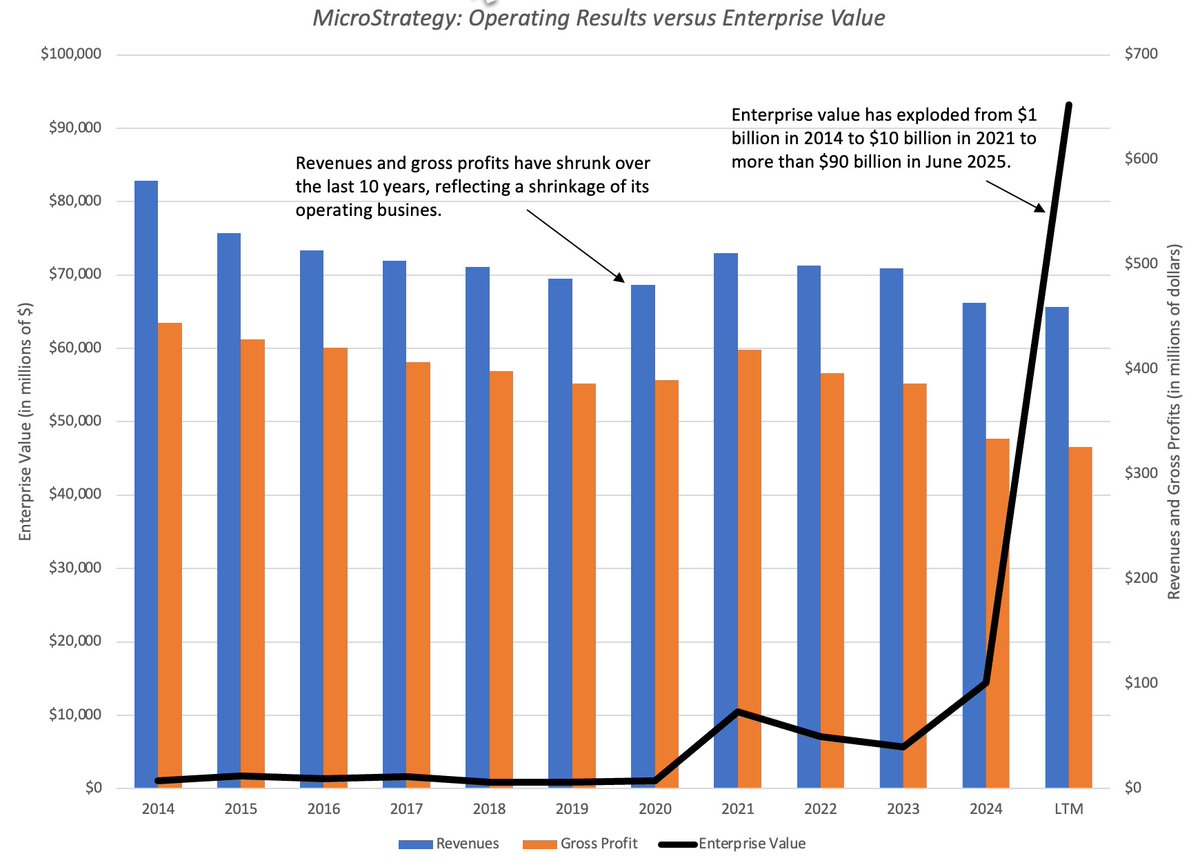

In the last few years, MicroStrategy has become a Bitcoin SPAC, with investors attributing savant-like status to Michael Saylor. Its success has led some to push companies to shift their cash into bitcoin. As a general principle, this is a bad idea, but there are four carveouts. bit.ly/40TEjXG

The reasons for holding cash vary depending on where a company is in the life cycle from survival for young growth firms to youth serum for mature firms to liquidation manager for declining firms. bit.ly/40TEjXG

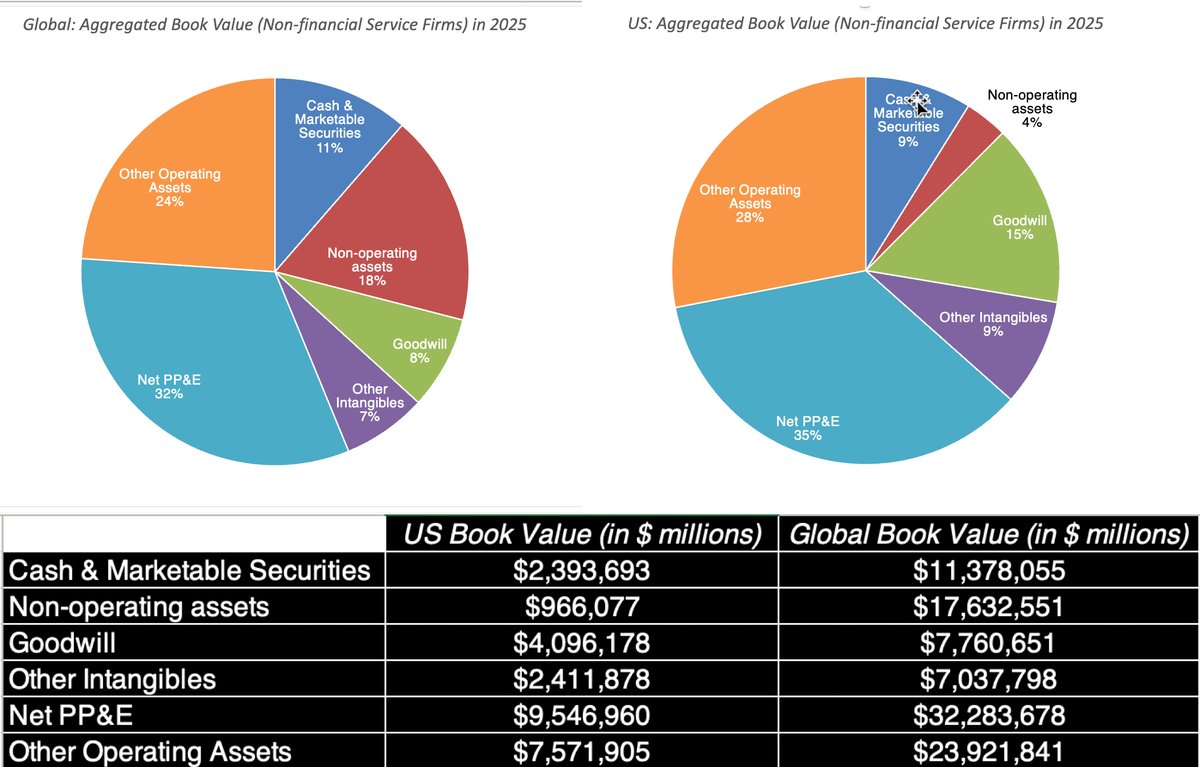

For all of these reasons, publicly traded firms held more than $11 trillion in cash as of June 2025; US firms held about $2.5 trillion in cash. Much of that cash is invested in close-to-riskless and liquid investments, earning low returns. bit.ly/40TEjXG

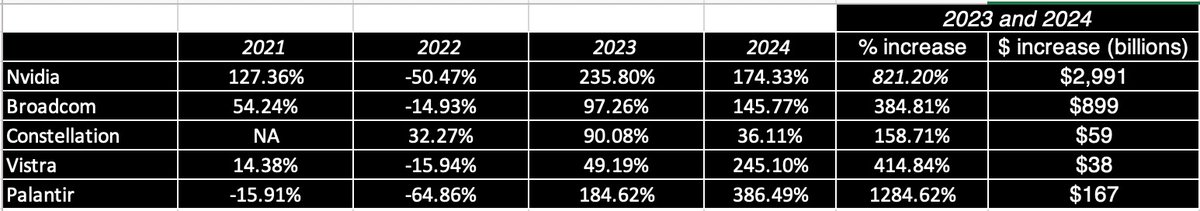

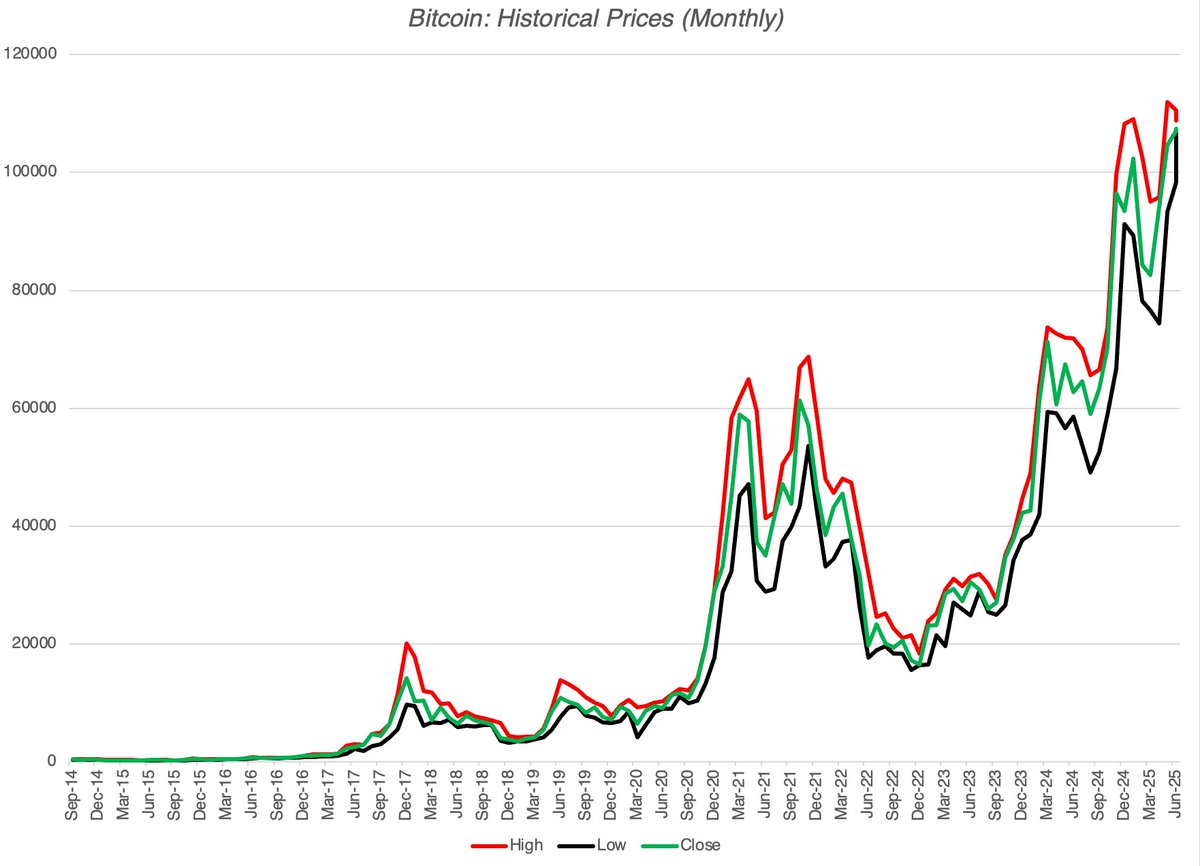

Born during the financial crisis, bitcoin's design and structure reflect the loss of trust in institutions. With volatility along the way, bitcoin has had quite a ride up the pricing ladder. bit.ly/40TEjXG

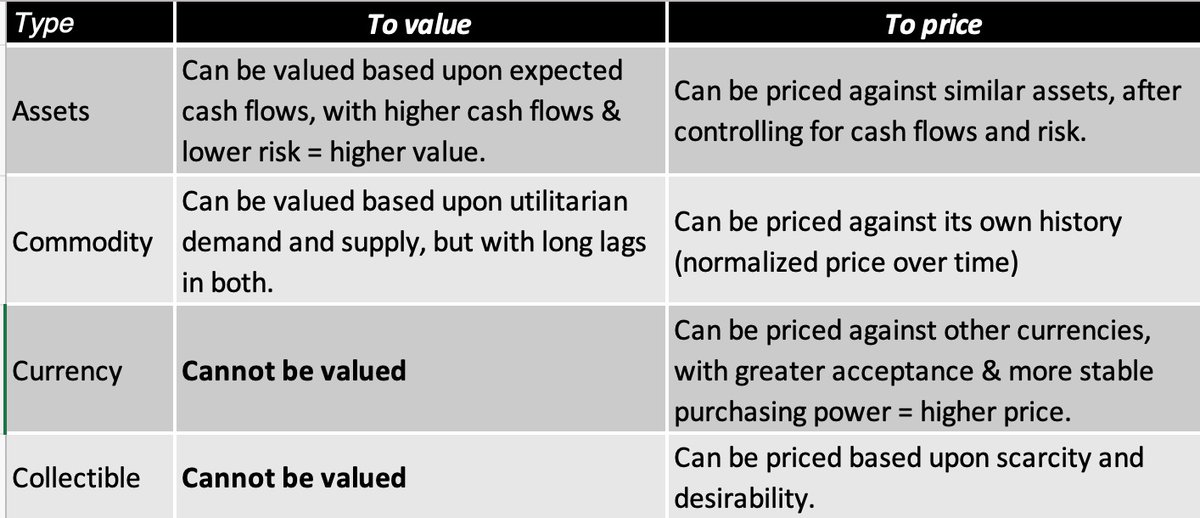

Debates about whether bitcoin is cheap or expensive are almost pointless, since as a currency or collectible, it can only be priced, not valued. Your perception of whether its demand will fade or endure (and grow) will determine your bitcoin price view. bit.ly/40TEjXG

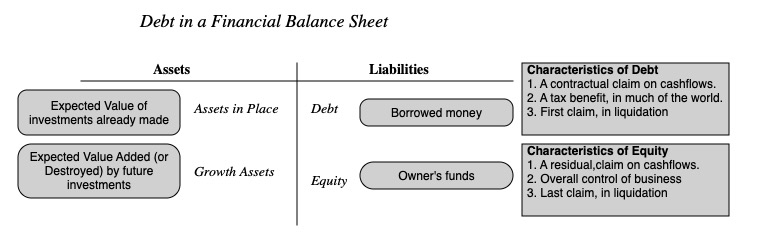

As a general rule, companies should not move cash into bitcoin, because it (a) does not share cash's shock absorber feature (b) steps on the company's business narrative (c) trusts managers to trade at the right times and (d) opens the door for self-dealing and fraud. bit.ly/40TEjXG

There are four exceptions. The first is in companies (MSTR?) where the CEO/CFO is perceived to be a bitcoin savant, much better at timing trades than the average investor. The peril is that perception is not always reality. bit.ly/40TEjXG

The second is companies that need bitcoin for day-to-day business (PayPal and Coinbase), but the bitcoin holdings should be proportional to bitcoin transactions, and operate more like working capital than investing bet. bit.ly/40TEjXG

The third is companies in countries with failed fiat currencies, where bitcoin is less volatile and more likely to hold its value than the domestic currency. bit.ly/40TEjXG

The fourth (and riskiest play) is in companies (AMC, Gamestop) with failed business models that have become meme stocks, where bitcoin supplants the failed business and the stock becomes a pure trading play. bit.ly/40TEjXG

Even with these exceptions to the general principle, you need guardrails - buy in from shareholders, transparency and disclosure on bitcoin holdings/trades and clearer accounting rules on marking (bitcoin) to market. bit.ly/40TEjXG

For bitcoin advocates, the upside of getting institutions & companies holding bitcoin is increased demand (and price), but the downside of establishment buy-in is that it will change the bitcoin market and make bitcoin behave more like stocks & bonds. bit.ly/40TEjXG

• • •

Missing some Tweet in this thread? You can try to

force a refresh