I write about generational companies that go unnoticed. Strong opinions, loosely held.

How to get URL link on X (Twitter) App

1/ GrabAds Today

1/ GrabAds Today

1) Grab engineers stopped shipping for 9 weeks, costing the business $100M

1) Grab engineers stopped shipping for 9 weeks, costing the business $100M

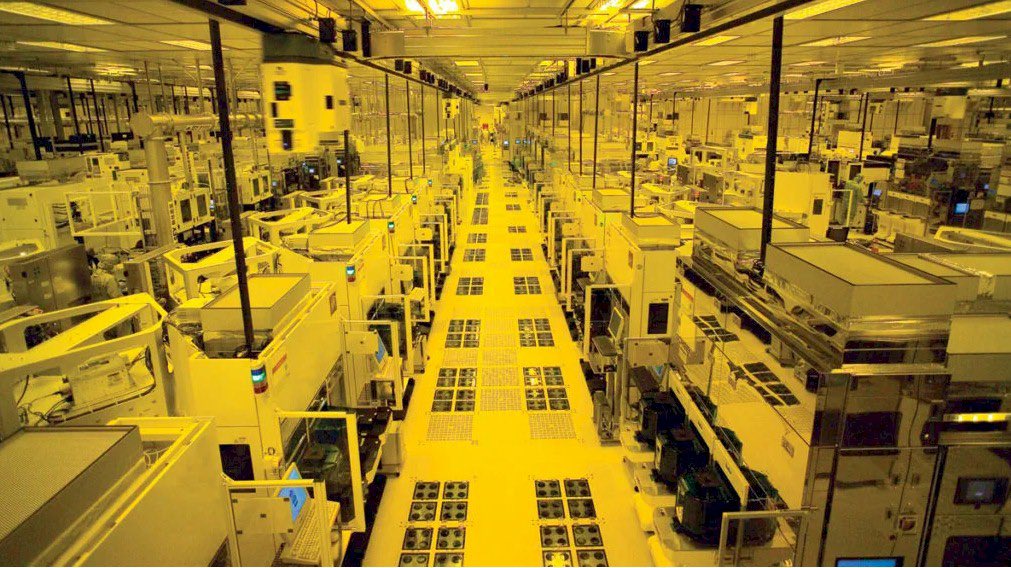

1) When people think chips, they think Nvidia, Intel or AMD, perhaps even Apple.

1) When people think chips, they think Nvidia, Intel or AMD, perhaps even Apple.

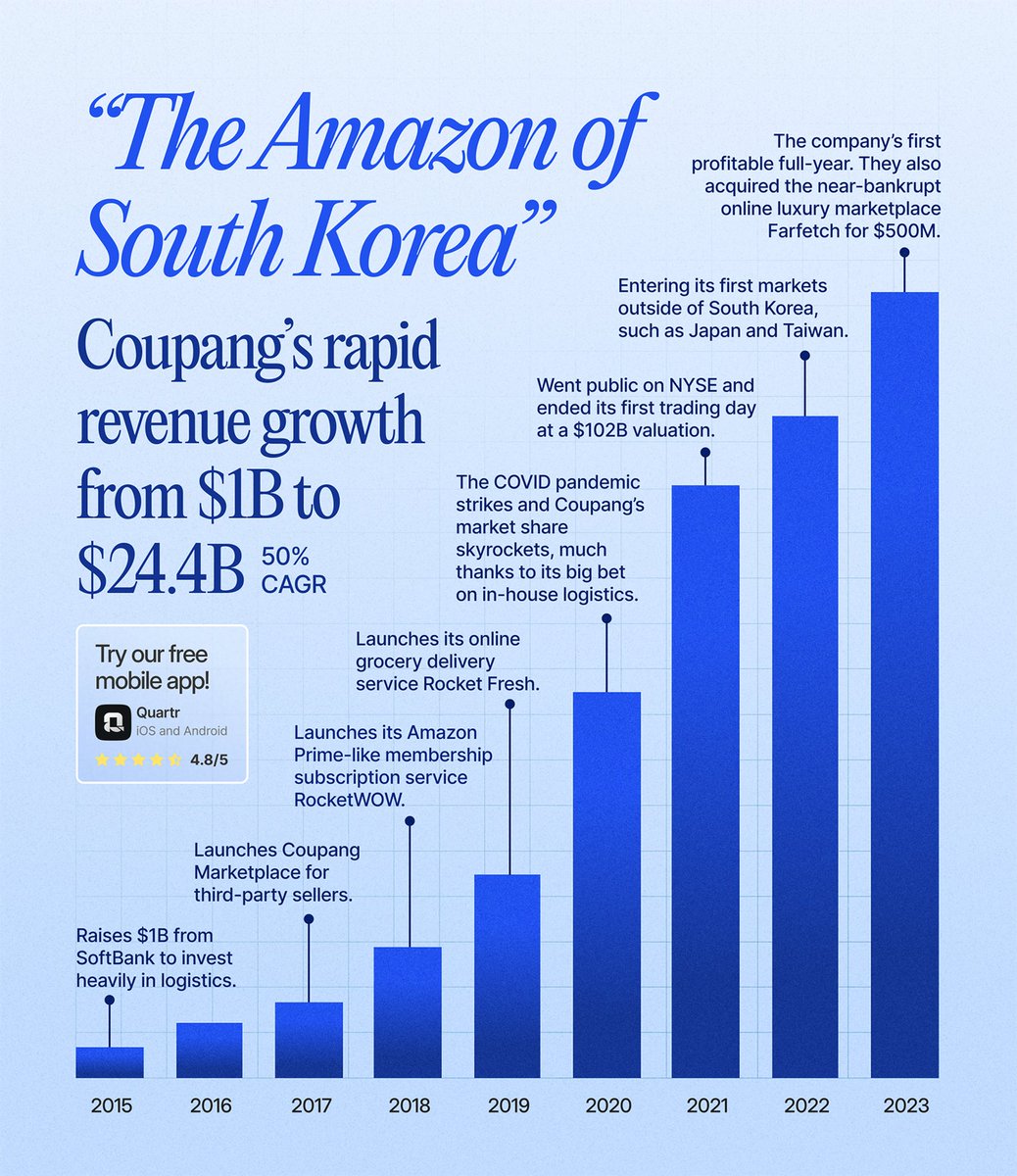

1/ Coupang is building what many call the “Amazon of South Korea”

1/ Coupang is building what many call the “Amazon of South Korea”

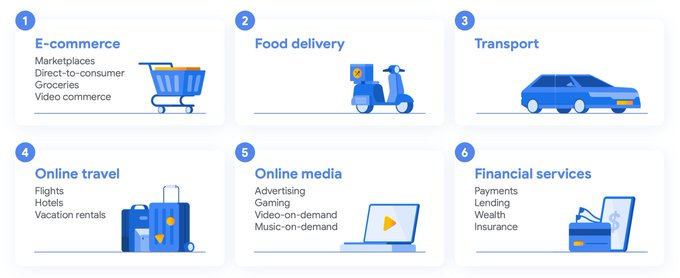

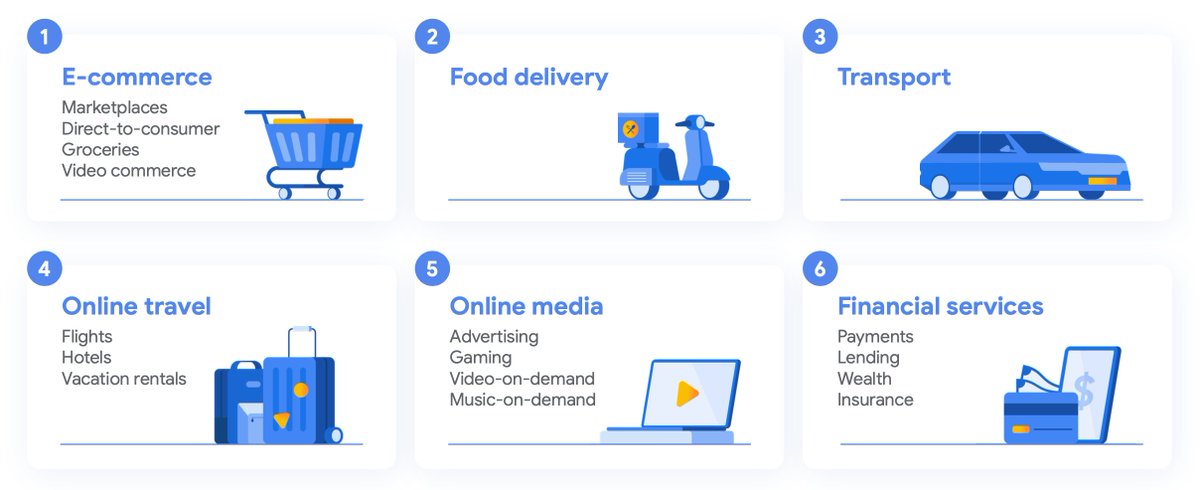

1/ The 6 Leading Sectors in the Digital Economy:

1/ The 6 Leading Sectors in the Digital Economy:

1. Introductory Paragraph

1. Introductory Paragraph

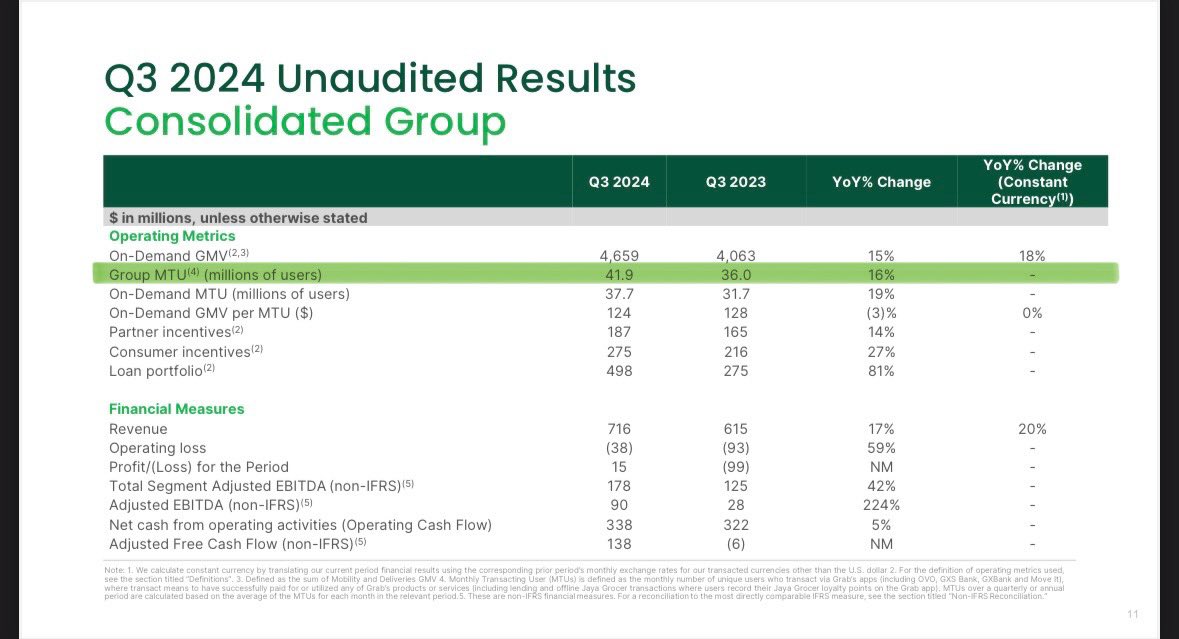

1. Group Monthly Transacting Users

1. Group Monthly Transacting Users

1/

1/

1/

1/

1/ The 6 Leading Sectors in the Digital Economy:

1/ The 6 Leading Sectors in the Digital Economy:

GFin: The Ultimate Goal

GFin: The Ultimate Goal

1/

1/

https://twitter.com/GabGrowth/status/1394558153899970561