I think foreigners — especially Americans — do not fully appreciate China's predilection for large, capital-intensive infrastructure projects because most do not know what it was like to live in a place starved of God-given natural endowments.

While we marvel at the economic benefits of a navigable Mississippi River system, bountiful arable land enabling "amber waves of grain", and "purple mountain majesties above the fruited plain" and rich stores of oil & gas + other useful commodities ...

readwriteinvest.com/p/america-the-…

readwriteinvest.com/p/america-the-…

... China trudged through the 20th century in relative poverty, cursed by a dearth of natural endowments like arable land and commodities relative to its huge population.

But it recognized the potential for capital-intensive infrastructure development to convert non-productive regions to productive ones.

But it recognized the potential for capital-intensive infrastructure development to convert non-productive regions to productive ones.

There are now many examples of successful infrastructure projects that have achieved this; to follow I will list some examples from different infrastructure categories to illustrate.

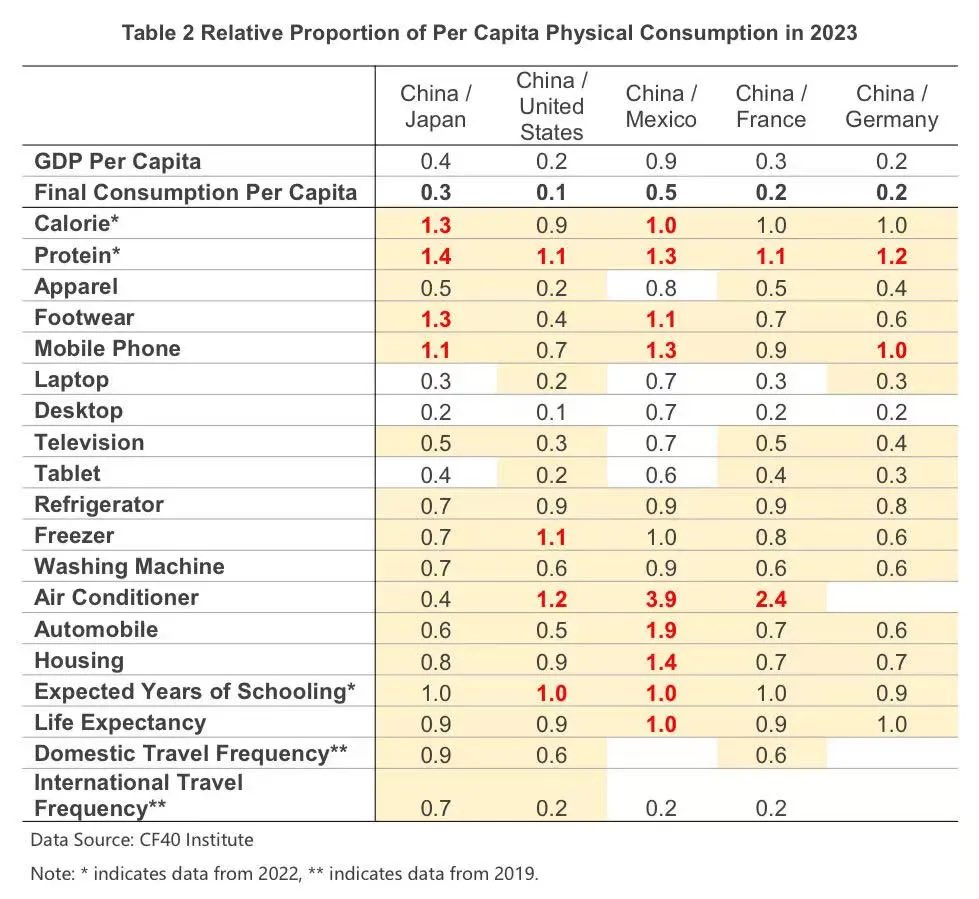

Chinese policymakers equate infrastructure development with scaling the development ladder on the way to becoming a fully developed society with high quality of life. When viewed in this context, its predilection for capital-intensive infrastructure should be wholly unsurprising. And safe to say it is unlikely to turn its back on this development model anytime soon.

Chinese policymakers equate infrastructure development with scaling the development ladder on the way to becoming a fully developed society with high quality of life. When viewed in this context, its predilection for capital-intensive infrastructure should be wholly unsurprising. And safe to say it is unlikely to turn its back on this development model anytime soon.

1⃣ Historically, deserts were barren, inhospitable places that could not support much biological life.

Now solar PV infrastructure can turn non-productive desert land into a highly productive energy producing region.

Now solar PV infrastructure can turn non-productive desert land into a highly productive energy producing region.

https://x.com/GlennLuk/status/1809648025507360946

2⃣ Windy steppe regions were also quite barren and did not support heavy population densities.

Now modern wind turbines can turn relatively non-productive regions in places like Inner Mongolia into energy powerhouses.

Now modern wind turbines can turn relatively non-productive regions in places like Inner Mongolia into energy powerhouses.

https://x.com/GlennLuk/status/1811050467146752317

3⃣ Landlocked mountainous provinces like Guizhou were historically very poor because of difficult access.

Bridges and tunnels remove these access barriers and enables Guizhou to benefit from increased trade with the rest of the country and the world.

Bridges and tunnels remove these access barriers and enables Guizhou to benefit from increased trade with the rest of the country and the world.

https://x.com/GlennLuk/status/1717068417700651150

4⃣ Regions like the "roof of the world" in Tibet were also historically poor because of the extreme mountainous terrain.

But massive hydro projects like this tap into these extremes (in this case, a massive elevation drop making it ideal for hydro power).

But massive hydro projects like this tap into these extremes (in this case, a massive elevation drop making it ideal for hydro power).

https://x.com/GlennLuk/status/1872321823947559037

5⃣ China is not blessed with significant petroleum and natural gas reserves relative to its huge population.

But the infrastructure-driven push to electrify transportation (e.g. electric vehicles, HSR, local metro) blunts these natural disadvantages.

But the infrastructure-driven push to electrify transportation (e.g. electric vehicles, HSR, local metro) blunts these natural disadvantages.

https://x.com/GlennLuk/status/1801647821000425824

• • •

Missing some Tweet in this thread? You can try to

force a refresh