How to get URL link on X (Twitter) App

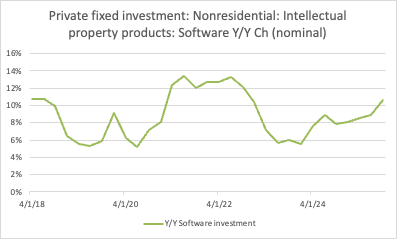

2/ Here's another: nominal business investment in software is accelerating (this incorporates developer salaries). This suggests software demand is elastic: as the price drops, demand rises even more. (Jevons paradox?)

2/ Here's another: nominal business investment in software is accelerating (this incorporates developer salaries). This suggests software demand is elastic: as the price drops, demand rises even more. (Jevons paradox?)

2/ This confirms what I have long suspected: Chinese growth does not "contribute" to global growth except in the purely arithmetic sense. It does not actually create positive feedbacks that lift other countries' growth. That's by design...

2/ This confirms what I have long suspected: Chinese growth does not "contribute" to global growth except in the purely arithmetic sense. It does not actually create positive feedbacks that lift other countries' growth. That's by design...

https://twitter.com/chamath/status/19647373576489656612/ A sample can be done extremely quickly. The unemployment rate & CPI are both based on samples, of households, and consumer spending outlets, & thus come out quickly and are never revised (except for seasonal adjustment). This imparts a false sense of precision and finality.

2/ Spears and Geruso don't invoke the usual risks of falling population such as a smaller labor force and more pressure on Social Security. Rather, they argue a larger, or stable, population is a good thing in and of itself.

2/ Spears and Geruso don't invoke the usual risks of falling population such as a smaller labor force and more pressure on Social Security. Rather, they argue a larger, or stable, population is a good thing in and of itself.

https://twitter.com/SpencerHakimian/status/19108456099525513532/ That may be true now, but not when Apple went to China 25 years ago. Apple had factories (& skills) in U.S. at the time. Cook came to Apple in 1998 to run operations, closed those factories and, imitating Dell & Compaq, offshored production to Asia. wsj.com/articles/tim-c…

2/ Real home prices and price/income ratios aren't good valuation measures when real cost & quality of shelter is rising. Price to rent ratios are superior because owning and renting are close substitutes. So rents up 24% v. prices up 51% since 2019 is a big red flag.

2/ Real home prices and price/income ratios aren't good valuation measures when real cost & quality of shelter is rising. Price to rent ratios are superior because owning and renting are close substitutes. So rents up 24% v. prices up 51% since 2019 is a big red flag.

https://twitter.com/michaelxpettis/status/17047895343726922712/ Does protection raise productivity and wages? If that were universally true, India and Brazil would have the world's highest wages. It worked for east Asia because it went hand in hand with export orientation, high investment, and businesses that learned & adapted quickly.