1/ If Trump forces Powell out, markets could no longer assume Fed will hit 2% inflation no matter what. Inflation would be subordinated to White House's larger agenda. No longer the brakes, the Fed would be part of the engine. My column: wsj.com/economy/centra…

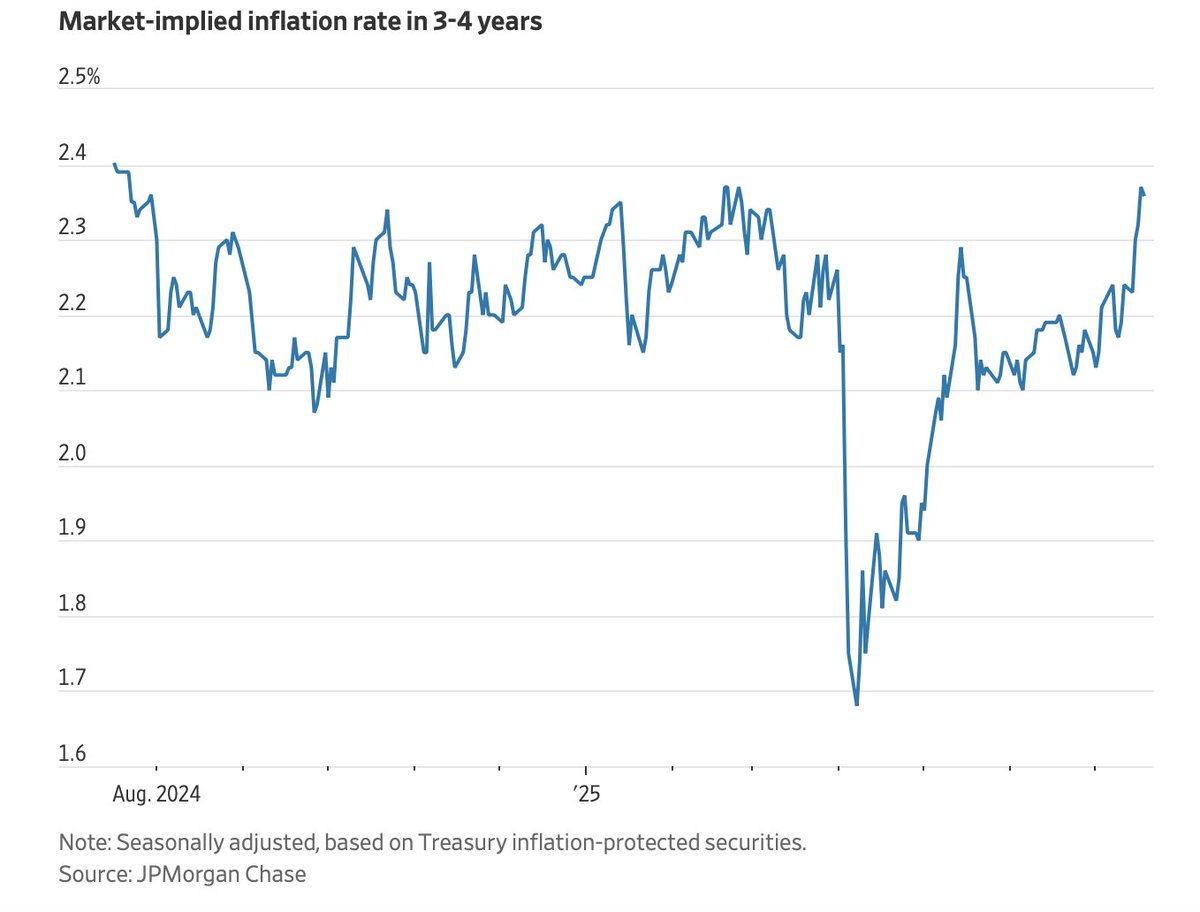

2/ It's remarkable that through pandemic, stimulus, tariffs, deportations & soaring debt, inflation expectations stayed anchored around 2%. A victory for post-93 regime of political noninterference & inflation targeting.

3/ If Powell is removed, markets would assume the next chair could also be removed if president isn't happy with him. (Removal "for cause" when president gets to define "cause" is tantamount to removal without cause.) Independence would, de facto, be gone.

4/ The repercussions would unfold slowly. I'm skeptical of predictions the market will crash; such predictions have been frequent & wrong about Trump (and Brexit) and seem to embolden Trump

https://x.com/greg_ip/status/1945865369018638417

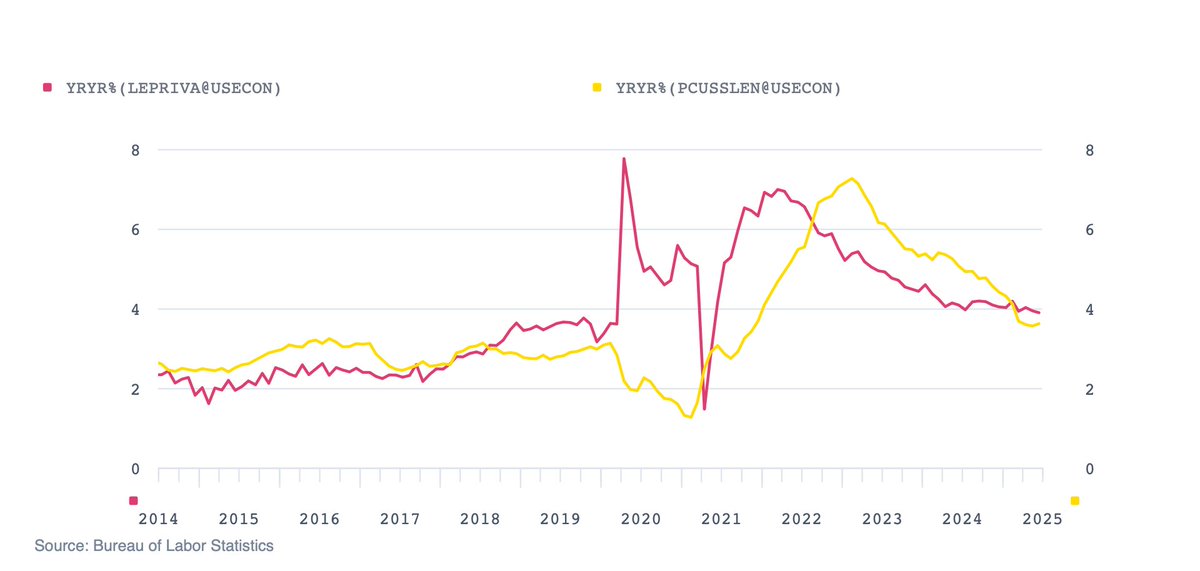

5/ And lags from Fed policy (incl. change of chair) to inflation are long and variable. Near term direction of inflation is down w/inertial service, wage inflation falling (red: wages, yellow: core CPI svcs). Tariffs both add to inflation pressure & subtract (reduce real income).

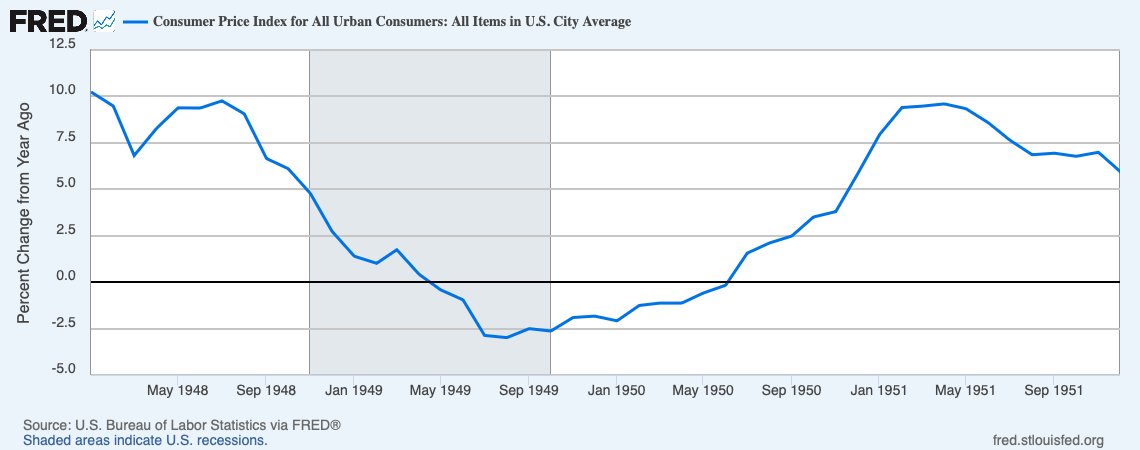

6/ Independence matters when pressures on inflation are upward and Fed has to decide how forcefully to pre-empt them. By the time Fed got out from under Treasury's thumb in '51, inflation was already rising rapidly (Korean War disruptions).

7/ Trump's threats against Powell have started to affect medium-term inflation expectations. The one-year TIPS inflation rate three years forward (after tariffs wash out) is up 21 bp this month (via JPMorgan)

• • •

Missing some Tweet in this thread? You can try to

force a refresh