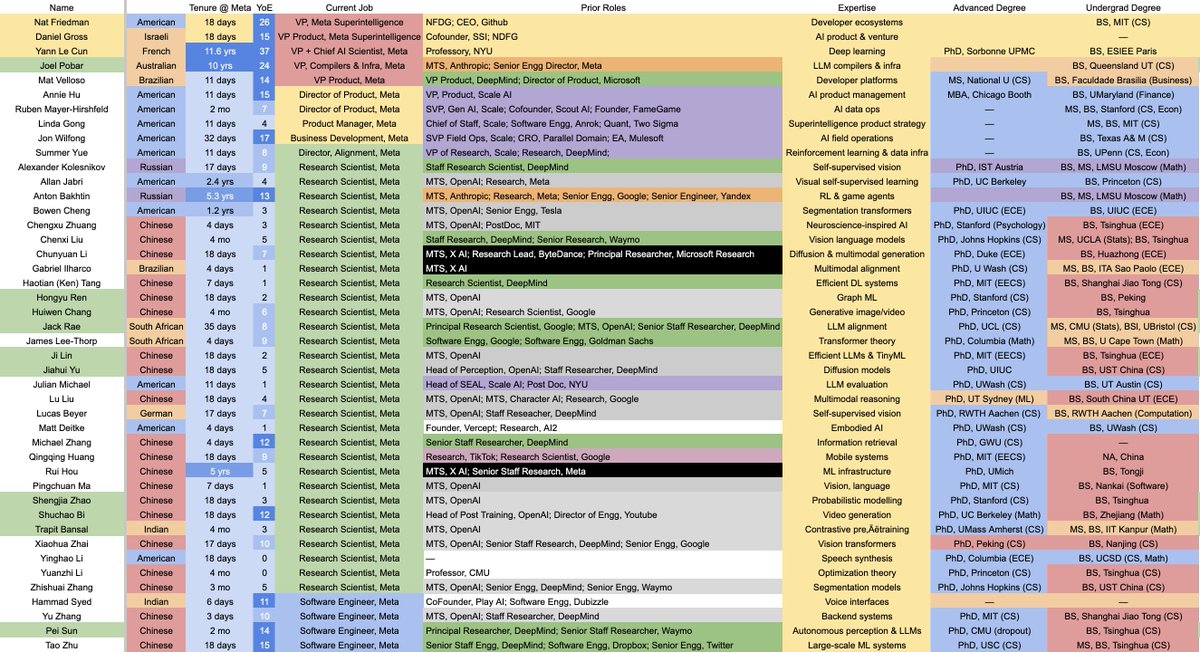

🚨 BREAKING: Detailed list of all 44 people in Meta's Superintelligence team.

— 50% from China

— 75% have PhDs, 70% Researchers

— 40% from OpenAI, 20% DeepMind, 15% Scale

— 20% L8+ level

— 75% 1st gen immigrants

Each of these people are likely getting paid $10-$100M/yr.

— 50% from China

— 75% have PhDs, 70% Researchers

— 40% from OpenAI, 20% DeepMind, 15% Scale

— 20% L8+ level

— 75% 1st gen immigrants

Each of these people are likely getting paid $10-$100M/yr.

Source: anonymous Meta employee

• • •

Missing some Tweet in this thread? You can try to

force a refresh