I used to panic at 1R.

Should I hold? Should I take profit?

I’d always go with my “gut feeling” - and usually regret it.

Now I have a simple rule that tells me exactly what to do.

Here’s how I decide when to partial vs hold full size:

🧵

Should I hold? Should I take profit?

I’d always go with my “gut feeling” - and usually regret it.

Now I have a simple rule that tells me exactly what to do.

Here’s how I decide when to partial vs hold full size:

🧵

Early in my trading, I either:

Took profit too early and missed the full run

OR

Held the whole way through… and gave it all back

The problem wasn’t the trade.

It was the uncertainty after entry.

Took profit too early and missed the full run

OR

Held the whole way through… and gave it all back

The problem wasn’t the trade.

It was the uncertainty after entry.

I thought profit-taking was all mindset

“Trust the process.”

“Let winners run.”

But the truth is, you need structure after the entry just as much as before

“Trust the process.”

“Let winners run.”

But the truth is, you need structure after the entry just as much as before

Now, I use the 20/50 EMA cloud to tell me:

Is this setup strong enough to go full-size?

Should I trim fast or hold for the bigger move?

It’s mechanical.

No guessing, and no regret.

Here’s how:

Is this setup strong enough to go full-size?

Should I trim fast or hold for the bigger move?

It’s mechanical.

No guessing, and no regret.

Here’s how:

1) HIGH conviction trades

(full size, hold to target)

This is when you go in with size and hold with conviction.

Momentum is clean across ALL timeframes.

This is where you make your month.

(full size, hold to target)

This is when you go in with size and hold with conviction.

Momentum is clean across ALL timeframes.

This is where you make your month.

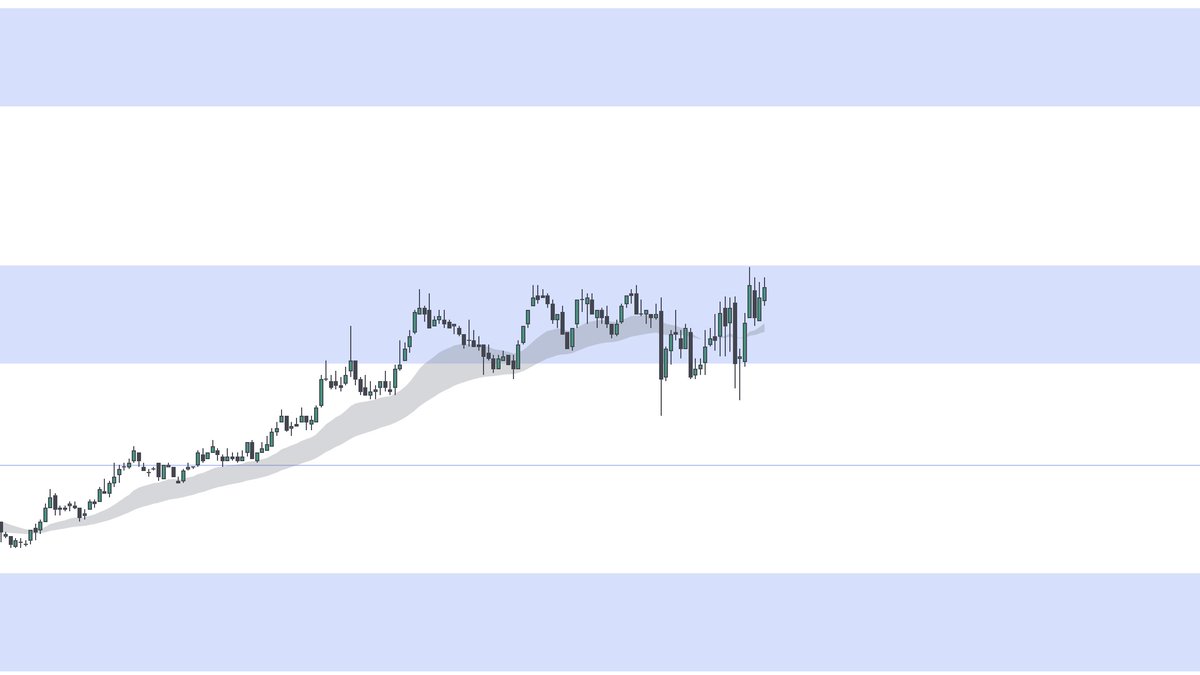

For high conviction trades, we want to see:

1-hour cloud: trending

5-min cloud: trending in the same direction

Should look like this:

1-hour cloud: trending

5-min cloud: trending in the same direction

Should look like this:

These conditions give the HIGHEST probability of the market moving in one direction rather than the other

Enter at a supply/demand level & exit in full once price reaches the next one

Enter at a supply/demand level & exit in full once price reaches the next one

2) MEDIUM conviction trades

(partial early, manage tight)

The bias is valid, but short-term momentum isn’t clean.

You might get a breakout, but expect chop first.

Take 40-50% off around 1R, or halfway

(partial early, manage tight)

The bias is valid, but short-term momentum isn’t clean.

You might get a breakout, but expect chop first.

Take 40-50% off around 1R, or halfway

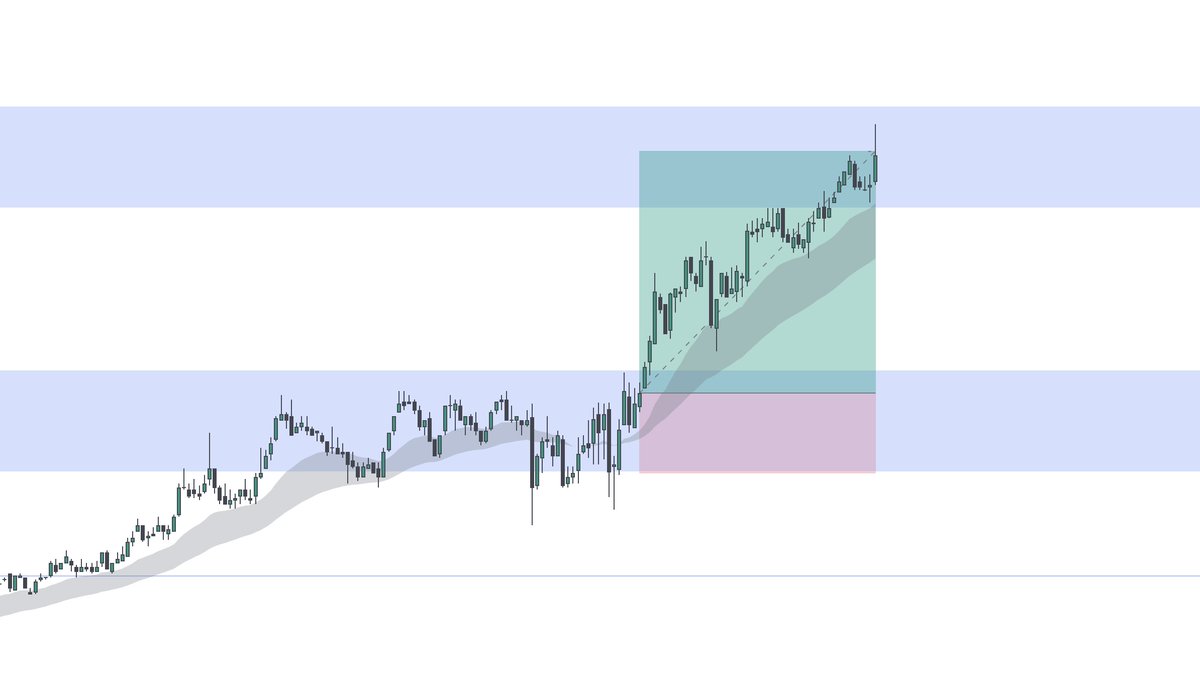

For medium conviction trades, we see:

1h cloud: trending

5 min cloud: flat or sideways

Should look like this:

1h cloud: trending

5 min cloud: flat or sideways

Should look like this:

These conditions give a slight edge to the market moving in one direction rather than the other

Enter at a supply/demand level, take profit early, exit at the next one

Enter at a supply/demand level, take profit early, exit at the next one

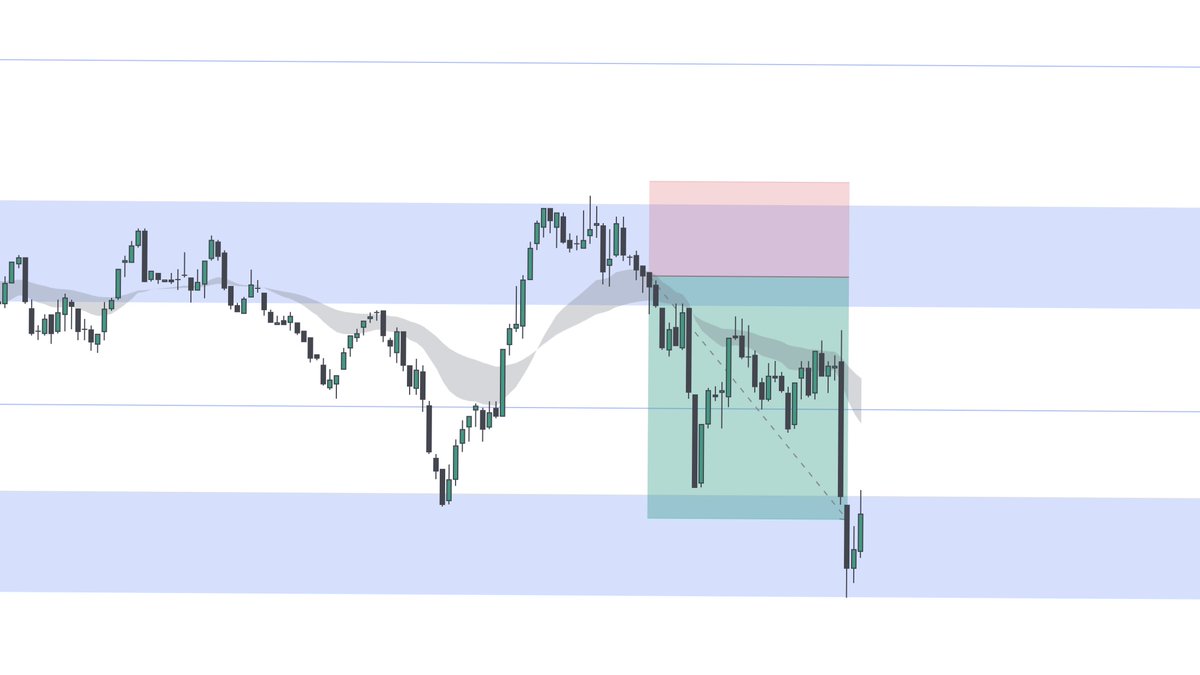

3) NO conviction trades

(Skip or scalp with tight leash)

Two conditions fall under this:

Both clouds are flat or messy

OR

Clouds are trending in opposite directions

This is where I used to force trades and donate to the market.

Now I just pass…

(Skip or scalp with tight leash)

Two conditions fall under this:

Both clouds are flat or messy

OR

Clouds are trending in opposite directions

This is where I used to force trades and donate to the market.

Now I just pass…

Most traders enter well but exit emotionally

They hope it runs, or panic when it hesitates

I just follow cloud conviction.

It tells me if the trade has real potential or if I should play defense.

That's the edge.

They hope it runs, or panic when it hesitates

I just follow cloud conviction.

It tells me if the trade has real potential or if I should play defense.

That's the edge.

If you want to learn the EXACT strategy to achieve this in detail, I made a free training showing you how:

thetradewriter.com/free-training?…

thetradewriter.com/free-training?…

Like this thread?

Follow me for more real trading advice

@Tradewrite

Like & retweet below👇

Follow me for more real trading advice

@Tradewrite

Like & retweet below👇

https://x.com/Tradewrite/status/1947109498247671980

• • •

Missing some Tweet in this thread? You can try to

force a refresh