Let’s talk about $GRAB GrabAds.

$216M run-rate business growing 60% YoY.

I believe this could be the greatest contributor to Grab’s bottom-line within the next 2 years. 🧵👇

$216M run-rate business growing 60% YoY.

I believe this could be the greatest contributor to Grab’s bottom-line within the next 2 years. 🧵👇

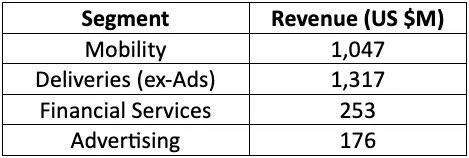

1/ GrabAds Today

GrabAds currently has 191,000 monthly active advertisers on its platform, up 49% YoY.

Average spend grew 30% YoY, driving Ad revenue to make up 1.7% of Deliveries GMV as of Q1 2025.

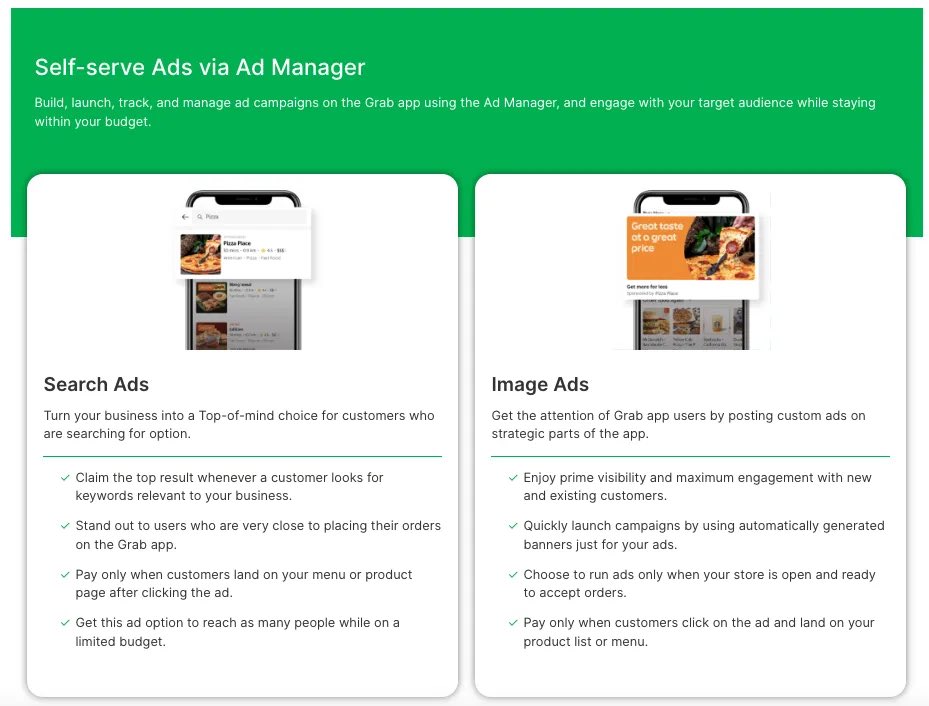

Grab’s ad product breadth is extremely wide, ranging from in-app sponsored listings, search, feed video, display, vouchers to offline formats (car wraps, in-car screens etc)…

Grab keeps Ads revenue inside the Deliveries P&L for now, but management has called it out as the primary driver of Deliveries margin expansion.

GrabAds currently has 191,000 monthly active advertisers on its platform, up 49% YoY.

Average spend grew 30% YoY, driving Ad revenue to make up 1.7% of Deliveries GMV as of Q1 2025.

Grab’s ad product breadth is extremely wide, ranging from in-app sponsored listings, search, feed video, display, vouchers to offline formats (car wraps, in-car screens etc)…

Grab keeps Ads revenue inside the Deliveries P&L for now, but management has called it out as the primary driver of Deliveries margin expansion.

2/ How does GrabAds work?

Firstly, you need to understand that Grab’s merchant base is overwhelmingly made up of micro, small and medium enterprises (MSMEs)

These are hawker-stall owners, family bakeries, neighbourhood minimarts.

They are not savvy at all.

Hence, $GRAB has built in an incredibly simplified system, allowing merchants to create ads within 3 minutes with built-in automation to avoid complexity.

Firstly, you need to understand that Grab’s merchant base is overwhelmingly made up of micro, small and medium enterprises (MSMEs)

These are hawker-stall owners, family bakeries, neighbourhood minimarts.

They are not savvy at all.

Hence, $GRAB has built in an incredibly simplified system, allowing merchants to create ads within 3 minutes with built-in automation to avoid complexity.

3/ Why it can become $GRAB ‘s 4th Pillar

Ads is a potentially huge business with significant runway. Most importantly it is a great fit for $GRAB:

1. GMV Leverage

Grab’s on-demand GMV in 2024 was $18.36B. A 1% point increase in take-rate leads to a doubling of Grab’s current ad revenue.

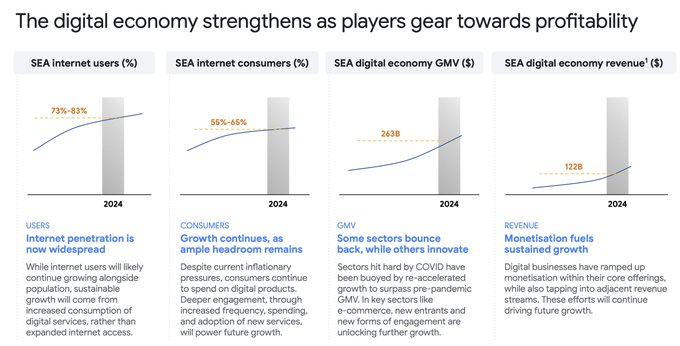

2. Unique Data Moat

Grab is in a unique position, with its core segments generating location, payment and SKU-level signals across food, groceries, rides and fintech, data that other platforms simply cannot match.

3. Closed Loop Attribution

Real, actual, calculable ROI.

Ads is a potentially huge business with significant runway. Most importantly it is a great fit for $GRAB:

1. GMV Leverage

Grab’s on-demand GMV in 2024 was $18.36B. A 1% point increase in take-rate leads to a doubling of Grab’s current ad revenue.

2. Unique Data Moat

Grab is in a unique position, with its core segments generating location, payment and SKU-level signals across food, groceries, rides and fintech, data that other platforms simply cannot match.

3. Closed Loop Attribution

Real, actual, calculable ROI.

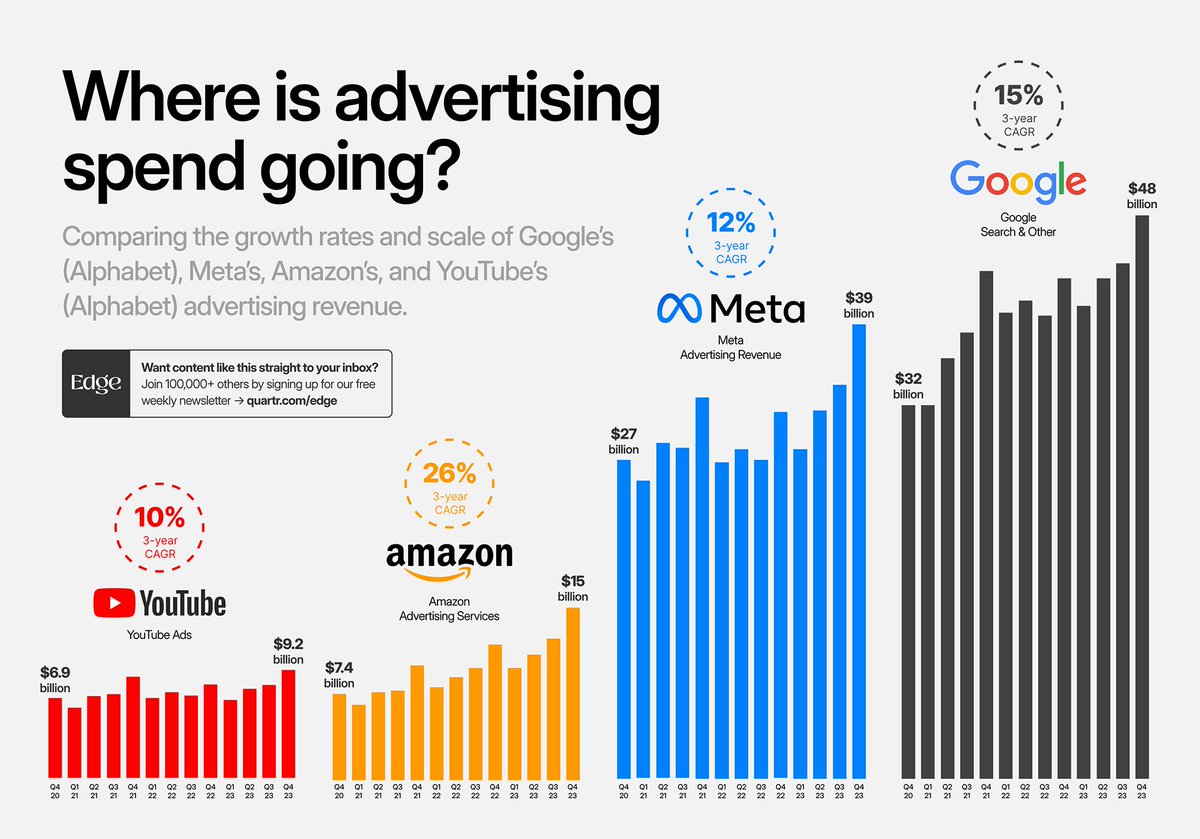

4/ Why Ads could be the most profitable business

Digital Ads are structurally high margin businesses. Some of the greatest businesses today, with insanely high margins, are fundamentally ad businesses.

Think $GOOGL $META $AMZN

What all these businesses have in common, is they own the ad platform, the checkout/delivery system and the user relationship.

This means they don’t need to rely on third-party data. Instead, they have proprietary information to inform brands about purchase behaviours and ROAS.

$GRAB is no different.

Assuming it achieves a base-case of 3% take-rate on on-demand GMV in 2027 ($27B), along with a conservative 50% EBITDA margin…

GrabAds will bring in $405M in EBITDA, nearly 80% of FY2025’s management guidance for GROUP EBITDA.

Digital Ads are structurally high margin businesses. Some of the greatest businesses today, with insanely high margins, are fundamentally ad businesses.

Think $GOOGL $META $AMZN

What all these businesses have in common, is they own the ad platform, the checkout/delivery system and the user relationship.

This means they don’t need to rely on third-party data. Instead, they have proprietary information to inform brands about purchase behaviours and ROAS.

$GRAB is no different.

Assuming it achieves a base-case of 3% take-rate on on-demand GMV in 2027 ($27B), along with a conservative 50% EBITDA margin…

GrabAds will bring in $405M in EBITDA, nearly 80% of FY2025’s management guidance for GROUP EBITDA.

I wrote my extended thoughts on substack for paid subs including how large the Ad opportunity is for Grab, and how I expect this to impact $GRAB the stock.

If you enjoyed this, and would like to learn more, do consider subscribing.

Thank you!

gabgrowth.substack.com/p/grabs-potent…

If you enjoyed this, and would like to learn more, do consider subscribing.

Thank you!

gabgrowth.substack.com/p/grabs-potent…

• • •

Missing some Tweet in this thread? You can try to

force a refresh