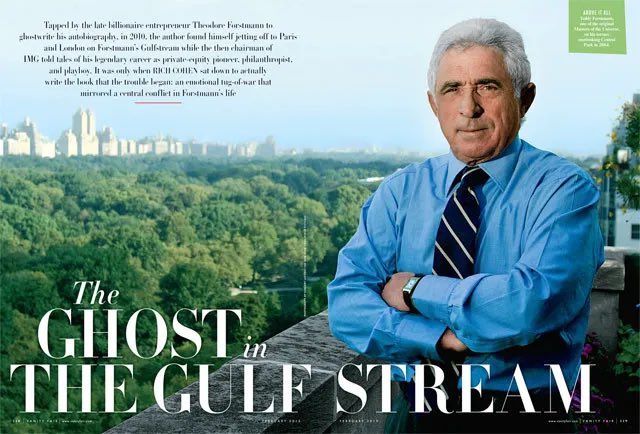

Private Equity Legend: Ted Forstmann

- Buy a dying jet company.

- Make it the Rolex of aviation.

- Sell it for $5.5B.

Now every billionaire wants one.

- Buy a dying jet company.

- Make it the Rolex of aviation.

- Sell it for $5.5B.

Now every billionaire wants one.

The Opportunity

Gulfstream was once a pioneer in business aviation.

In 1990, it was stagnating:

- Aging aircraft models (GIII near end-of-life)

- Bloated org chart, low productivity

- Undifferentiated in an increasingly crowded market

- R&D cutbacks = innovation freeze

Gulfstream was once a pioneer in business aviation.

In 1990, it was stagnating:

- Aging aircraft models (GIII near end-of-life)

- Bloated org chart, low productivity

- Undifferentiated in an increasingly crowded market

- R&D cutbacks = innovation freeze

Forstmann’s Investment Philosophy

Forstmann didn’t believe in “junk bond LBOs.

He believed in:

- Low leverage

- Operational value creation

- Long-term compounding

Gulfstream wasn’t a buy-and-flip.

It was a buy-and-build-back-better.

Forstmann didn’t believe in “junk bond LBOs.

He believed in:

- Low leverage

- Operational value creation

- Long-term compounding

Gulfstream wasn’t a buy-and-flip.

It was a buy-and-build-back-better.

Step 1: Rebuild the Product Engine (R&D)

- Re-opened dormant engineering programs

- Funded development of next-gen jets (G-IV, then G-V)

- Prioritized range, avionics, and cabin experience

- Integrated pilot feedback loops and supplier optimization

- Re-opened dormant engineering programs

- Funded development of next-gen jets (G-IV, then G-V)

- Prioritized range, avionics, and cabin experience

- Integrated pilot feedback loops and supplier optimization

Step 2: Reposition the Brand (Luxury / Status)

He repositioned Gulfstream as the private jet for world leaders, billionaires, and Fortune 500s.

- Aggressive marketing to UHNWIs

- Partnerships with concierge networks & wealth managers

- Visual rebranding of cabins and finishes

He repositioned Gulfstream as the private jet for world leaders, billionaires, and Fortune 500s.

- Aggressive marketing to UHNWIs

- Partnerships with concierge networks & wealth managers

- Visual rebranding of cabins and finishes

Operational Discipline

- Streamlined middle management

-Restructured procurement & parts logistics

- Consolidated suppliers

- Reduced lead times on custom builds

- Refined after-sales support → high-margin service revenue

- Streamlined middle management

-Restructured procurement & parts logistics

- Consolidated suppliers

- Reduced lead times on custom builds

- Refined after-sales support → high-margin service revenue

Scale Revenue, Defend Margin

By 1995–1998, Gulfstream had:

Launched the G-IV and G-V lines

Backlog of elite clients (gov’t, execs, royalty)

Best-in-class range & safety record

Industry-leading resale values (brand halo effect)

By 1995–1998, Gulfstream had:

Launched the G-IV and G-V lines

Backlog of elite clients (gov’t, execs, royalty)

Best-in-class range & safety record

Industry-leading resale values (brand halo effect)

💰 The Exit

Year: 1999

🏷️ Acquirer: General Dynamics

💵 Deal Size: $5.3–$5.5B

IRR: Estimated 35%+ over ~9 years

Multiple expansion: Massive (low-multiple distressed → luxury multiple)

General Dynamics integrated Gulfstream as its flagship aerospace brand.

To this day, it remains one of GD’s most valuable business units.

Year: 1999

🏷️ Acquirer: General Dynamics

💵 Deal Size: $5.3–$5.5B

IRR: Estimated 35%+ over ~9 years

Multiple expansion: Massive (low-multiple distressed → luxury multiple)

General Dynamics integrated Gulfstream as its flagship aerospace brand.

To this day, it remains one of GD’s most valuable business units.

• • •

Missing some Tweet in this thread? You can try to

force a refresh