Don't forget to get yield on your profits.

🚨BEST STABLECOIN YIELDS ISSUE #13🚨

There are quite a few new ones...

(Bookmark for later reference)

🧵👇

🚨BEST STABLECOIN YIELDS ISSUE #13🚨

There are quite a few new ones...

(Bookmark for later reference)

🧵👇

1) Everyone's new favorite vault on @HyperliquidX

@0xHyperBeat's USDT vault has been averaging around 15-35% APR for the last week (largely due to high funding rates).

It also generates hyperbeat points, and potentially HyperEVM points.

@0xHyperBeat's USDT vault has been averaging around 15-35% APR for the last week (largely due to high funding rates).

It also generates hyperbeat points, and potentially HyperEVM points.

2) The blacksheep makes a comeback

@FalconStable ran into turbulence recently but has committed to fully transparent proof of reserves; the yields have been pretty great since.

The peg has also been fully restored, loopers and arbitragers rejoice.

35-60% APR on @eulerfinance

@FalconStable ran into turbulence recently but has committed to fully transparent proof of reserves; the yields have been pretty great since.

The peg has also been fully restored, loopers and arbitragers rejoice.

35-60% APR on @eulerfinance

3) @ResolvLabs has been a major beneficiary of this run up.

RLP: 27% 7d APR

wstrUSR: 13.75% 7d APR

And, if you wanted to get cute and leverage on @eulerfinance:

RLP: 97% Leveraged APR

PT-RLP: 65% Leveraged APR

RLP: 27% 7d APR

wstrUSR: 13.75% 7d APR

And, if you wanted to get cute and leverage on @eulerfinance:

RLP: 97% Leveraged APR

PT-RLP: 65% Leveraged APR

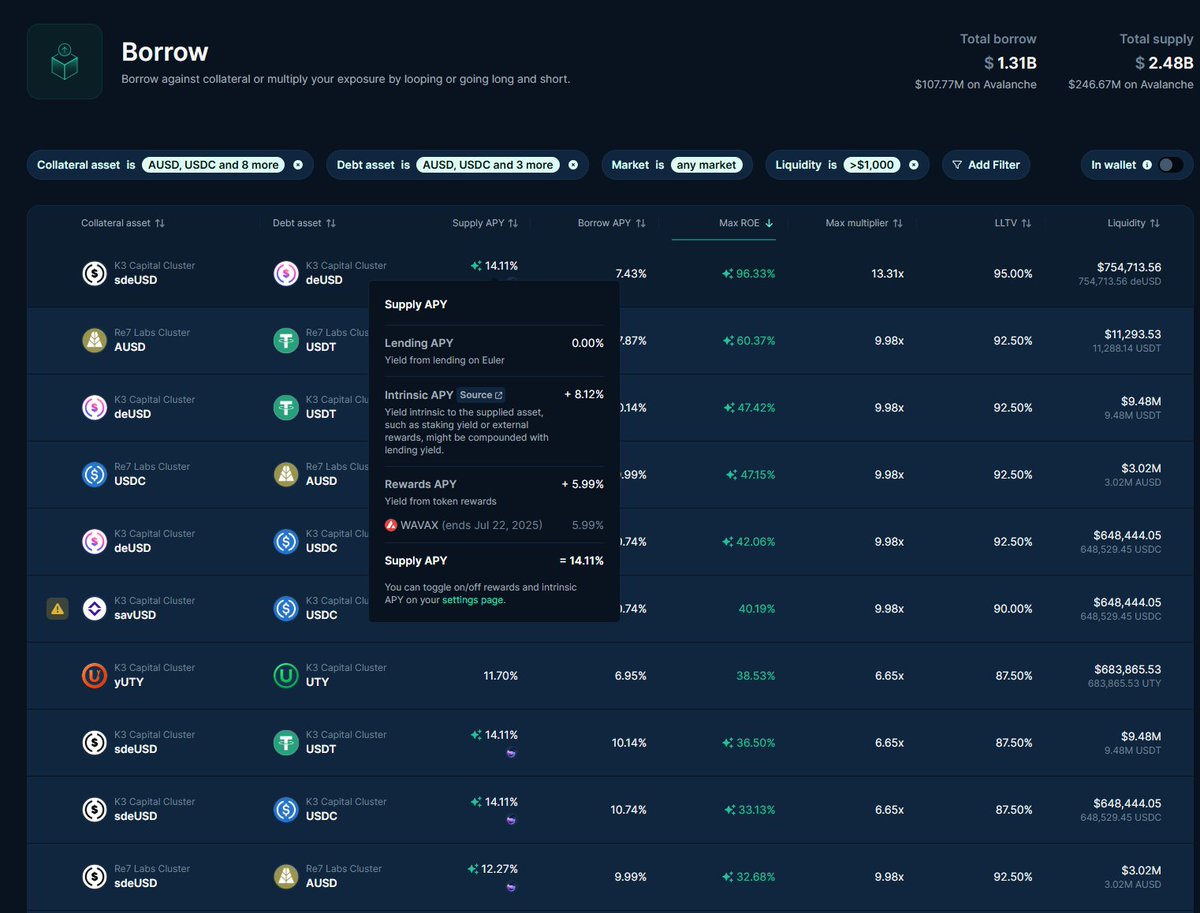

4) @avax are live again!

This means

► 96% on sdeUSD

► 60% on AUSD

► 47% on deUSD

► 47% on USDC

All on @eulerfinance

etc.

DeFi Summer 2.0 is here

This means

► 96% on sdeUSD

► 60% on AUSD

► 47% on deUSD

► 47% on USDC

All on @eulerfinance

etc.

DeFi Summer 2.0 is here

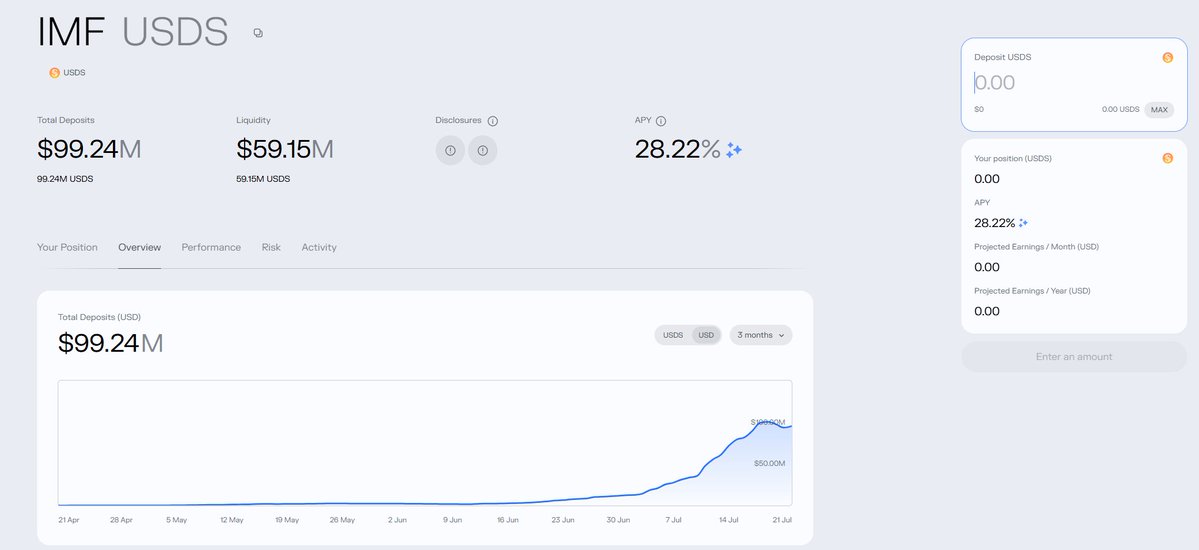

6) @merkl_xyz imo is still slept on

There are a few opportunities worth looking at, but one of them is lending $USDS on Morpho.

28% APR at the moment

➢ 10% Organic

➢ 18% $IMF incentives

There are a few opportunities worth looking at, but one of them is lending $USDS on Morpho.

28% APR at the moment

➢ 10% Organic

➢ 18% $IMF incentives

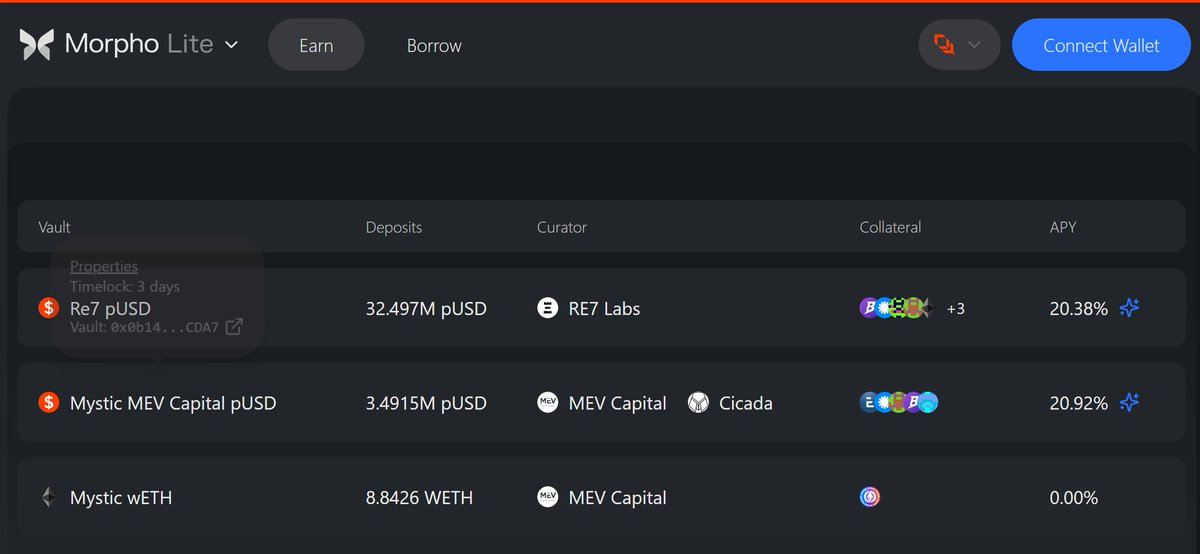

7) @plumenetwork is an absolute sleeper

➤ 20% to lend pUSD @MorphoLabs Re7 vault

➤ 21% to lend pUSD on the @MEVCapital vault

...but wait! There's more

➤ 20% to lend pUSD @MorphoLabs Re7 vault

➤ 21% to lend pUSD on the @MEVCapital vault

...but wait! There's more

8) One major benefit of the Plume pUSD is that you can mint and redeem it for USDC.

But let's check out looping for @NestCredit.

► 63% on looped nBASIS

► 120% on looped mMEV

► 80% on looped nCREDIT

Note: Nest assets need 10 days to unstake, so unwinding can be tricky

But let's check out looping for @NestCredit.

► 63% on looped nBASIS

► 120% on looped mMEV

► 80% on looped nCREDIT

Note: Nest assets need 10 days to unstake, so unwinding can be tricky

9) Quick reminder about @gauntlet_xyz

A casual 12% for lending USDC to Gauntlet's Alpha product.

When composability, Gauntlet? When can I leverage this?

A casual 12% for lending USDC to Gauntlet's Alpha product.

When composability, Gauntlet? When can I leverage this?

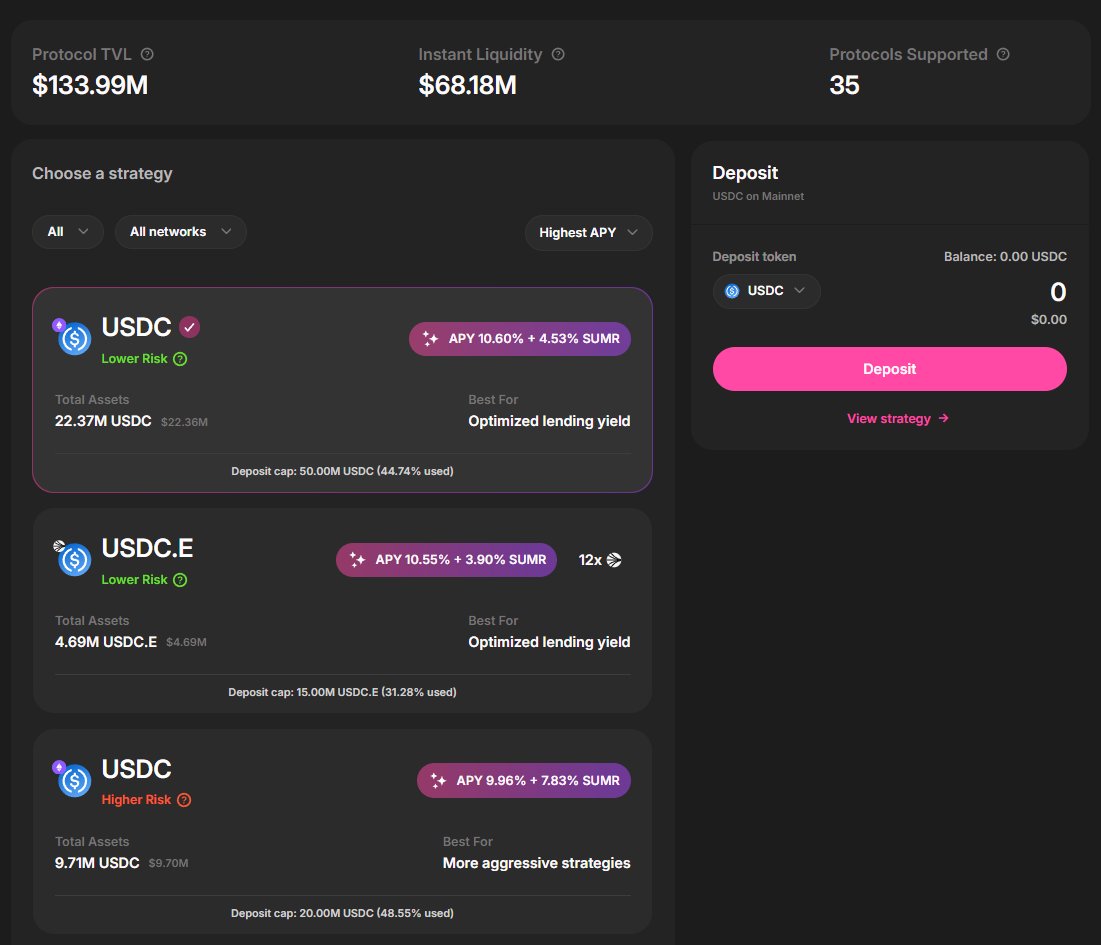

11) For the leverage averse, @summerfinance_ is still one of the best places.

► 7-10% Organic APR

► +4-7% $SUMR incentives

Total: 11-17% non-leveraged APR

Plus bonus for using our ref link:

summer.fi/earn?referralC…

► 7-10% Organic APR

► +4-7% $SUMR incentives

Total: 11-17% non-leveraged APR

Plus bonus for using our ref link:

summer.fi/earn?referralC…

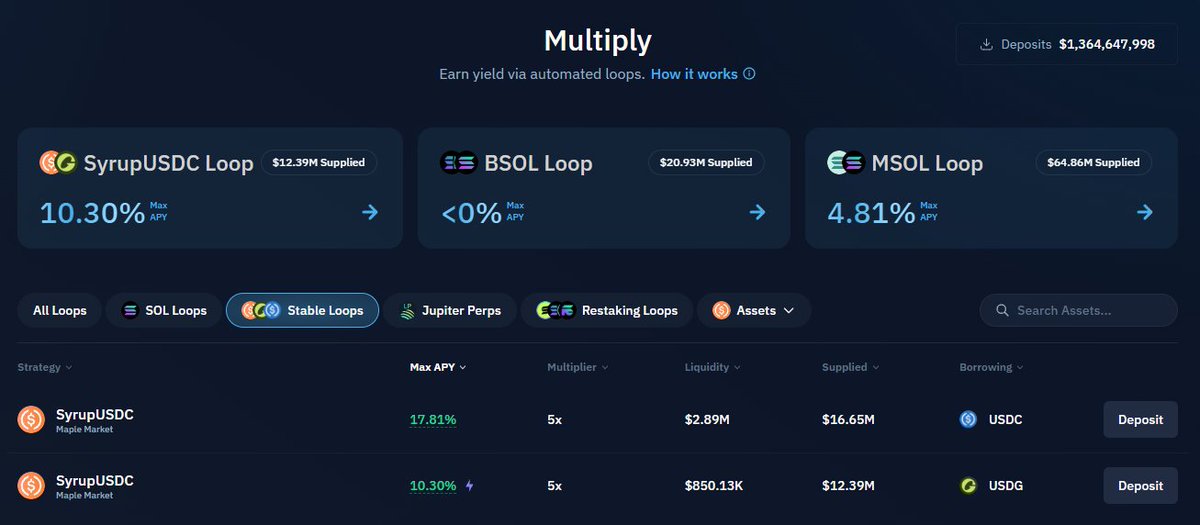

12) h/t to @KaminoFinance for having the best consistent stablecoin positions on @solana

18% on leveraged @syrupfi

18% on leveraged @syrupfi

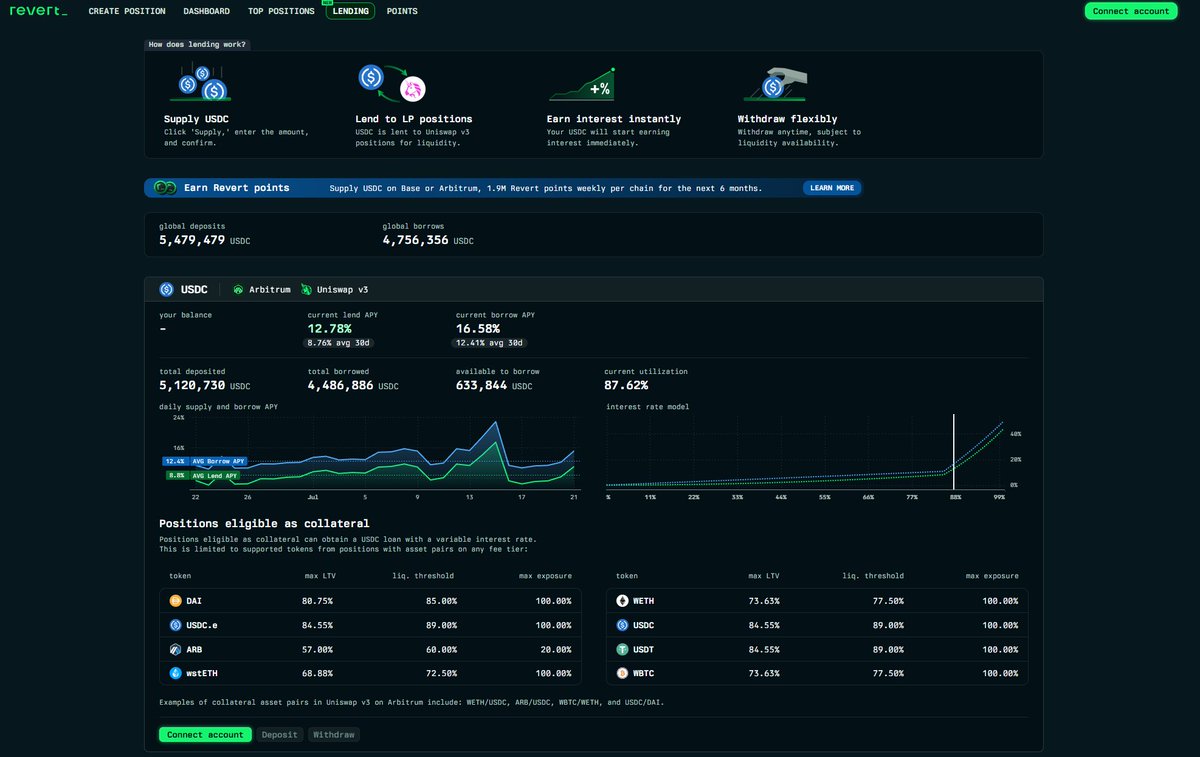

13) I also just want to mention...

@revertfinance, which is a protocol that deserves more love than it gets, has 13% APY to lend USDC to CLP leveragoooors on their platform.

@revertfinance, which is a protocol that deserves more love than it gets, has 13% APY to lend USDC to CLP leveragoooors on their platform.

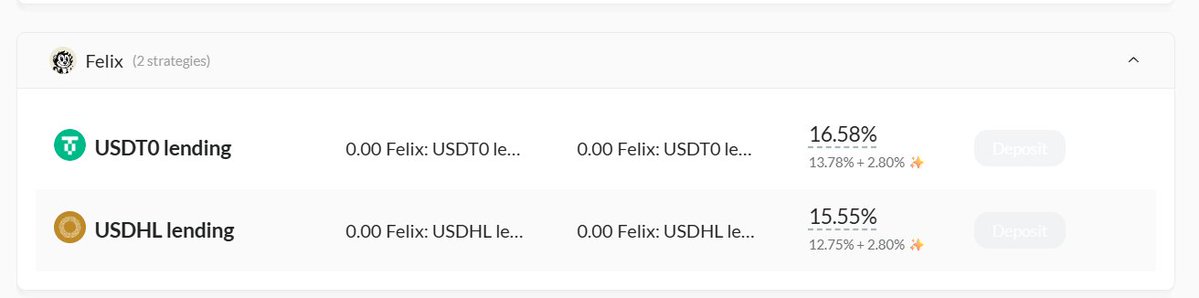

14) @felixprotocol

11.5% for the feUSD stability pool (plus the chance to get some cheap liquidated BTC or HYPE.

You can also toss those on @RumpelLabs and farm tokenized points on those for a real APR of 16%, points minted weekly.

11.5% for the feUSD stability pool (plus the chance to get some cheap liquidated BTC or HYPE.

You can also toss those on @RumpelLabs and farm tokenized points on those for a real APR of 16%, points minted weekly.

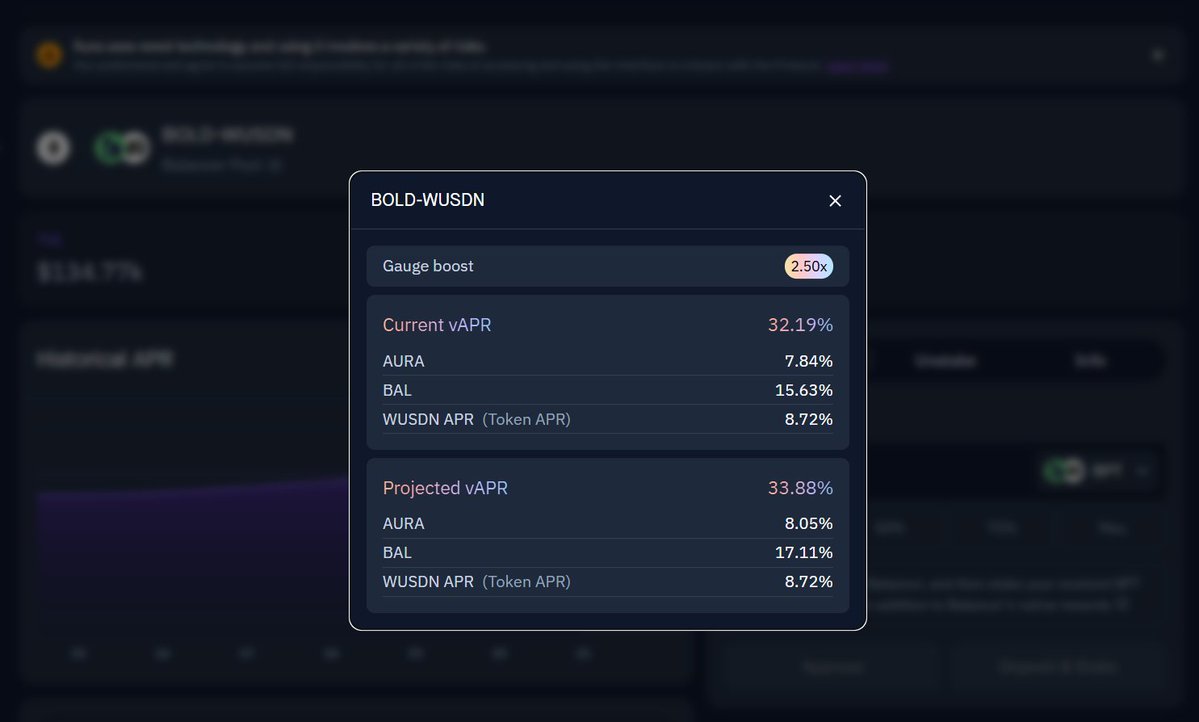

15) @LiquityProtocol, @SmarDex, @AuraFinance

32% APR right now on BOLD<>WUSDN

One of the highest stablecoin LPs out there

Love to see it. It's a great way to farm $BAL as well.

32% APR right now on BOLD<>WUSDN

One of the highest stablecoin LPs out there

Love to see it. It's a great way to farm $BAL as well.

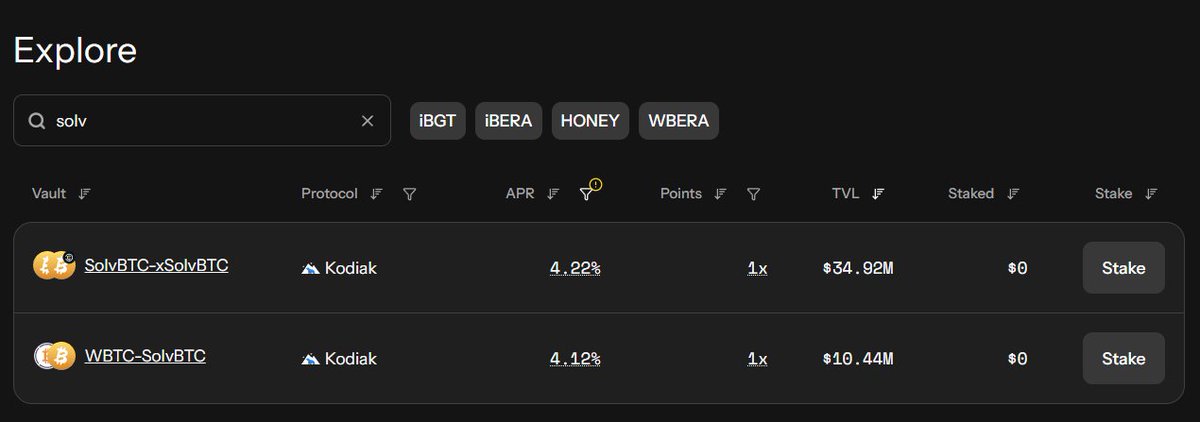

16) Last one! Just reminding you that you can leverage @pendle_fi LPs.

► 50x sats

► 20% organic yield at 10x

You get the 50x sats on 65% of the position

50x sats are valued at 13% APR

SO, the IY of the points you're getting is

10 x 0.65(13%) = 84.5% additional APR

► 50x sats

► 20% organic yield at 10x

You get the 50x sats on 65% of the position

50x sats are valued at 13% APR

SO, the IY of the points you're getting is

10 x 0.65(13%) = 84.5% additional APR

THAT'S IT!

I hope you enjoyed some of the new additions.

There are so many yields out there now, it's nuts.

Ambassadorships mentioned:

► Pendle

► Euler

► Resolv

► Reservoir

► Liquity

► Falcon

► SummerFi

► Avalabs

I hope you enjoyed some of the new additions.

There are so many yields out there now, it's nuts.

Ambassadorships mentioned:

► Pendle

► Euler

► Resolv

► Reservoir

► Liquity

► Falcon

► SummerFi

► Avalabs

• • •

Missing some Tweet in this thread? You can try to

force a refresh