How to get URL link on X (Twitter) App

Shift 4 is a major PSP.

Shift 4 is a major PSP.

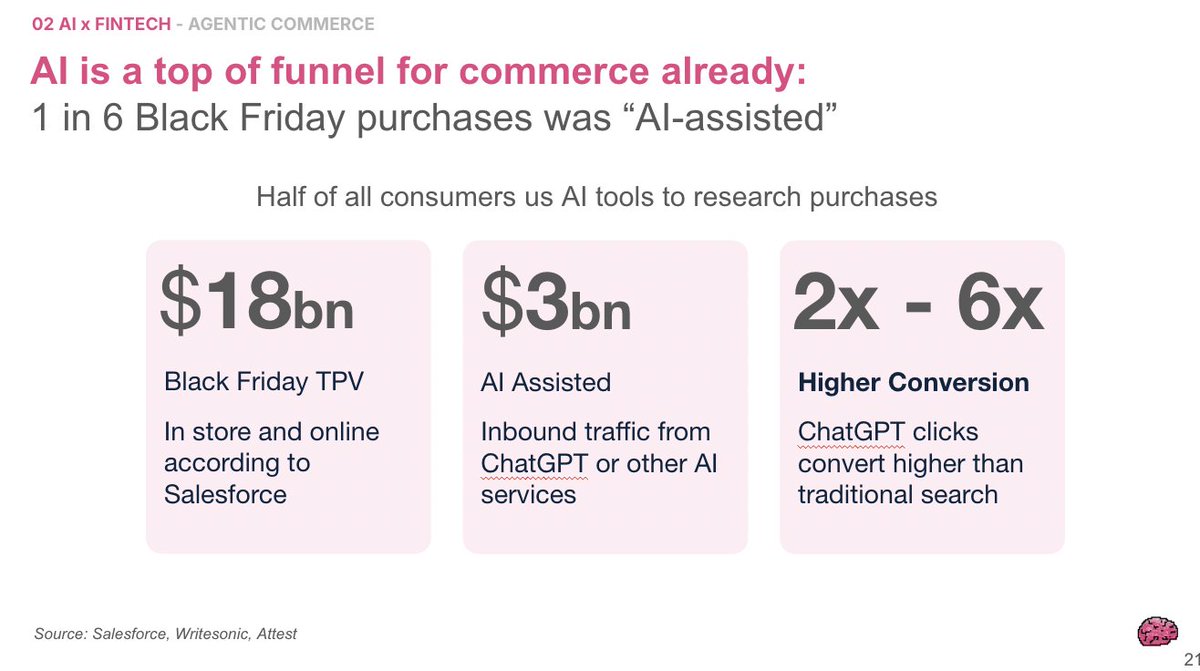

AI assisted 1 in 6 purchases this Black Friday.

AI assisted 1 in 6 purchases this Black Friday.

Right now, AI agents are phenomenal at finding things to buy.

Right now, AI agents are phenomenal at finding things to buy.

Picture the actual flow:

Picture the actual flow:

1. The Industrial Revolution

1. The Industrial Revolution

What actually happened:

What actually happened:

That's a benchmark every other organization in finance should print out on their wall. Only webank in China (with 494m users) can beat.

That's a benchmark every other organization in finance should print out on their wall. Only webank in China (with 494m users) can beat.

Think of it like this:

Think of it like this:

2019: "What's Pay by Bank?"

2019: "What's Pay by Bank?"

But what about prediction markets generally? Isn't it just gambling?

But what about prediction markets generally? Isn't it just gambling?

Imagine telling your Agent.

Imagine telling your Agent.

Charlie Javice founded Frank, a financial aid platform for students. By 2021, she'd raised over $20M from notable investors.

Charlie Javice founded Frank, a financial aid platform for students. By 2021, she'd raised over $20M from notable investors.

Visa doesn't move money; banks do.

Visa doesn't move money; banks do.

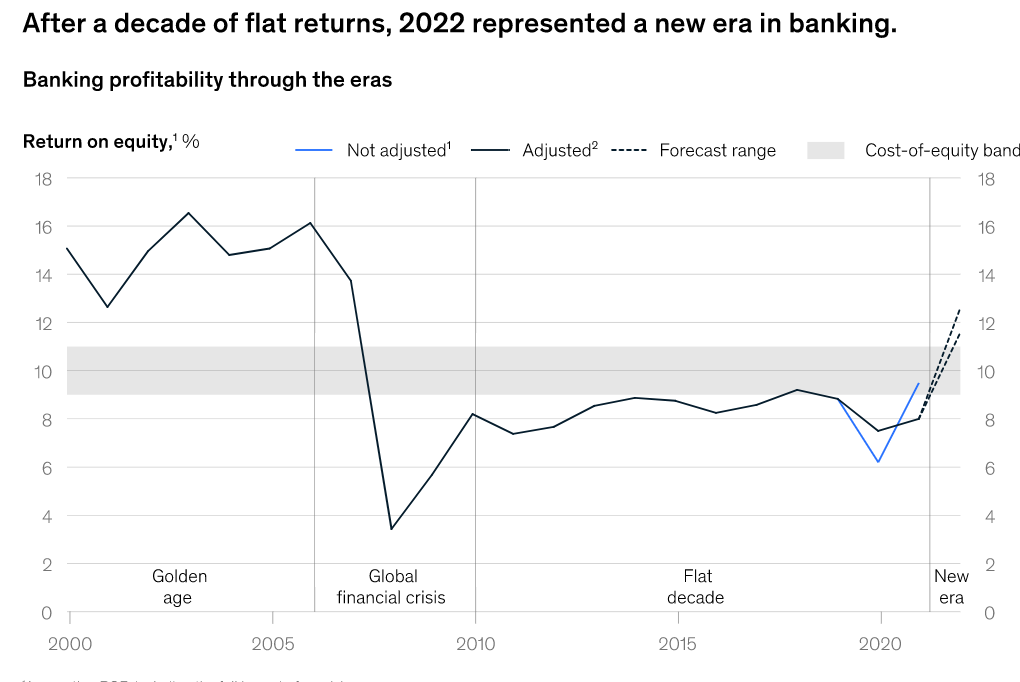

2. Banks are making a come back, but it won’t last forever

2. Banks are making a come back, but it won’t last forever