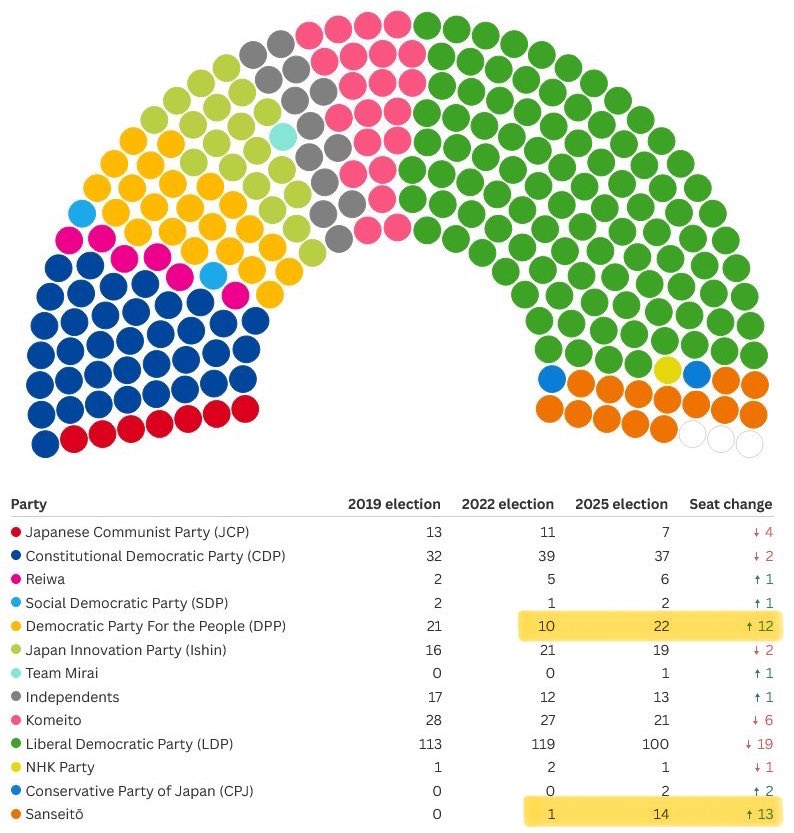

🚨 Japan just had a political earthquake.

Its ruling coalition lost power weeks before a major tariff deadline with the U.S.

The fallout could hit everything from car prices to the U.S. bond market.

(Save this thread)

Its ruling coalition lost power weeks before a major tariff deadline with the U.S.

The fallout could hit everything from car prices to the U.S. bond market.

(Save this thread)

Prime Minister Shigeru Ishiba’s government has now lost its majority in both chambers of Japan’s parliament.

His strategy? Signal strength in trade talks with the U.S. to boost public support.

The reality? Voters punished him over inflation, stagnating wages, and immigration anxiety.

His strategy? Signal strength in trade talks with the U.S. to boost public support.

The reality? Voters punished him over inflation, stagnating wages, and immigration anxiety.

The big winner wasn’t just the opposition, it was populism.

The far-right Sanseito party, with an anti-immigration, "Japan First" message, gained 14 seats.

In a country long defined by political moderation, that’s a rupture and a reflection of deeper global patterns.

The far-right Sanseito party, with an anti-immigration, "Japan First" message, gained 14 seats.

In a country long defined by political moderation, that’s a rupture and a reflection of deeper global patterns.

Why does this matter beyond Japan’s borders?

Because on August 1, unless a new deal is reached, Trump-era tariffs of 25% on all Japanese imports will go into effect.

With a fractured government, Tokyo may be unable to finalize or push through any agreement.

Because on August 1, unless a new deal is reached, Trump-era tariffs of 25% on all Japanese imports will go into effect.

With a fractured government, Tokyo may be unable to finalize or push through any agreement.

And these tariffs are no longer symbolic.

They hit autos, electronics, and capital goods, the machinery and components that anchor U.S. manufacturing.

Tariffing Japan means squeezing your own industrial supply chain and stoking inflation in the process.

They hit autos, electronics, and capital goods, the machinery and components that anchor U.S. manufacturing.

Tariffing Japan means squeezing your own industrial supply chain and stoking inflation in the process.

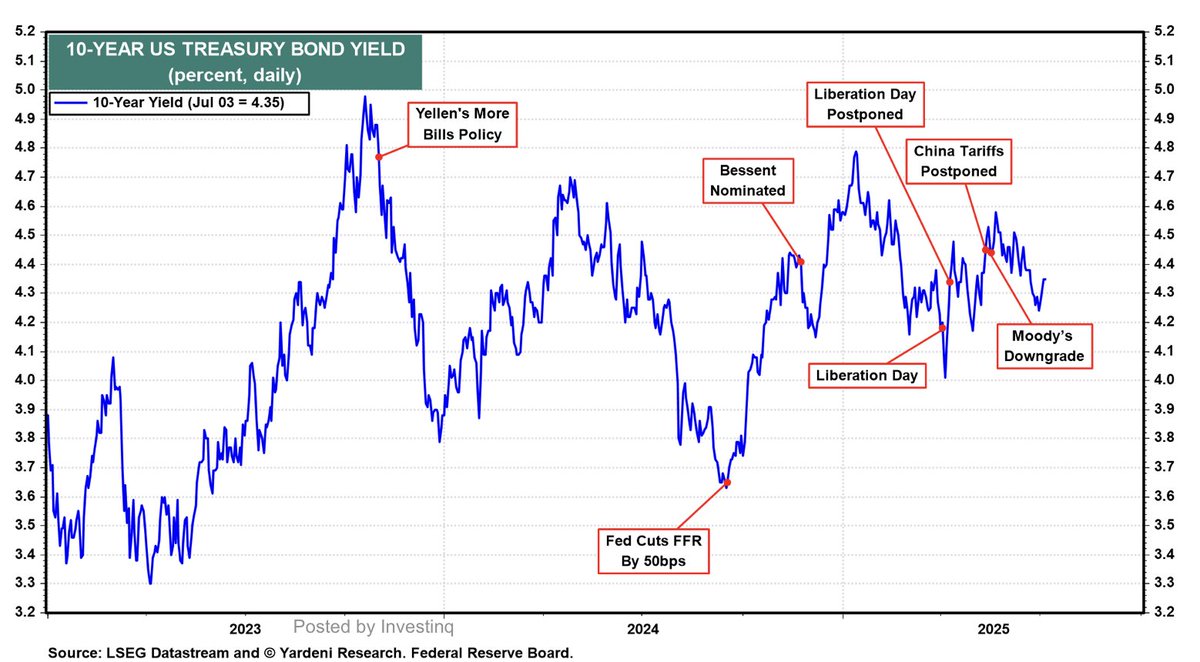

But the more overlooked risk is in the bond market.

Japan is the largest foreign holder of U.S. Treasurys, owning over $1.1 trillion in debt.

And when a country that crucial to global finance becomes politically unstable, money moves.

Japan is the largest foreign holder of U.S. Treasurys, owning over $1.1 trillion in debt.

And when a country that crucial to global finance becomes politically unstable, money moves.

Here’s the chain reaction:

– Political instability weakens the yen

– Japan faces capital outflows as investors seek safer havens

– To stabilize the currency, the Bank of Japan might intervene, selling dollar assets (like U.S. Treasurys) to buy yen

– That pushes U.S. yields higher

– Political instability weakens the yen

– Japan faces capital outflows as investors seek safer havens

– To stabilize the currency, the Bank of Japan might intervene, selling dollar assets (like U.S. Treasurys) to buy yen

– That pushes U.S. yields higher

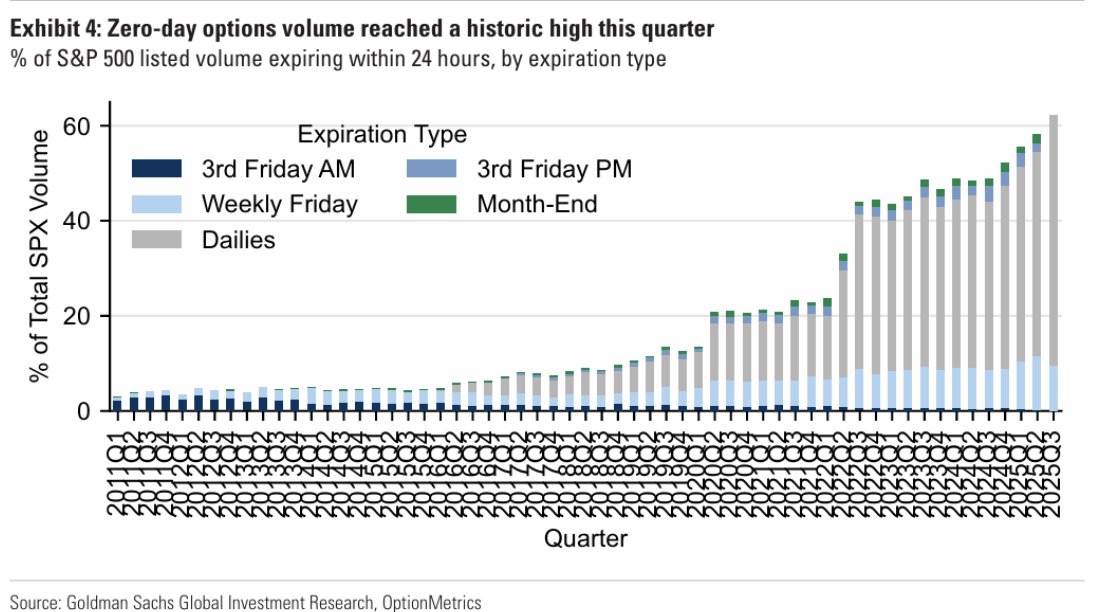

Translation: even if Jerome Powell cuts interest rates, external forces like Tokyo selling Treasury's could send borrowing costs up.

That tightens financial conditions in the U.S., raises mortgage rates, and stresses corporate balance sheets.

That tightens financial conditions in the U.S., raises mortgage rates, and stresses corporate balance sheets.

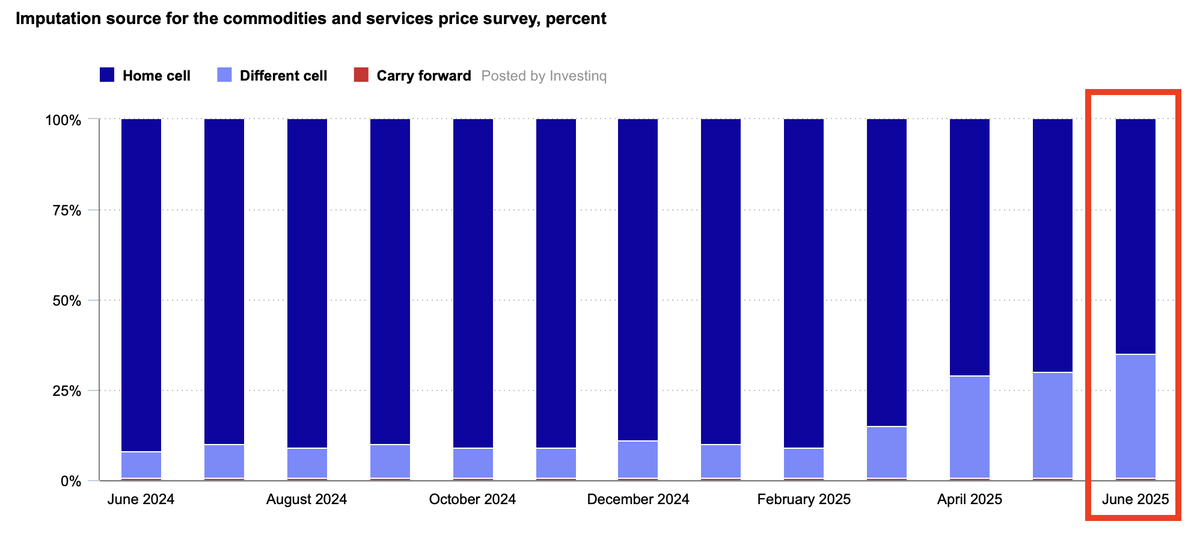

And this isn’t hypothetical.

Japan has already sold U.S. bonds before to stabilize the yen, most recently in 2022.

A post-election selloff isn’t likely to be large, but even expectation of reduced demand can rattle bond markets already on edge from rising deficits.

Japan has already sold U.S. bonds before to stabilize the yen, most recently in 2022.

A post-election selloff isn’t likely to be large, but even expectation of reduced demand can rattle bond markets already on edge from rising deficits.

Let’s add context:

The U.S. is now running $2+ trillion annual deficits, and needs a steady stream of foreign buyers to finance its debt at scale.

If your largest lender becomes a question mark, the cost of capital for the U.S. government rises.

The U.S. is now running $2+ trillion annual deficits, and needs a steady stream of foreign buyers to finance its debt at scale.

If your largest lender becomes a question mark, the cost of capital for the U.S. government rises.

And if Japan’s central bank holds the line on Treasurys?

Private Japanese investors might not. With the yen at 40-year lows, they’re losing money on dollar-denominated assets.

That creates pressure to rebalance portfolios, even if the BoJ stays pat.

Private Japanese investors might not. With the yen at 40-year lows, they’re losing money on dollar-denominated assets.

That creates pressure to rebalance portfolios, even if the BoJ stays pat.

Meanwhile, a weaker yen = stronger dollar.

That further widens the U.S. trade deficit, especially with Japan.

And in an election year, that becomes fuel for more protectionism, a vicious feedback loop of tariffs and retaliation.

That further widens the U.S. trade deficit, especially with Japan.

And in an election year, that becomes fuel for more protectionism, a vicious feedback loop of tariffs and retaliation.

So we get:

– Rising U.S. trade deficits

– Tariff pressure from Washington

– Weaker Japanese political capacity to negotiate

– Currency misalignment

– Potential bond market instability

Each channel amplifies the others.

– Rising U.S. trade deficits

– Tariff pressure from Washington

– Weaker Japanese political capacity to negotiate

– Currency misalignment

– Potential bond market instability

Each channel amplifies the others.

But this isn't just economic.

It’s strategic.

Japan is the cornerstone of America’s Indo-Pacific security network hosting 50,000 U.S. troops and serving as a forward base of deterrence against China and North Korea.

It’s strategic.

Japan is the cornerstone of America’s Indo-Pacific security network hosting 50,000 U.S. troops and serving as a forward base of deterrence against China and North Korea.

That security architecture relies on political stability and policy coordination.

If Tokyo is consumed by leadership battles or populist disruption, Washington loses a critical partner at a time of rising tensions in Taiwan, the South China Sea, and semiconductor supply chains.

If Tokyo is consumed by leadership battles or populist disruption, Washington loses a critical partner at a time of rising tensions in Taiwan, the South China Sea, and semiconductor supply chains.

This convergence of trade, currency, debt, and geopolitics is what makes the moment so dangerous.

We no longer live in a world where a foreign election is a regional issue.

Everything is interlinked, and confidence is the glue holding the system together.

We no longer live in a world where a foreign election is a regional issue.

Everything is interlinked, and confidence is the glue holding the system together.

In 2025, **a failed trade deal in Tokyo can:

– Spike U.S. Treasury yields

– Stoke inflation in Ohio

– Undermine Pacific deterrence

– Trigger political retaliation in Washington

That’s the web we now live in.

– Spike U.S. Treasury yields

– Stoke inflation in Ohio

– Undermine Pacific deterrence

– Trigger political retaliation in Washington

That’s the web we now live in.

Trump’s trade policy only accelerates this shift.

His administration has already forced the U.K., Vietnam, and others into tougher deals with higher tariffs.

Japan despite being a top ally is being told: accept the terms or face full penalties.

His administration has already forced the U.K., Vietnam, and others into tougher deals with higher tariffs.

Japan despite being a top ally is being told: accept the terms or face full penalties.

This isn’t just a Japanese election.

It’s a test of whether the modern global system built on trade openness, financial interdependence, and strategic alignment can hold under strain.

If Japan wobbles, we all feel the aftershocks.

It’s a test of whether the modern global system built on trade openness, financial interdependence, and strategic alignment can hold under strain.

If Japan wobbles, we all feel the aftershocks.

If you found these insights valuable: Sign up for my FREE newsletter! thestockmarket.news

I hope you've found this thread helpful.

Follow me @_Investinq for more.

Like/Repost the quote below if you can:

Follow me @_Investinq for more.

Like/Repost the quote below if you can:

https://x.com/_investinq/status/1947128865794502918?s=46

• • •

Missing some Tweet in this thread? You can try to

force a refresh