Market Outlook

1. Bitcoin

2. Super cycle

3. Altszn

4. Profit taking

⚠️ This product contains bull propaganda. A highly addictive substance.

1. Bitcoin

2. Super cycle

3. Altszn

4. Profit taking

⚠️ This product contains bull propaganda. A highly addictive substance.

1. Bitcoin

Let's start with daddy bitcoin. I'll be splitting this up into a part for our regular 4-year cycle and a part for the looming super cycle.

// Time:

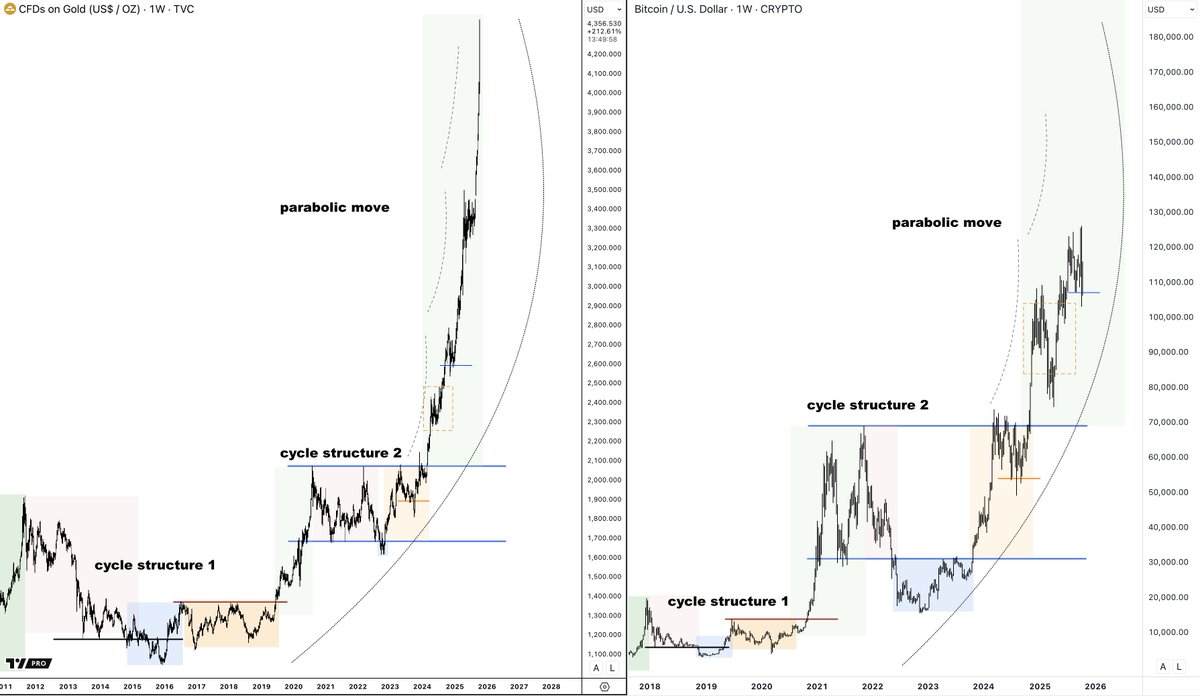

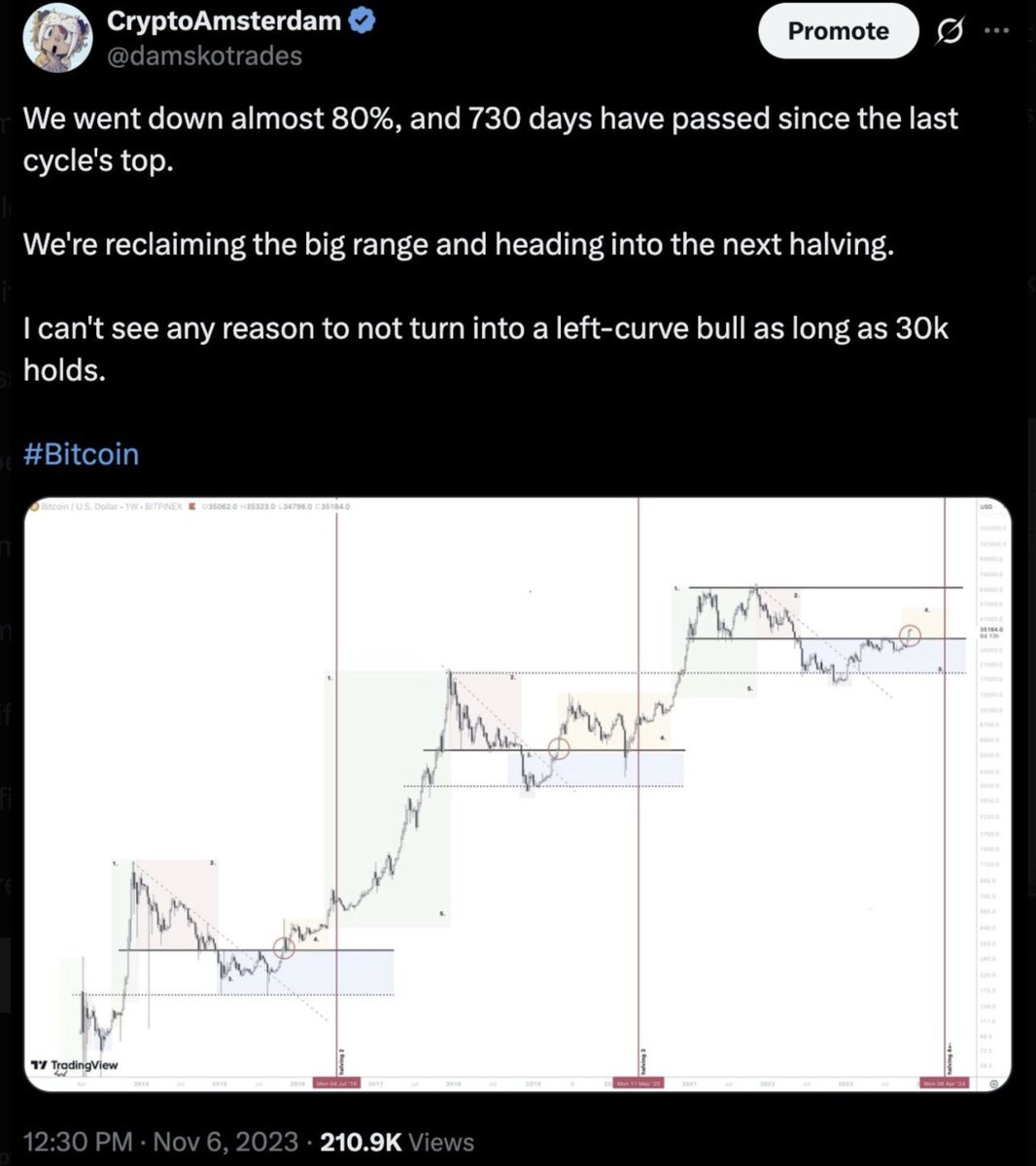

Bitcoin is currently roughly 1340 days into the 4-year cycle, which usually takes roughly around 1435-1480 days.

// Structure:

- Market structure: The price action is still bullish.

- Local price action: We just broke out of a 250-day-old range. Usually these breakouts, as long as its valid, don't top after one week and one candle.

- Cycle structure: If we look at the cycle structure, we are clearly in stage 5 of the cycle. We broke into new highs as always, and we printed the first swing leg up into ATHs, had the usual consolidation, and are now starting our second swing leg up.

Historically, this is the leg that leads us into a cycle top.

Also, we are approaching our parabolic 4-year cycle resistance line, which is hard to 'exactly' draw, but I'd see it sitting in the 125k-140k zone. It also depends on when we arrive at that line.

Let's start with daddy bitcoin. I'll be splitting this up into a part for our regular 4-year cycle and a part for the looming super cycle.

// Time:

Bitcoin is currently roughly 1340 days into the 4-year cycle, which usually takes roughly around 1435-1480 days.

// Structure:

- Market structure: The price action is still bullish.

- Local price action: We just broke out of a 250-day-old range. Usually these breakouts, as long as its valid, don't top after one week and one candle.

- Cycle structure: If we look at the cycle structure, we are clearly in stage 5 of the cycle. We broke into new highs as always, and we printed the first swing leg up into ATHs, had the usual consolidation, and are now starting our second swing leg up.

Historically, this is the leg that leads us into a cycle top.

Also, we are approaching our parabolic 4-year cycle resistance line, which is hard to 'exactly' draw, but I'd see it sitting in the 125k-140k zone. It also depends on when we arrive at that line.

Thoughts:

/ Late cycle stage as per the 4-year cycle metrics (time-wise/structure-wise with the 2nd swing into all-time highs + approaching parabolic cycle resistance)

/ If you are in with us since the 20-35k stage 3/range low reclaim, it's imo a good time to slowly secure some profits in this current leg up

/ Again, I think it goes higher still, but also acknowledging where Bitcoin is as per our historical metrics.

This time could be different, and it's something I'm actively preparing for, but with a different Bitcoin position. Later, more about this.

For now, if you are riding this Bitcoin cycle since much lower, I think it's smart to slowly start paying yourself, even if it's partially, heading into the cycle resistance line.

Betting on this time being different (aka no bear or noteworthy downtrend) is a dangerous bet; you don't want to round-trip it all down again.

Let's continue with the more bullish propaganda content below:

/ I think the Bitcoin trade is late stage, while I think the Altcoin trade is still early

/ What if this is the super cycle?

/ Late cycle stage as per the 4-year cycle metrics (time-wise/structure-wise with the 2nd swing into all-time highs + approaching parabolic cycle resistance)

/ If you are in with us since the 20-35k stage 3/range low reclaim, it's imo a good time to slowly secure some profits in this current leg up

/ Again, I think it goes higher still, but also acknowledging where Bitcoin is as per our historical metrics.

This time could be different, and it's something I'm actively preparing for, but with a different Bitcoin position. Later, more about this.

For now, if you are riding this Bitcoin cycle since much lower, I think it's smart to slowly start paying yourself, even if it's partially, heading into the cycle resistance line.

Betting on this time being different (aka no bear or noteworthy downtrend) is a dangerous bet; you don't want to round-trip it all down again.

Let's continue with the more bullish propaganda content below:

/ I think the Bitcoin trade is late stage, while I think the Altcoin trade is still early

/ What if this is the super cycle?

2. The super cycle

I've been thinking about this for a long time.

The super cycle.

1. What is it?

2. How am I playing it?

1. What is it?

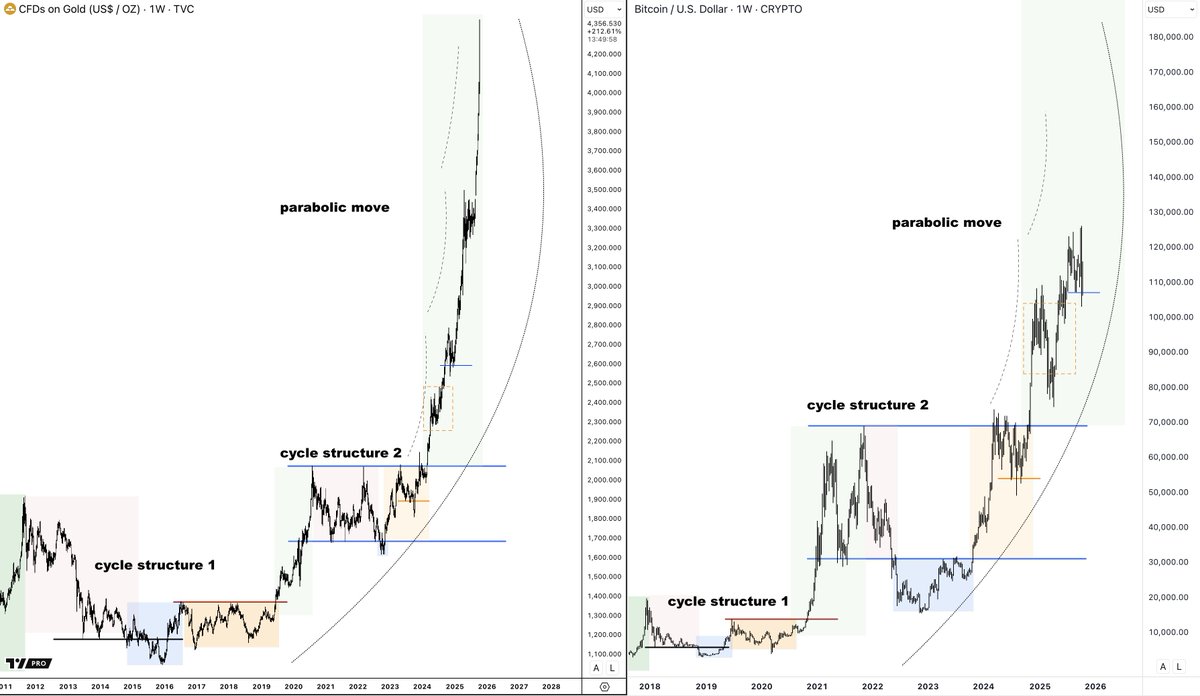

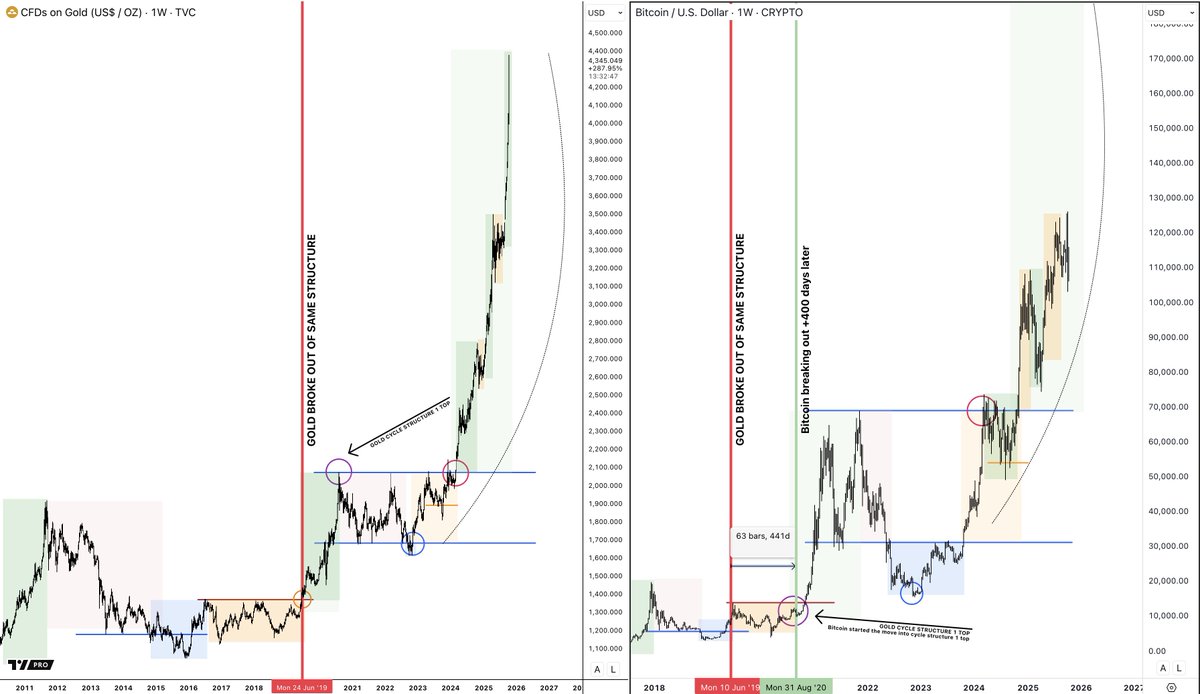

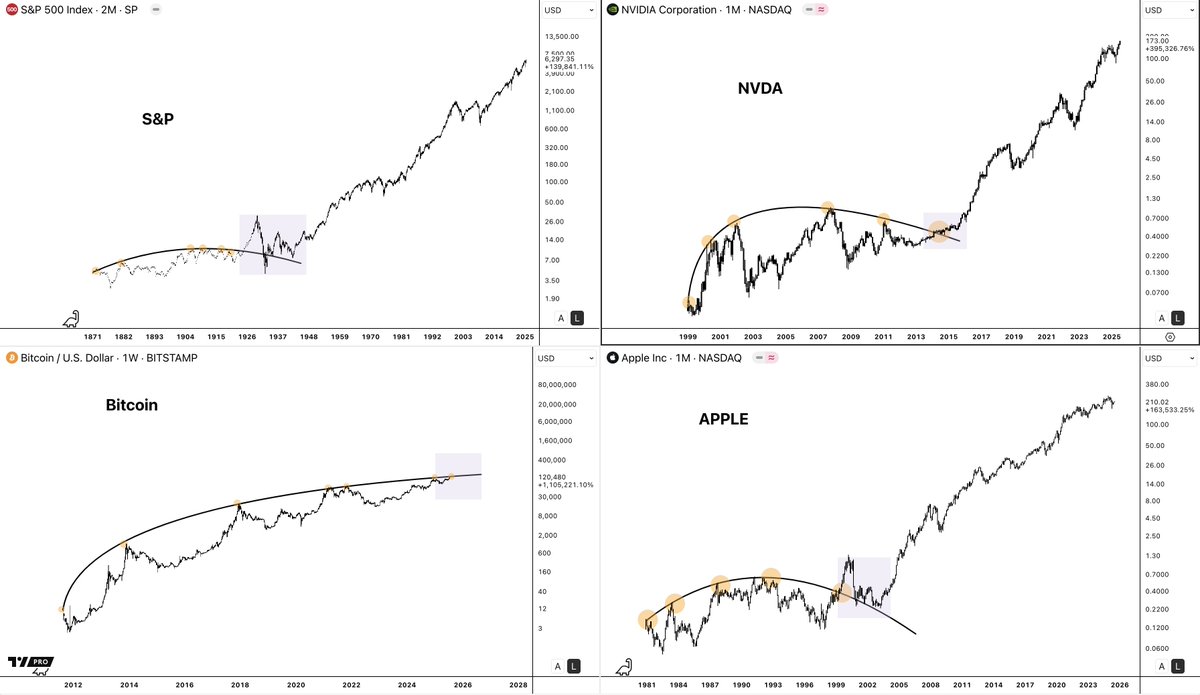

Many of the other older and successful assets, like the ones on the chart below, had a similar initial period with cycles and a parabolic line that capped the growth each cycle.

Until something fundamentally happened, and they entered their 'super cycle':

> SPX: America became the world's superpower

> APPL: iPhone 3 was born

> NVDA: AI growth exploded

> Bitcoin: ETFs, pro Bitcoin governments, reserve currencies, institutional fomo?

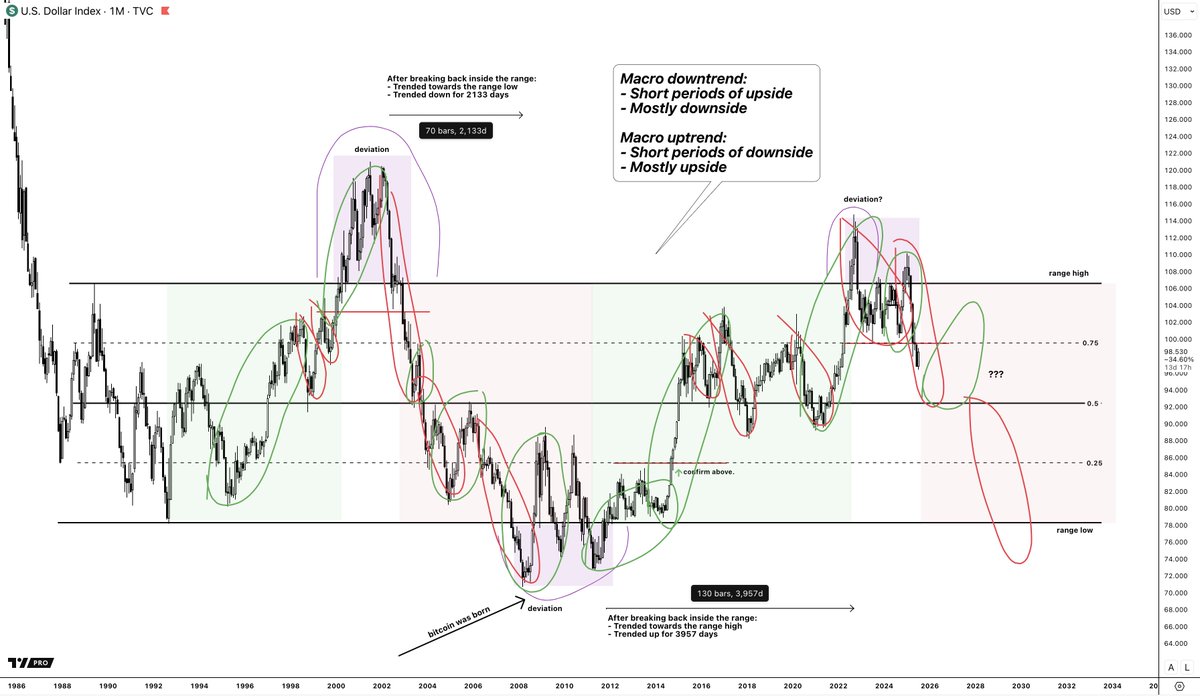

On the other hand, we have the Dollar as an extra confluence for this idea.

The dollar’s been in this macro range since 1987. It deviates at the highs and lows and then reverses for the next 5–10 years to the other side of the range.

But since Bitcoin was born, the dollar’s been in one of those 10+ year trends, this time to the upside.

So all the Bitcoin growth over the past 10 years and all the 4-year cycles happened in a macro bullish Dollar environment.

Interestingly, the dollar now did a range high deviation back into the range, + had a bearish market structure break.

Purely from a price action perspective, we can say:

> If the price is ranging, more ranging is the most likely outcome.

> A deviation after breakout/breakdown increases that probability.

> A market structure break after the deviation strengthens it even more.

So yeah, purely based on PA, a reversal back toward the range low looks most likely imo.

/ Dynamics between up and downside within different macro trends

The most bullish crypto periods were during the moments the dollar took a breather in its macro uptrend.

Macro uptrends are mostly up, but they have short dips along the way. Those dips were the opportunity windows for Bitcoin.

On the other hand, in macro downtrends, there will be periods where prices bounce and the downtrend takes a break.

Macro uptrends: mostly up, with short pauses or dips. Macro downtrends: mostly down, with short pauses or bounces.

Our 4-year cycles—and the upside within them—lined up with the short breaks the dollar took during its macro uptrend.

But what if now, instead of another 10-year uptrend, the dollar shifts into a 5–10 year downtrend... And those short downside pauses flip into longer periods of downside, with only brief upside bounces?

If this happens, I can only imagine that this would completely change our usual 4-year cycle outlook, and the pattern in periods of up and downside as we know it for Bitcoin.

2. How am I playing it?

What if this time is different? The idea of being sidelined after being in this space for almost a decade, when Bitcoin goes on a super cycle, genuinely put fear in me.

But on the other hand, I don't think ignoring the 4-year cycle metrics, I've always been playing pretty well, is a good idea. Betting on this 'time being different' is a weird bet to make.

> The 4-year cycle:

Playing it as usual, taking profits and scaling out on Bitcoin in the latter part of the cycle as per the metrics. (described in the post above), and altcoins in the stage after where (hopefully) Bitcoin dominance drops (later, more about this)

> The super cycle:

Building a separate, longer-term Bitcoin position that outgrows the timing of the cycles as we know them. I already started and will from now on if Dominance thanks split 50/50 of the Altcoin profits into BTC (longer term) and fiat.

TLDR:

4-year cycle:

- Bitcoin late stage

- Already taken some profits into fiat late 2024 (SOL and BTC sells)

- From here on profits 50/50 fiat/btc longer term

Super cycle:

- Building a separate Bitcoin stack for the super cycle, and will hold this until this happens. Could be this cycle, the next, or never (nothing is certain)

I've been thinking about this for a long time.

The super cycle.

1. What is it?

2. How am I playing it?

1. What is it?

Many of the other older and successful assets, like the ones on the chart below, had a similar initial period with cycles and a parabolic line that capped the growth each cycle.

Until something fundamentally happened, and they entered their 'super cycle':

> SPX: America became the world's superpower

> APPL: iPhone 3 was born

> NVDA: AI growth exploded

> Bitcoin: ETFs, pro Bitcoin governments, reserve currencies, institutional fomo?

On the other hand, we have the Dollar as an extra confluence for this idea.

The dollar’s been in this macro range since 1987. It deviates at the highs and lows and then reverses for the next 5–10 years to the other side of the range.

But since Bitcoin was born, the dollar’s been in one of those 10+ year trends, this time to the upside.

So all the Bitcoin growth over the past 10 years and all the 4-year cycles happened in a macro bullish Dollar environment.

Interestingly, the dollar now did a range high deviation back into the range, + had a bearish market structure break.

Purely from a price action perspective, we can say:

> If the price is ranging, more ranging is the most likely outcome.

> A deviation after breakout/breakdown increases that probability.

> A market structure break after the deviation strengthens it even more.

So yeah, purely based on PA, a reversal back toward the range low looks most likely imo.

/ Dynamics between up and downside within different macro trends

The most bullish crypto periods were during the moments the dollar took a breather in its macro uptrend.

Macro uptrends are mostly up, but they have short dips along the way. Those dips were the opportunity windows for Bitcoin.

On the other hand, in macro downtrends, there will be periods where prices bounce and the downtrend takes a break.

Macro uptrends: mostly up, with short pauses or dips. Macro downtrends: mostly down, with short pauses or bounces.

Our 4-year cycles—and the upside within them—lined up with the short breaks the dollar took during its macro uptrend.

But what if now, instead of another 10-year uptrend, the dollar shifts into a 5–10 year downtrend... And those short downside pauses flip into longer periods of downside, with only brief upside bounces?

If this happens, I can only imagine that this would completely change our usual 4-year cycle outlook, and the pattern in periods of up and downside as we know it for Bitcoin.

2. How am I playing it?

What if this time is different? The idea of being sidelined after being in this space for almost a decade, when Bitcoin goes on a super cycle, genuinely put fear in me.

But on the other hand, I don't think ignoring the 4-year cycle metrics, I've always been playing pretty well, is a good idea. Betting on this 'time being different' is a weird bet to make.

> The 4-year cycle:

Playing it as usual, taking profits and scaling out on Bitcoin in the latter part of the cycle as per the metrics. (described in the post above), and altcoins in the stage after where (hopefully) Bitcoin dominance drops (later, more about this)

> The super cycle:

Building a separate, longer-term Bitcoin position that outgrows the timing of the cycles as we know them. I already started and will from now on if Dominance thanks split 50/50 of the Altcoin profits into BTC (longer term) and fiat.

TLDR:

4-year cycle:

- Bitcoin late stage

- Already taken some profits into fiat late 2024 (SOL and BTC sells)

- From here on profits 50/50 fiat/btc longer term

Super cycle:

- Building a separate Bitcoin stack for the super cycle, and will hold this until this happens. Could be this cycle, the next, or never (nothing is certain)

3. Altszn

The super cycle might change Altcoin/Bitcoin dynamics, but no clue if that’s this cycle or later. Even if it does, it could still start off like usual, giving altcoins time to run.

So for this analysis (and the bet I’m making), we’re assuming the 4-year cycle holds, at least at first.

1. Part of the cycle

It's nothing new that the initial ~1000 days of the cycle are terrible for altcoins.

We've been here before in other cycles.

While Bitcoin reclaims the range lows, rallies to the highs, and even when it initially breaks into price discovery, Bitcoin dominance goes up only, and many altcoins are down 70–80%.

Below you can see it's nothing new, and that until we hit the initial consolidation (chop) period in new highs, dominance goes up only.

But you can also see that since the 2017 cycle, something magical happens when Bitcoin breaks out of the initial consolidation and goes for its second leg into new highs.

Dominance historically starts dropping like a rock there, often right at the moment when people are giving up on altcoins and start to believe only in Bitcoin.

Feels pretty similar to this cycle's sentiment at the chop and peak high from dominance:

- Institutional Bitcoin only talks

- This time is different

- Ethereum is dead

- People are switching back to Bitcoin

So far, Bitcoin dominance has taken a good beating right at the historical trendline resistance, when Bitcoin broke into new highs for the second leg.

Not enough to fully confirm a breakdown, but it's a good sign and the most likely outcome until proven wrong is that this time likely won't be different.

> Historical point in the cycle where dominance drops

> Sentiment lined up

> Historical dominance resistance trendline

Can it go higher? Yes, sure, everything can play out slightly differently or even totally differently.

Main concerns?

> Bitcoin hasn’t had a true parabola yet, and sentiment still feels like there’s room

> We might break the super cycle trendline and run higher as usual. That second leg into new highs is usually Bitcoin’s last—money flows into alts looking for more gains → dominance drops → altseason

> But if the parabolic Bitcoin resistance truly breaks, the 4-year cycle structure breaks too, changing the dynamics between Bitcoin and altcoins as we know it.

That said, betting on this time being different is risky.

And as we’ll cover next, there are more and more positive altcoin signals showing up.

Key to betting on altcoins, imo:

> Always keep the majority of your portfolio in Bitcoin

> Bet on strength and outperformance, just like Solana and memes outperformed early in the bull market, I believe that focusing on the coins grabbing attention right now gives you a much higher chance of doing well, no matter how things play out.

I’m personally focused on HYPE, AAVE + CRV (DeFi/stablecoin plays), and ETH.

The super cycle might change Altcoin/Bitcoin dynamics, but no clue if that’s this cycle or later. Even if it does, it could still start off like usual, giving altcoins time to run.

So for this analysis (and the bet I’m making), we’re assuming the 4-year cycle holds, at least at first.

1. Part of the cycle

It's nothing new that the initial ~1000 days of the cycle are terrible for altcoins.

We've been here before in other cycles.

While Bitcoin reclaims the range lows, rallies to the highs, and even when it initially breaks into price discovery, Bitcoin dominance goes up only, and many altcoins are down 70–80%.

Below you can see it's nothing new, and that until we hit the initial consolidation (chop) period in new highs, dominance goes up only.

But you can also see that since the 2017 cycle, something magical happens when Bitcoin breaks out of the initial consolidation and goes for its second leg into new highs.

Dominance historically starts dropping like a rock there, often right at the moment when people are giving up on altcoins and start to believe only in Bitcoin.

Feels pretty similar to this cycle's sentiment at the chop and peak high from dominance:

- Institutional Bitcoin only talks

- This time is different

- Ethereum is dead

- People are switching back to Bitcoin

So far, Bitcoin dominance has taken a good beating right at the historical trendline resistance, when Bitcoin broke into new highs for the second leg.

Not enough to fully confirm a breakdown, but it's a good sign and the most likely outcome until proven wrong is that this time likely won't be different.

> Historical point in the cycle where dominance drops

> Sentiment lined up

> Historical dominance resistance trendline

Can it go higher? Yes, sure, everything can play out slightly differently or even totally differently.

Main concerns?

> Bitcoin hasn’t had a true parabola yet, and sentiment still feels like there’s room

> We might break the super cycle trendline and run higher as usual. That second leg into new highs is usually Bitcoin’s last—money flows into alts looking for more gains → dominance drops → altseason

> But if the parabolic Bitcoin resistance truly breaks, the 4-year cycle structure breaks too, changing the dynamics between Bitcoin and altcoins as we know it.

That said, betting on this time being different is risky.

And as we’ll cover next, there are more and more positive altcoin signals showing up.

Key to betting on altcoins, imo:

> Always keep the majority of your portfolio in Bitcoin

> Bet on strength and outperformance, just like Solana and memes outperformed early in the bull market, I believe that focusing on the coins grabbing attention right now gives you a much higher chance of doing well, no matter how things play out.

I’m personally focused on HYPE, AAVE + CRV (DeFi/stablecoin plays), and ETH.

Here you can see more clearly that in the last cycle, when Bitcoin ran from 10K to 40K into new highs, super performers like Solana were still 79% down at the same time.

Very similar to what tokens like HYPE did this cycle.

Same kind of downside, around the same point in the cycle, and now the recovery is starting to line up too.

Very similar to what tokens like HYPE did this cycle.

Same kind of downside, around the same point in the cycle, and now the recovery is starting to line up too.

2. Ethereum

I still believe that whenever Ethereum does well, we’ll get a much wider and more sustainable altcoin rally. I’ve been betting on Ethereum since early April, eyeing the range low reclaim, which has played out perfectly so far.

That it already played out might make it harder to get ETH exposure here, but there’s still upside, which still favors the wider altcoin market imo.

As long as Ethereum does well and looks strong, I’m bullish on altcoins.

Usually, first Ethereum runs → money flows into high → mid → low caps after.

I still believe that whenever Ethereum does well, we’ll get a much wider and more sustainable altcoin rally. I’ve been betting on Ethereum since early April, eyeing the range low reclaim, which has played out perfectly so far.

That it already played out might make it harder to get ETH exposure here, but there’s still upside, which still favors the wider altcoin market imo.

As long as Ethereum does well and looks strong, I’m bullish on altcoins.

Usually, first Ethereum runs → money flows into high → mid → low caps after.

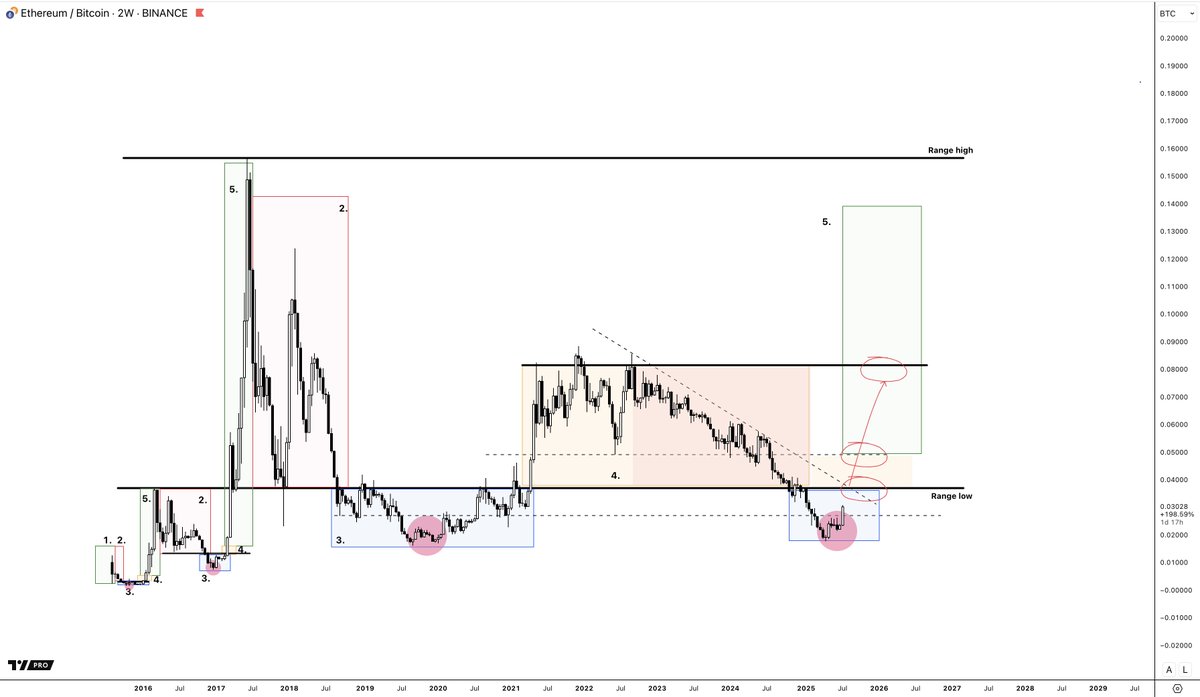

> ETHBTC

Also, ETHBTC is at an interesting spot. It’s too early to confirm, but it’s right where you’d expect a bottom to form.

It’s interesting that this whole Ethereum pump is happening while ETH is still in a bottom-forming zone. It would be even better if (!) ETHBTC can actually reclaim the range low and start an uptrend.

One more note: bottom formations can take time—and we’re still in one as long as we’re below the range low.

Also, ETHBTC is at an interesting spot. It’s too early to confirm, but it’s right where you’d expect a bottom to form.

It’s interesting that this whole Ethereum pump is happening while ETH is still in a bottom-forming zone. It would be even better if (!) ETHBTC can actually reclaim the range low and start an uptrend.

One more note: bottom formations can take time—and we’re still in one as long as we’re below the range low.

3. Money Flow

This lines up with the usual cycle money flow.

You can divide the market into four parts:

> Bitcoin

> Major altcoins (tracked via the Total3 chart)

> The rest of the top 100 altcoins (tracked via the "Others" chart)

> Lower cap altcoins (no chart, but last in line)

These charts tend to follow similar range and cycle structures, just with delays—later sectors always lag behind.

1. First, Bitcoin runs

2. Then the majors join—we’ve already seen that in 2024 with Solana and XRP

3. The rest follows later—recently, many were still sitting at their range lows

Let's take a look:

> We can see Bitcoin leading the cycle into new highs.

> In early 2024, Solana and Ripple mostly led the majors up to the range high.

> Right now, we’re at that resistance, so a pullback could happen. But once we close above, I believe Ethereum will lead the next leg into new highs.

Just like with Bitcoin, the Total3 and 'Others' charts have always followed. There hasn’t been a single cycle where they didn’t rally into new highs.

Lastly, there’s the 'Others' chart. This one usually moves last, and typically takes off when altseason (BTC dominance down) really kicks in.

Most people on Twitter probably hold altcoins that fall into this category.

Years ago, @SecretsOfCrypto made this beautiful visual, which is still very useful. Obviously, the flow has been a bit different with Solana and Ethereum, but I still think it's very relevant now that Ethereum is rallying.

This lines up with the usual cycle money flow.

You can divide the market into four parts:

> Bitcoin

> Major altcoins (tracked via the Total3 chart)

> The rest of the top 100 altcoins (tracked via the "Others" chart)

> Lower cap altcoins (no chart, but last in line)

These charts tend to follow similar range and cycle structures, just with delays—later sectors always lag behind.

1. First, Bitcoin runs

2. Then the majors join—we’ve already seen that in 2024 with Solana and XRP

3. The rest follows later—recently, many were still sitting at their range lows

Let's take a look:

> We can see Bitcoin leading the cycle into new highs.

> In early 2024, Solana and Ripple mostly led the majors up to the range high.

> Right now, we’re at that resistance, so a pullback could happen. But once we close above, I believe Ethereum will lead the next leg into new highs.

Just like with Bitcoin, the Total3 and 'Others' charts have always followed. There hasn’t been a single cycle where they didn’t rally into new highs.

Lastly, there’s the 'Others' chart. This one usually moves last, and typically takes off when altseason (BTC dominance down) really kicks in.

Most people on Twitter probably hold altcoins that fall into this category.

Years ago, @SecretsOfCrypto made this beautiful visual, which is still very useful. Obviously, the flow has been a bit different with Solana and Ethereum, but I still think it's very relevant now that Ethereum is rallying.

4. Profit taking

1. Introduction

2. Some tips

3. My strategy

1. Introduction

If you don't have a profit-taking plan or any guidelines at all. You should make one today, because if things do work out, you'll turn into a much more euphoric version of yourself soon.

A version you don't want to trust when it comes to taking chips off the table, you can rather trust the slightly sceptical version of yourself today.

Today, some are still underwater, or around break-even. But again, if things work out, many will, while much closer to the end, feel and experience:

1. Feel Euphoric

2. Feel FOMO (need more exposure)

3. Raise goals (10m isn't enough to retire, bro)

4. A hysteria on crypto Twitter where everyone around you will scream higher and laugh about people selling

5. Worldwide bullish media attention.

6. This train won't ever stop. This is it, right?

People slide the leverage bar of risk and exposure up, peaking at the end of the cycle, while it should be the other way around:

> Risk early and hard and leverage down along the way

And then it hits. The market is down 40% within 2 days. You are down half of your total net worth in shitters. But this will surely recover. Just hold, that worked as well in the past months.

We all know how this story is ending. We have all been here, and for many, it will happen in the same way once again.

Some people here will make insane amounts by holding, being a very good risk taker, or having some luck.

The people who will keep it aren't necessarily these people.

The ones thinking about their exit plans already and can stick to their strategies whenever euphoria runs through their body and Twitter.

These people will make it and sit on a chunk of cash after this bull market.

Trust the plan of the calm man (you), not the plan of the euphoric man (you later) (if we get our second leg up)

1. Introduction

2. Some tips

3. My strategy

1. Introduction

If you don't have a profit-taking plan or any guidelines at all. You should make one today, because if things do work out, you'll turn into a much more euphoric version of yourself soon.

A version you don't want to trust when it comes to taking chips off the table, you can rather trust the slightly sceptical version of yourself today.

Today, some are still underwater, or around break-even. But again, if things work out, many will, while much closer to the end, feel and experience:

1. Feel Euphoric

2. Feel FOMO (need more exposure)

3. Raise goals (10m isn't enough to retire, bro)

4. A hysteria on crypto Twitter where everyone around you will scream higher and laugh about people selling

5. Worldwide bullish media attention.

6. This train won't ever stop. This is it, right?

People slide the leverage bar of risk and exposure up, peaking at the end of the cycle, while it should be the other way around:

> Risk early and hard and leverage down along the way

And then it hits. The market is down 40% within 2 days. You are down half of your total net worth in shitters. But this will surely recover. Just hold, that worked as well in the past months.

We all know how this story is ending. We have all been here, and for many, it will happen in the same way once again.

Some people here will make insane amounts by holding, being a very good risk taker, or having some luck.

The people who will keep it aren't necessarily these people.

The ones thinking about their exit plans already and can stick to their strategies whenever euphoria runs through their body and Twitter.

These people will make it and sit on a chunk of cash after this bull market.

Trust the plan of the calm man (you), not the plan of the euphoric man (you later) (if we get our second leg up)

2. Some tips

> Mindset and habits

Before making a plan, let's think about mindset and see if we can understand the toxic way of thinking that leads to giving back all your money and controlling it.

Acceptance and the mission 95% of people:

A) think they need to be either fully allocated or entirely out, and B) try to sell the absolute top of the bull market.

99% of those who try this either sell way too early and end up completely sidelined, FOMO back in higher, or miss the top and hold back to zero while dreaming about their peak net worth.

Accept that trying to sell it all at the top is a recipe for disaster.

You don’t need every move to be all-in or all-out. You can scale in and out over time.

There’s no reason to stay fully allocated as we head into the late part of the cycle, even if you think the best is still to come (I do).

The goal is simple:

> Scale in early, scale out late.

> Catch most of the move.

> Walk away with more than you put in.

If you walk away from this cycle with more than you put in, if you have more cash in the next bear than the last one, you outperformed 90% of people.

> Mindset and habits

Before making a plan, let's think about mindset and see if we can understand the toxic way of thinking that leads to giving back all your money and controlling it.

Acceptance and the mission 95% of people:

A) think they need to be either fully allocated or entirely out, and B) try to sell the absolute top of the bull market.

99% of those who try this either sell way too early and end up completely sidelined, FOMO back in higher, or miss the top and hold back to zero while dreaming about their peak net worth.

Accept that trying to sell it all at the top is a recipe for disaster.

You don’t need every move to be all-in or all-out. You can scale in and out over time.

There’s no reason to stay fully allocated as we head into the late part of the cycle, even if you think the best is still to come (I do).

The goal is simple:

> Scale in early, scale out late.

> Catch most of the move.

> Walk away with more than you put in.

If you walk away from this cycle with more than you put in, if you have more cash in the next bear than the last one, you outperformed 90% of people.

> Long-term goal

Stop aiming to get rich and retire this cycle.

Most will feel it’s not enough at the end, even with multiples of what they started with.

This mindset leads to roundtripping.

Think long-term.

Each cycle teaches you many lessons, and if you can manage to also end up with a big cash increase in the next bear market, you can compound gains and knowledge in the next cycle.

Many underestimate the power of having a lot of cash in the next big downtrend.

Don’t aim to make it this cycle, aim for the next or the one after. A few might get lucky with big wins, but most round-trip 5-7 figures chasing more.

(You don't need $10m and retire at your 22nd birthday, you'll survive)

Stop aiming to get rich and retire this cycle.

Most will feel it’s not enough at the end, even with multiples of what they started with.

This mindset leads to roundtripping.

Think long-term.

Each cycle teaches you many lessons, and if you can manage to also end up with a big cash increase in the next bear market, you can compound gains and knowledge in the next cycle.

Many underestimate the power of having a lot of cash in the next big downtrend.

Don’t aim to make it this cycle, aim for the next or the one after. A few might get lucky with big wins, but most round-trip 5-7 figures chasing more.

(You don't need $10m and retire at your 22nd birthday, you'll survive)

> Higher highs vs. higher lows

Shift your focus away from your peak net worth this cycle. It’s a magical number that almost no one actually realizes in cash, yet it’s the number most people fixate on.

The number that drags people back to zero because they’ll always feel unsatisfied, not hitting it again.

This leads to holding too long, not selling, and taking on more risk late in the cycle.

Instead of focusing on your high, focus on creating higher lows in your net worth.

Your most recent high might not be broken again this cycle, but setting a higher low compared to the last cycle is much more realistic.

Focusing on printing higher lows each cycle will help you feel satisfied, proud, and more at peace, realizing profits even if you’re down a bit from the top.

Shift your focus away from your peak net worth this cycle. It’s a magical number that almost no one actually realizes in cash, yet it’s the number most people fixate on.

The number that drags people back to zero because they’ll always feel unsatisfied, not hitting it again.

This leads to holding too long, not selling, and taking on more risk late in the cycle.

Instead of focusing on your high, focus on creating higher lows in your net worth.

Your most recent high might not be broken again this cycle, but setting a higher low compared to the last cycle is much more realistic.

Focusing on printing higher lows each cycle will help you feel satisfied, proud, and more at peace, realizing profits even if you’re down a bit from the top.

> Change your life

If you stay around long enough while printing higher lows and securing success by compounding cycle, there's a good chance you will have that 'lucky' moment where you will suddenly super print.

Maybe it's an airdrop (HyperLiquid?) or a position doing a x100+.

If this happens, it is very likely you now think, hey, I might be able to raise my targets I had this cycle, as I now suddenly, earlier than expected, have this life-changing amount. If I now start playing with this and take a new position, I might hit the numbers that some people on Twitter are playing with.

Brother, if you are lucky or have exceeded your expectations, print a life-changing number and get it out as soon as possible.

Cash out half, or more, in cash into your bank and change your life.

If you don't have a plan and outperformed greatly by being a (great) degenerate, but without a boring system, you will very likely give it all back as a degenerate again.

If you stay around long enough while printing higher lows and securing success by compounding cycle, there's a good chance you will have that 'lucky' moment where you will suddenly super print.

Maybe it's an airdrop (HyperLiquid?) or a position doing a x100+.

If this happens, it is very likely you now think, hey, I might be able to raise my targets I had this cycle, as I now suddenly, earlier than expected, have this life-changing amount. If I now start playing with this and take a new position, I might hit the numbers that some people on Twitter are playing with.

Brother, if you are lucky or have exceeded your expectations, print a life-changing number and get it out as soon as possible.

Cash out half, or more, in cash into your bank and change your life.

If you don't have a plan and outperformed greatly by being a (great) degenerate, but without a boring system, you will very likely give it all back as a degenerate again.

> Lock it in (truly).

If you sell but leave the cash or stables on the exchange, you can wait for euphoria to kick in again.

Still overconfident from your last win, you’re back in plays before you know, chasing the next 100x your favorite influencer found.

Cash out into your bank, move it to a hardware wallet, buy real estate, watches, or whatever. Just make it hard to access and don't give it back.

If you sell but leave the cash or stables on the exchange, you can wait for euphoria to kick in again.

Still overconfident from your last win, you’re back in plays before you know, chasing the next 100x your favorite influencer found.

Cash out into your bank, move it to a hardware wallet, buy real estate, watches, or whatever. Just make it hard to access and don't give it back.

> Rotating

While rotating early in the cycle is okay, be careful not to keep doing it endlessly.

You put $1,000 into a token; it’s now $5,000, and you sold.

Great! Do it again, and it’s $50,000.

It works out.

You’re sitting on $50k, thinking, “One more time, and I’ll make life-changing money.”

Your money goes into the next “world-changing” altcoin. It dips, but in a bull market, dips get bought up, right?

This time it dips deeper and doesn’t bounce.

You hold, telling yourself, “diamond hands.” It’s now worth $20k.

You feel terrible, but keep holding. The market nukes again, and you’re now a community member.

A year later, it’s worth $750; you’ve round-tripped everything.

Stop rotating endlessly. Secure money and sell to cash out, not to chase the next plan.

The longer the uptrend lasts, the more euphoric and irrational you’ll get. Protect your gains and take them out.

While rotating early in the cycle is okay, be careful not to keep doing it endlessly.

You put $1,000 into a token; it’s now $5,000, and you sold.

Great! Do it again, and it’s $50,000.

It works out.

You’re sitting on $50k, thinking, “One more time, and I’ll make life-changing money.”

Your money goes into the next “world-changing” altcoin. It dips, but in a bull market, dips get bought up, right?

This time it dips deeper and doesn’t bounce.

You hold, telling yourself, “diamond hands.” It’s now worth $20k.

You feel terrible, but keep holding. The market nukes again, and you’re now a community member.

A year later, it’s worth $750; you’ve round-tripped everything.

Stop rotating endlessly. Secure money and sell to cash out, not to chase the next plan.

The longer the uptrend lasts, the more euphoric and irrational you’ll get. Protect your gains and take them out.

> Make selling a habit

People are fast getting exposure (often too fast), but too slow to protect capital.

Just like it's difficult for people to buy when things are trending down, at low prices, or support, it's also very difficult for people to sell when things are flying or when the party is over, but they're too attached to hope and dreams (and their peak networth number)

Nobody is good at selling when things go up.

Instead of finding a super difficult edge in the market, find your edge by getting used to selling.

Sell regularly (scheme it into your plan), in tiny amounts, maybe at the start to not even really secure profits but just to get used to hitting that sell button and putting some in your bank account.

The more you are used to selling, the easier it is to hit that button; the better your odds of making it out alive.

Start today, seriously, sell 100 dollars or any relative mini amount just to once hit that cash out button.

People are fast getting exposure (often too fast), but too slow to protect capital.

Just like it's difficult for people to buy when things are trending down, at low prices, or support, it's also very difficult for people to sell when things are flying or when the party is over, but they're too attached to hope and dreams (and their peak networth number)

Nobody is good at selling when things go up.

Instead of finding a super difficult edge in the market, find your edge by getting used to selling.

Sell regularly (scheme it into your plan), in tiny amounts, maybe at the start to not even really secure profits but just to get used to hitting that sell button and putting some in your bank account.

The more you are used to selling, the easier it is to hit that button; the better your odds of making it out alive.

Start today, seriously, sell 100 dollars or any relative mini amount just to once hit that cash out button.

> Have a plan

/ If you don't have a plan ready to scale out, the probability of ever scaling out, while running high on euphoria, will be low.

My plan is based on:

> Consistently taking amounts out.

> Scaling out VERY slowly, the further we are in the cycle.

> Scaling out on tokens, slowly, the higher they go.

> Based on range levels, cycle stages, and price action.

Everyone's plan will and should differ, but I'll give an example (!) plan around my profit-taking strategies. 👇

/ If you don't have a plan ready to scale out, the probability of ever scaling out, while running high on euphoria, will be low.

My plan is based on:

> Consistently taking amounts out.

> Scaling out VERY slowly, the further we are in the cycle.

> Scaling out on tokens, slowly, the higher they go.

> Based on range levels, cycle stages, and price action.

Everyone's plan will and should differ, but I'll give an example (!) plan around my profit-taking strategies. 👇

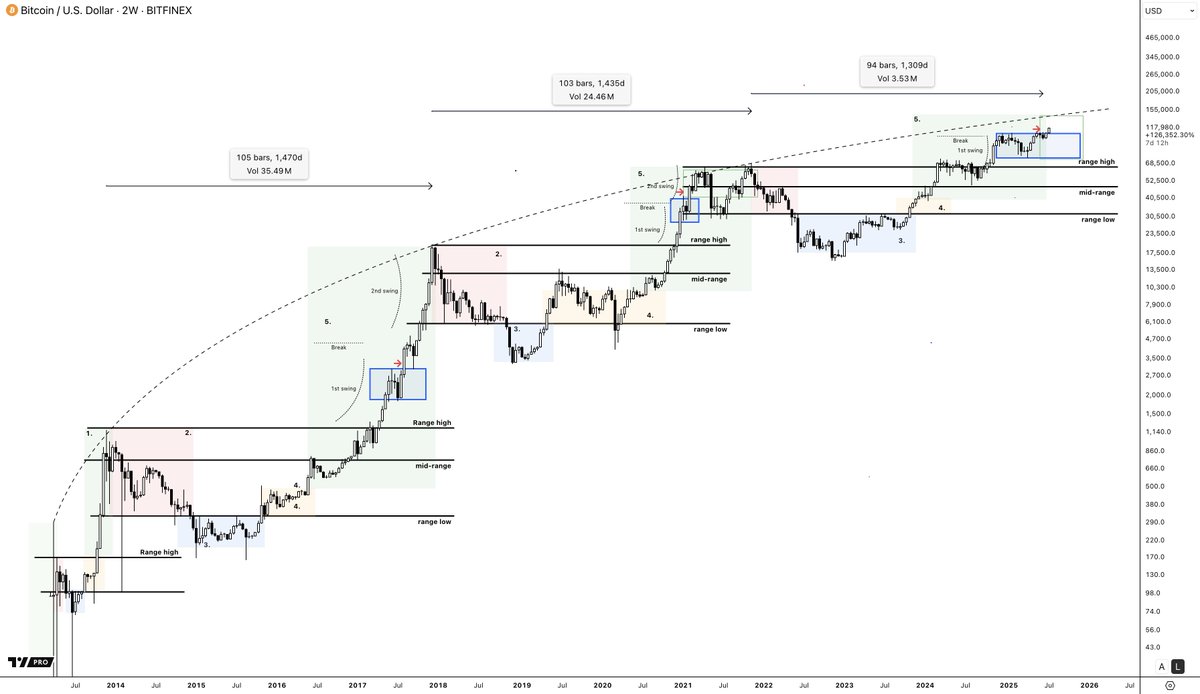

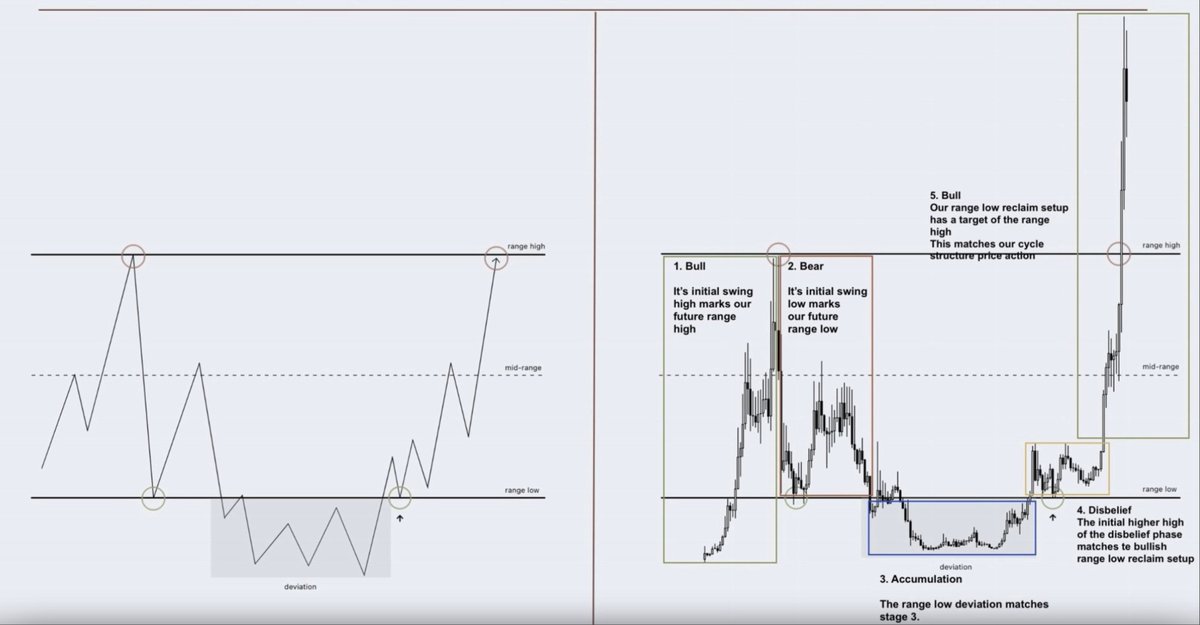

> My plan and example

I base my profit-taking strategy on my core concept, which also helped me scale in crypto late 2023.

> Ranges and Cycles

Most of the crypto market (if the project is not dead) goes through very similar cycles.

Even Bitcoin and total market cap charts.

1. Bull (parabolic up)

2. Bear (steeply down)

3. Accumulation (sideways)

4. Disbelief (initial higher high and range low reclaim)

5. Bull (slowly up to the range high, parabolic price action later above the range)

The range:

- Goal is to accumulate at the lowest part of the range (sub 0.25 the first quarter) and start selling in the upper part of the range (0.75, the 3rd quarter into the range high)

The cycle:

- Accumulate in stages 3 and 4, and sell gradually into the (parabolic) stage 5, move into price discovery

This is the inverse of how we scaled in earlier on Bitcoin and Solana, at the range low zone in stages 3 and 4.

I base my profit-taking strategy on my core concept, which also helped me scale in crypto late 2023.

> Ranges and Cycles

Most of the crypto market (if the project is not dead) goes through very similar cycles.

Even Bitcoin and total market cap charts.

1. Bull (parabolic up)

2. Bear (steeply down)

3. Accumulation (sideways)

4. Disbelief (initial higher high and range low reclaim)

5. Bull (slowly up to the range high, parabolic price action later above the range)

The range:

- Goal is to accumulate at the lowest part of the range (sub 0.25 the first quarter) and start selling in the upper part of the range (0.75, the 3rd quarter into the range high)

The cycle:

- Accumulate in stages 3 and 4, and sell gradually into the (parabolic) stage 5, move into price discovery

This is the inverse of how we scaled in earlier on Bitcoin and Solana, at the range low zone in stages 3 and 4.

Metrics and asset scaling out

I scale out based on a few key things:

> Total3 market cap – When it hits the upper part of the range, I start slowly scaling out of some majors. Did my first sales in 2024 when Total3 hit the range high and sold some Solana.

> Bitcoin – Same idea: scale out when it reaches the range high zone or enters price discovery.

> 'Others' – Still at the range low for now, but once it hits the range high and goes into price discovery, I’ll start slowly scaling out of matching assets.

> Single assets – If a token I’m in hits stage 5, the range high, and price discovery, I’ll start scaling out slowly, no matter where the total market cap charts say.

This strategy below counts for all assets. I already exited a bit on Bitcoin and the majors (total 3), and will continue to do so if individual assets or the 'others' chart hit these levels.

I'll do it slowly, with many sells, over a longer period.

I scale out based on a few key things:

> Total3 market cap – When it hits the upper part of the range, I start slowly scaling out of some majors. Did my first sales in 2024 when Total3 hit the range high and sold some Solana.

> Bitcoin – Same idea: scale out when it reaches the range high zone or enters price discovery.

> 'Others' – Still at the range low for now, but once it hits the range high and goes into price discovery, I’ll start slowly scaling out of matching assets.

> Single assets – If a token I’m in hits stage 5, the range high, and price discovery, I’ll start scaling out slowly, no matter where the total market cap charts say.

This strategy below counts for all assets. I already exited a bit on Bitcoin and the majors (total 3), and will continue to do so if individual assets or the 'others' chart hit these levels.

I'll do it slowly, with many sells, over a longer period.

It's important to make your own plan. My plan might not work for you.

TLDR:

> Know what charts you are looking at to scale out

> Know how much, when, and how you scale out

> Have an invalidation for the total thesis

> Know what you're gonna scale out into and where you store it, and why

> You can also add a bearish htf soft invalidation

> Scale out slowly over time, not all at once

> Get used to a selling habit.

TLDR:

> Know what charts you are looking at to scale out

> Know how much, when, and how you scale out

> Have an invalidation for the total thesis

> Know what you're gonna scale out into and where you store it, and why

> You can also add a bearish htf soft invalidation

> Scale out slowly over time, not all at once

> Get used to a selling habit.

Thanks for reading fam, really appreciate it.

If you enjoyed it, feel free to retweet it.

Love, Amsterdam. 🫡

If you enjoyed it, feel free to retweet it.

Love, Amsterdam. 🫡

• • •

Missing some Tweet in this thread? You can try to

force a refresh