Western Union is

- A $4.2bn revenue business

- Revenue down 3.2% YoY

- $150bn annual volume

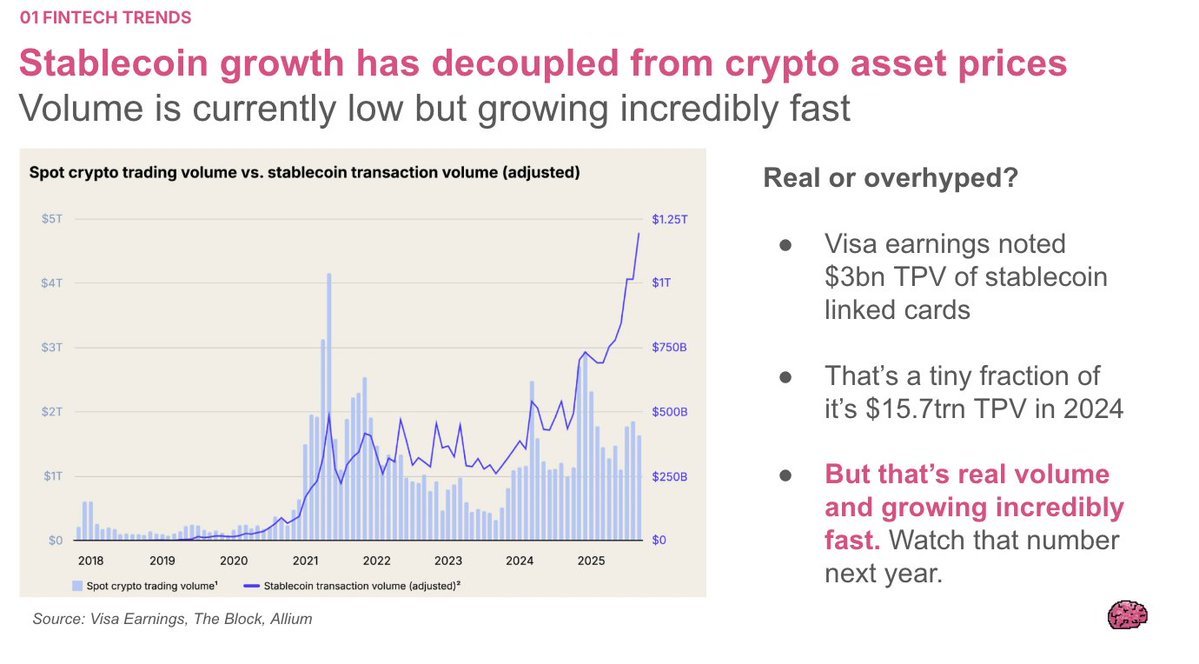

Meanwhile Visa estimates "Retail-sized stablecoin transactions"

- $4.8bn monthly volume

- $57.6bn annualized

- Growing 1x to 4x YoY (if not much higher)

- A $4.2bn revenue business

- Revenue down 3.2% YoY

- $150bn annual volume

Meanwhile Visa estimates "Retail-sized stablecoin transactions"

- $4.8bn monthly volume

- $57.6bn annualized

- Growing 1x to 4x YoY (if not much higher)

At 2.6bn Market Cap Western Union trades below its top line revenue ($4.2bn)

Contrast this with Circle trading at $48bn market cap - trading at 20x+ revenue, and 70x+ earnings

Clearly, CRCL is crowded, and there's hype.

But can the incumbent get innovation before the innovator gets distribution?

Contrast this with Circle trading at $48bn market cap - trading at 20x+ revenue, and 70x+ earnings

Clearly, CRCL is crowded, and there's hype.

But can the incumbent get innovation before the innovator gets distribution?

Excited to chat more about this on @TokenizedPod this coming week

• • •

Missing some Tweet in this thread? You can try to

force a refresh