Hartford Funds recently conducted one of the most in-depth research studies on dividend stocks over the last 94 years.

The results will blow your mind.

Here is what they found: 👇

The results will blow your mind.

Here is what they found: 👇

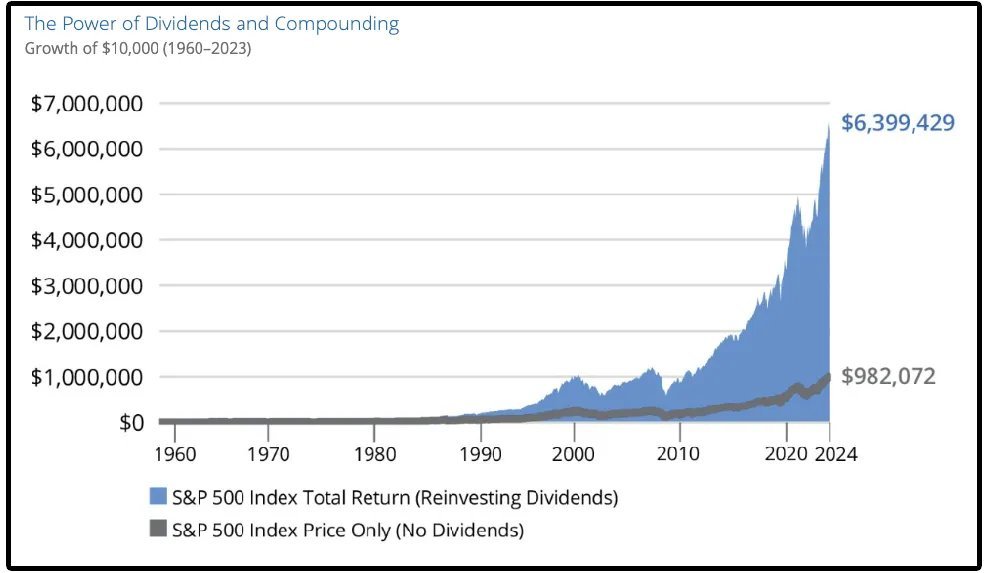

1. Since 1960, staggering 85% of the S&P 500's cumulative return has come from reinvested dividends and the power of compounding.

$10,000 invested in the S&P 500 in 1960 without reinvesting dividends?

Turned into $982,072.

$10,000 invested in the S&P 500 in 1960 while reinvesting dividends?

Turned into $6,399,429.

$10,000 invested in the S&P 500 in 1960 without reinvesting dividends?

Turned into $982,072.

$10,000 invested in the S&P 500 in 1960 while reinvesting dividends?

Turned into $6,399,429.

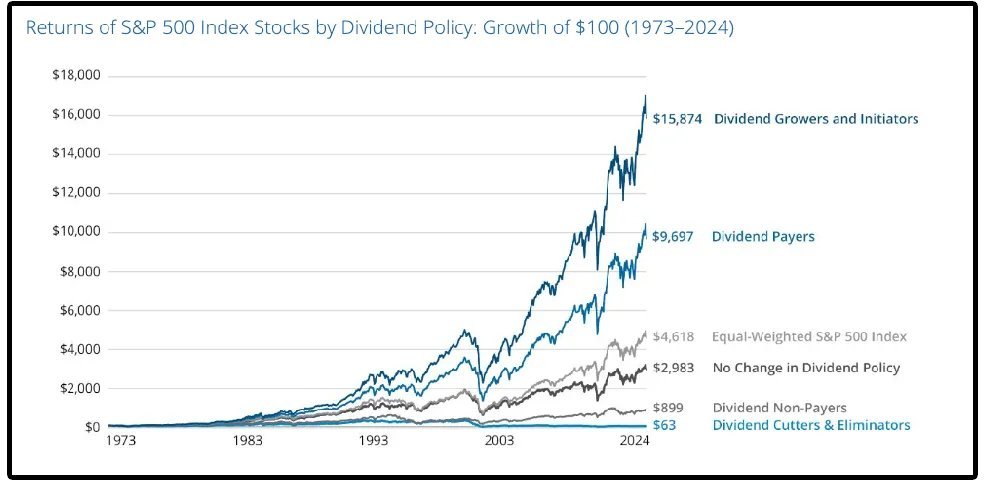

2. From 1973 to 2024, companies that grew or initiated dividends produced the highest total returns (10.2%/year).

Why would this be the case?

Think about what a stock growing its dividend often means:

- Cash flow can cover the dividend

- Management is confident earnings will continue to grow in the future

- It forces management to focus on the highest ROI projects

- Management is focused on long term objectives

Remember: Dividend growth and share price appreciation are byproducts of free cash flow growth.

Why would this be the case?

Think about what a stock growing its dividend often means:

- Cash flow can cover the dividend

- Management is confident earnings will continue to grow in the future

- It forces management to focus on the highest ROI projects

- Management is focused on long term objectives

Remember: Dividend growth and share price appreciation are byproducts of free cash flow growth.

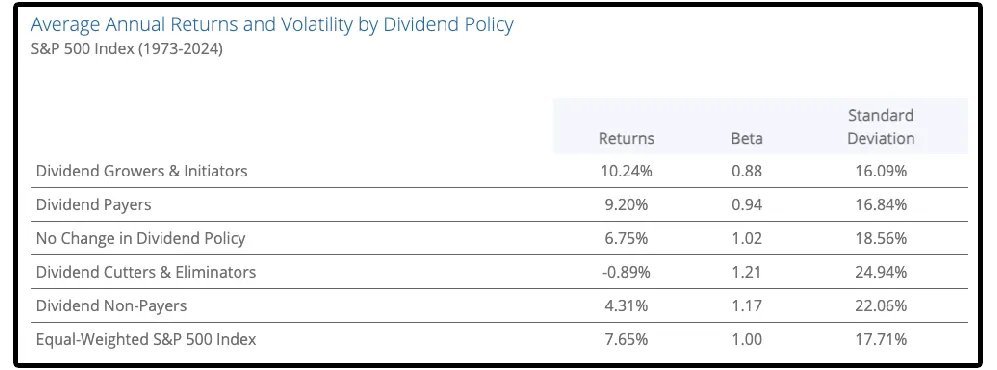

3. Not only have dividend growth stocks provided better historical returns-

They have also been less volatile. (Lower beta and lower standard deviation)

They have also been less volatile. (Lower beta and lower standard deviation)

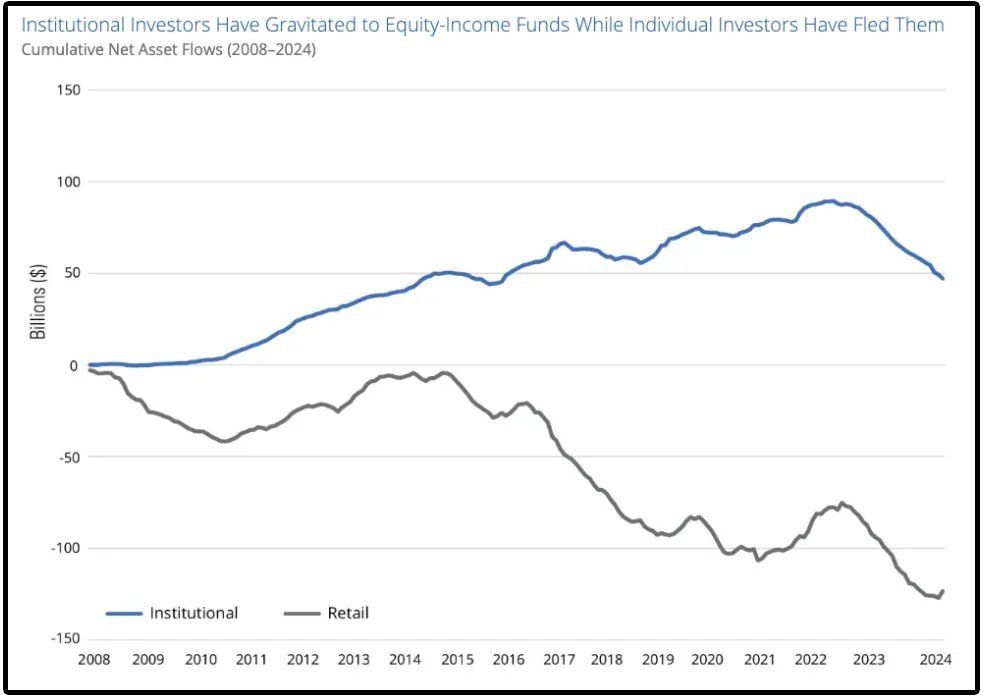

4. Since the Global Financial Crisis, there’s been a striking divergence between institutional and retail investors when it comes to income strategies.

Institutional investors have poured nearly $47 billion into equity-income funds since 2008.

Meanwhile, retail investors have pulled out nearly $123 billion from those same funds over that same time frame.

Are institutions ahead of the curve?

Institutional investors have poured nearly $47 billion into equity-income funds since 2008.

Meanwhile, retail investors have pulled out nearly $123 billion from those same funds over that same time frame.

Are institutions ahead of the curve?

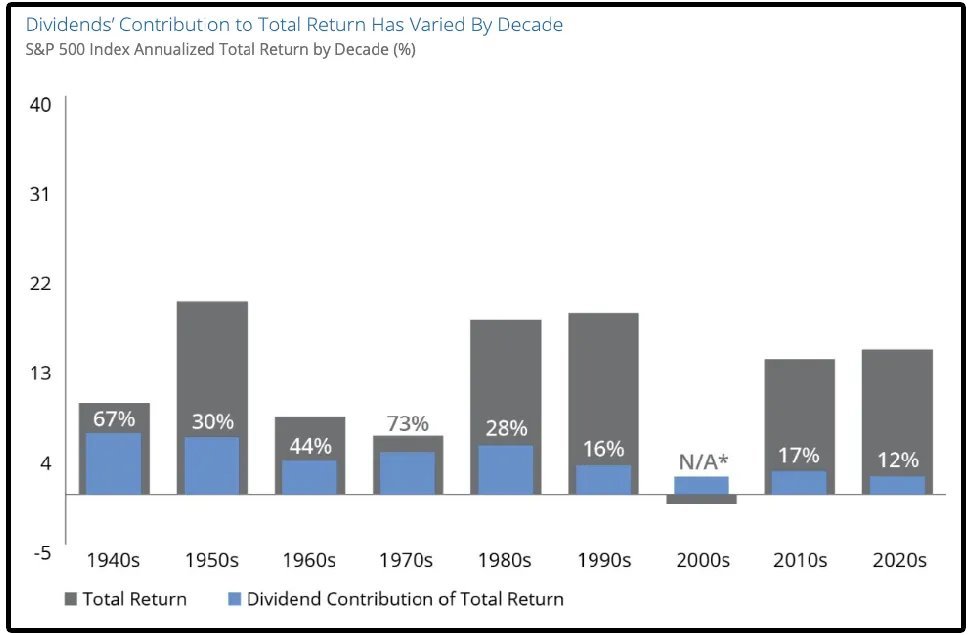

5. From 1940–2024, dividend’s contribution to the total return of the S&P 500 Index averaged 34%.

In the 1940s and 1970s, dividends accounted for over 60% of the total returns.

And in the 2000’s… The S&P 500 had negative returns.

Dividends were the only source of positive return that decade.

That’s exactly why living off dividends can help protect retirees from sequence of return risk.

In the 1940s and 1970s, dividends accounted for over 60% of the total returns.

And in the 2000’s… The S&P 500 had negative returns.

Dividends were the only source of positive return that decade.

That’s exactly why living off dividends can help protect retirees from sequence of return risk.

If you want to read more, you can do so here: dividendology.com/p/the-truth-ab…

• • •

Missing some Tweet in this thread? You can try to

force a refresh