5 Powerful Lessons from Unfair Advantage: The Power of Financial Education by Robert Kiyosaki

1. Delayed Gratification Is a Competitive Advantage

In a culture driven by consumerism and urgency, those who can delay gratification position themselves for long-term success.

Rather than chasing quick wins, the financially educated understand the value of compounding, whether in investing, learning, or decision-making.

Success belongs to those who prepare, not those who rush.

In a culture driven by consumerism and urgency, those who can delay gratification position themselves for long-term success.

Rather than chasing quick wins, the financially educated understand the value of compounding, whether in investing, learning, or decision-making.

Success belongs to those who prepare, not those who rush.

2. You Do Not Rise to the Level of Your Goals. You Fall to the Level of Your Systems

Desire alone does not build wealth; discipline and structure do.

Financial education is only useful when paired with actionable systems: saving habits, investment plans, budgeting frameworks, and regular review.

Your systems quietly determine your financial outcomes.

Desire alone does not build wealth; discipline and structure do.

Financial education is only useful when paired with actionable systems: saving habits, investment plans, budgeting frameworks, and regular review.

Your systems quietly determine your financial outcomes.

3. Your Network Influences Your Net Worth

One of the most understated principles in building wealth is proximity.

Being around people who understand money, talk about opportunities, and take action will elevate your thinking and standards.

Environment is not just physical; it's intellectual and emotional too.

One of the most understated principles in building wealth is proximity.

Being around people who understand money, talk about opportunities, and take action will elevate your thinking and standards.

Environment is not just physical; it's intellectual and emotional too.

4. In a Distracted World, Focus Is a High-Income Skill

While most people drown in information and entertainment, the financially educated learn to focus.

They allocate their attention to high-leverage activities. reading financial statements, analyzing opportunities, building businesses, or developing skill sets.

Focus converts potential into productivity.

While most people drown in information and entertainment, the financially educated learn to focus.

They allocate their attention to high-leverage activities. reading financial statements, analyzing opportunities, building businesses, or developing skill sets.

Focus converts potential into productivity.

5. Money Is a Tool, Not a Trophy

Financially literate individuals do not pursue money for validation.

They use money as a tool to acquire freedom, generate passive income, and gain control over time and choices.

Wealth is not about appearing rich. It's about having options.

Financially literate individuals do not pursue money for validation.

They use money as a tool to acquire freedom, generate passive income, and gain control over time and choices.

Wealth is not about appearing rich. It's about having options.

Want to Build Your Own Financial Advantage No Matter Your Background?

Start here.

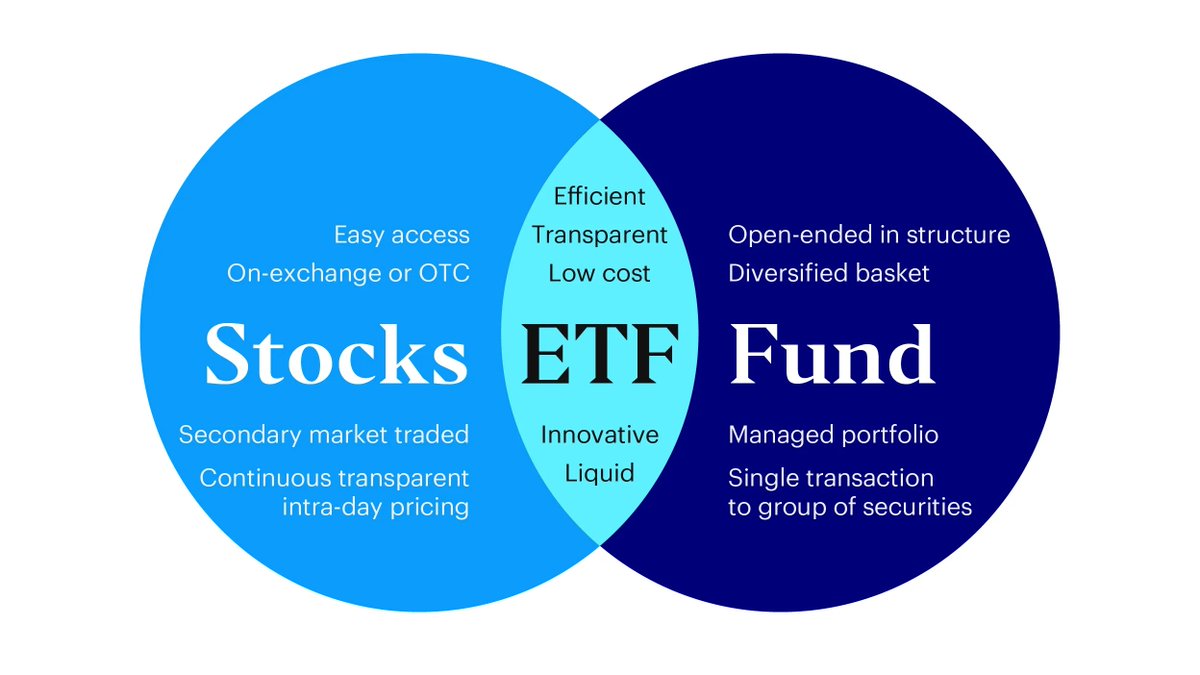

Discover The Naija Investor—a simple, practical guide to understanding how Nigeria’s stock market really works. Whether you're a Nepo or a Lapo, this book will teach you how to:

Make your first investment confidently

Understand the power of compounding in the Nigerian context

Avoid costly beginner mistakes

Multiply what you already have

Build wealth intentionally and legally

Over 300 young Nigerians have used this guide to start their journey into financial freedom.

Available now.

selar.com/d50i92

Your background is your story, not your sentence.

Learn how to change your financial narrative, one investment at a time.

Start here.

Discover The Naija Investor—a simple, practical guide to understanding how Nigeria’s stock market really works. Whether you're a Nepo or a Lapo, this book will teach you how to:

Make your first investment confidently

Understand the power of compounding in the Nigerian context

Avoid costly beginner mistakes

Multiply what you already have

Build wealth intentionally and legally

Over 300 young Nigerians have used this guide to start their journey into financial freedom.

Available now.

selar.com/d50i92

Your background is your story, not your sentence.

Learn how to change your financial narrative, one investment at a time.

• • •

Missing some Tweet in this thread? You can try to

force a refresh