Investing is all about finding a reason to say no as soon as possible.

Here are 10 red flags you should watch out for:

Here are 10 red flags you should watch out for:

1. 🚨 Declining Gross Margins

If revenue grows but gross margin shrinks, the company might be facing rising costs or pricing pressure.

A warning sign of declining competitiveness.

If revenue grows but gross margin shrinks, the company might be facing rising costs or pricing pressure.

A warning sign of declining competitiveness.

2. 🚨 Consistently Negative Free Cash Flow (FCF)

Net income is one thing, but if FCF is persistently negative, the business may be unsustainable without external funding.

Visual by .velotrade

Net income is one thing, but if FCF is persistently negative, the business may be unsustainable without external funding.

Visual by .velotrade

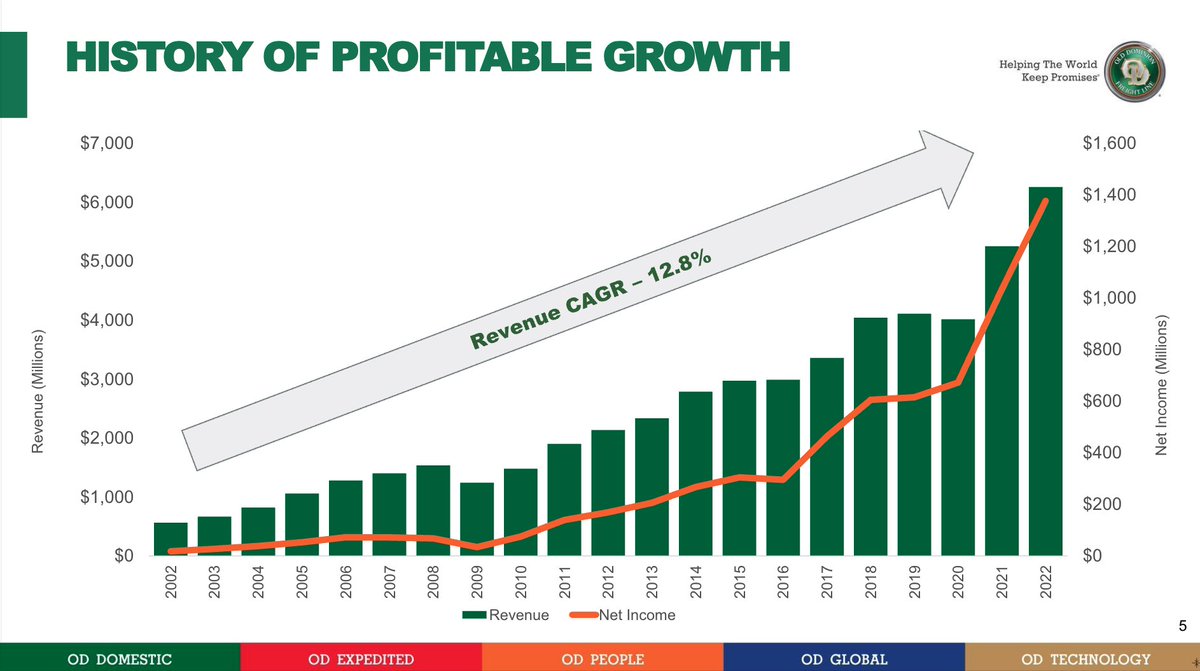

3. 🚨 Unusual Revenue Growth

Massive jumps in revenue without a clear explanation or without corresponding cash flow often suggest aggressive (or questionable) accounting.

Massive jumps in revenue without a clear explanation or without corresponding cash flow often suggest aggressive (or questionable) accounting.

4. 🚨 Frequent One-Time Charges

Non-recurring items should be rare.

Frequent “one-offs” may be a tactic to manipulate earnings and hide real business performance.

Non-recurring items should be rare.

Frequent “one-offs” may be a tactic to manipulate earnings and hide real business performance.

5. 🚨 Sudden Increase in Accounts Receivable

If receivables grow faster than revenue, the company might be booking sales that haven’t been collected.

This may be a potential signal of weak cash inflows.

If receivables grow faster than revenue, the company might be booking sales that haven’t been collected.

This may be a potential signal of weak cash inflows.

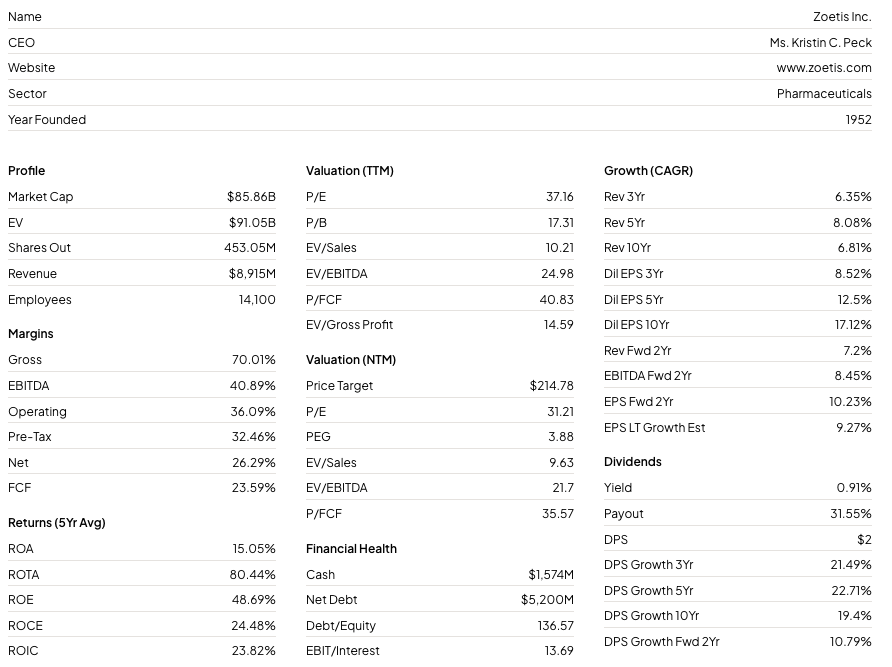

6. 🚨 High Debt-to-Equity Ratio

Excessive leverage can put the company at risk in downturns.

Watch for rising debt levels without a clear use or return on capital.

Visual by R.E.tipster

Excessive leverage can put the company at risk in downturns.

Watch for rising debt levels without a clear use or return on capital.

Visual by R.E.tipster

7. 🚨 Inventory Buildup

Growing inventory could mean weak sales or overproduction.

Could lead to write-downs or discounting later.

Growing inventory could mean weak sales or overproduction.

Could lead to write-downs or discounting later.

8. 🚨 Auditor Red Flags or Resignations

If an auditor resigns or issues a qualified opinion, take it seriously.

This is a huge signal something may be wrong behind the scenes.

If an auditor resigns or issues a qualified opinion, take it seriously.

This is a huge signal something may be wrong behind the scenes.

9. 🚨 Management Compensation Misaligned

Watch out if executive pay is rising while profits or shareholder returns aren’t.

Incentives drive behavior: misaligned ones lead to trouble.

Watch out if executive pay is rising while profits or shareholder returns aren’t.

Incentives drive behavior: misaligned ones lead to trouble.

10. 🚨 Complex or Vague Disclosures

If the footnotes and MD&A sections are overly complex or obscure, the company may be hiding risk or bad news in plain sight.

If the footnotes and MD&A sections are overly complex or obscure, the company may be hiding risk or bad news in plain sight.

I can't stress the importance of spotting red flags enough.

Here's an e-book with even more red flags: compounding-quality.kit.com/d0c5a57cf2

Here's an e-book with even more red flags: compounding-quality.kit.com/d0c5a57cf2

• • •

Missing some Tweet in this thread? You can try to

force a refresh