How to get URL link on X (Twitter) App

https://twitter.com/theicahnist/status/2020610043985416435

1. Buying Airbus’ “Orphan”

1. Buying Airbus’ “Orphan”

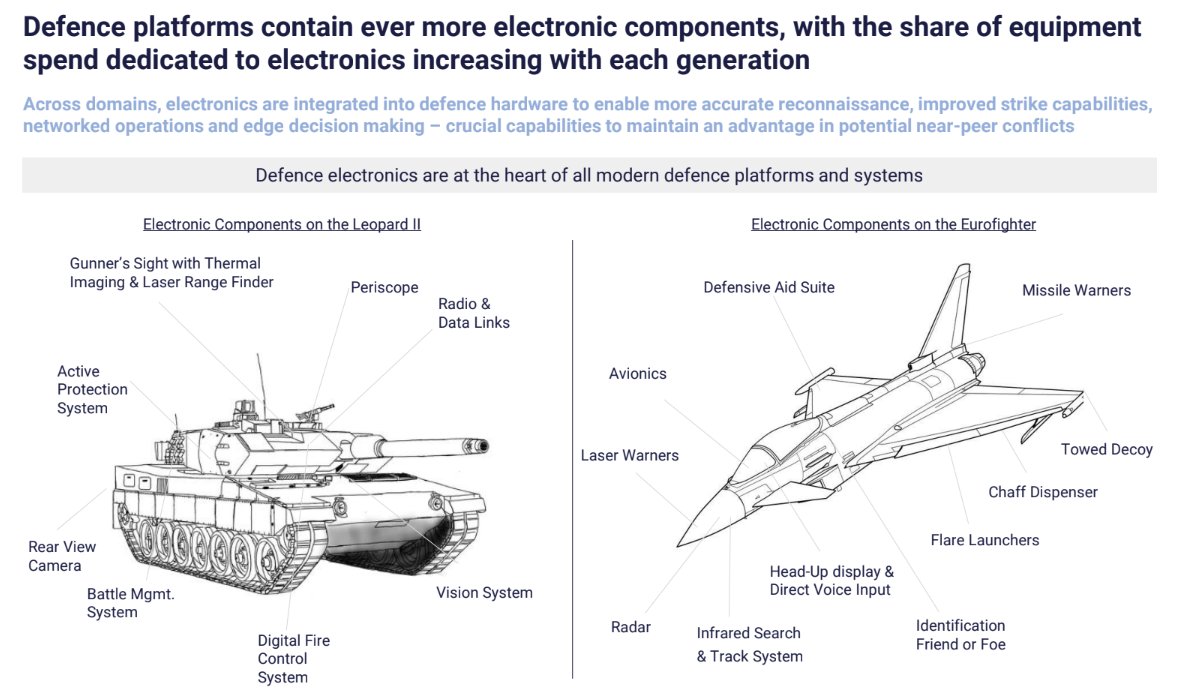

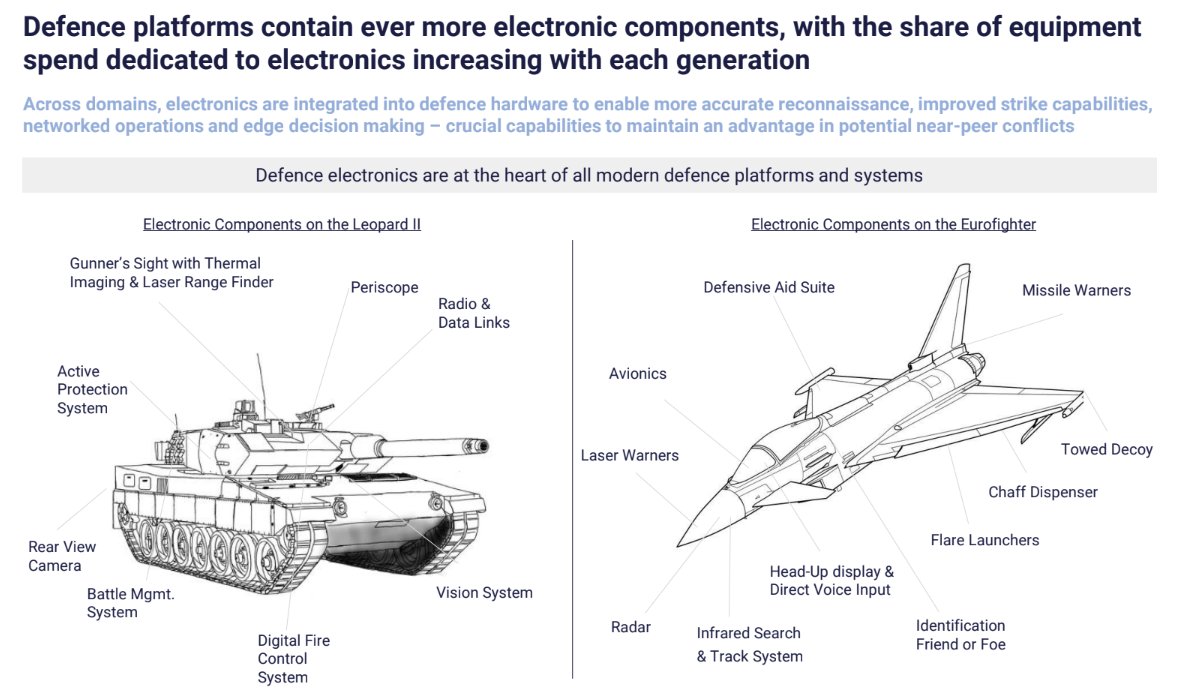

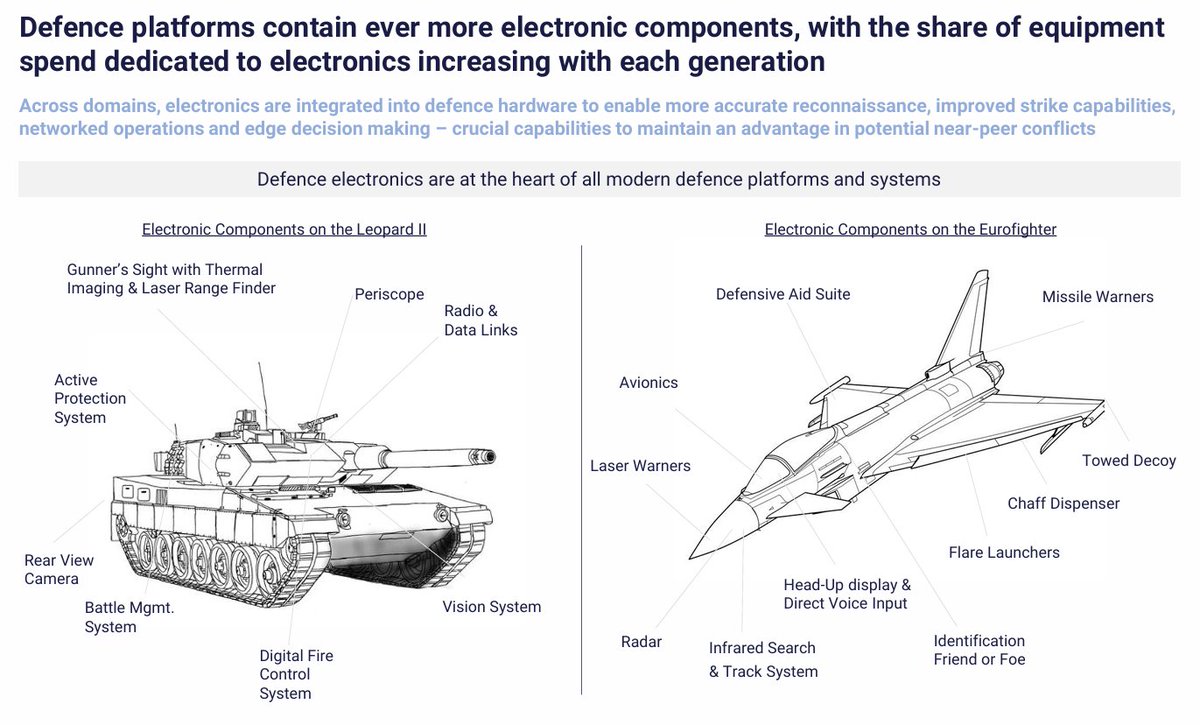

Why electronics have all the leverage

Why electronics have all the leverage

John Risley grew up watching his father struggle to pay bills

John Risley grew up watching his father struggle to pay bills

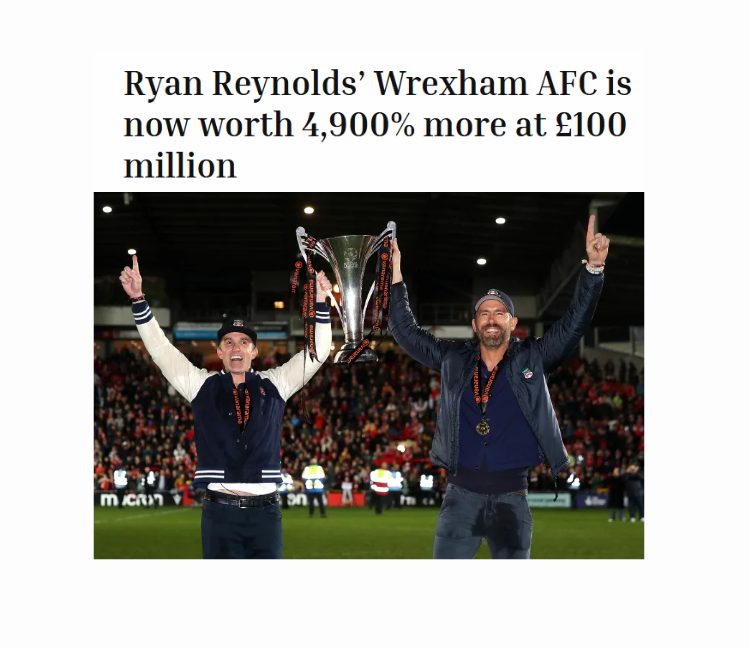

Ryan Reynolds and Rob McElhenney bought Wrexham AFC for £2M in February 2021.

Ryan Reynolds and Rob McElhenney bought Wrexham AFC for £2M in February 2021.

The Playboy Years

The Playboy Years

The Philosopher Who Studied How We Lie

The Philosopher Who Studied How We Lie

Peter Thiel studied under René Girard at Stanford

Peter Thiel studied under René Girard at Stanford

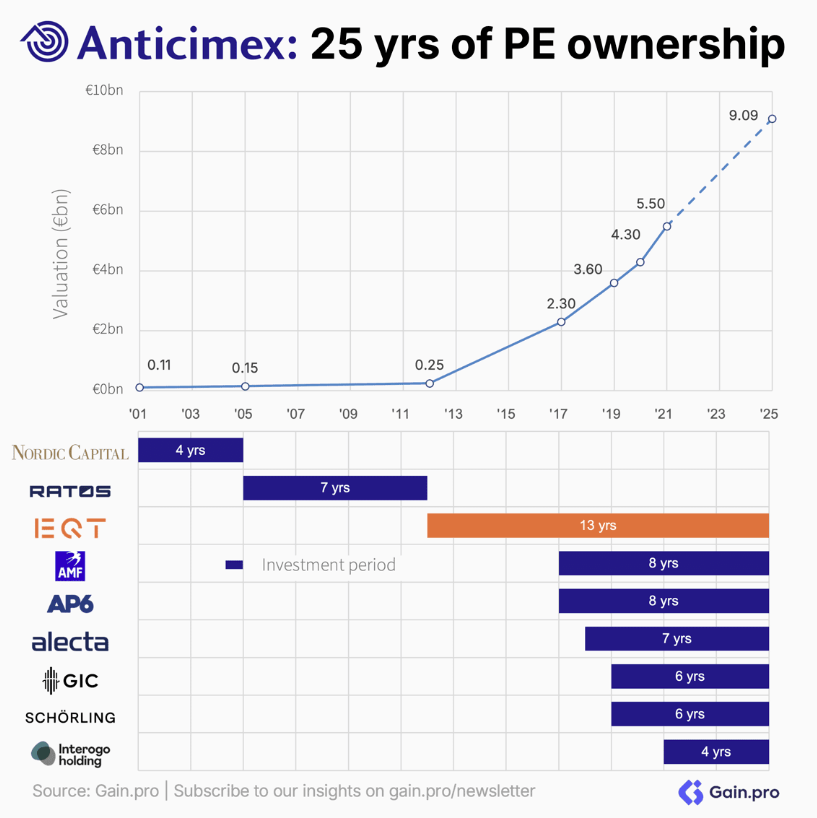

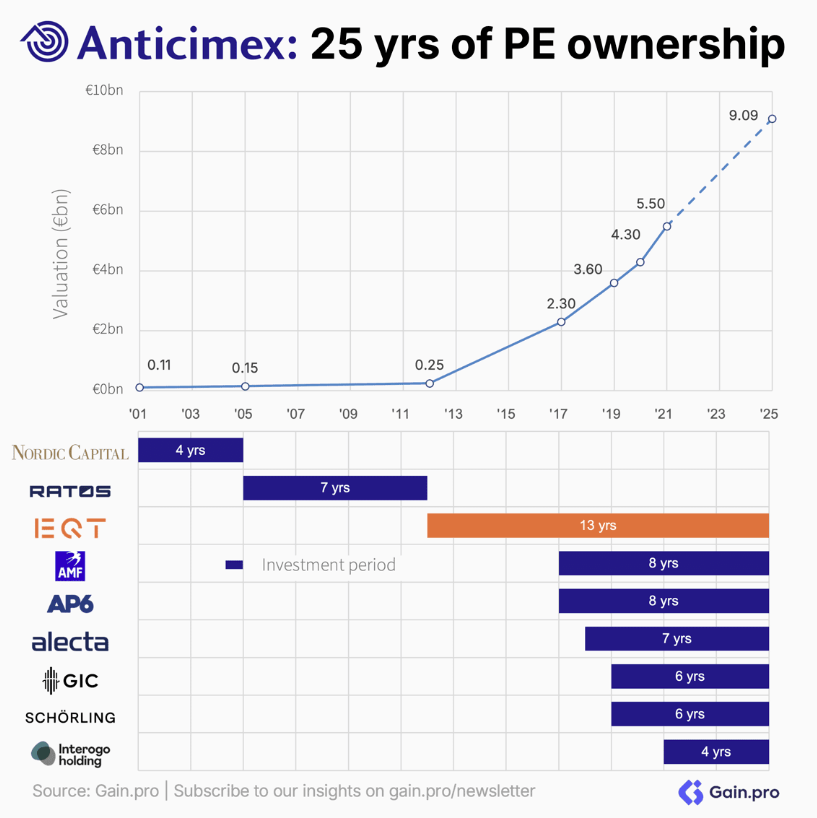

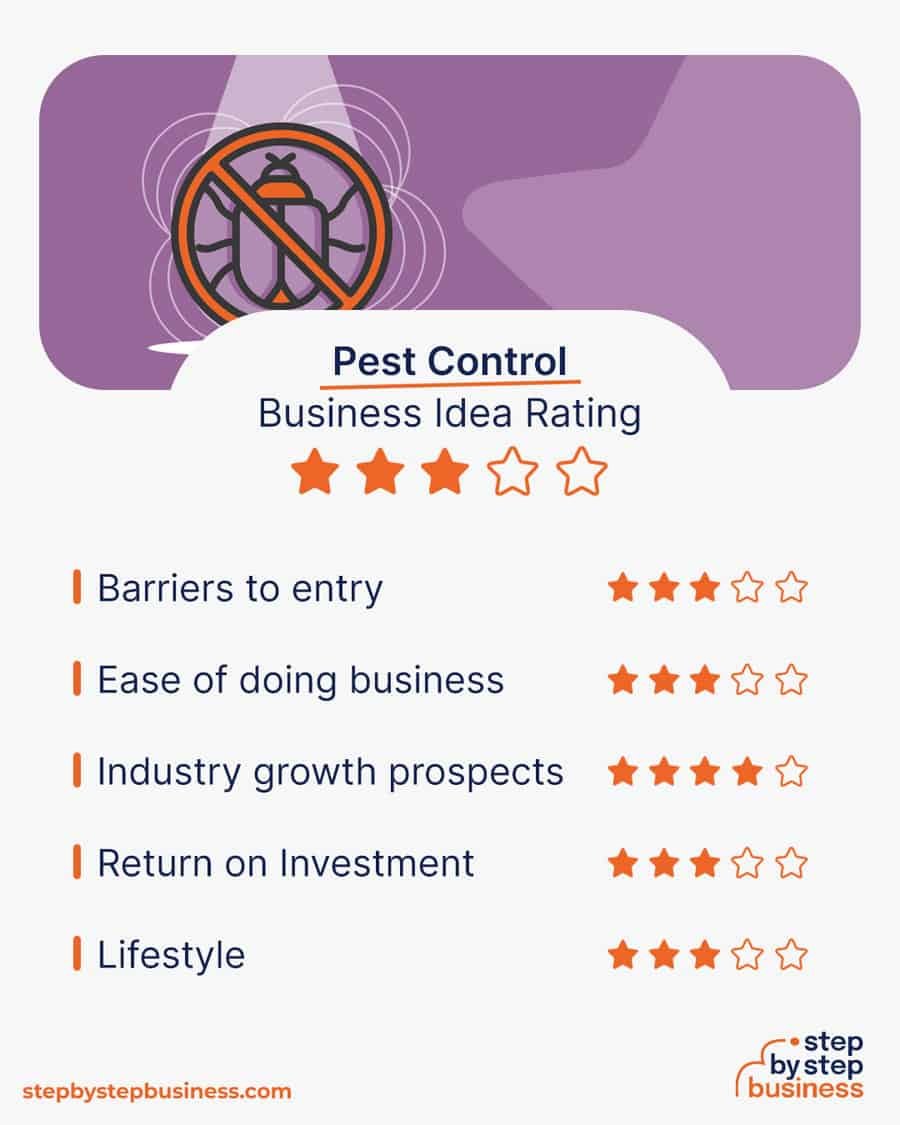

Why pest control?

Why pest control?

Every big winner controls one of four chokepoints:

Every big winner controls one of four chokepoints:

Larry Mendelson started as accountant, trained to stare at numbers until the truth appeared.

Larry Mendelson started as accountant, trained to stare at numbers until the truth appeared.

When a NVIDIA, makes up 8% of the S&P 500, it’s reasonable to wonder whether an AI bubble is inflating.

When a NVIDIA, makes up 8% of the S&P 500, it’s reasonable to wonder whether an AI bubble is inflating.

A Giant Under Siege

A Giant Under Siege

For decades, Denny’s WAS America

For decades, Denny’s WAS America

Buy and Rebuild

Buy and Rebuild

Germany, 1945.

Germany, 1945.

TARGET

TARGET

The Rebel Lawyer

The Rebel Lawyer

First Taste of Leverage

First Taste of Leverage

$150K Bet That Made $15 Million

$150K Bet That Made $15 Million

Origins of a Warrior Banker

Origins of a Warrior Banker

What They Buy

What They Buy