Tiger Brokers $TIGR 🐯 Q1:

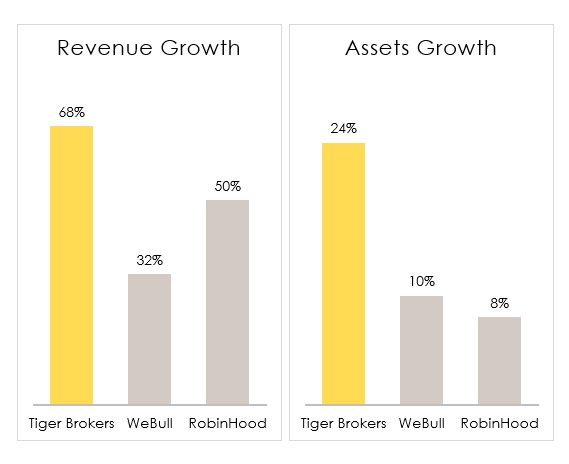

▪️Revenue: +68%

▪️Operating Profit: +203%

▪️Operating Margin: 38% (⬆️17 p.p.)

▪️OPEX-to-Revenue: ATL (and declining)

▪️ARPU: +35%

📊Trading Volume: +155%

👪Customers: +24%

💷Customer Assets: 40%

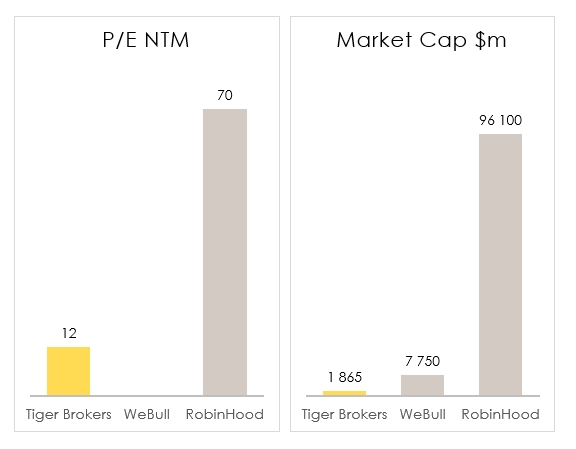

P/E 12x NTM is probably too cheap. A short 🧵👇

▪️Revenue: +68%

▪️Operating Profit: +203%

▪️Operating Margin: 38% (⬆️17 p.p.)

▪️OPEX-to-Revenue: ATL (and declining)

▪️ARPU: +35%

📊Trading Volume: +155%

👪Customers: +24%

💷Customer Assets: 40%

P/E 12x NTM is probably too cheap. A short 🧵👇

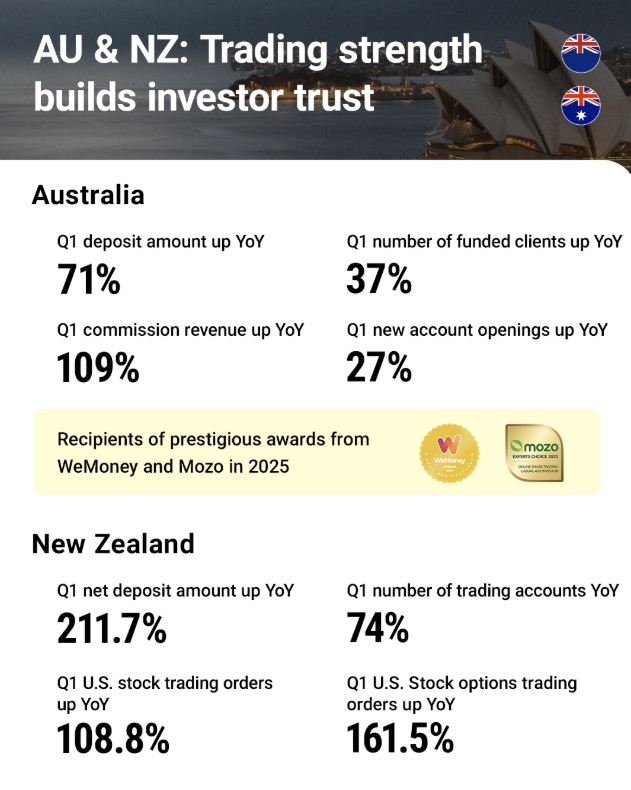

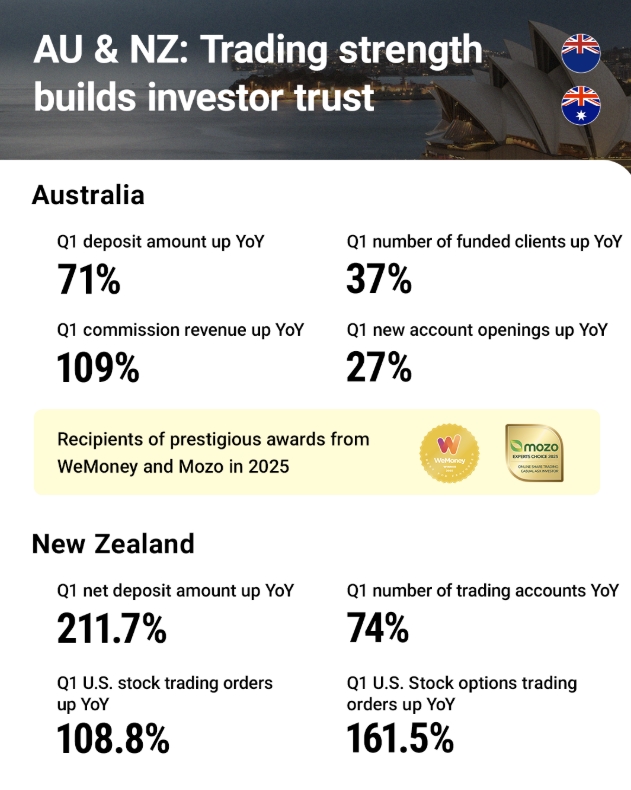

In Australia 🇦🇺 and New Zealand 🇳🇿 the breakneck growth and market share gains seen in 2024 continued into Q1-2025:

Singapore 🇸🇬, already a well-established profit center- much like Germany 🇩🇪 is for $FTK.DE or Sweden 🇸🇪 is for $SAVE - still delivered impressive 60-100% growth rates across several segments.

In December 2022, call it early 2023, $TIGR decided to enter the home-turf of $FUTU: Hong Kong 🇭🇰

Hypergrowth experienced in 2024 continued into Q1-2025. Mind you, most of these are QoQ numbers...😶

Hypergrowth experienced in 2024 continued into Q1-2025. Mind you, most of these are QoQ numbers...😶

Last month, the CEO announced plans to double headcount in Hong Kong in the coming years - and we're still just scratching the surface.

Moreover, the data I’ve compiled shows that the Hong Kong expansion has already proven highly beneficial.

Moreover, the data I’ve compiled shows that the Hong Kong expansion has already proven highly beneficial.

Another interesting KPI that I can share is that last month trading by clients of Tiger surpassed that of Ant Group's Bright Smart Securities on the HKEX.

2x mcap $tigr 1428.hk

2x mcap $tigr 1428.hk

Their entry into the United States 🇺🇸 is small and, for me at least, irrelevant at this point.

As all the licenses are already in place, and products/markets are already established - one can look at it as purely incremental nonetheless.

As all the licenses are already in place, and products/markets are already established - one can look at it as purely incremental nonetheless.

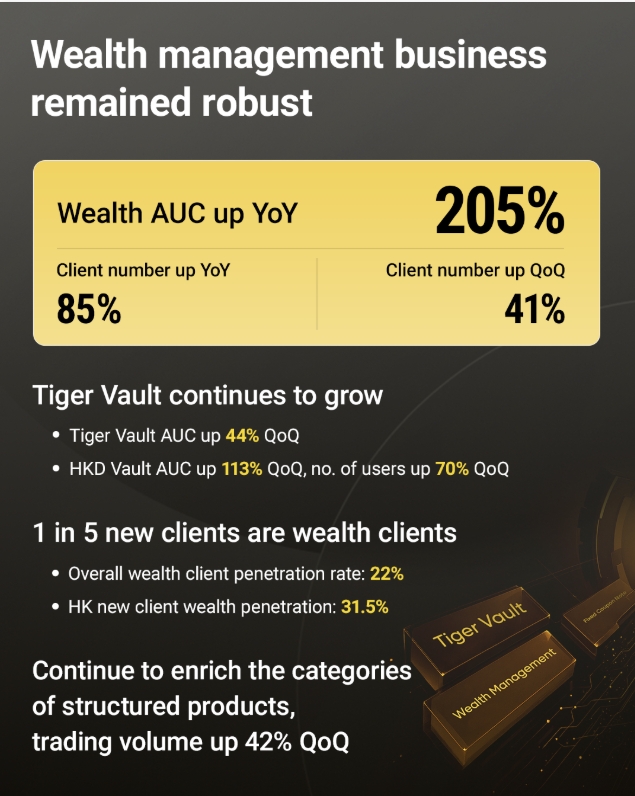

My main focus right now is Wealth Management - as it creates a sticky revenue base.

*scrolls for emoji's*

🚀🚀🚀

*scrolls for emoji's*

🚀🚀🚀

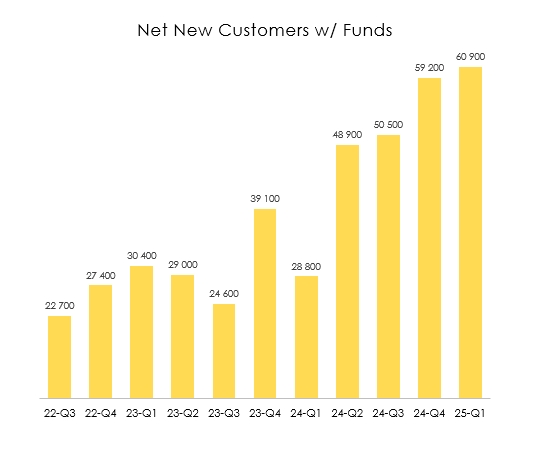

Tiger is guiding for 150,000 new accounts in FY2025 - but smashed the expectations with adding 60,900 already in Q1 (40% of the annual target).

Can't wait for the upward revisions...

Can't wait for the upward revisions...

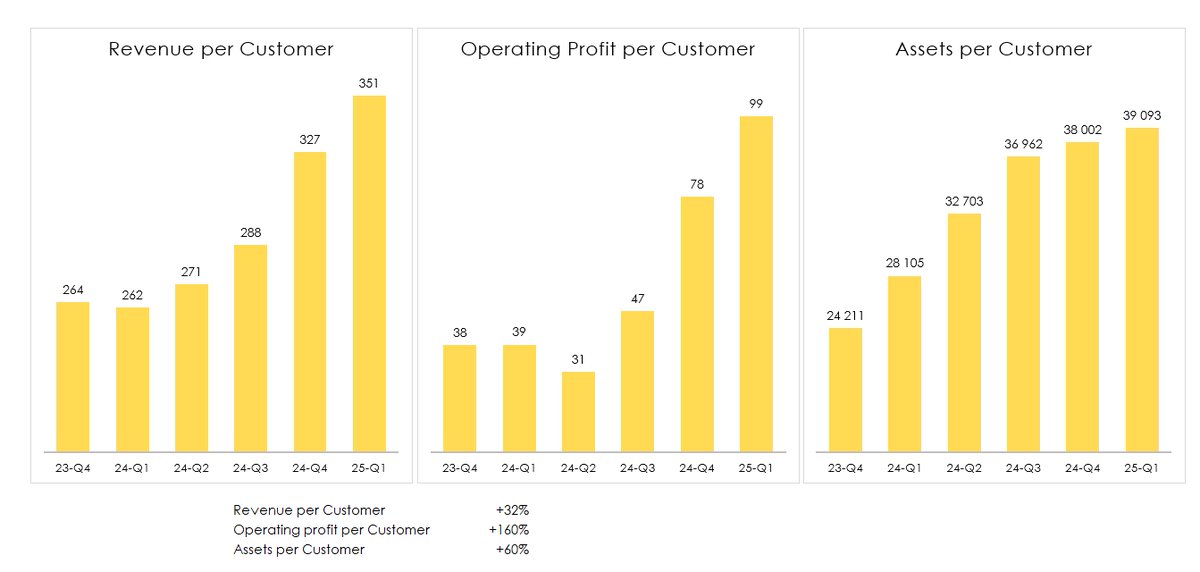

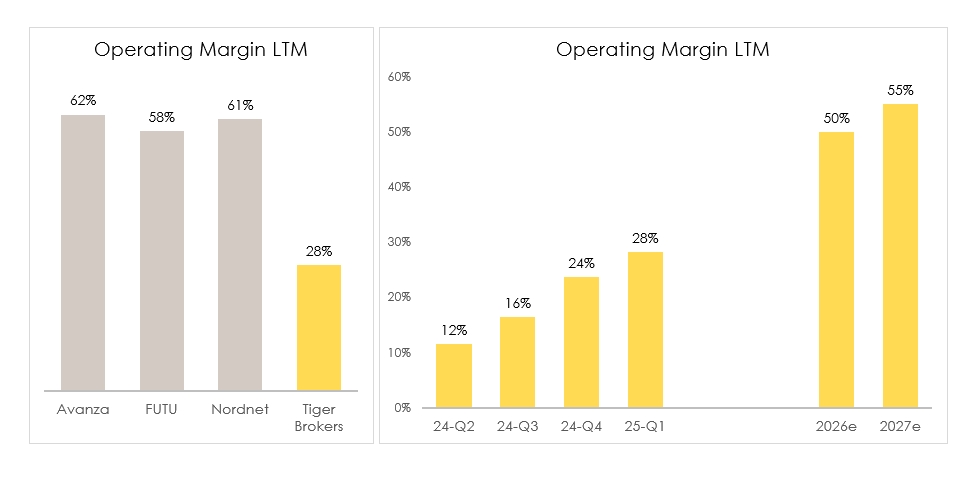

Now that the business has reached sufficient scale, we're seeing operating leverage kick in - and the impact is massive.

The valuation dislocation is outrageous and $TIGR could double overnight, and still be cheap. $BULL $HOOD

Although I'm very grateful for the print 🧧💵by $FUTU this year - it's getting frothy and I've started to unload.

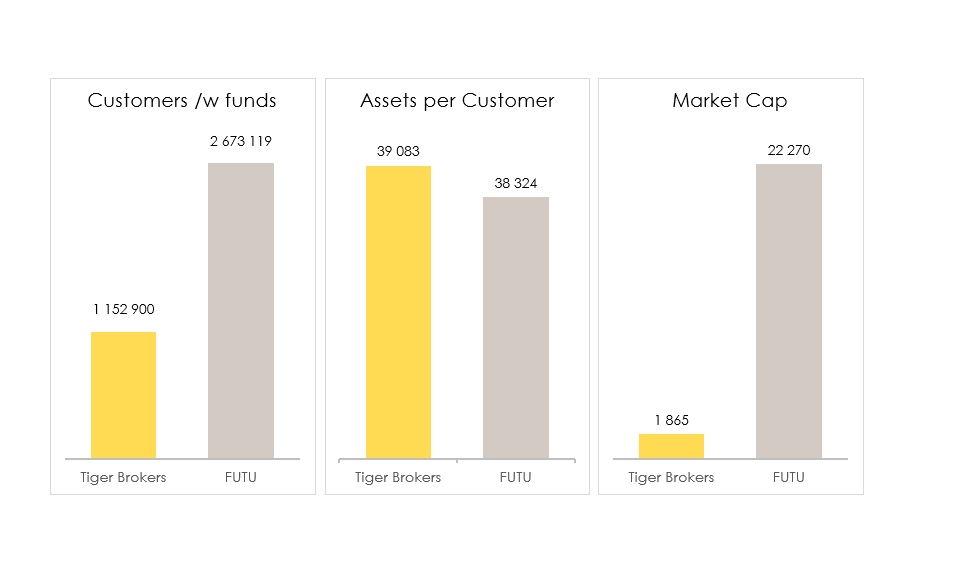

Pay up 12x the market cap of $TIGR, but only get 2.5x the customers (and similar growth rates)?

Switcheroo 🏇!

Pay up 12x the market cap of $TIGR, but only get 2.5x the customers (and similar growth rates)?

Switcheroo 🏇!

Here's the real kicker: margins.

As $TIGR shifts from land-grab mode to scaled operations, its margin trajectory should mirror other mature brokers - just as they did post-scale.

Consensus have margins topping out at ~30% which I will bet against, by being aggressively long.

As $TIGR shifts from land-grab mode to scaled operations, its margin trajectory should mirror other mature brokers - just as they did post-scale.

Consensus have margins topping out at ~30% which I will bet against, by being aggressively long.

Disclaimer:

Largest position going into Q2.

These views are drawn from my personal analysis and are inherently biased. This is not a recommendation. You should always do your own thorough research and seek professional advice before investing.

Largest position going into Q2.

These views are drawn from my personal analysis and are inherently biased. This is not a recommendation. You should always do your own thorough research and seek professional advice before investing.

• • •

Missing some Tweet in this thread? You can try to

force a refresh