Semiconductors, Analyst @SemiAnalysis_

No investment advice. Opinions are mine only.

How to get URL link on X (Twitter) App

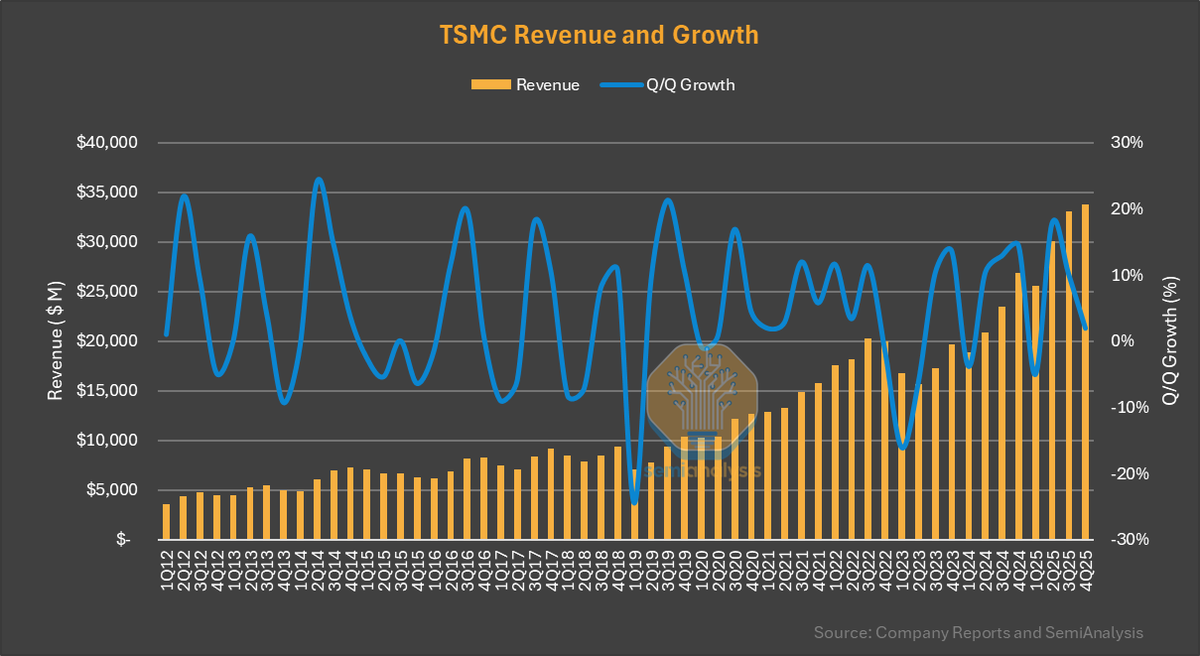

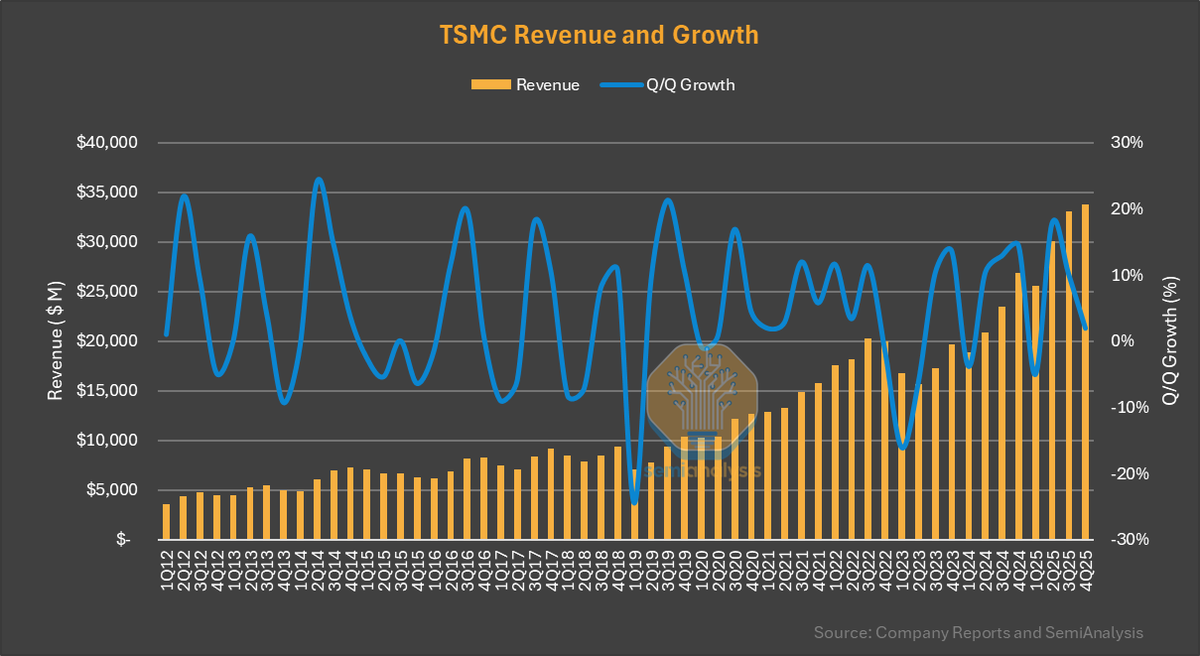

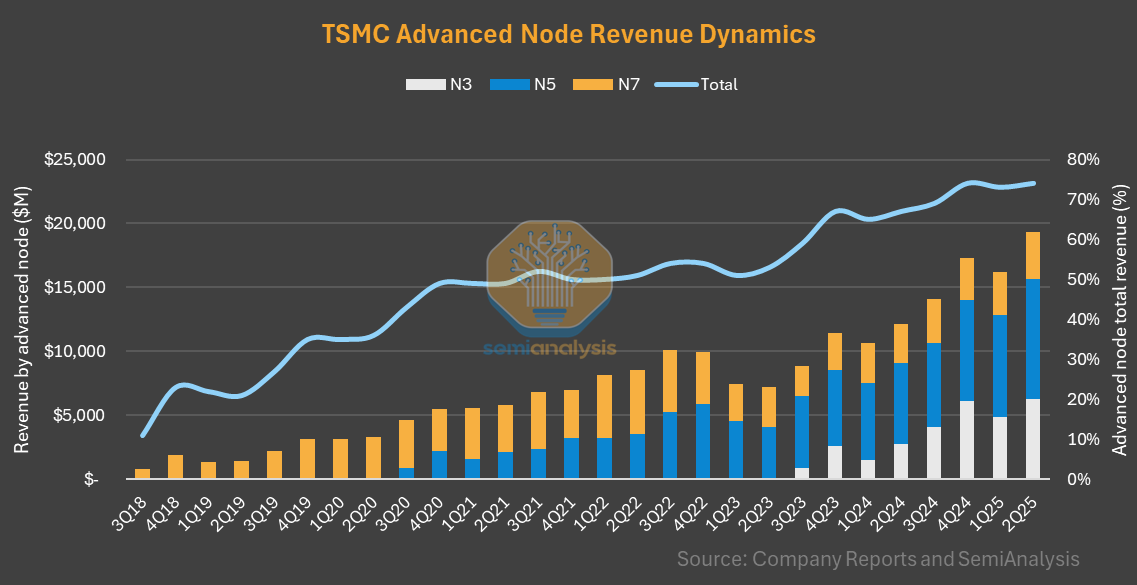

Advanced node revenue (N7 and below) up 10% q/q and 51% y/y to $21.3B. N3: +5% q/q; N5:+13%; N7: +10%. Android drove N3 despite Apple seasonality.

Advanced node revenue (N7 and below) up 10% q/q and 51% y/y to $21.3B. N3: +5% q/q; N5:+13%; N7: +10%. Android drove N3 despite Apple seasonality.

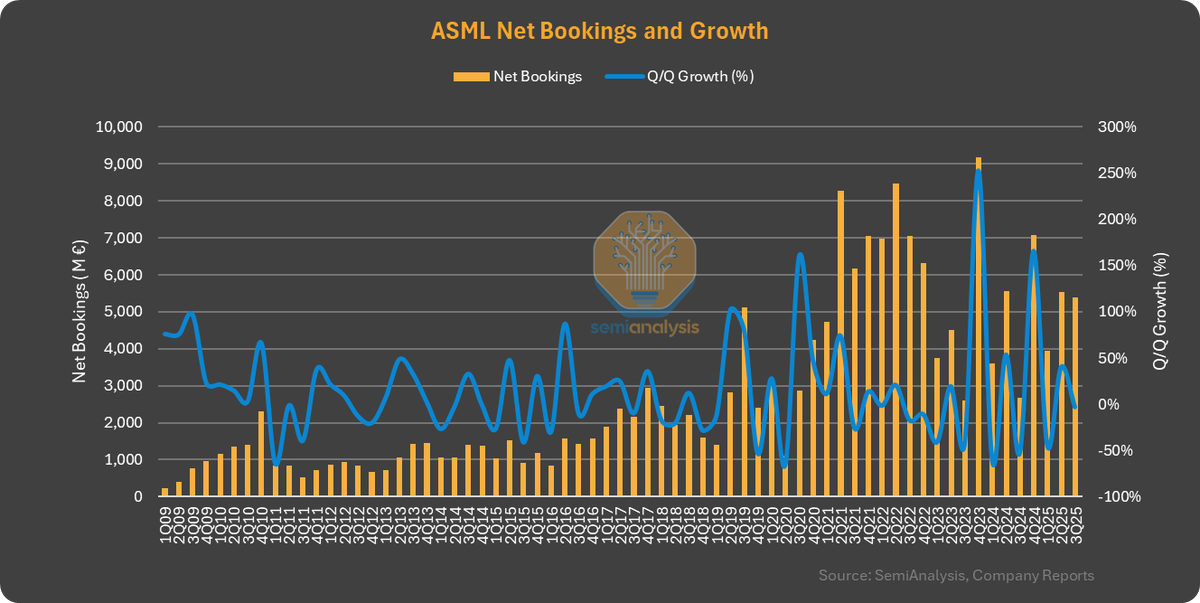

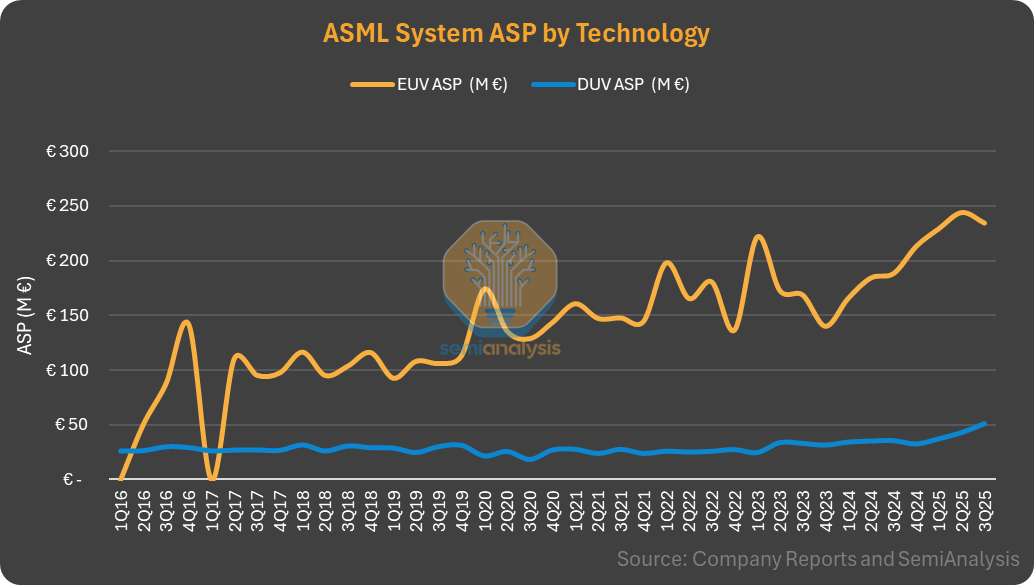

- EUV revenue down -21% q/q while DUV up 15%

- EUV revenue down -21% q/q while DUV up 15%

Advanced node revenue (N7 and below) up 19% q/q and 59% y/y to $19.3B. N3: +29% q/q; N5:+18%; N7: +10%. Android drove N3 despite Apple seasonality.

Advanced node revenue (N7 and below) up 19% q/q and 59% y/y to $19.3B. N3: +29% q/q; N5:+18%; N7: +10%. Android drove N3 despite Apple seasonality.

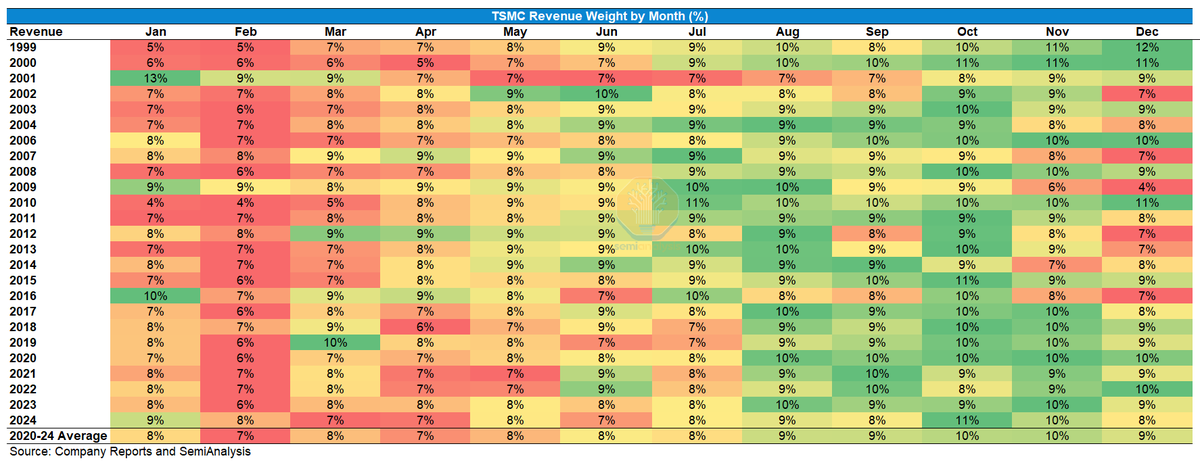

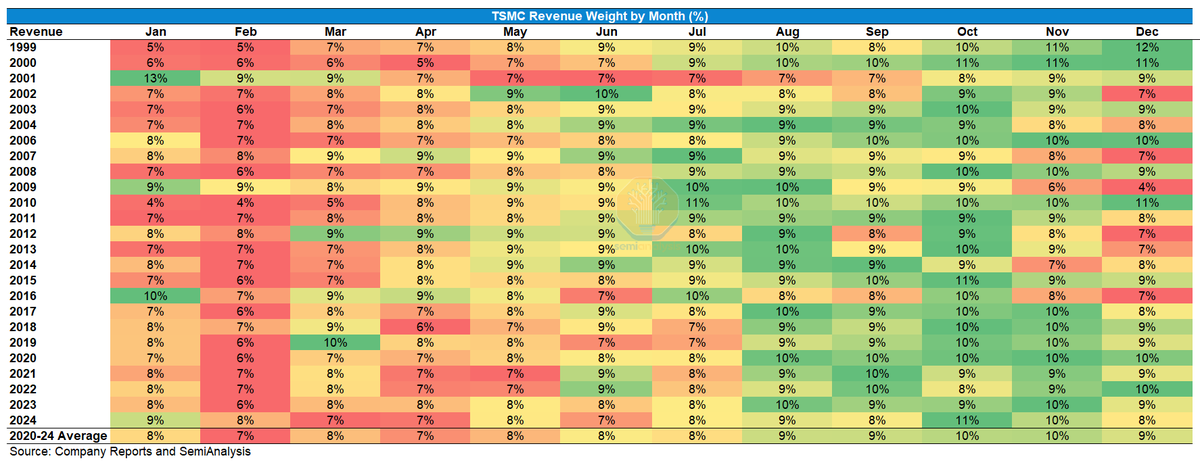

- In terms of month on month growth, March and August often see strong DD % growth

- In terms of month on month growth, March and August often see strong DD % growth

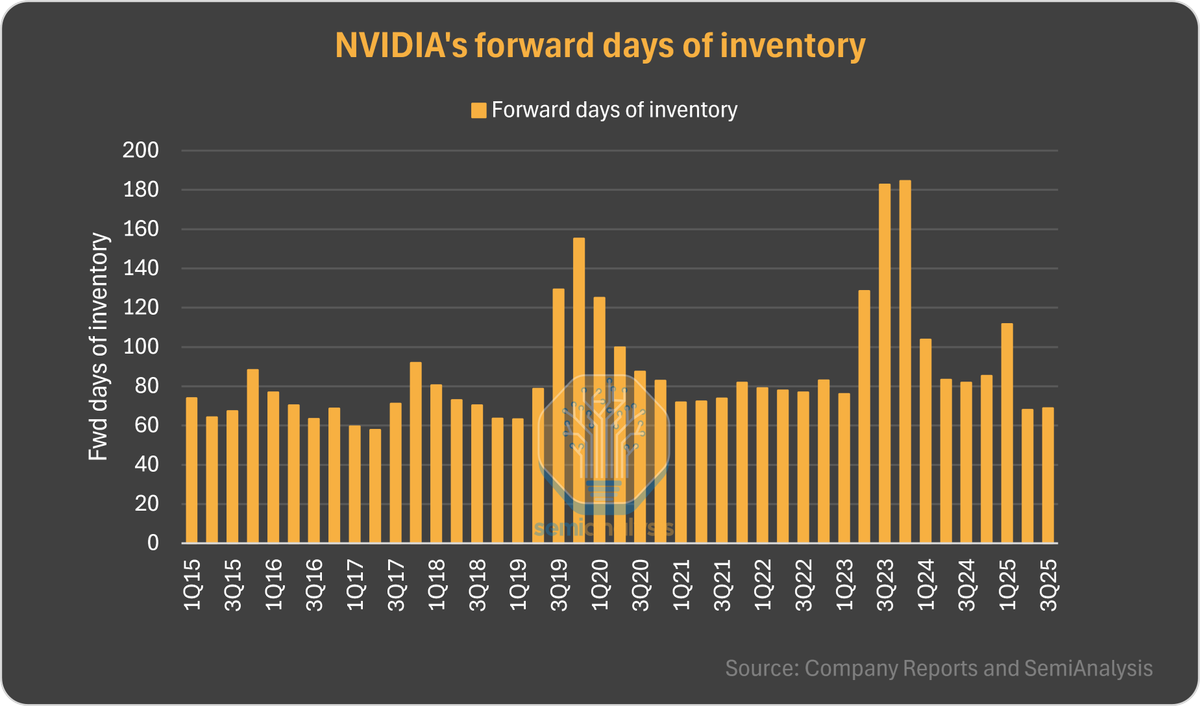

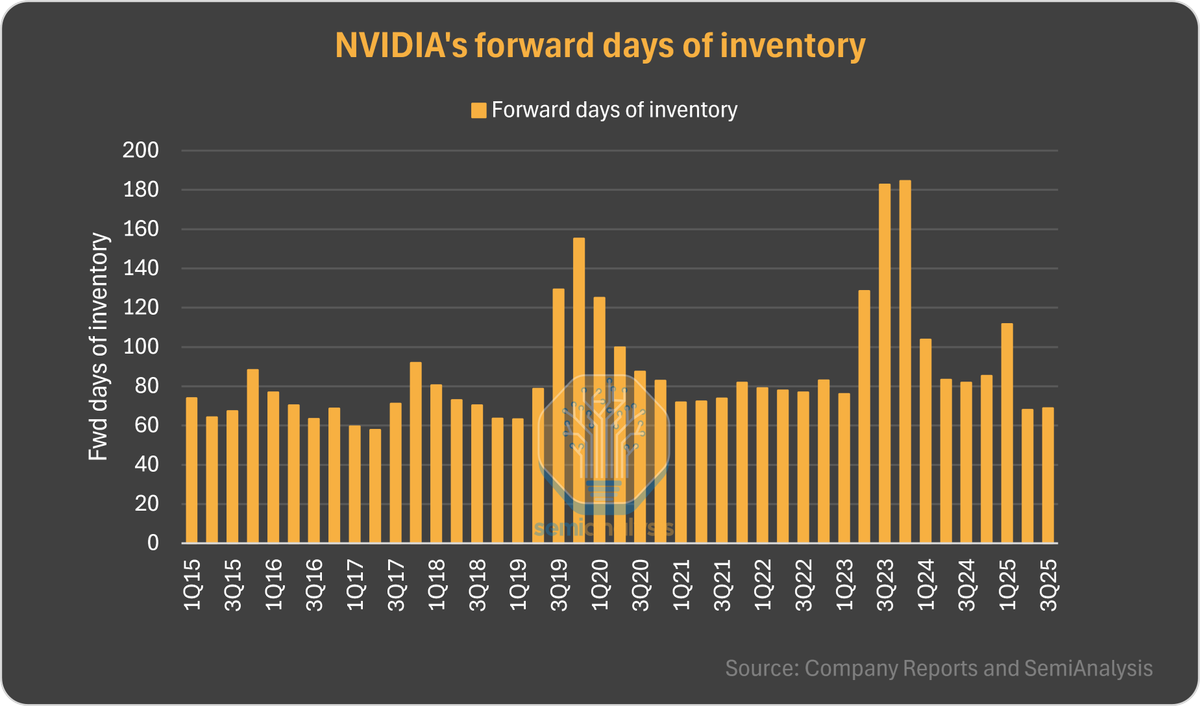

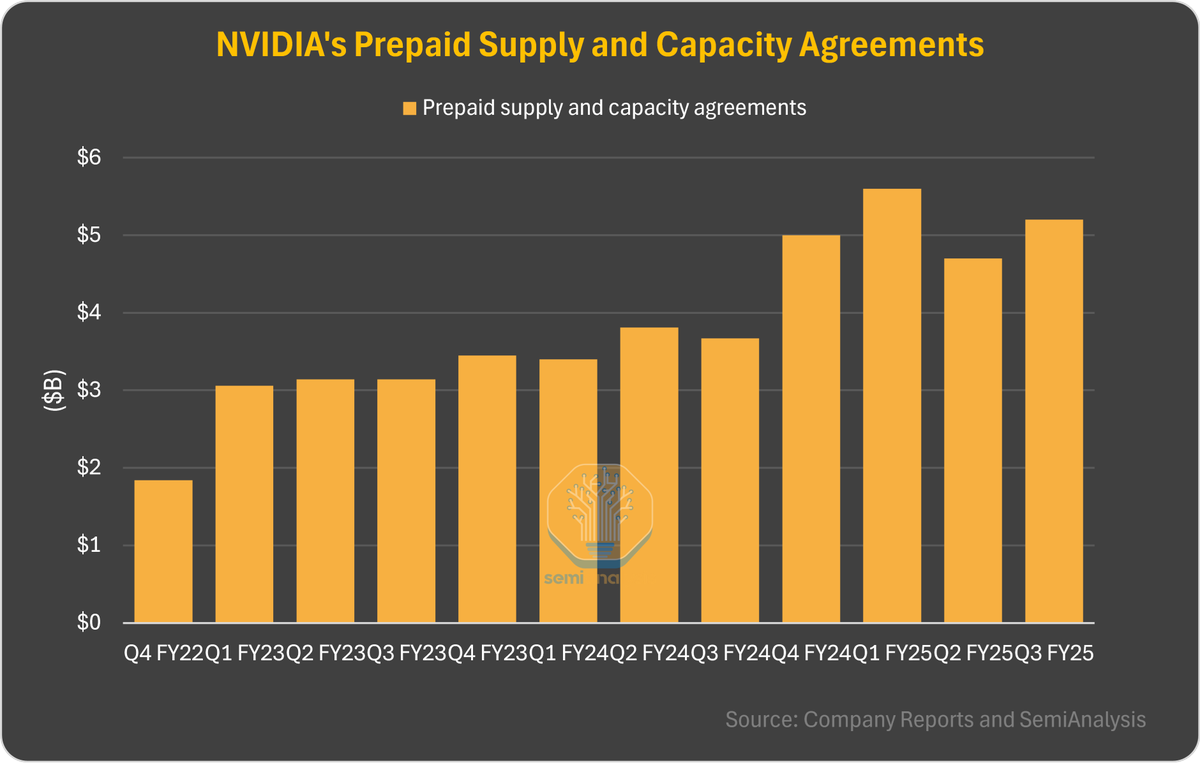

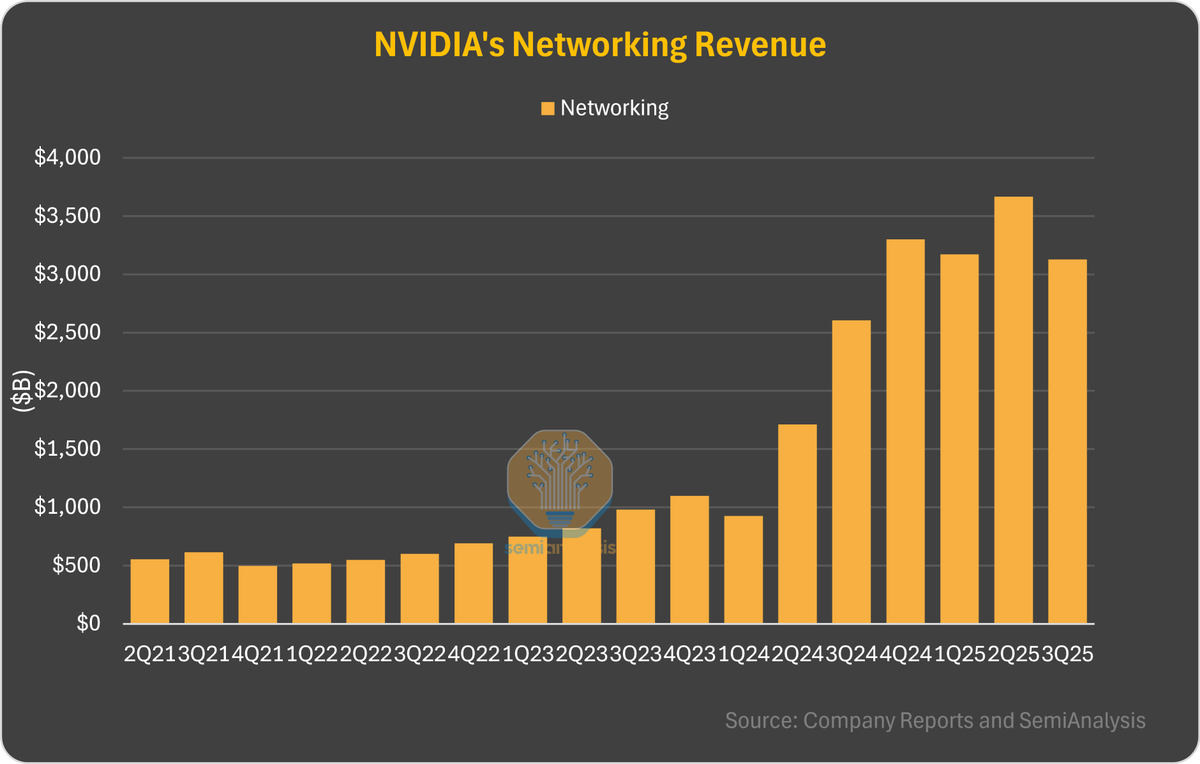

DC revenue grew q/q for every single quarter since 1QFY15 (except for 3 quarters). Networking is down this quarter but will be up next quarter.

DC revenue grew q/q for every single quarter since 1QFY15 (except for 3 quarters). Networking is down this quarter but will be up next quarter.

- 6th straight quarter of double-digit y/y growth for auto

- 6th straight quarter of double-digit y/y growth for auto

- Flat q/q guidance for 2Q23; 2H > 1H in revenue in 2023; DC will see double-digit y/y growth in 2023

- Flat q/q guidance for 2Q23; 2H > 1H in revenue in 2023; DC will see double-digit y/y growth in 2023

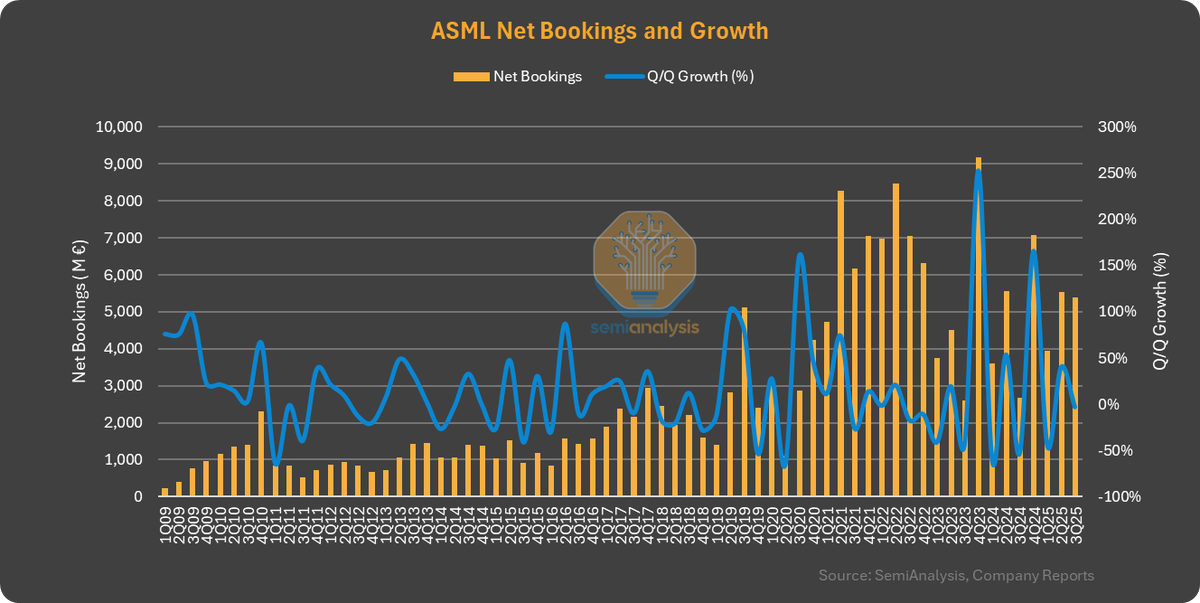

- The book-to-bill ratio was <1 and will be the case for the next quarter or two

- The book-to-bill ratio was <1 and will be the case for the next quarter or two

Despite a 23 percent unit shipment decline, Qualcomm posted a 32 percent revenue growth, driven by high average selling prices (ASPs) for its premium tier APs. $QCOM

Despite a 23 percent unit shipment decline, Qualcomm posted a 32 percent revenue growth, driven by high average selling prices (ASPs) for its premium tier APs. $QCOM

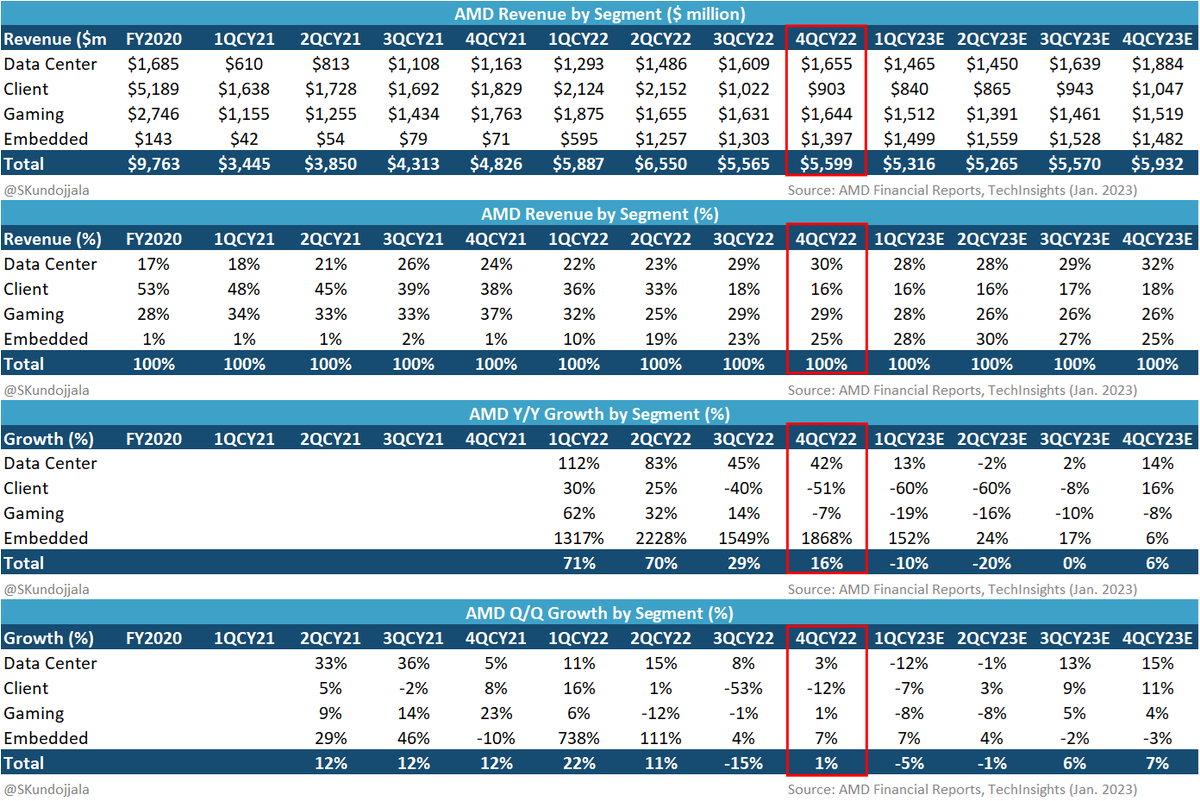

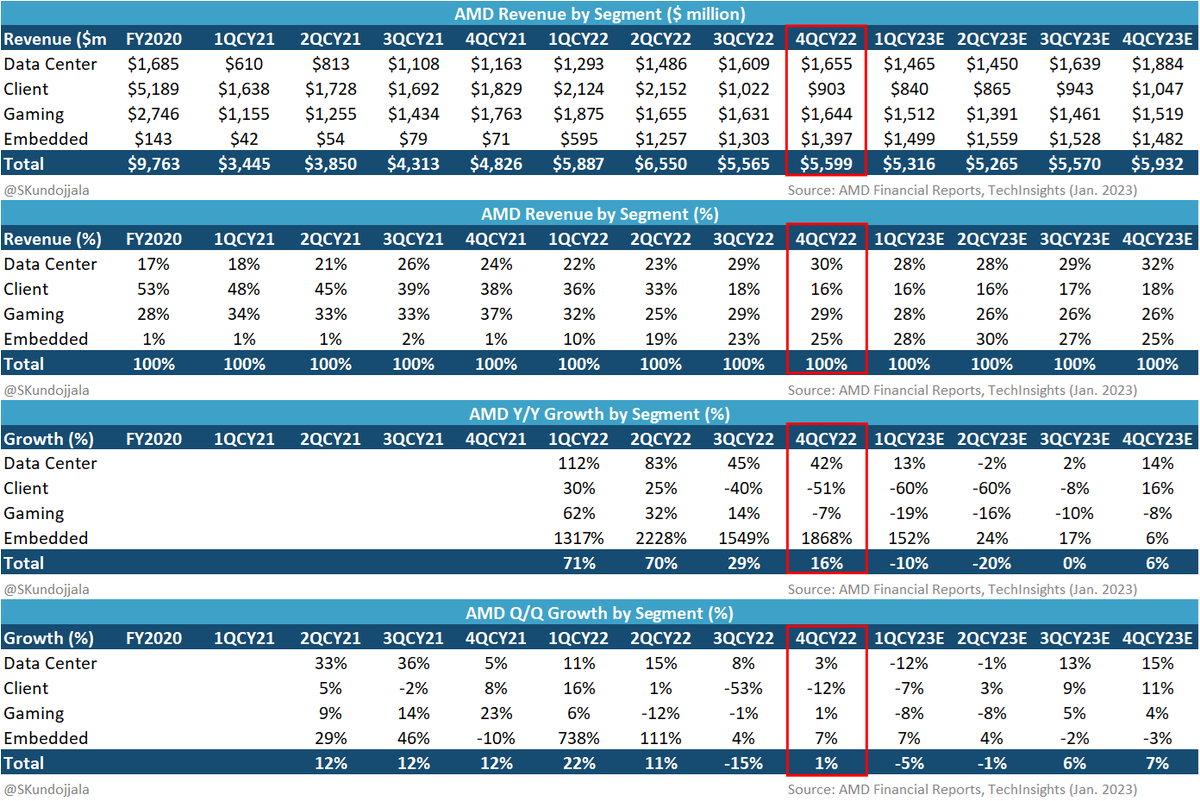

- Decent guidance for 1Q23 (-5% q/q)

- Decent guidance for 1Q23 (-5% q/q)