📊**The "LCOE is misleading" megathread **📊

When I write about electricity prices, one of the most common comebacks is a link to some form of LCOE report that says wind and solar are insanely cheap.

Let’s break down what it leaves out, and why it misleads on renewables. 🧵

When I write about electricity prices, one of the most common comebacks is a link to some form of LCOE report that says wind and solar are insanely cheap.

Let’s break down what it leaves out, and why it misleads on renewables. 🧵

1️⃣Levelised Cost of Electricity is the average lifetime cost per unit from a power source.

Add up all costs to build & run a generator and divide by total expected MWh produced. Simple, right? It’s been used for decades to compare power sources on an “equal” basis

Add up all costs to build & run a generator and divide by total expected MWh produced. Simple, right? It’s been used for decades to compare power sources on an “equal” basis

2️⃣ In the old days of big power plants, planners needed a single number to compare dispatchable baseload options (oil, coal, gas, nuclear) in regulated markets.

It assumes steady output, local build and ignores when or how power is delivered – a key point, as we’ll see.

It assumes steady output, local build and ignores when or how power is delivered – a key point, as we’ll see.

3️⃣ LCOE ignores timing and reliability. It does not account for when electricity is produced or if it matches demand.

A kWh at 3am is treated the same as one during evening peak. For intermittent renewables that only generate when nature allows, this is a big blind spot.

A kWh at 3am is treated the same as one during evening peak. For intermittent renewables that only generate when nature allows, this is a big blind spot.

4️⃣ Traditional power plants can ramp up whenever demand spikes—they’re dispatchable. Wind & solar cannot: they rely on weather.

LCOE ignores this mismatch. It might rate solar at £50/MWh, but on a calm, dark January evening it's worthless.

LCOE ignores this mismatch. It might rate solar at £50/MWh, but on a calm, dark January evening it's worthless.

5️⃣ LCOE usually excludes the cost of backup power or storage needed for renewables.

Wind & solar often produce electricity that must be stored for later – extra costs LCOE doesn’t include. It’s like claiming a car is cheap to run but not mentioning you need a second car.

Wind & solar often produce electricity that must be stored for later – extra costs LCOE doesn’t include. It’s like claiming a car is cheap to run but not mentioning you need a second car.

6️⃣ Perhaps the biggest flaw – LCOE ignores all the extra infrastructure required for intermittent renewables.

LCOE estimates rarely include the real costs high renewable shares require: new transmission lines, grid reinforcement, flywheels, capacity markets and batteries.

LCOE estimates rarely include the real costs high renewable shares require: new transmission lines, grid reinforcement, flywheels, capacity markets and batteries.

7️⃣ LCOE made sense comparing steady-output plants. But for variable renewables, it’s unsuitable. Even the U.S. Energy Dept and grid operators now use more nuanced metrics such as LACE.

But LCOE’s simplicity keeps it in play – often misused by those pushing a narrative.

But LCOE’s simplicity keeps it in play – often misused by those pushing a narrative.

8️⃣ Even without these core flaws it's a poor measurement for such location dependent technology. Back in the days of nuclear, coal and gas the cost to build in the Kentucky was roughly the same as the Yorkshire or Brittany. There was little location dependency to account for.

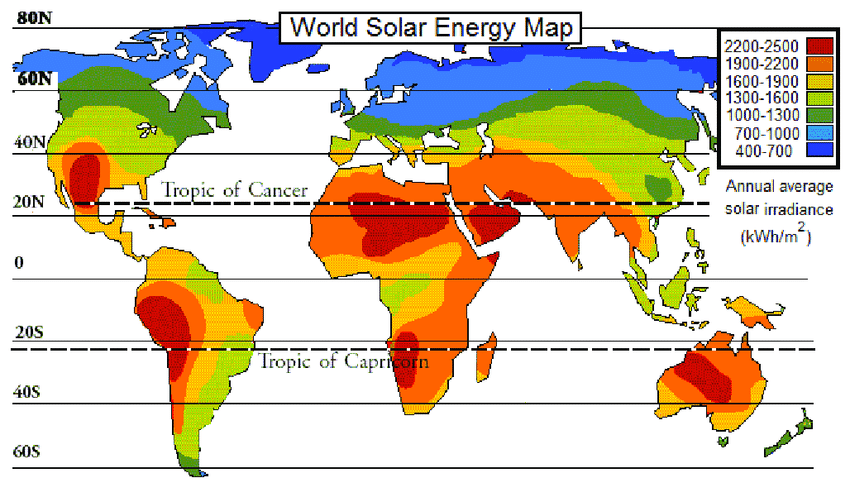

9️⃣ You’ll hear boasts like “solar is $20/MWh now” from reports by IRENA or Lazard. But location matters – a lot.

These are global or U.S. averages, often assuming sunny deserts or high winds. Using those averages for a cloudy, northern place like the UK is highly misleading.

These are global or U.S. averages, often assuming sunny deserts or high winds. Using those averages for a cloudy, northern place like the UK is highly misleading.

🔟 The UK simply doesn’t get as much sun as California or the UAE. A solar panel in England might produce less than half the energy of the same panel in Spain. That means the real cost per MWh here is far higher, even if capital costs are similar. LCOE glosses over this.

1️⃣1️⃣ British consumers aren’t seeing £40/MWh solar or £30/MWh wind. Not even close. Our renewables are funded via long-term subsidy schemes, and the effective costs are many times higher than those global LCOEs. Even for new projects.

https://x.com/LoftusSteve/status/1935230694956941444

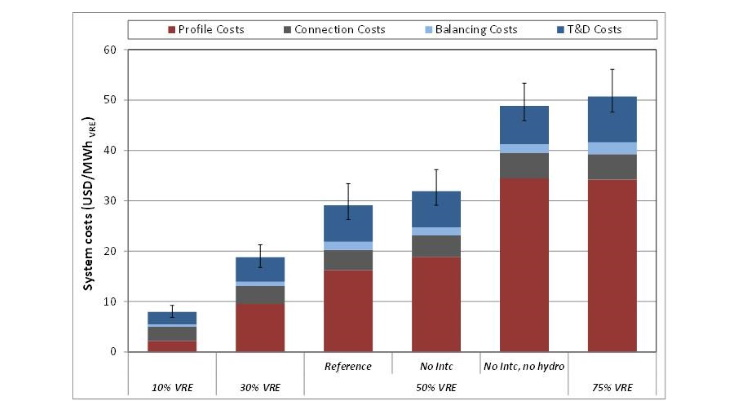

1️⃣2️⃣ Even these numbers do not include the extra gymnastics the grid must do to handle intermittent supply. National Grid spends fortunes on balancing services to keep your lights on when wind drops, building new transmission lines to remote wind farms, voltage control, etc.

1️⃣3️⃣ This OECD chart illustrates how system costs stack up as more renewables enter the mix. The bars on the right (wind, solar at high penetration) show significant added costs for network upgrades to maintain reliability. Conventional plants (left side) have minimal extras.

1️⃣4️⃣ UK politicians still cling to LCOE to claim “renewables are cheapest” and blame gas for high bills. Ed Miliband says more wind/solar will cut costs—but ignores the real burden: massive renewable subsidies and hidden costs layered on top. LCOE hides the true price we pay.

1️⃣5️⃣ Ironically, the one thing LCOE did get right – falling renewable costs – has hit a speed bump. The latest renewable auctions saw higher prices than a few years ago - up 35%, and some offshore wind farms that won contracts at low prices found they can’t afford to build.

bbc.co.uk/news/articles/…

bbc.co.uk/news/articles/…

1️⃣6️⃣ LCOE is a nice neat number, but it hides more than it reveals. It doesn’t guarantee low consumer prices. When someone claims wind or solar is “dirt cheap” because of a glossy LCOE report, remember - location matters. timing matters. integration costs matter.

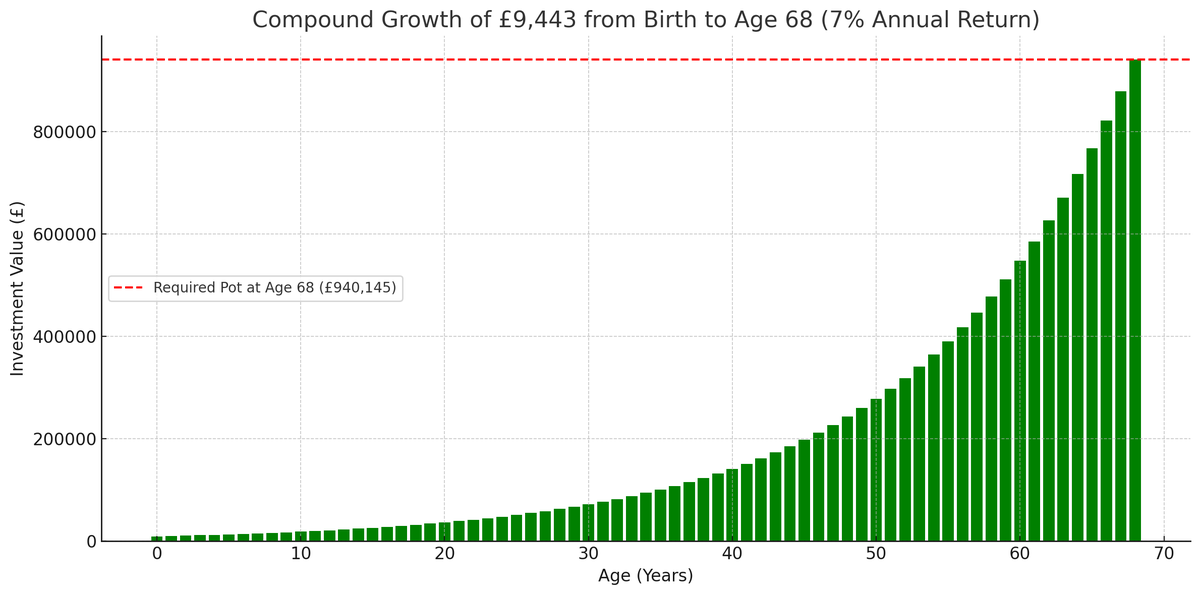

1⃣7⃣ A better measurement, and one that needs more work to make it mainstream is Levelised Full System Cost of Electricity (LFSCOE). This add all system costs to LCOE and make the picture look very different.

• • •

Missing some Tweet in this thread? You can try to

force a refresh