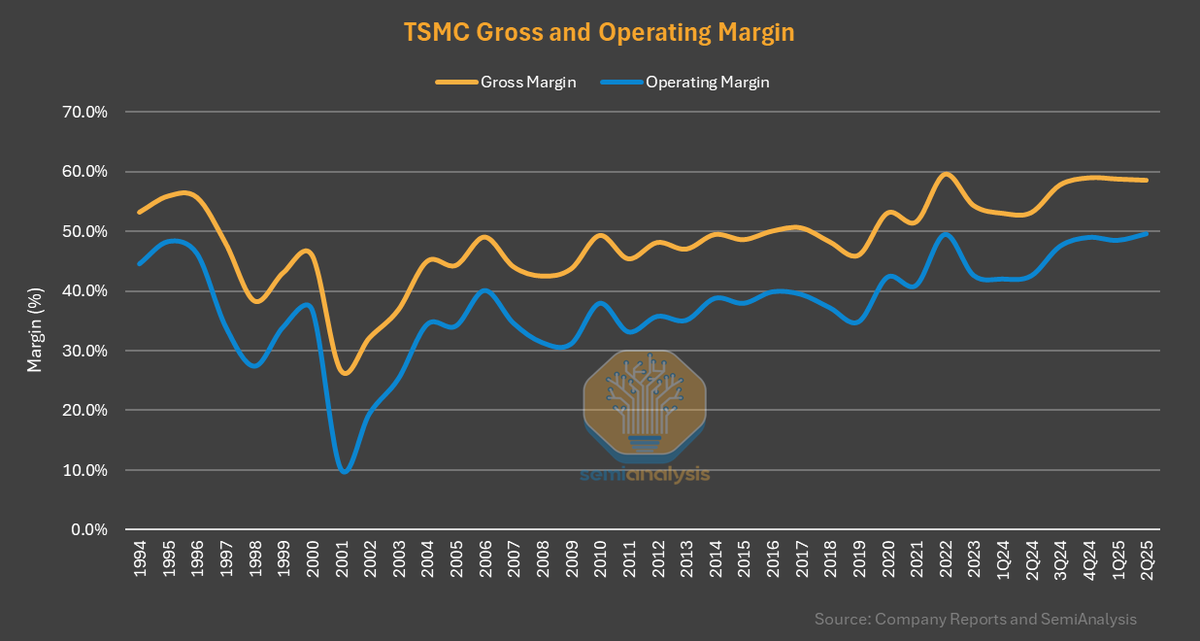

Gross Margin: 58.6% (53.2%)

Operating Margin: 49.6% (42.5%)

CapEx: $9.6B (+51%)

Wafer Shipments: 3.718 m (+19%)

Wafer ASP: $7027 (+21%)

2Q25 vs 2Q24

Revenue: $30.070B (+44%)

Gross Margin: 58.6% (53.2%)

Operating Margin: 49.6% (42.5%)

CapEx: $9.6B (+51%)

Wafer Shipments: 3.718 m (+19%)

Wafer ASP: $7027 (+21%)

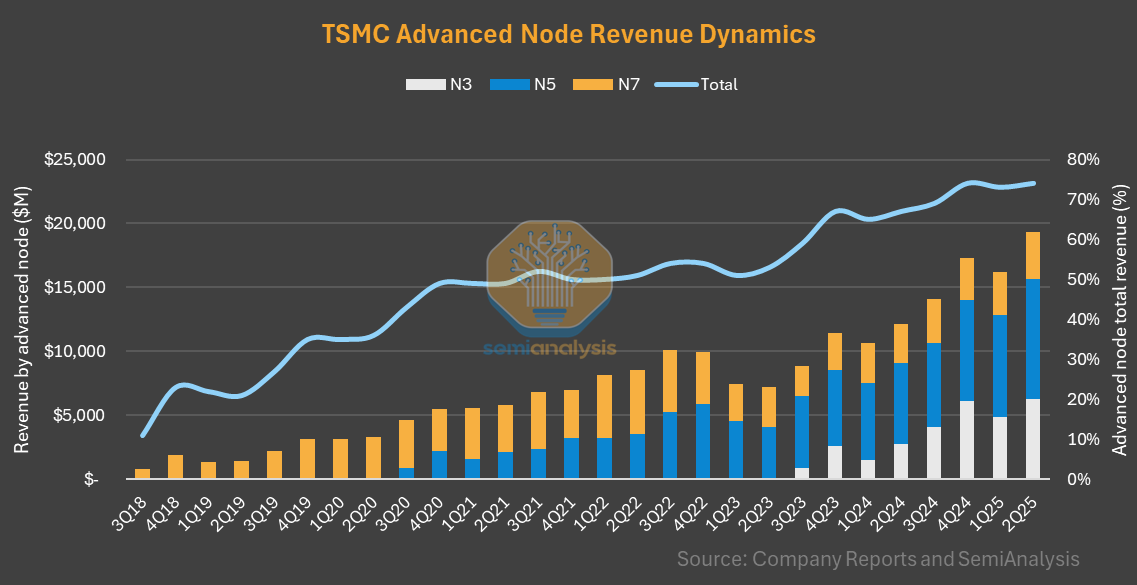

Advanced node revenue (N7 and below) up 19% q/q and 59% y/y to $19.3B. N3: +29% q/q; N5:+18%; N7: +10%. Android drove N3 despite Apple seasonality.

All end markets up. HPC drove $3B incremental rev while smartphone drove almost $1B. HPC drove 67% of incremental rev and up 20% q/q and 67% y/y. Auto all-time-high for the 2nd straight quarter.

Gross margin strength (58.6%) continued despite FX headwind. Pricing power, utilization, and better cost structure likely helped. Multiple headwinds. N3 dilution, N2 ramp, overseas fabs, inflationary costs, utility rate hikes etc.

Guidance: Revenue: $31.8-$33B (8% q/q ; 38% y/y); GM: 55.5-57.5%; OPM: 45.5-47.5%; Maintains $38-$42B capex guidance.

Higher utilization is clearly visible in big jump wafer shipments. Boosted GM.

3Q GM to be affected by FX and more pronounced overseas fabs. Dilution due to overseas fabs: next 5 year 2-3 percentage points (early yrs) and in the later period 3-4 percentage points.

All of TSMC revenue and 75% of COGS denominated in USD. 100% sensitivity between NTD and USD. 1% FX affects 0.4% GM.

3Q25 revenue affected by FX: 6.6 percentage points (+ve); 260bps GM impact (-ve)

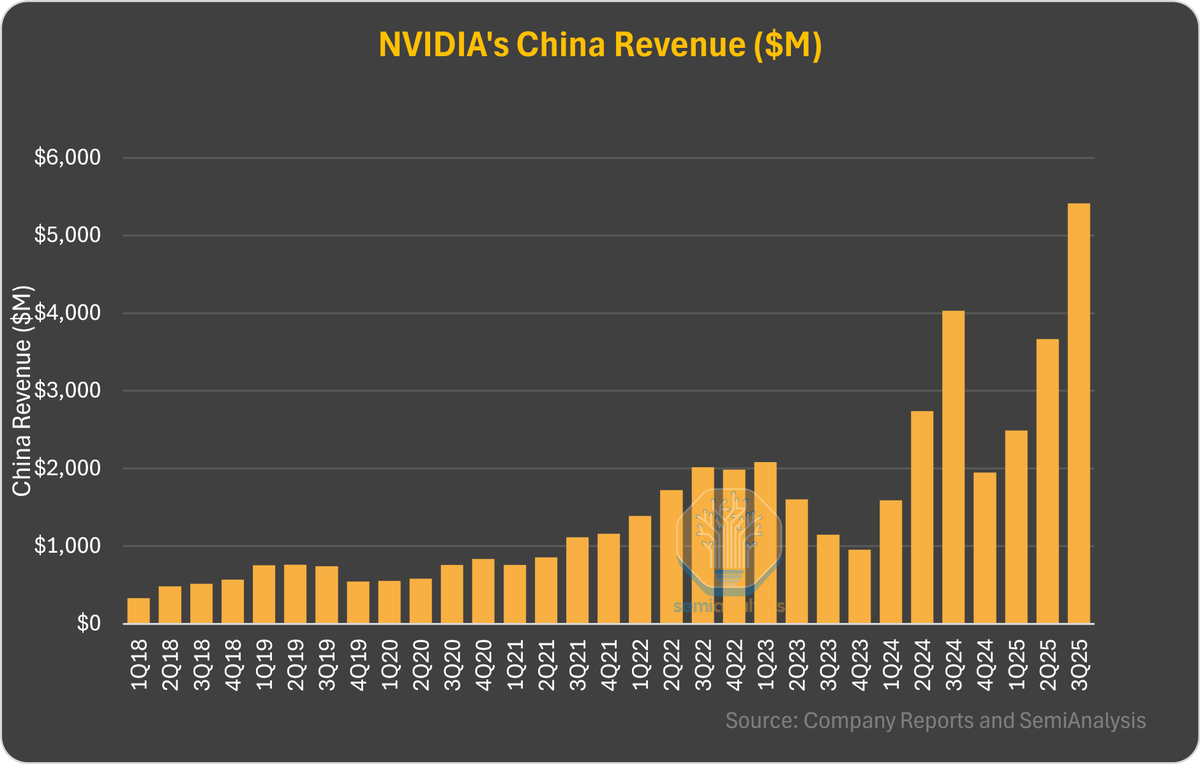

No change in customer behavior so far. China subsidies short-term upside to demand. Raises 2025 guidance to 30% from earlier mid-20s %.

Arizona mass production started in 4Q24 on N4 with yields comparable to Taiwan fabs. 2nd fab (N3/N2) will be advanced by multiple quarters (original schedule in 2028). Fab 3 will also likely be expedited.

Reiterates 30% of 2nm capacity will be Arizona (after the completion of 6 fab cluster).

European fab ESMC ramp schedule will be based on customers' need and market conditions. 11 wafer fabs and 4 advanced packaging facility in Taiwan over the next few years.

N2 on track. N2 tape-outs to outnumber N5 and N3 in the same period in the first 2 years. HVM in 2H25. N2P in 2H26. A16 dedicated to HPC (7-10% density gain vs N2P).

A14 HVM in 2028 and backside power version of A14 in 2029.

Strong demand from DC AI. Smartphone/PC AI chip die sizes are increasing by 5-10%.

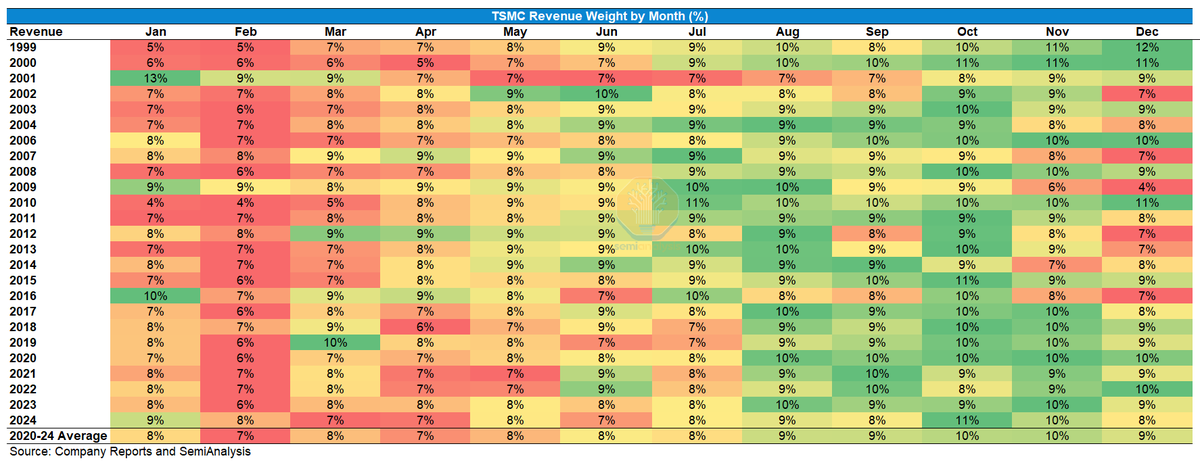

Implied 4Q revenue will decline 10% q/q but up 8% y/y. 2nd time in the last 10 years. In 2022, 4Q revenue declined q/q.

53% gross margin and higher target still intact. Not yet ready to increase forecast due to H20 comeback.

N2 ramp profile will be similar to N3. N2 constrained by capacity. Revenue contribution will be bigger vs N3 due to higher pricing.

N5 capacity tight and N3 even tighter. 85-90% toll commonality between leading-nodes. N7 capacity is used to support N5 demand. Also, converting N5 to N3. Will continue to do so.

1% efficiency gains due to AI means $1B for TSMC. Talked about this in previous earnings calls.

N2 profitability is better than N3. It took N3 10-12 quarters vs 8-10 quarters before. Sees N2 going back to old days.

Sees it is unlikely Capex dollars dropping by a big amount any given year given TSMC's size.

• • •

Missing some Tweet in this thread? You can try to

force a refresh