Covering the biggest moves in the stock market, the headlines making waves, and the trends shaping tomorrow. Not Financial Advice!

6 subscribers

How to get URL link on X (Twitter) App

In September, small business job openings fell to the lowest level since the 2020 crisis.

In September, small business job openings fell to the lowest level since the 2020 crisis.

Every AI model, image, and chatbot reply burns electricity.

Every AI model, image, and chatbot reply burns electricity.

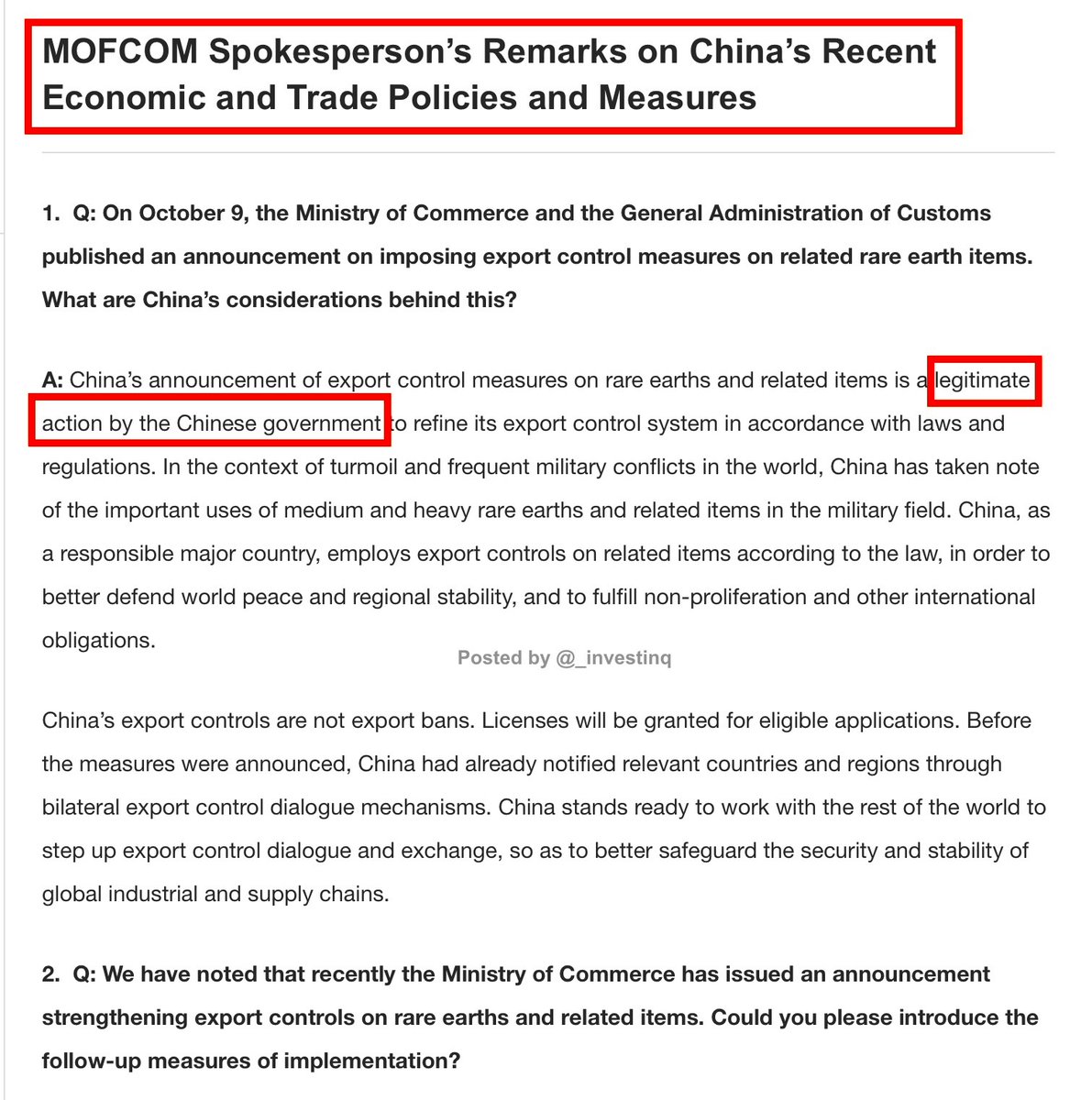

MOFCOM said the measures were designed “to better defend world peace and regional stability, and to fulfill non-proliferation and other international obligations.”

MOFCOM said the measures were designed “to better defend world peace and regional stability, and to fulfill non-proliferation and other international obligations.”

This came during one of the most fragile weeks of the year.

This came during one of the most fragile weeks of the year.

First Brands wasn’t small. It supplied parts to Walmart, AutoZone, and O’Reilly.

First Brands wasn’t small. It supplied parts to Walmart, AutoZone, and O’Reilly.

Office towers are collapsing as a business model.

Office towers are collapsing as a business model.

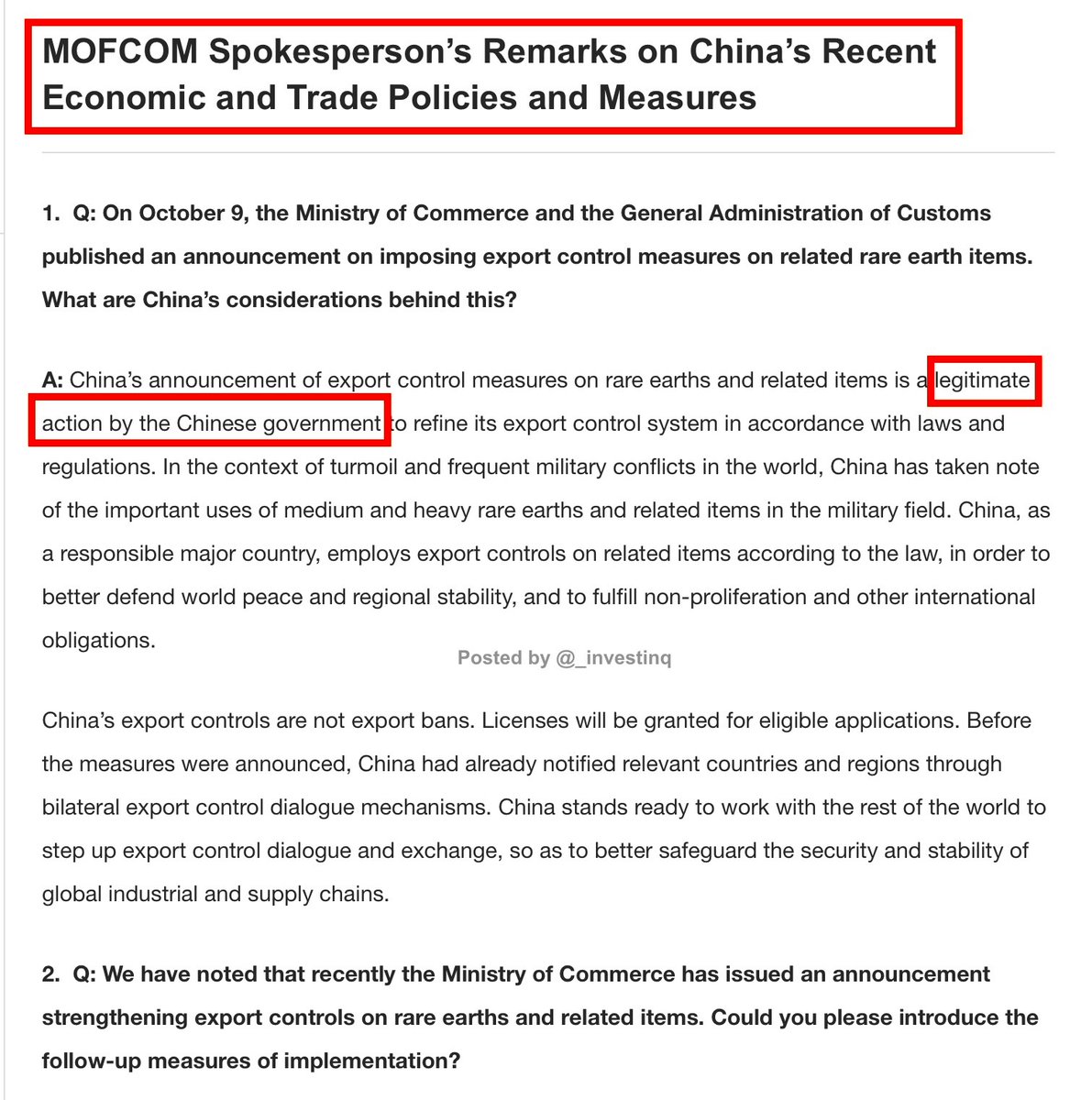

The Reverse Repo Facility is the Fed’s overnight parking lot for cash.

The Reverse Repo Facility is the Fed’s overnight parking lot for cash.

The shutdown is now in week two and Washington’s gone silent.

The shutdown is now in week two and Washington’s gone silent.

AMD and OpenAI are the latest example.

AMD and OpenAI are the latest example.

Let’s start with the labor market.

Let’s start with the labor market.

A budget deficit means Washington is spending more than it collects in taxes.

A budget deficit means Washington is spending more than it collects in taxes.

Heavy trucks are the backbone of American industry. They haul food, steel, machinery, and consumer goods.

Heavy trucks are the backbone of American industry. They haul food, steel, machinery, and consumer goods.

Here’s the issue: the average U.S. homeowner has a mortgage at just 4.1%.

Here’s the issue: the average U.S. homeowner has a mortgage at just 4.1%.

Retail Sales hit Tuesday at 8:30 ET.

Retail Sales hit Tuesday at 8:30 ET.

There are three main methods BLS uses in the CPI Commodities & Services survey:

There are three main methods BLS uses in the CPI Commodities & Services survey:

The PPI measures “factory door inflation.”

The PPI measures “factory door inflation.”

Every month, the government publishes payroll numbers using a survey called the Current Employment Statistics (CES).

Every month, the government publishes payroll numbers using a survey called the Current Employment Statistics (CES).

Prime Minister François Bayrou was toppled after losing a no-confidence vote 364–194.

Prime Minister François Bayrou was toppled after losing a no-confidence vote 364–194.

What is a benchmark revision? Each month, the BLS estimates job growth by surveying ~122,000 businesses.

What is a benchmark revision? Each month, the BLS estimates job growth by surveying ~122,000 businesses.