How to get URL link on X (Twitter) App

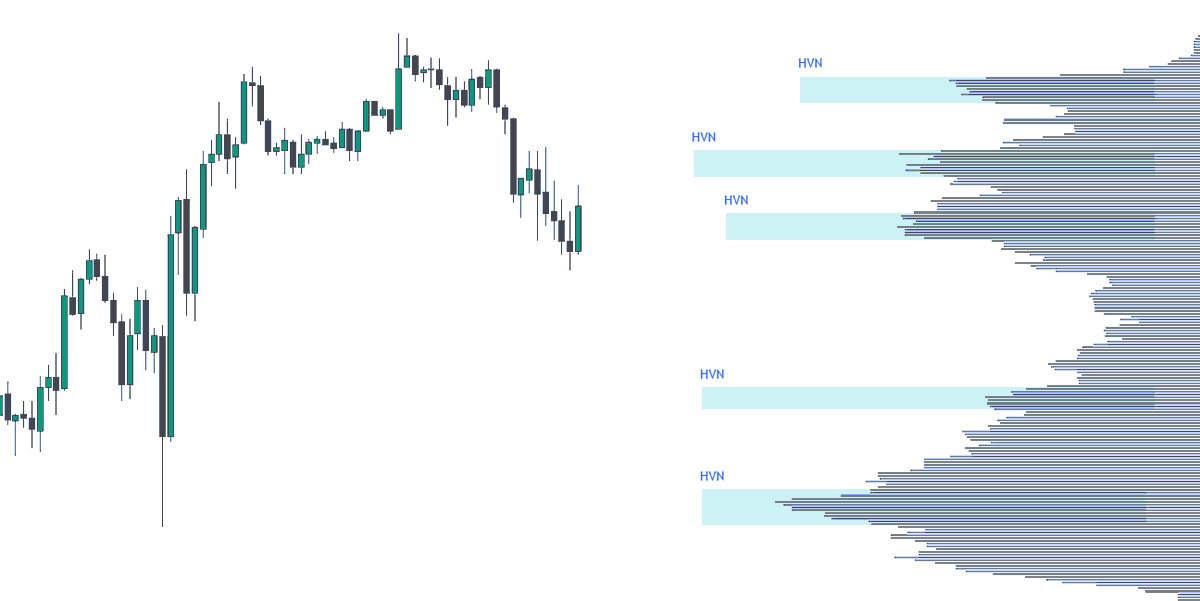

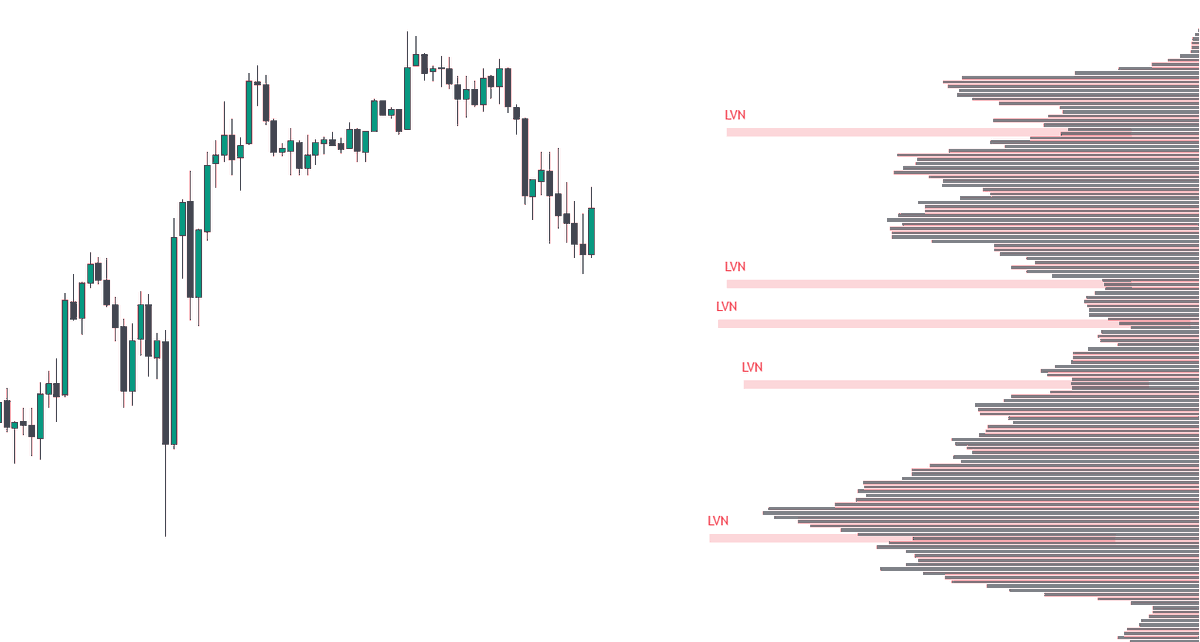

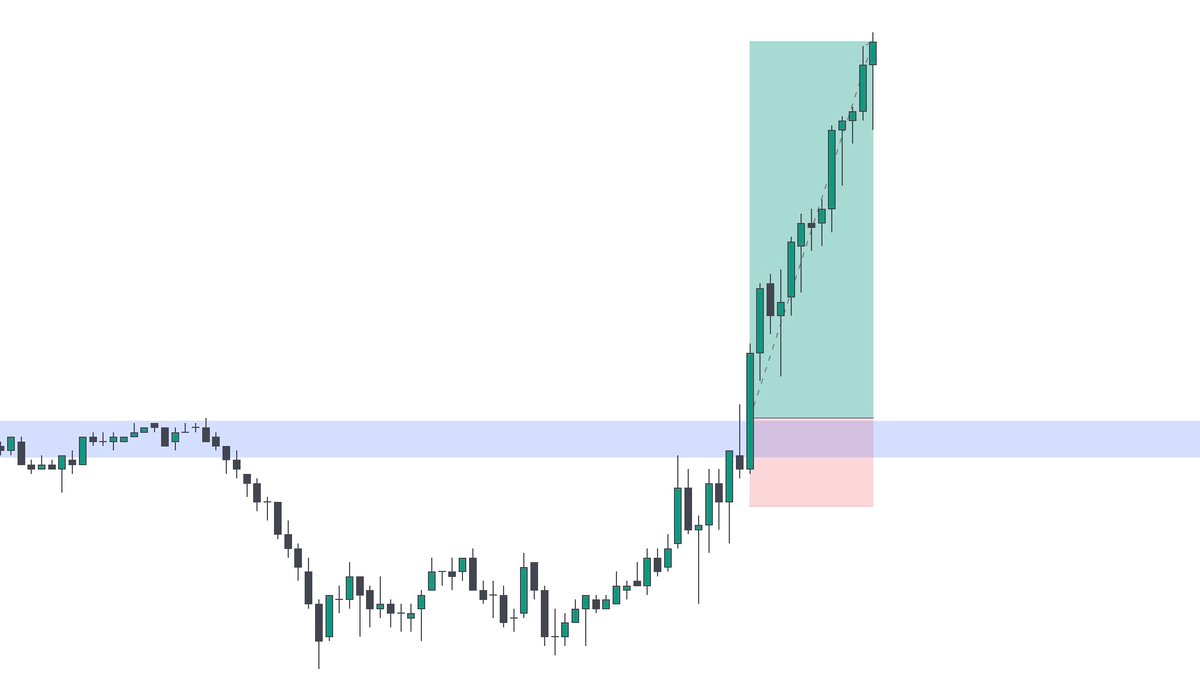

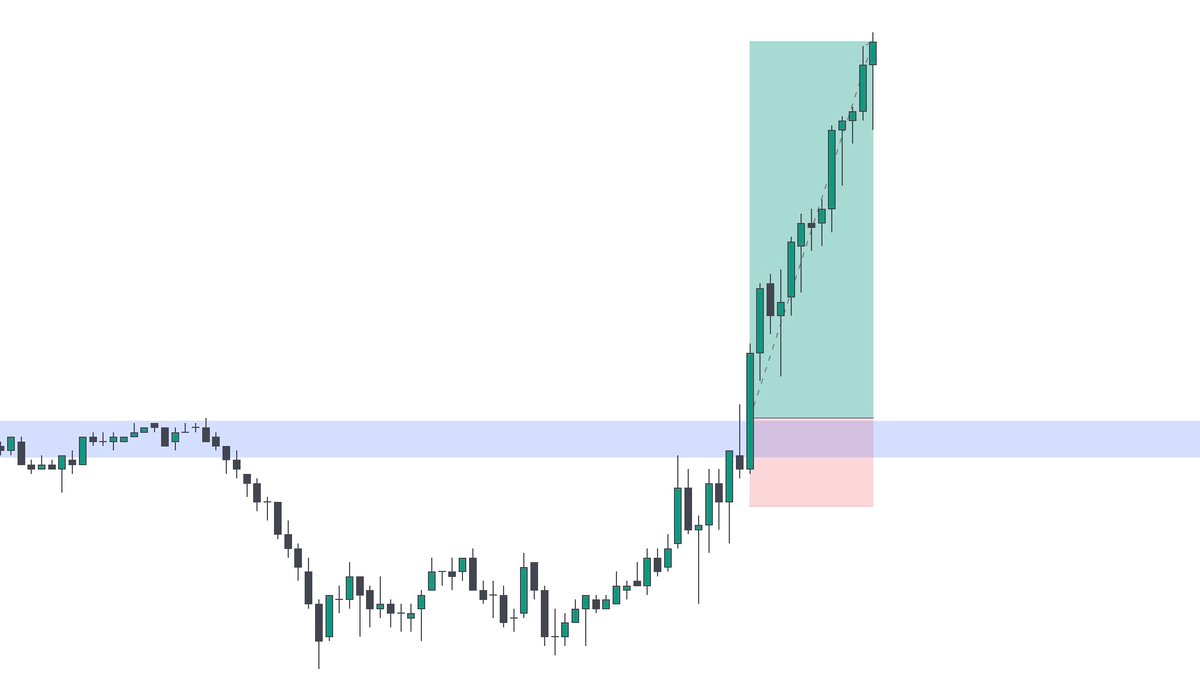

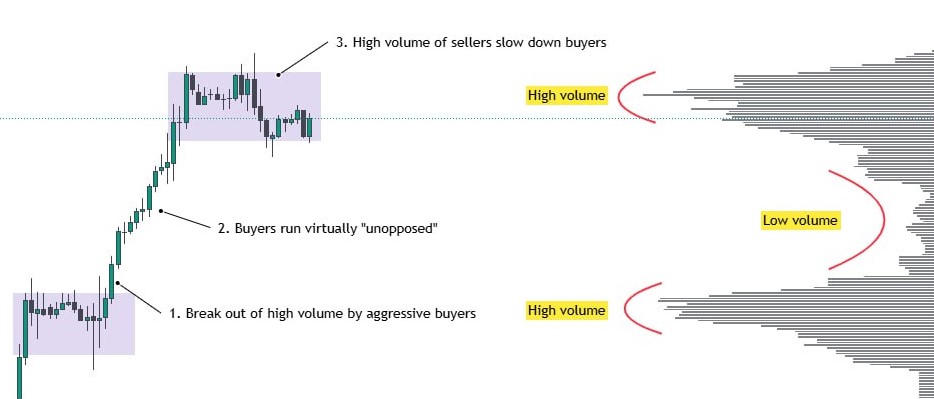

Volume Profile shows you how much volume was traded at each price.

Volume Profile shows you how much volume was traded at each price.

Trading what you think will happen is a losing game.

Trading what you think will happen is a losing game.

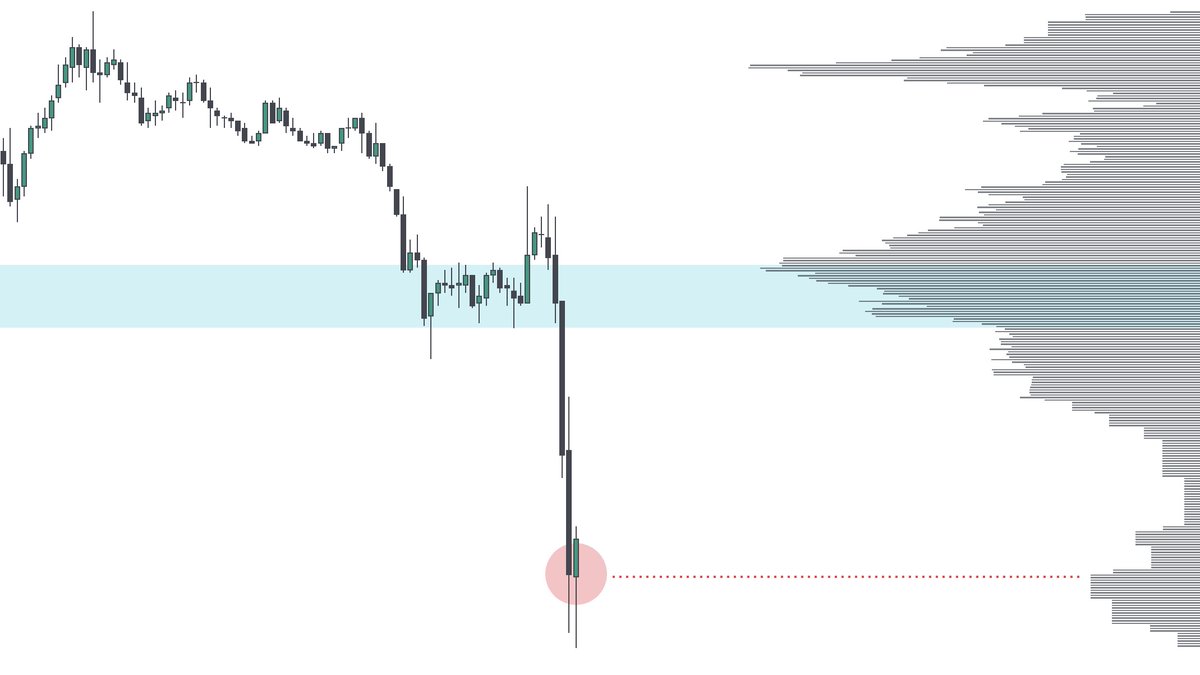

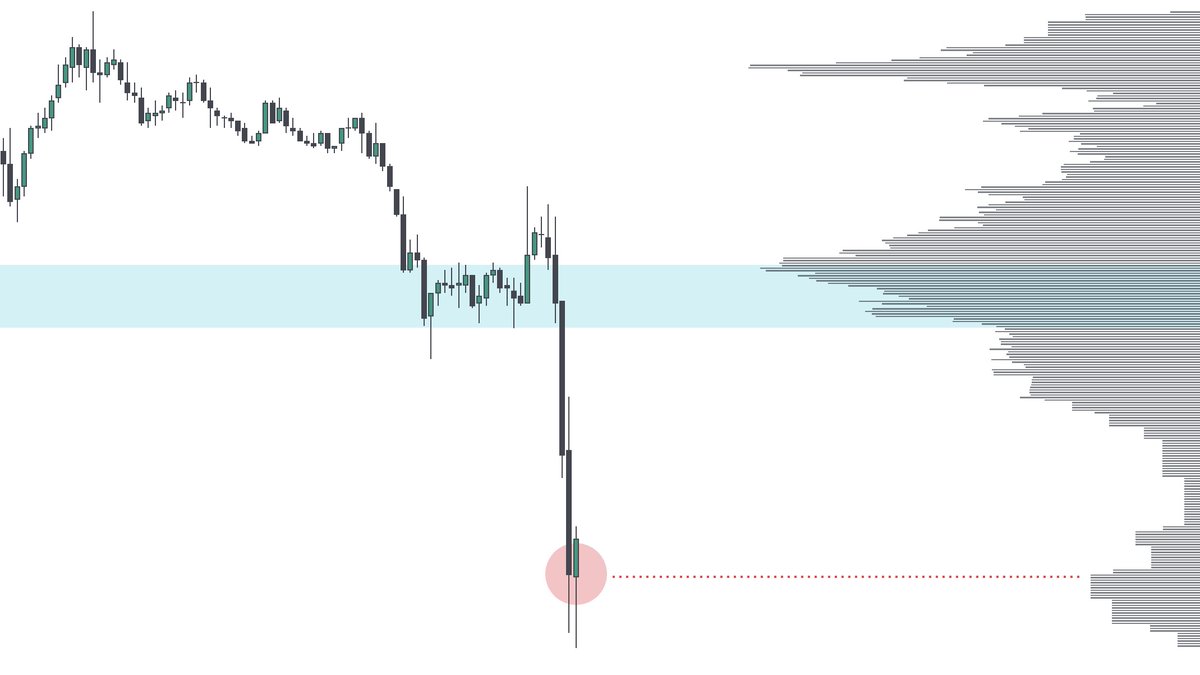

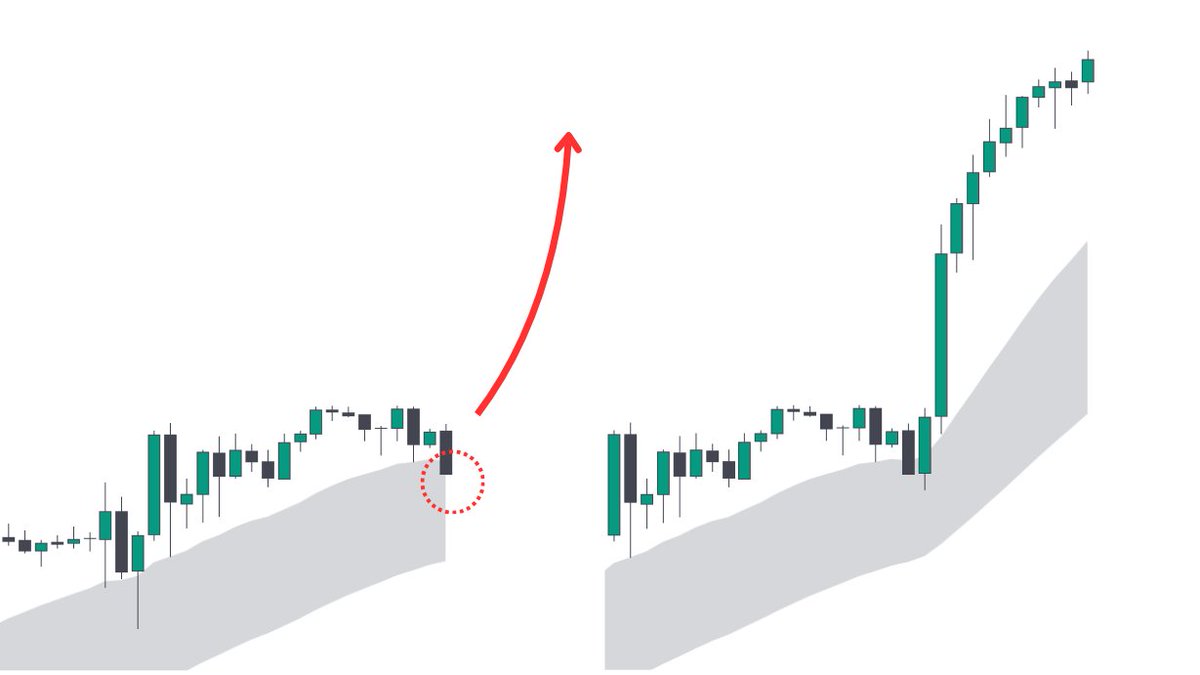

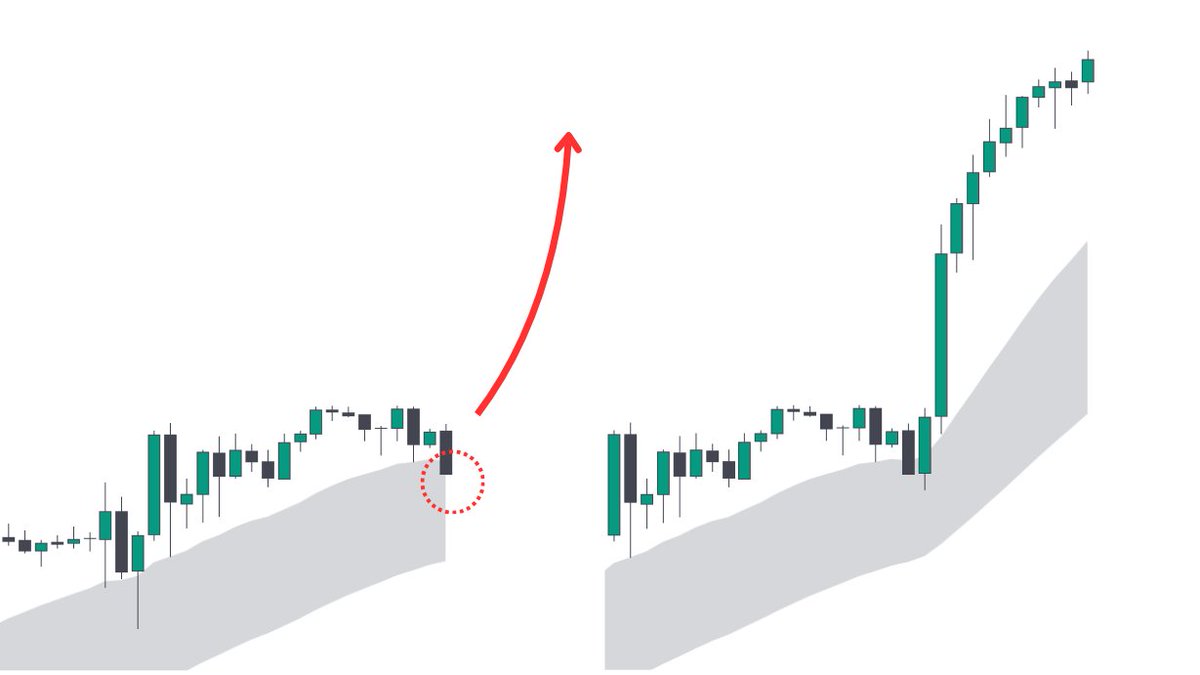

Breakouts have built entire trading careers

Breakouts have built entire trading careers

Early in my trading, I either:

Early in my trading, I either:

Volume profile shows you how much volume was traded at each price level.

Volume profile shows you how much volume was traded at each price level.

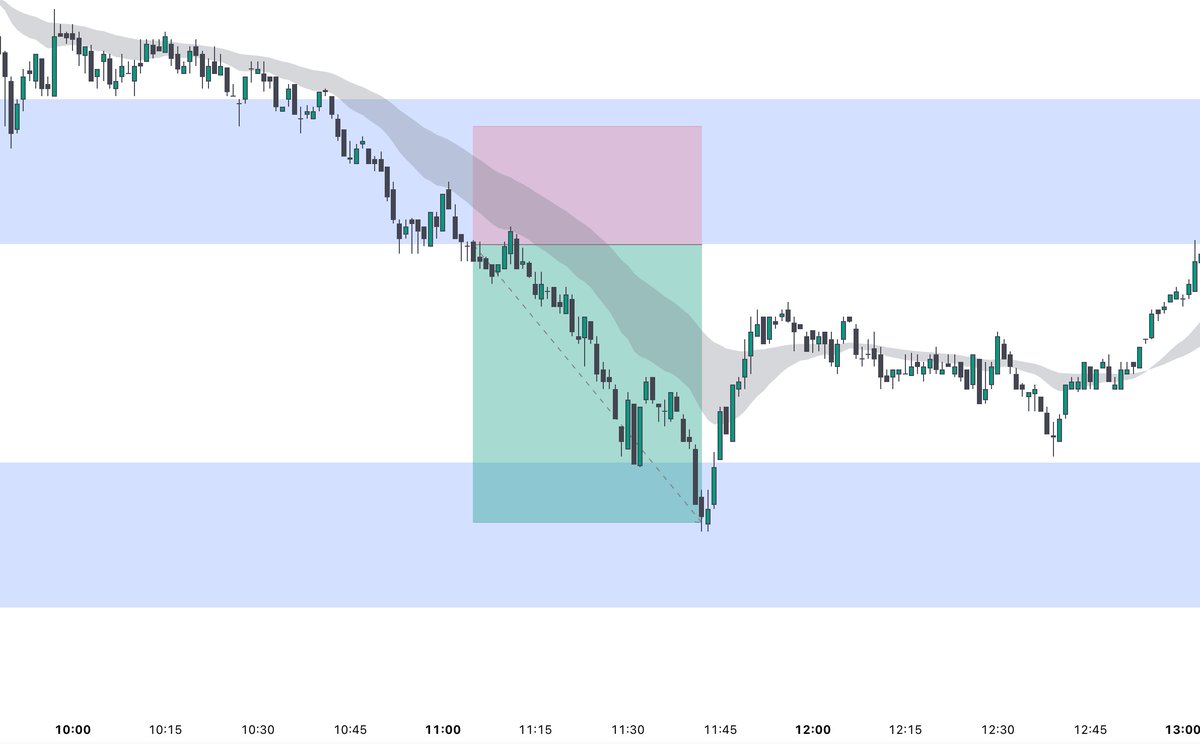

There are only TWO types of trades you can take:

There are only TWO types of trades you can take: